Texas Manufacturing Outlook Survey

Texas manufacturing activity rebounds, though outlooks wane

For this month’s survey, Texas business executives were asked supplemental questions on remote work and the impact of recent federal government legislation. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

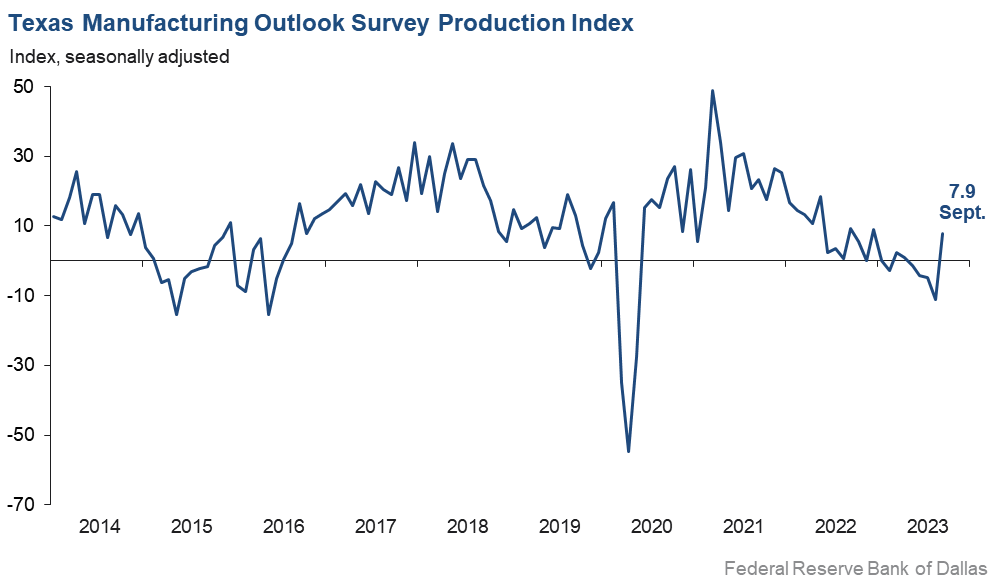

Growth in Texas factory activity resumed in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rebounded nearly 20 points to 7.9—its highest reading of the year.

Other measures of manufacturing activity also moved up this month, though some remained in negative territory. The new orders index pushed up 11 points to -5.2, a reading still indicative of falling demand though not at the pace seen in the past several months. The capacity utilization index rebounded into positive territory, rising from -3.7 to 7.8, while the shipments index moved up to near zero after slipping to -15.8 in August.

Perceptions of broader business conditions continued to worsen in September. The general business activity and company outlook indexes remained largely unchanged at -18.1 and -17.5, respectively. Uncertainty regarding outlooks picked up notably, with the corresponding index pushing up 14 points to 27.0, its highest reading in nearly a year.

Labor market measures suggest stronger employment growth and longer workweeks in September. The employment index rebounded nine points to 13.6, a reading well above the series average of 7.9. Twenty-three percent of firms noted net hiring, while 9 percent noted net layoffs. The hours worked index climbed back into positive territory, coming in at 5.1.

Price and wage pressures were mixed. The raw materials prices index rose again this month, to 25.0. This is after trending down in the first half of the year—all the way to a near-zero reading in June—and now trending back up to near its average reading. The finished goods prices index, however, has remained in a -2.0 to 2.0 range since retreating to zero in May. The index held steady at 1.8 this month, suggesting little price growth. The wages and benefits index remained highly elevated at 34.8.

Expectations regarding future manufacturing activity were mixed in September. The future production index remained positive and pushed up five points to 10.9. The future general business activity index fell further negative to -16.5. Most other measures of future manufacturing activity advanced into slightly more positive territory this month.

Next release: Monday, October 30

Data were collected Sept. 12–20, and 89 Texas manufacturers responded to the survey. The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary.

