Focus Area: Economic Opportunity

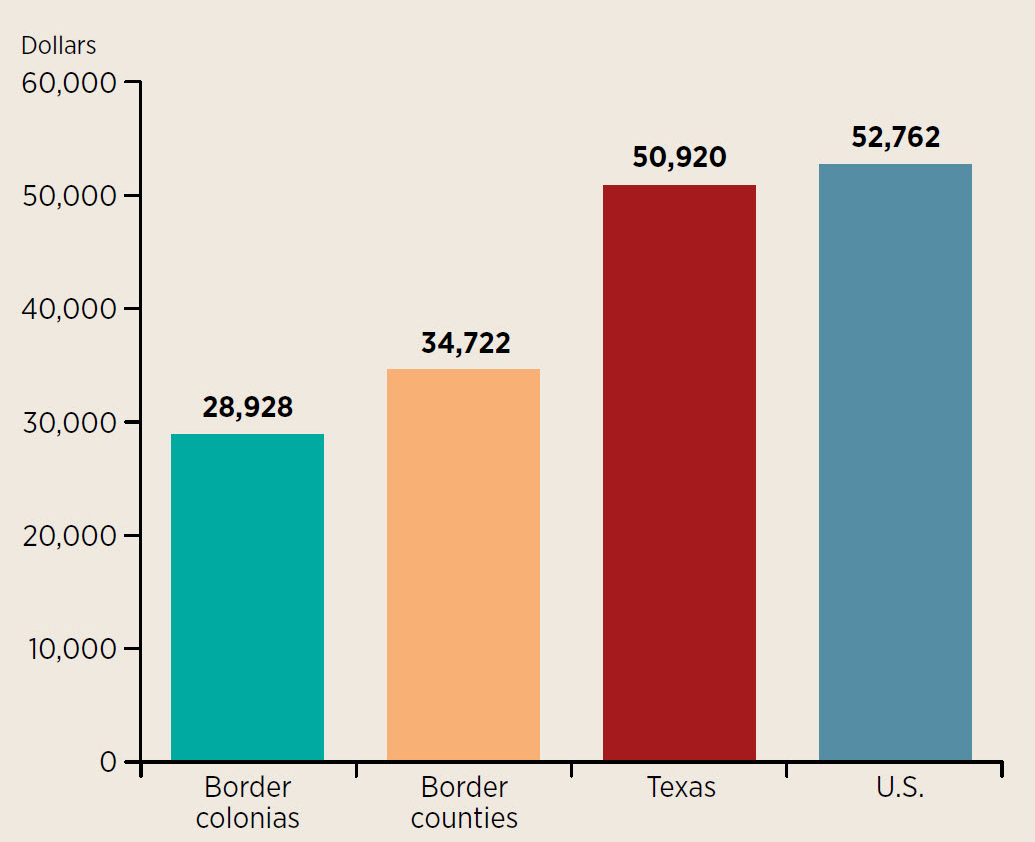

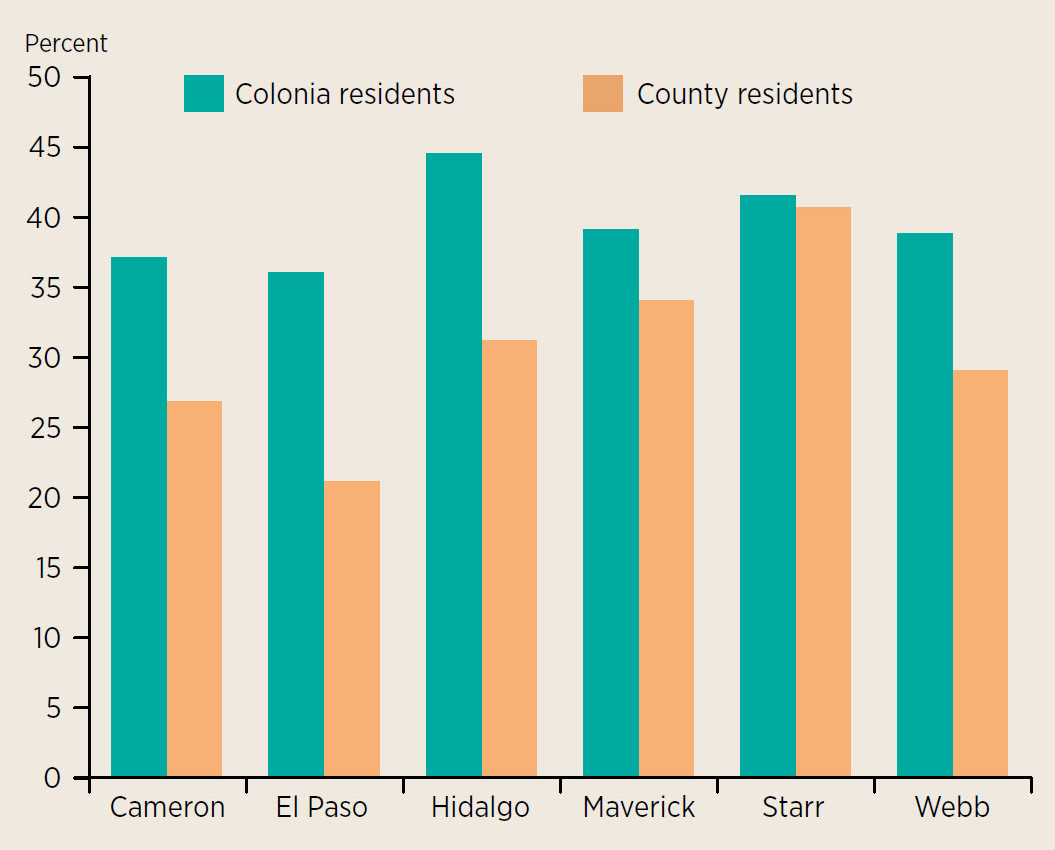

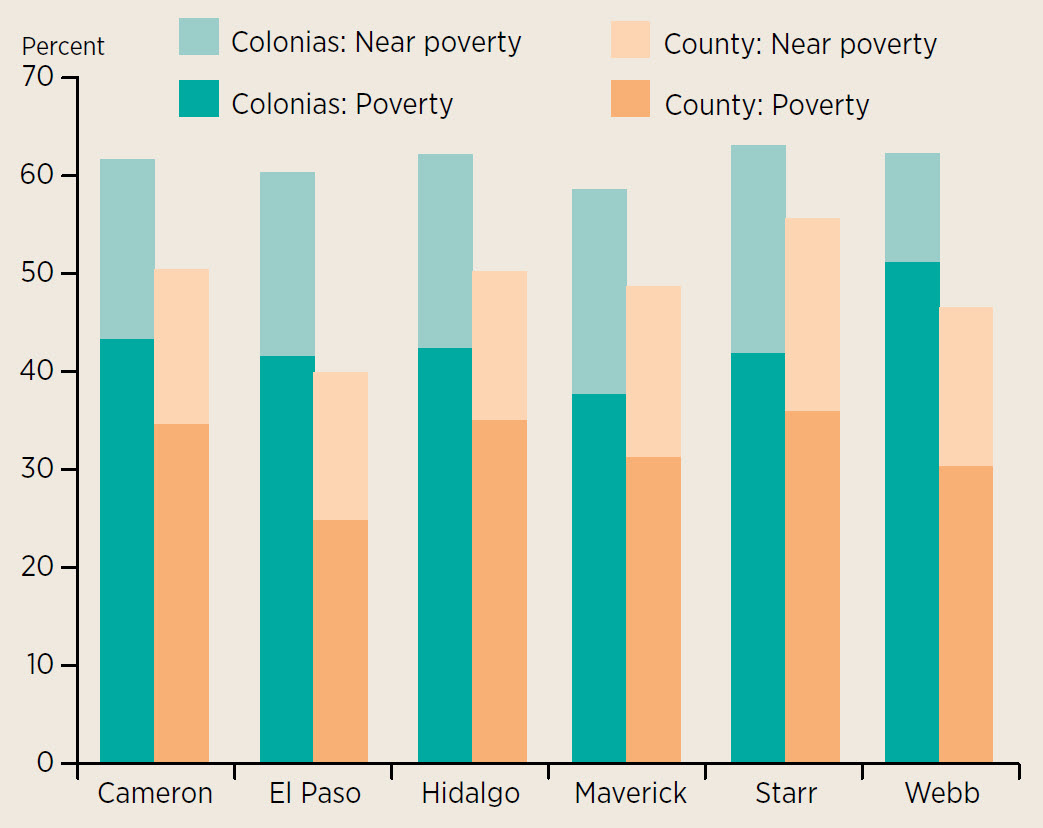

Forty-two percent of the Texas colonia population lives below the poverty line and another 19 percent are close to it. While the national average for median income is $52,762, colonia households struggle to survive on a median income of $28,928. Roughly 40 percent of households rely on public assistance or food stamps. The charts below show comparisons among counties.

| Poverty Is Far Reaching in Colonias |

|---|

|

