Comments on Tailored Regulation and Forward Guidance

May 9, 2014 New Orleans, Louisiana

Thank you, Drake (Mills). Your service as president of the Federal Reserve Board’s Community Depository Institutions Advisory Council is greatly appreciated. You are kind to have a Texan come speak to you and your fellow Louisiana bankers, though this is not without precedent: The great blues guitarist and singer Clarence Garlow may have been born in Louisiana, but he had long lived in Texas before he recorded “Bon Ton Roula” in 1949 and gave New Orleans the reputation of the American city where les bon temps rouler.

It would be hard to say that the good times are rolling for community bankers, though the pace and rhythm of the economies of the U.S. and Louisiana and your next-door neighbor, Texas, are getting stronger daily.

I have been outspoken as to why our community banks feel besieged. Everyone in this room and their sister or brother knows what I preach about the continuing problem of banks considered “too big to fail” and the witches’ brew that was concocted by Congress, known as Dodd–Frank. My colleagues at the Dallas Fed and I submit that Louisiana’s and the nation’s community and regional banks play on an uneven playing field against the giant money-center banks. The Fed is coming down hard on the big guys to ensure they are adequately capitalized and liquid. We are using all means within our power to make sure they never again place the American taxpayer at risk by bringing the financial system to its knees. But the fact remains that the big banks have a greater share of the deposit market than ever, are coming into our communities and regions to lend money on terms and at prices that any banker with a memory cell knows from experience usually end in tears, and are putting independent bankers in a precarious position.

And as to Dodd–Frank, I am skeptical that the bureaucracy and rules and regulations this massive legislative initiative has created, even with the careful execution by the Fed, will vanquish too big to fail—the law’s very intention as stated in its preamble. But of this I am certain: It has made the lives of community and regional banks vastly more complicated. Like almost anything that comes out of the U.S. Congress, it has primarily been a boon to lawyers and consultants and compliance officers, adding to expenses but doing little to help you grow your businesses.

We at the Dallas Fed are acutely conscious of this. We think of Dodd–Frank as akin to what Dr. Seuss once wrote about medicine:

Interest margins for community and regional banks have been shrinking for some 20 years. To be sure, the low interest rates the Fed has engineered to bring the economy out of the death spiral threatened by the Financial Panic of 2007–09 exacerbated pressures on margins as we awaited the strengthening economy we are now beginning to experience. But adding the pills and the bills of extra layers of compliance and legal expenses generated by Dodd–Frank has compounded the difficulty of passing on profitable franchises to your banking heirs.

This is why, Systemwide, the Fed has been sensitive to the situation of banks under $50 billion, and especially sensitive to the situation of banks with less than $10 billion in footings. To be sure, we are as committed as ever to safety and soundness and the application of the law; we always have been and always will be. But at the Dallas Fed, we believe we can apply the requisite discipline required to safeguard our banking system in a way that is beneficial to regional and community banks. We and our fellow Federal Reserve Banks have worked hard to instill a constructive and interactive relationship, rather than a hostile, purely formulaic one, with the banks we supervise. You might have noted that Janet Yellen’s speech of May 1 to the Independent Community Bankers was titled “Tailored Supervision of Community Banks.” The Federal Reserve banks take this charge seriously.

This is no idle claim. Just looking at the Eleventh District, we are increasingly being petitioned by banks for membership in the Federal Reserve System. The number of state member banks in the Dallas Fed district increased by 8 percent in 2012, by 19 percent in 2013, and we have already increased membership an annualized 26 percent in the first three months of 2014.

So I would just say this to those of you who are madder than (bleep!) about what Congress and the regulators have wrought: The Federal Reserve knows what community and regional banks do for their communities. We appreciate that you are the backbone for the homeowners, small businesses, service clubs and school sports teams and scouts and churches and myriad other activities that make for better communities. We want you not only to endure, but to succeed and grow. And we want to make sure you play on an even playing field with those who have legions of white-shoe lawyers and K Street lobbyists you couldn’t dream of affording.

I wanted to just say that at the outset.

Monetary Policy Going Forward: De-Spiking the Punch Bowl 10 Ounces at a Time

Now, if you will indulge me, I want to speak of the direction of monetary policy from here onward.

