Texas Manufacturing Outlook Survey

Tepid Texas manufacturing recovery continues

For this month’s survey, Texas business executives were asked supplemental questions on credit conditions. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

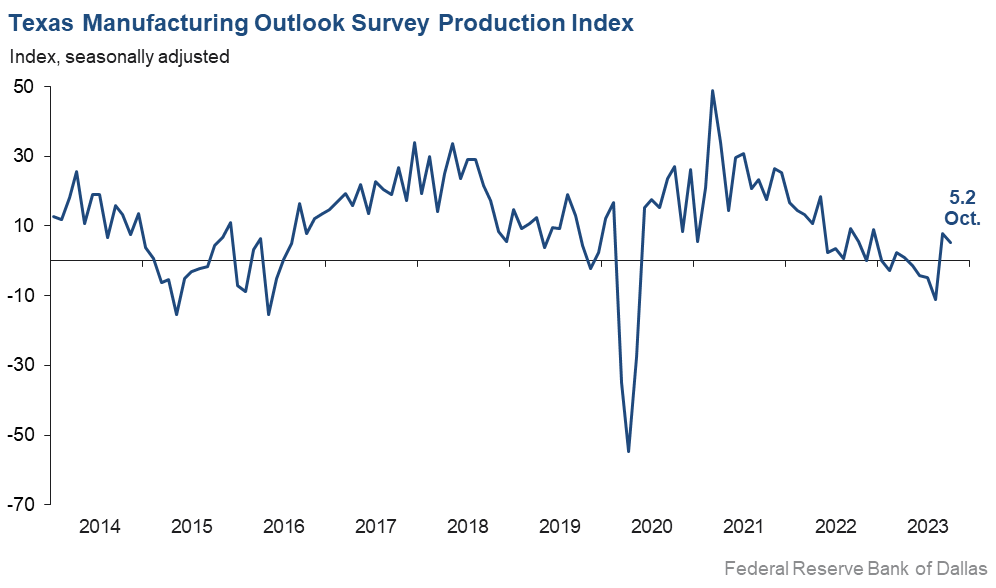

Growth in Texas factory activity continued in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, posted a second positive reading after four months in negative territory. It edged down to 5.2, a reading that signals a modest pace of output expansion.

Other measures of manufacturing activity showed mixed signals this month. The new orders index remained negative and slipped four points to -8.8. The capacity utilization index posted a second consecutive positive reading, coming in at 5.4, while the shipments index remained near zero.

Perceptions of broader business conditions continued to worsen in October. The general business activity and company outlook indexes remained largely unchanged at -19.2 and -17.1, respectively, having now spent a year and a half in negative territory. The outlook uncertainty index remained elevated but retreated from 27.0 to 20.2.

Labor market measures suggest slower employment growth and shorter workweeks in October. The employment index declined seven points to 6.7, a reading just below the series average of 7.9. Nineteen percent of firms noted net hiring, while 13 percent noted net layoffs. The hours worked index slipped back into negative territory, coming in at -2.3.

Upward pressure on input costs—both labor and materials—retreated this month, and selling prices fell modestly. The raw materials prices index dropped 11 points to 13.6, a reading well below average. The finished goods prices index fell to -2.1, its lowest reading in more than three years. The wages and benefits index dropped 10 points to 24.4, a reading much closer to average than what has typically been seen the past three years.

Expectations regarding future manufacturing activity were mixed in October. The future production index remained positive and pushed up nine points to 20.0. The future general business activity index rose 10 points but remained negative at -6.8. Most other measures of future manufacturing activity advanced into more-positive territory this month.

Next release: Monday, November 27

Data were collected Oct. 17–25, and 94 Texas manufacturers responded to the survey. The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary.