| SOURCE: Census Bureau, 2011 American Community Survey 5-Year Estimates. |

A home-based small business in Cameron County; an example of a store/home combination common to colonias (see Housing section)

Because of these struggles, many Texas colonia residents rely on alternative financial service providers, such as payday and auto title lenders, pawnshops and rent-to-own stores. Although these lenders may be able to provide relatively fast and easy money to families in a bind, they come with extremely high interest rates that make the loans nearly impossible to pay off.

Despite these challenges, many colonia residents have been able to improve their financial well-being through entrepreneurship. Proximity to the border creates a competitive advantage for small-business owners and cost savings for consumers.

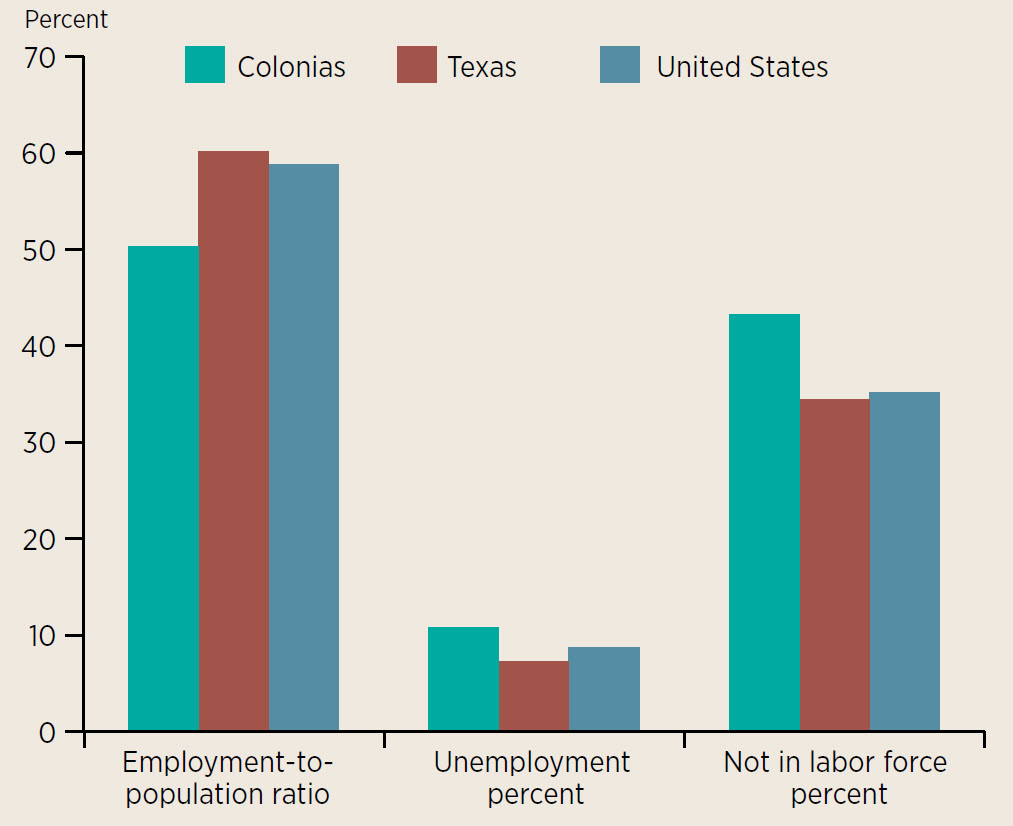

Much of this work is part of the border’s informal economy, which means it provides little job security or government protection and regulation; however, it can be what allows a family to make ends meet. In Texas colonias, 43 percent of residents are not in the labor force, so it is evident that many residents support themselves by participating in this informal economy as employers, employees and consumers.