The Federal Open Market Committee (FOMC) is in the process of winding down its massive purchases of Treasuries and mortgage-backed securities. At our last meeting, in recognition that the economy is improving and acknowledging that we have generated massive amounts of excess reserves among depository institutions operating in the U.S., we voted to reduce our purchases to a combined $45 billion per month, on the path to eliminating them at the earliest practicable date. Speaking only for myself as a voting member, barring some destabilizing development in the real economy that comes out of left field, I will continue to vote for the pace of reduction we have undertaken, reducing by $10 billion per meeting our purchases and eliminating them entirely at the October meeting with a final reduction of $15 billion.

I was not for this program, popularly known as QE3, to begin with. I doubted its efficacy and was convinced that the financial system already had sufficient liquidity to finance recovery without providing tinder for future inflation. But I lost that argument in the fall of 2012, and I am just happy that we will be rid of the program soon enough.

I am often asked why I do not support a more rapid deceleration of our purchases, given my agnosticism about their effectiveness and my concern that they might well be leading to froth in certain segments of the financial markets. The answer is an admission of reality: We juiced the trading and risk markets so extensively that they became somewhat addicted to our accommodation of their needs. You may remember the “taper tantrum” market operators threw last spring when we broached the idea of temperance. It went over about as big as would saying you wanted to ban Hurricanes and other happy-making libations here in New Orleans!

Preventing Market Seizures and the DTs

Until just recently, Herb Kelleher was chairman of the Dallas Fed board. I can safely say that I had the funniest chairman of any Federal Reserve Bank, and one of the smartest ever. Herb is not only the iconic founder of Southwest Airlines, but he is also an iconic consumer of Wild Turkey Bourbon. A wise man, he advised me that you can’t go from Wild Turkey to cold turkey overnight. So despite having argued against spiking the punchbowl to the degree we did, I have accepted that the prudent course of action and the best way to prevent the onset of market seizures and delirium tremens is to gradually reduce and eventually eliminate the flow of excess liquidity we have been supplying. The financial markets now seem to be unperturbed by and appear to be fully discounting the reduction pattern I am supporting.

You should bear in mind that the Fed works directly only with depository institutions. And that they represent only a fifth or less of the credit markets in the U.S. And yet as I speak, depository institutions, including foreign banks doing business in the United States, have $2.5 trillion in excess reserves on the books of the 12 Federal Reserve Banks. So one would be hard pressed to say that ending our asset purchases, which the depository institutions from which we buy them deposit back with us as excess reserves, would deny the economy needed liquidity.

“Normalizing” Policy

The focus of our discussions now is when and how to “normalize” monetary policy. Given that we work directly with only 20 percent or less of the highly developed U.S. credit intermediation system, this becomes a complicated matter. It raises questions, for example, about whether we should focus on the federal funds rate, which has been our traditional fulcrum, or some other measure, such as the rate we pay on excess reserves or that we pay on overnight reverse repos or some mix thereof. You can expect to hear more about this as time passes. Today, I am going to focus on another aspect of “normalization,” and that is: Once we have wound down QE3, when are we likely to raise the short-term rate that anchors the yield curve?

In the parlance of the trade, market operators and bankers alike are seeking “forward guidance” about our intentions. I spoke about this at length in a recent speech in Hong Kong, and I refer you to that speech if you need a sleeping aid this evening.[1]

The Advent of the Dots

The intense focus on when we are likely to raise the overnight rate is understandable. I was a banker in my previous life, before migrating to portfolio management; I spent 20 years in both professions before going into public service so as to “pay it back.” As a banker and market operator, I naturally wanted to eliminate uncertainty as much as possible. The adage “don’t fight the Fed,” was prevalent then, as it is now, so I would garner as much knowledge as possible about future Federal Reserve intentions and moves in order to position my book.

Then, we had little information. The FOMC under Paul Volcker did not even announce its decisions, and the market was left to discover them on its own. Later, under Alan Greenspan, the FOMC began the process of releasing information about decisions taken, but any clues as to future intentions required one to divine some signal from the chairman’s almost mystical pronouncements and oracular circumlocution. Chairman Ben Bernanke worked with the FOMC to instill greater transparency under the assumption that providing as much information as we can enlightens markets so as to modulate the possible disruption of surprises and allows decision-makers—from consumers to businesses to bankers and investors—to plan forward. To this end, we now release copious amounts of information, including the forecasts of economic activity and the year-end level at which we see the rate on overnight money trading, as foreseen by each individual FOMC participant under his or her assessment of appropriate monetary policy.