Results summary

Historical data are available from June 2004 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 5.2 | 7.9 | –2.7 | 10.3 | 2(+) | 26.8 | 51.6 | 21.6 |

Capacity Utilization | 5.4 | 7.8 | –2.4 | 8.3 | 2(+) | 24.9 | 55.6 | 19.5 |

New Orders | –8.8 | –5.2 | –3.6 | 5.6 | 17(–) | 21.7 | 47.7 | 30.5 |

Growth Rate of Orders | –16.8 | –7.7 | –9.1 | –0.2 | 18(–) | 17.9 | 47.3 | 34.7 |

Unfilled Orders | –12.9 | 0.4 | –13.3 | –1.8 | 1(–) | 8.1 | 70.9 | 21.0 |

Shipments | –1.4 | –1.1 | –0.3 | 8.7 | 10(–) | 26.8 | 45.0 | 28.2 |

Delivery Time | –7.8 | –1.5 | –6.3 | 1.2 | 7(–) | 8.9 | 74.4 | 16.7 |

Finished Goods Inventories | –5.3 | –6.9 | +1.6 | –3.2 | 5(–) | 13.8 | 67.0 | 19.1 |

Prices Paid for Raw Materials | 13.6 | 25.0 | –11.4 | 27.5 | 42(+) | 26.7 | 60.2 | 13.1 |

Prices Received for Finished Goods | –2.1 | 1.8 | –3.9 | 8.8 | 1(–) | 13.1 | 71.7 | 15.2 |

Wages and Benefits | 24.4 | 34.8 | –10.4 | 21.2 | 42(+) | 28.7 | 67.0 | 4.3 |

Employment | 6.7 | 13.6 | –6.9 | 7.9 | 8(+) | 19.2 | 68.3 | 12.5 |

Hours Worked | –2.3 | 5.1 | –7.4 | 3.6 | 1(–) | 16.1 | 65.5 | 18.4 |

Capital Expenditures | 2.3 | –6.8 | +9.1 | 6.6 | 1(+) | 19.1 | 64.1 | 16.8 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –17.1 | –17.5 | +0.4 | 5.2 | 20(–) | 8.8 | 65.3 | 25.9 |

General Business Activity | –19.2 | –18.1 | –1.1 | 1.5 | 18(–) | 11.0 | 58.8 | 30.2 |

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 20.2 | 27.0 | –6.8 | 17.1 | 30(+) | 33.0 | 54.3 | 12.8 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 20.0 | 10.9 | +9.1 | 36.8 | 42(+) | 37.1 | 45.8 | 17.1 |

Capacity Utilization | 12.3 | 5.9 | +6.4 | 33.6 | 42(+) | 32.1 | 48.1 | 19.8 |

New Orders | 12.4 | 10.1 | +2.3 | 34.1 | 12(+) | 32.5 | 47.4 | 20.1 |

Growth Rate of Orders | 8.4 | 3.1 | +5.3 | 25.2 | 5(+) | 29.0 | 50.4 | 20.6 |

Unfilled Orders | 2.6 | –10.7 | +13.3 | 3.0 | 1(+) | 15.0 | 72.6 | 12.4 |

Shipments | 22.7 | 9.7 | +13.0 | 35.1 | 42(+) | 40.2 | 42.4 | 17.5 |

Delivery Time | –4.7 | –8.7 | +4.0 | –1.5 | 7(–) | 8.8 | 77.7 | 13.5 |

Finished Goods Inventories | –4.6 | –7.3 | +2.7 | 0.1 | 6(–) | 13.8 | 67.8 | 18.4 |

Prices Paid for Raw Materials | 29.3 | 22.2 | +7.1 | 33.7 | 43(+) | 34.9 | 59.5 | 5.6 |

Prices Received for Finished Goods | 26.4 | 14.9 | +11.5 | 20.8 | 42(+) | 31.0 | 64.4 | 4.6 |

Wages and Benefits | 41.0 | 37.3 | +3.7 | 39.4 | 42(+) | 42.6 | 55.8 | 1.6 |

Employment | 11.7 | 12.9 | –1.2 | 23.1 | 41(+) | 27.6 | 56.5 | 15.9 |

Hours Worked | 5.7 | –3.0 | +8.7 | 9.0 | 1(+) | 18.4 | 68.9 | 12.7 |

Capital Expenditures | 14.5 | 11.9 | +2.6 | 19.6 | 41(+) | 29.0 | 56.5 | 14.5 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Increase | % Reporting No Change | % Reporting Worsened |

Company Outlook | –2.6 | –3.9 | +1.3 | 18.6 | 2(–) | 15.5 | 66.4 | 18.1 |

General Business Activity | –6.8 | –16.5 | +9.7 | 12.7 | 3(–) | 13.6 | 66.0 | 20.4 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Production index

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

- The Middle East situation has raised uncertainty.