| Fewer Colonia Residents Participate in Formal Economy |

|---|

|

| SOURCE: Census Bureau, 2011 American Community Survey 5-Year Estimates. |

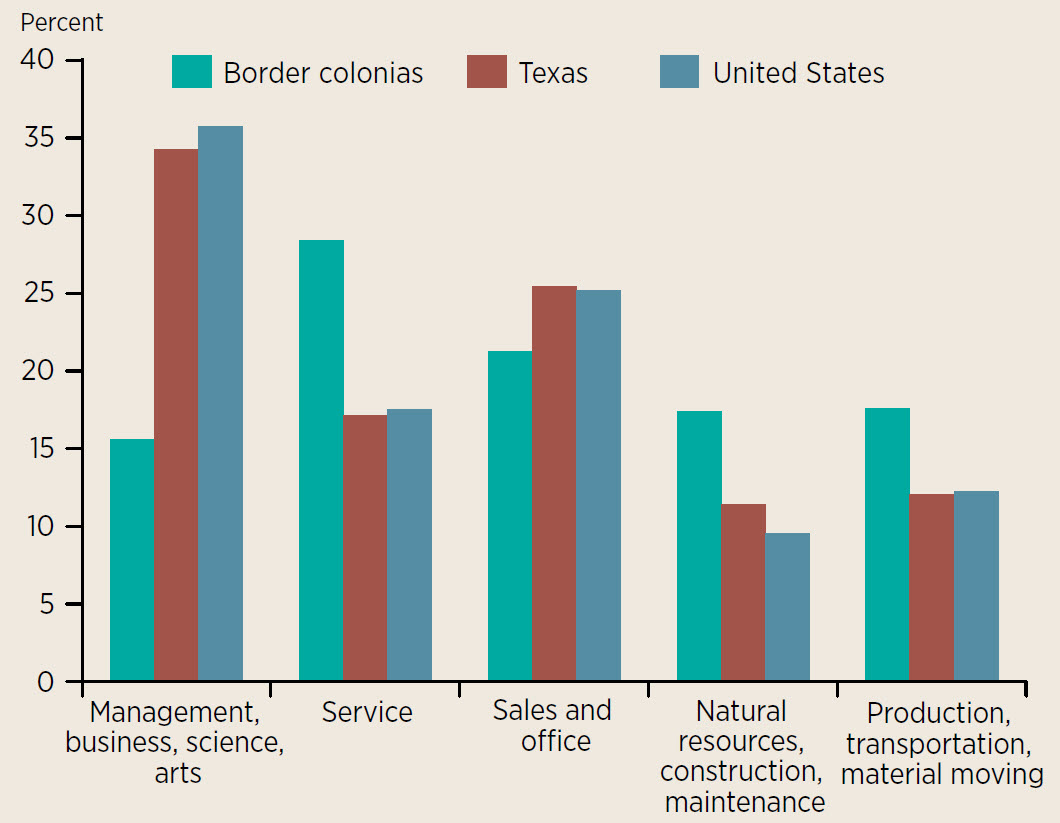

| Employment Concentrated in Different Sectors in Colonias than in Texas and Nation |

|---|

|

| NOTE: A comprehensive list of what each category includes is available at http://www.bls.gov/cps/cenocc2010.pdf. SOURCE: Census Bureau, 2011 American Community Survey 5-Year Estimates. |

Pulgas, or flea markets, are the hub of the informal marketplace and common to colonias. They provide entrepreneurs with flexibility and the opportunity to sell a wide range of products. Community members can also buy basic goods at pulgas at an affordable price. They enable colonia residents to regularly earn an income, stretch their budgets and develop social networks.

A booth at a pulga

A vendor and booth at a pulga