Record-breaking Texas summer heat tests the grid, ERCOT operations

Electricity demand and temperatures set records in Texas this summer. Fortunately, surging demand, also known as load, was met with rapidly increasing solar-generating capacity and reliable output from existing thermal power plants (gas, coal and nuclear) during the hottest stretches.

The summer of 2023 provides several key lessons. First, rising peak load levels demonstrate the need for conservation efforts. Second, while booming solar capacity helped keep the lights on, longer term it creates challenges for operating conditions at thermal power plants. Finally, wholesale electricity prices experienced stunning increases during peak hours on many days, due in part to the management of power reserves.

As electricity demand continues to grow and extreme summer temperatures become more common, preventing rolling blackouts or worse will be a larger challenge for the Electric Reliability Council of Texas (ERCOT), the grid operator responsible for 90 percent of Texas’ power load. But continued capacity additions across fuel sources, most notably battery storage, and demand response programs can help ensure future reliability.

Peak load smashes previous record

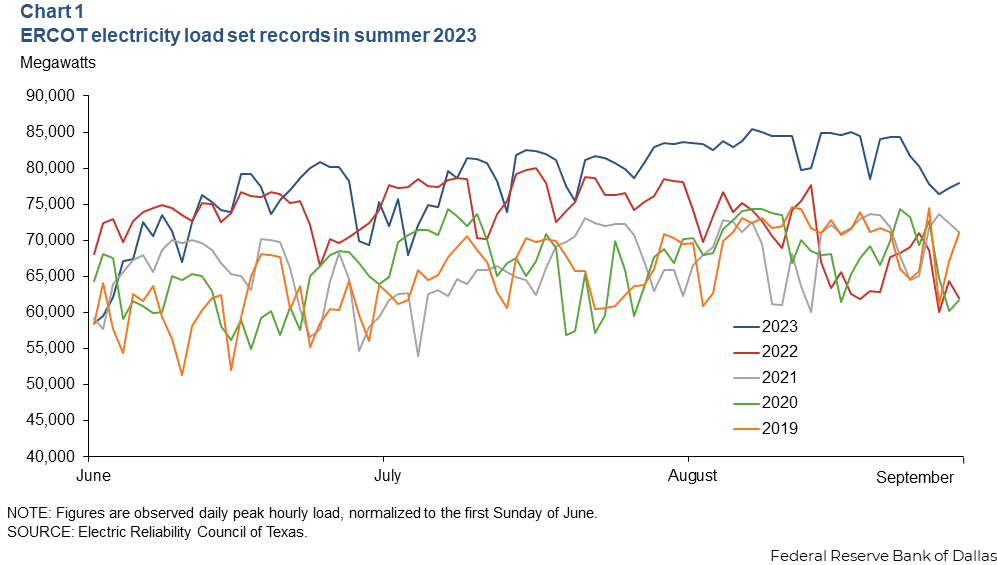

On an hourly basis, ERCOT load had never exceeded 80,000 megawatts (MW) before this summer. Not only was a record 85,464 MW load set on Aug. 10, but demand breached 80,000 MW on 42 days between June 1 and Aug. 31 (Chart 1). One might point to Texas’ population and economic growth as primary reasons for such high levels of electricity consumption, but a closer look reveals more forces are at play.

Texas population grew by 1.6 percent in 2022, and the same growth rate is expected in 2023, according to the Texas Demographic Center. Real state GDP increased 3.4 percent in 2022 and stood at an annualized 2.9 percent in the most recent reading in first quarter 2023.

Annual electricity consumption increases in Texas tend to follow GDP growth more closely than population, but even then, the correlation is sometimes rough. Population and GDP cannot explain peak summer load growth of 9 percent in 2022 and 7 percent in 2023. This indicates high temperatures and resulting air conditioning demand is the primary cause of load peaks disconnecting from underlying trends.

Demand response programs—when electricity consumers volunteer to be paid to reduce usage during periods of tight grid conditions—are not widespread within the ERCOT service area. These arrangements exist directly between ERCOT and some large industrial users but are less common between households and retail electricity providers. A broader, statewide demand response initiative has the potential to reduce peak load levels when every megawatt counts.

Generating capacity rises to the challenge

Fortunately, increased generating capacity handled unprecedented peak load this summer. This was primarily the result of capacity additions from solar facilities and a thermal power plant fleet that experienced few unplanned outages during critical periods.