- With the unrest in the Middle East, there is now additional global uncertainty and about how it will impact the U.S. and overall global economy. There is limited optimism; we will see a very slow recovery in the first quarter depending on the global impacts of additional conflict.

- Overall customer projections are said to be up for 2024, but our forecasts don't match and are down.

- We are working our way to find a cyclical bottom. The overall economy is still the wild card, and it’s not helping. If things stay stable in the economy overall, customer inventories should have stopped draining, and our growth should resume sometime by mid next year.

- Supply-chain issues, particularly with the Panama Canal [bottleneck], have created delays that have resulted in reduced sales over the summer. Hopefully, these have been sorted out now.

- Business is great. Our profit, great.

- We are seeing a pronounced slowdown in owners going forward with new projects. There is too much uncertainty in the economy and globally.

- Reduction in government grants, cash flow issues with customers and the uncertainty created by the lack of border controls [are issues affecting our business].

- Food service demand is soft. Retail (grocery) demand has remained steady. Our premium pet food business has fallen off significantly.

- We have experienced a small reduction in our workforce over the last several weeks as we have shifted our strategy with our maintenance team. This reduction in workforce has not impacted our volume or sales. We expect mild growth next year.

- Business has slowed down significantly; we see no signs of improvement in business activity.

- Six months from now is actually quite scary. The economy is uncertain, and customers cannot predict with any certainty what they see. Political pressure and the wars are now forcing customers to reevaluate their business activities and reduce their outlook. It’s very uncertain.

- Oh, how we long for the days of a stable market. We just lost another long-time customer to China where the pricing for the finished product was what we pay for the raw material. With the inflation we have being imposed on us here in the U.S., we won't ever see those customers come back.

- We are off by 20 percent this year so far. I don't expect it to get better. Prices of goods are going up. Shipping is going up.

- The continuing UAW [United Auto Workers] strike is beginning to decrease our sales.

- In a consumer business, we are hearing a lot more "I can't afford this" than we ever have before.

- Activity is definitely slowing down. We remain optimistic at this point for a turnaround, but cautiously.

- The economy is slowing.

- Our industry continues to be severely damaged by foreign countries dumping product into the U.S. and our territories. That, coupled with overall business being down, has caused a loss of jobs and capital dollars going back into our industry.

- We anticipate that business conditions will remain constant or decline over the next three to four months, based on the rate that we are receiving orders. Oil and gas orders have been weak all year, which is strange since oil prices have been high and are anticipated to continue to increase with the uncertainty in the world order.

- We are starting to get slow and have seen this coming for a while. Quote levels are way down, which is a bad indicator of what's to come. We did, however, get a large reorder on a job we have done many times over the years, which will buffer the slowness for a while. I believe we are trending into a softer economy that is going to have repercussions for our industry for a while.

- Order and sales volume have slightly increased month over month from September. We have seen longer delivery times and lead/wait times at the Los Angeles port, causing slight delays with inventory shipments. Overall uncertainty as to demand is high. The general consensus among other manufacturers/sellers is that demand/sales are weak, and no one is sure what the short-term future holds.

- We are currently forecasting a 20 percent drop in 2024 versus 2023 (previously planned for a 13 percent drop), so the market forecast has worsened month over month.

- The lack of petroleum-based energy policy is troublesome.

Historical Data

Historical data can be downloaded dating back to June 2004.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Manufacturing Outlook Survey is released on the web.