We call this exercise the Summary of Economic Projections, or SEP for short. We release it quarterly. I draw your attention to it because it has become something of a phenomenon among analysts preoccupied with the entrails of policymaking and has taken on a life of its own. You read about it in the papers and get analysis of it from market soothsayers. Yet, I want to caution you against becoming overly preoccupied with the FOMC’s SEP. In my less than humble opinion, it is a flawed tool. Let me explain why.

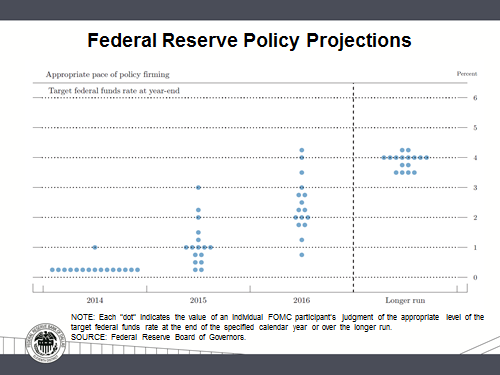

Here is what the last SEP release for the fed funds rate looked like. It provided the FOMC participants’ projections for the overnight rate at year-end for the next three years and beyond to the “longer run,” as foreseen from March 19:

You can see why it is referred to in the business as “the dot chart.” The best guesses of the entire panoply of participants in FOMC deliberations—19 when we have a full complement (the 12 Fed bankers and the maximum of seven governors appointed by the president subject to approval of the Senate)—are summarized in dots with the expected level on the “y-axis” and the year at the end of which it is thought likely to occur on the “x-axis.”

I use the term “best guesses” deliberately. The participants in the FOMC have sophisticated econometric models, a deep knowledge of theory and a great breadth of experience to draw upon. But truth be told, however we dress up our forecasts as rigorous analysis, they are no more than the very best educated guesses of the superbly trained but still human staffs of the 12 Fed bankers and the active governors.

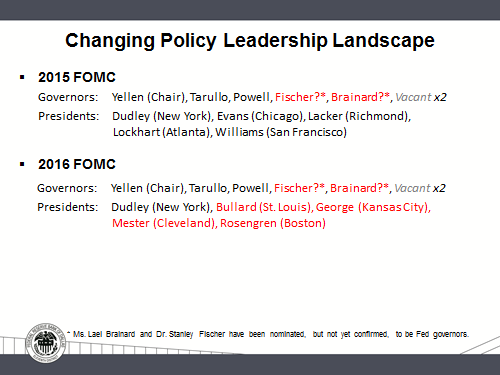

And the composition of those among the FOMC participants who actually vote on policy changes periodically. With the departure of Governor Jeremy Stein at the end of this month, we will have eight people, including me, who vote on policy for the remainder of this year. We are hopeful that the full Senate will confirm the two governors who have now come out of the Senate Banking Committee, but we don’t know when that will occur. That will bring the total number of voters to 10. But the composition of those 10 voters will change each year going forward.

Here, for example, is how the voters have changed just since last year and how the voting group will morph on into 2016, with those names in red indicating new positions or votes.

Dot-ology or Doxology?

Even though the Fed has a remarkable assembly of the best economic thinkers on the planet (present company excluded), no one on the FOMC is a seer and none possess Nostradamus-like insight, even when looking out just a couple of quarters; and, given that the roster of those who actually vote on policy is constantly changing, it is a wonder that the analytical community and market economists have become so fixated on “the dots.”

Some analysts practically worship the dots. They have become analytical idols around which a doxology of sorts has developed (“Praise dots from whom all insights flow”). Others consider their fallibility but still spill plenty of ink slicing and dicing them.

For example, here is a foray into dot-ology sent out on April 23 by the highly regarded chief international economist of Deutsche Bank, Torsten Slok: “One important question is how confident FOMC members are in their forecasts. One way to measure this is to look at the standard deviation around FOMC members’ forecasts of where they think the fed funds rate will be in two years’ time, i.e. look at the standard deviation of the dots in the Fed’s dot chart. … At their latest meeting the FOMC members felt more certain about the coming hike in the fed funds rate than they did a year ago.”[2]

I cite Mr. Slok’s analysis only as an example of an entire field of study—a veritable industry—that has evolved around “the dots.” So extensive is the preoccupation with this that it would not surprise me if Harrah’s Casino here on Canal Street eventually starts taking bets on how the dots will shift from quarter to quarter.