Results summary

Historical data are available from June 2004 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Sep Index | Aug Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 7.9 | –11.2 | +19.1 | 10.3 | 1(+) | 26.8 | 54.3 | 18.9 |

Capacity Utilization | 7.8 | –3.7 | +11.5 | 8.3 | 1(+) | 25.8 | 56.2 | 18.0 |

New Orders | –5.2 | –15.8 | +10.6 | 5.7 | 16(–) | 24.3 | 46.1 | 29.5 |

Growth Rate of Orders | –7.7 | –12.5 | +4.8 | –0.2 | 17(–) | 21.5 | 49.2 | 29.2 |

Unfilled Orders | 0.4 | –13.2 | +13.6 | –1.8 | 1(+) | 18.0 | 64.4 | 17.6 |

Shipments | –1.1 | –15.8 | +14.7 | 8.7 | 9(–) | 23.3 | 52.3 | 24.4 |

Delivery Time | –1.5 | –4.3 | +2.8 | 1.2 | 6(–) | 13.0 | 72.5 | 14.5 |

Finished Goods Inventories | –6.9 | –6.9 | 0.0 | –3.2 | 4(–) | 13.6 | 65.9 | 20.5 |

Prices Paid for Raw Materials | 25.0 | 17.4 | +7.6 | 27.6 | 41(+) | 32.2 | 60.6 | 7.2 |

Prices Received for Finished Goods | 1.8 | 1.8 | 0.0 | 8.8 | 3(+) | 13.1 | 75.6 | 11.3 |

Wages and Benefits | 34.8 | 34.9 | –0.1 | 21.2 | 41(+) | 38.2 | 58.4 | 3.4 |

Employment | 13.6 | 4.3 | +9.3 | 7.9 | 7(+) | 23.0 | 67.6 | 9.4 |

Hours Worked | 5.1 | –3.8 | +8.9 | 3.7 | 1(+) | 14.9 | 75.3 | 9.8 |

Capital Expenditures | –6.8 | –8.6 | +1.8 | 6.6 | 3(–) | 12.9 | 67.4 | 19.7 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Sep Index | Aug Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –17.5 | –18.4 | +0.9 | 5.3 | 19(–) | 9.8 | 62.9 | 27.3 |

General Business Activity | –18.1 | –17.2 | –0.9 | 1.6 | 17(–) | 11.7 | 58.5 | 29.8 |

| Indicator | Sep Index | Aug Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 27.0 | 12.7 | +14.3 | 17.0 | 29(+) | 36.0 | 55.1 | 9.0 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Sep Index | Aug Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 10.9 | 6.3 | +4.6 | 36.8 | 41(+) | 32.7 | 45.5 | 21.8 |

Capacity Utilization | 5.9 | 2.5 | +3.4 | 33.7 | 41(+) | 28.3 | 49.4 | 22.4 |

New Orders | 10.1 | 3.2 | +6.9 | 34.2 | 11(+) | 27.2 | 55.7 | 17.1 |

Growth Rate of Orders | 3.1 | 0.5 | +2.6 | 25.3 | 4(+) | 21.4 | 60.3 | 18.3 |

Unfilled Orders | –10.7 | –12.5 | +1.8 | 3.0 | 2(–) | 6.7 | 75.9 | 17.4 |

Shipments | 9.7 | 5.5 | +4.2 | 35.2 | 41(+) | 28.7 | 52.3 | 19.0 |

Delivery Time | –8.7 | –3.9 | –4.8 | –1.5 | 6(–) | 8.8 | 73.7 | 17.5 |

Finished Goods Inventories | –7.3 | –15.9 | +8.6 | 0.1 | 5(–) | 11.0 | 70.7 | 18.3 |

Prices Paid for Raw Materials | 22.2 | 20.8 | +1.4 | 33.7 | 42(+) | 31.0 | 60.2 | 8.8 |

Prices Received for Finished Goods | 14.9 | 2.5 | +12.4 | 20.8 | 41(+) | 27.2 | 60.5 | 12.3 |

Wages and Benefits | 37.3 | 39.5 | –2.2 | 39.4 | 41(+) | 42.1 | 53.1 | 4.8 |

Employment | 12.9 | 13.2 | –0.3 | 23.2 | 40(+) | 29.9 | 53.1 | 17.0 |

Hours Worked | –3.0 | –1.3 | –1.7 | 9.0 | 2(–) | 11.0 | 75.0 | 14.0 |

Capital Expenditures | 11.9 | 14.2 | –2.3 | 19.6 | 40(+) | 26.6 | 58.7 | 14.7 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Sep Index | Aug Index | Change | Series Average | Trend** | % Reporting Increase | % Reporting No Change | % Reporting Worsened |

Company Outlook | –3.9 | 6.1 | –10.0 | 18.7 | 1(–) | 19.4 | 57.3 | 23.3 |

General Business Activity | –16.5 | –3.3 | –13.2 | 12.7 | 2(–) | 14.0 | 55.5 | 30.5 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Production index

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

- China’s economic woes are believed to be much worse than reported, driving down exports, while internal pressures on building and construction, automotive and general merchandise through inflationary pressures and particularly the cost of financing is slowing growth domestically. As a basic materials company, this is hitting us on all fronts and slowing business dramatically.