Utility-scale solar capacity in Texas has surged over the past two years. Large solar farm output is a major part of the Texas electricity portfolio, rising from less than 4,000 MW in optimal conditions in 2020 to exceeding 12,000 MW at the peak most summer days in 2023 (Chart 2).

While thermal power plant additions have lagged this pace, plant capacity this summer was adequate to meet demand. Thermal plants frequently experience unexpected malfunctions or require quick repairs and maintenance that result in unplanned outages. ERCOT forecasted unplanned thermal outages to average 5,034 MW this summer; they averaged 6,848 MW. However, unplanned outages were kept at a minimum throughout August when load frequently exceeded 80,000 MW and low wind speeds placed greater demand on the thermal plants (Chart 3).

Interestingly, thermal plant outages appeared to spike during periods when temperatures fell below 100 degrees and load experienced a minor pullback. This suggests, circumstantially, that plant operators deferred minor repairs and maintenance until periods when the grid could afford to lose some thermal plant capacity.

‘Net load ramp’ emerging as a challenge

Though growing solar capacity helped keep the lights on this summer, it brings with it challenges to balancing the grid. Solar output usually enters the power mix mid-morning, crests during peak load hours in the early evening and falls precipitously shortly thereafter as the sun goes down.

Before solar generation was a major contributor, net load (combined generation minus solar and wind) followed a relatively smooth and predictable curve every 24-hour period. But with solar power’s load profile, many thermal plants are now called on to ramp up and pull back twice a day (Chart 4).

More frequent and intense cycling of thermal plants, which most often falls to natural-gas-fired plants, can increase wear and shorten the lifespan of equipment. This not only accelerates maintenance needs but can also contribute to unplanned outages.

Additionally, natural gas pipelines that serve power plants flow at a constant rate throughout the day. As natural gas plants experience a more uneven net load curve due to solar generation, managing pipeline deliveries and on-site gas storage will prove more challenging.

Another consequence of increased solar generation is net load (nonsolar, nonwind) peaking in the early evening versus late afternoon when total load peaks. This shift is primarily why several of the electricity conservation notices ERCOT issued this summer focused on the 7–9 p.m. window.

Battery storage playing a growing, more critical role

The widening net load ramp is a challenge that utility-scale battery storage can help solve. Batteries have the potential to smooth the transition between solar and thermal generation during critical early evening hours.

Additionally, as a dispatchable source much like natural gas plants, batteries can play a role in the reserve power portfolio but face challenges on how long they can store power. However, battery storage was instrumental in maintaining grid stability during certain tight periods this summer.

Installed battery capacity increased from 153 MW in 2019 to 3,518 MW in 2023. Interconnection agreements have been signed for an additional 7,945 MW of battery storage through 2024, allowing batteries to play a growing role in daily power needs in the near future.

Wholesale peak prices spike during tight periods

While the median wholesale electricity price in ERCOT’s service area was $25/MWh between June 1 and Aug. 31, price spikes above $1,000/MWh occurred 182 times in the real-time market (priced in 15-minute intervals). This is significant when compared with the 73 occurrences in 2022 and 15 in 2021.

Since the February 2021 winter storm that caused widespread, multiday power outages, ERCOT has developed policies and electricity market products that increase the amount of dispatchable generation it holds in reserve. One measure of reserve capacity is ERCOT’s Physical Responsive Capability, or PRC.

For June through August 2022, PRC averaged 4,830 MW. During the same months in 2023, PRC averaged 7,084 MW. For reference, ERCOT begins emergency procedures when PRC falls below 3,000 MW. Rolling outages start when PRC falls below 1,000 MW.

On 130 occasions when wholesale prices breached $1,000/MWh this summer, PRC was at least 5,000 MW. Although maintaining high reserve levels can help prevent outages when power plants unexpectedly trip offline, holding excessive generating capacity in reserve comes at a cost.

ERCOT achieves record deliveries as temperatures soar

Texas just witnessed its second-hottest summer ever and its highest electricity demand without experiencing interruption to electricity delivery. It was accomplished through a breakout in solar-generating capacity, strong thermal plant generation and the emergence of utility-scale battery storage.

Challenges await as the shift in the net load curve develops, ERCOT works to hold reserve power generation without significantly increasing costs, and greater electrification of transportation adds new long-term power demands. But taken as a whole, Texas is demonstrating a pathway to incorporate higher renewable electricity generation without sacrificing reliability.