Surely, economists of high repute are aware of the imperfections of this exercise and the fundamental problem with date-based forward guidance (projecting a schedule for future policy changes). We, on the FOMC, certainly are.

Dr. Seuss or Strother Martin?

There have been suggestions from outside and within the Fed on how to better present our “best guesses” as to when we will move the base rate for anchoring the yield curve. For example, some have suggested identifying which dots belong to current voting members of the FOMC. Others have suggested that we report only the median of responses or the median of voter responses, rather than the entire array of dots. But neither of these approaches would do anything to enlighten the markets as to the views of future voters, nor would they overcome the underlying problem with date-based forward guidance.

What to do? If the dot chart creates confusion, one option would be to dispense with the exercise altogether. Having evoked Dr. Seuss earlier, I can imagine his bidding the dots farewell with some ditty like this:

Yet expressing the FOMC participants’ perceptions of, and possible reactions to, an assortment of future scenarios—however often the committee’s composition may change—does strike me as having some merit, if only to give markets insight into how the central bank might react under different circumstances.

In the parlance of the trade, this is called “state-based” guidance. Yet here, too, we have struggled. For example, until two meetings ago, we used an unemployment figure of 6½ percent as a point sometime after which we would begin to consider pulling back on monetary accommodation, then decided this wasn’t quite the ticket.

This may be a little more inside baseball than you expected to hear today, but here’s the point: Expect the Fed to continue refining its communications. We are getting better at it. But to invoke the immortal words from the chain gang captain portrayed by Strother Martin in the 1967 movie Cool Hand Luke: “What we’ve got here is failure to communicate.” We are working on it so that you and other bankers, market operators, businesses and consumers will develop the best possible insight into how your monetary authority will behave. I expect that our new Chair, Janet Yellen, will play a significant role here as she uses her press conferences to explain what simply cannot be communicated with a series of dots or within the statement we release after each meeting.

Alas, There Is Congress

Now mind you, your monetary authority—your Federal Reserve—does not hold every card to your future in its hand. No matter how clearly we communicate, no matter how expertly we tailor our supervision of your banks, no matter how we conduct monetary policy, our work is necessary but not sufficient to the success of the Louisiana, Texas and U.S. economies. The fiscal authorities—Congress and the executive branch—must do their job to provide the proper tax, spending and regulatory incentives for businesses to take advantage of the cheap and abundant money the Fed has made possible and put it to work to grow, expand their payrolls and let America truly prosper.

I will spare you my thoughts on Congress (it is not very central banker-like to resort to profanity). All I will say is that you and your neighbors and friends and customers are the ones who elect people to office and whether you are a "D" or an "R," you need only look at yourself in the mirror to see who is in charge of placing the right people in office to get the job done of putting the American economy back on track. I’d say you have some serious work to do here.

Conclusion

For today, just bear in mind that the Fed is doing its utmost to be an enlightened regulator of your banks. For the economy as a whole, there is abundant liquidity to finance economic expansion, and the FOMC will assure that it remains affordable as long as the prospect of inflation rising above its 2 percent target remains in abeyance. It is too early to say that the economy can declare laissez les bon temps rouler. But for you bankers in this audience today, you might be forgiven if you kick up your heels a little bit while you are in New Orleans … though the curmudgeonly old Fed will be watching to make sure that for its part, you don’t let things get out of hand.

Thank you, Drake. Thank you all.

Now, in the best tradition of central banking, I would be happy to avoid answering any questions you have.

Notes

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.

- See “Forward Guidance,” by Richard W. Fisher, remarks before the Asia Society Hong Kong Center, Hong Kong, April 4, 2014, www.dallasfed.org/news/speeches/fisher/2014/fs140404.cfm.

- “Standard Deviation of the Dots in the Dot Chart,” by Torsten Slok, Deutsche Bank Research, April 23, 2014.

About the Author

Richard W. Fisher served as president and CEO of the Federal Reserve Bank of Dallas from April 2005 until his retirement in March 2015.