- We are still seeing wage pressure for our blue-collar employees, so we did another mid-year raise in order to keep our experienced team. We finally feel like the rate of wage increases will slow down. New orders have slowed slightly but a lot less than one would think from watching the news. Our products are nondiscretionary expense items, so we aren’t nearly as subject to slowdowns as capital equipment providers or discretionary spend items. We are buying some new production equipment, and we are seeing much shorter lead times and flexibility on price from suppliers.

- We had a very slow summer. Things seem to be picking up a little, but the slow summer will cause the total recurring revenue numbers to be lower, and we are constantly below our system sales numbers.

- As a member of the industrial production segment, we have had a very hard time hiring qualified personnel. For the last three years, we as a country are trying to reshore our manufacturing back to the U.S. and become more independent of China and Taiwan. The federal government is doing very little to incentivize bringing manufacturing back to our country. Our capital equipment customers are telling us that they are looking for specific manufacturing capabilities, and they are not finding them here at home. They have all moved to China in the last 30 years. I don’t have to say that raising interest rates to this level does affect the capital equipment purchases in a big way, obviously. Most of them are sold in leases, and over the last 35 years in this industry, our company has experienced the same every time interest rates go up beyond 5 percent. Hiring in the industrial production environment is a lot more difficult and costly than in the consumer industry. We are living under completely different economic circumstances to have high interest rates. Isn’t it time to start lowering interest rates and have the country’s backbone manufacturing industry become more confident in the economy?

- Due to the cost of borrowing and lower order levels for the fourth quarter, the company had to "optimize" staff and is looking to focus on the bottom line.

- We have one vendor who uses aluminum, and their lead time has increased to over five months. It is causing us all kinds of difficulties.

- China remains very weak, with no uptick post-COVID. All markets have weakened except auto, which has built inventory over the last several quarters. We expect that market to roll over, too; perhaps the UAW [United Auto Workers] strike will be the impetus.

- Supply constraints are improving, but there are still some ongoing challenges.

- Uncertainty related to economy, fiscal policy and the ability to renew our line of credit on favorable terms in early 2024 [are issues affecting our business].

- We are having a record level of sales, production and revenue for the last six months.

- As we prepare for continued uncertainty in the economy, we are holding off on replacing team members who leave for retirement or other reasons. We are also introducing the lean principles and mindset to our organization to reduce waste in every area of our business.

- Beef prices and availability are posing challenges to our business right now. Chicken is also increasing in cost.

- A significant cut in U.S. government purchasing looms, yet domestic orders have increased. The latter is a blip due to a specialized funding program.

- The consumer is changing purchasing habits and looking for value in their food purchases. This trend will continue.

- The summer funk has not relented. We see glimmers of potential, but purchase orders are not being released, quantities are being scaled back, and general sentiment is rather blase.

- The demand for our products remains soft, and we see no signs of improved business activity for at least another year.

- Overall activity is now trending down 2–3 percent. Our industry is down 6–10 percent.

- We continue to see weakening demand in the primary metals sectors. This is in part due to uncertainty on many fronts, but especially with federal regulations and taxes. We are closely monitoring trends across all sectors of the economy but continue to receive feedback from the majority of customers that the economy is slowing down considerably.

- We have been very fortunate to have had some large jobs that have kept us very busy this summer, when many in our industry have been slow. September will be as good if not better than August, but then it seems our world will get slower and see greater uncertainty. Labor costs are continuing to go up, but it seems that prices we pay for our materials are possibly staying constant.

- The outlook is dismal with oil prices increasing and interest rates strangling many sectors, including ours.

- 2024 is looking better for the commercial vehicle industry in spite of increased interest rates. However, we are still forecasting a 13 percent drop in customer demand.

Historical Data

Historical data can be downloaded dating back to June 2004.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Manufacturing Outlook Survey is released on the web.