Correcting ‘Dodd–Frank’ to Actually End ‘Too Big to Fail’

June 26, 2013 Washington, D.C.

Chairman Hensarling, Ranking Member Waters, and Members of the Committee, thank you for the opportunity to testify at this hearing on “Examining How the Dodd–Frank Act Could Result in More Taxpayer-Funded Bailouts.”

Before I begin, I want to recognize the common goal that we all share—ending “too big to fail” (TBTF) and taxpayer-funded bailouts. However, as iconic patriot Patrick Henry said in one of his greatest speeches, “Different men often see the same subject in different lights.” I recognize and respect a difference of opinion on this critical issue of how to eliminate taxpayer-funded bailouts. But I trust that in the marketplace of ideas and after careful deliberation—such as this hearing—our democratic process will shine through and decisions will be made that are in the best interest of our country.

In the same speech, Patrick Henry also appealed to all perspectives to do right: “This is no time for ceremony,” he said, for it “…is one of awful moment to this country.”

The great patriot was, of course, addressing the injustice of perpetuating the rule of the British Crown. This morning, I want to address what I consider the injustice of perpetuating financial institutions that are so large, complex and opaque that they are seen as critical to the proper functioning of our economy and are therefore considered TBTF.

I will argue that these institutions operate under a privileged status that exacts an unfair and nontransparent tax upon the American people and represents not only a threat to financial stability, but to the rule of law as well as principles of fair and open competition—hallmarks of the democratic capitalism that makes our country great.

I will argue that the effort crafted by Congress to correct the problems of TBTF—known as the 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd–Frank)—is, despite its best intentions, ineffective, burdensome, imposes a prohibitive cost burden on the non-TBTF banking institutions and needs to be amended. It is an example of the triumph of hope over experience.

And, lastly, I will argue that dealing with TBTF is a cause that should be embraced by Republicans, Democrats and Independents alike. For regardless of your ideological bent, there is no escaping the reality that TBTF banks’ bad decisions inflicted harm upon the American people in the excessive credit boom through 2007 and particularly during the “awful moment” of the 2008–09 crisis.[1] The American people will be grateful to whoever liberates them from the risk of a recurrence of taxpayer bailouts and the serious threat of another Great Depression.

Federal Reserve convention requires that I issue a disclaimer here: As is our practice, I speak only for myself, not for others associated with our nation’s central bank. There are different views on this issue even within the Fed; like Patrick Henry’s co-patriots, we too “see the same subject in different lights.” In addition to Jeff Lacker, President of the Richmond Fed, who is here with us today, the chairman of the Fed, Ben Bernanke, and three other governors, Jeremy Stein, Daniel Tarullo and Jerome Powell, all good friends and men I greatly admire, have expressed different views than ours in Dallas about how to address the problem of TBTF. You should consider their views, as well as those of Mr. Hoenig and Ms. Bair who join Mr. Lacker and me on this panel.[2] Today, I’ll simply give you the views that have been thought through over several years by my colleagues and me at the Dallas Fed.

What’s the Problem?

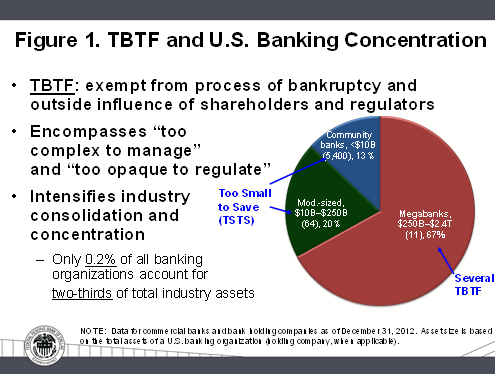

Less than a dozen megabanks—a mere 0.2 percent of all banking organizations—control two-thirds of the assets in the U.S. banking industry. The concentration of assets has been ongoing for more than 30 years, but it picked up pace in the 1990s and greatly intensified during the 2008–09 financial crisis, when several failing giants were absorbed, with taxpayers’ support, by larger, presumably healthier ones.

The result is a lopsided financial system, and the episode we all experienced in 2008–09 is one we are still in the process of recovering from. None of us ever wish to experience another catastrophe such as occurred in fall 2008. Yet, given the well-intentioned but impracticable reforms forged in the crucible of the crisis, I believe the likelihood and severity of another crisis have risen rather than receded.

Here are the facts: Today, we have about 5,500 banking organizations in the United States. Nearly each and every one of these bank holding companies represents no threat to the survival of our economic system. But less than a dozen of the largest and most complex banks are each capable—through a series of missteps by their management—of seriously damaging the vitality, resilience and prosperity that has personified the U.S. economy. Any of these megabanks, given their systemic footprint and interconnectedness with other large financial institutions, could threaten to bring down the economy, again. This 0.2 percent of banks, deemed candidates to be considered “too big to fail,” is treated differently from the other 99.8 percent and differently from other businesses (Figure 1).

Implicit government policy has made these megabank institutions exempt from the normal processes of bankruptcy and creative destruction. TBTF is a euphemism for a financial institution so large, interconnected and/or complex that its functions are seen as critical and policymakers think its demise could substantially damage the financial system and economy if it were allowed to fail. Without fear of closure, these banks and their counterparties can take excessive risks. We regularly see this reported in the press: Megabanks are too often driven by a culture directed more toward the generation of revenue growth to inflate their share price, without sufficient regard to prudent risk management. Executives and investors capture the upside; the taxpayers bear the downside risk (although this is not measured in our federal budget).

In our capitalist economic system, when companies that experience difficulties fail, their business models are rationalized, streamlined and reorganized. The highly diverse economic engine of growth that is the United States has become robustly dynamic upon the currents of what the renowned economist Joseph Schumpeter termed “creative destruction”—a “reap what you sow,” free-market process of success and failure, innovation and obsolescence. Viable business models should be given the opportunity to compete and prosper on their own merits, while unattractive strategies should be allowed to fail. Subverting the ability to fail, on the taxpayers’ dime, is a perversion of American capitalism.

Advantages to being Too Big, Too Complex, Too Opaque

The playing field is tilted to the advantage of the megabanks that can raise capital more cheaply than their smaller competitors due to perceived taxpayer support. Studies, including those published by the International Monetary Fund and the Bank for International Settlements, estimate this advantage to be as much as 1 percentage point, or some $50 billion to $100 billion annually for U.S. TBTF banks, during the period surrounding the financial crisis.[3] In a popular post by editors at Bloomberg, the 10 largest U.S. banks are estimated to enjoy an aggregate longer-term subsidy of $83 billion per year.[4]

Andy Haldane, executive director for financial stability at the Bank of England, estimates the current implicit TBTF subsidy to be roughly $300 billion per year for the 29 global institutions identified as “systemically important.”[5]

Large banks and their allies have pushed back against these points, producing a flurry of counter-claims in recent months. My staff and I have reviewed these arguments and have found them to be assertions lacking merit.

Given this range of estimates, Sens. Sherrod Brown of Ohio and David Vitter of Louisiana have asked the Government Accountability Office (GAO) to calculate just how much of a cost-of-funds advantage the big banks have over the mid-sized and smaller community banking organizations that make up the 99.8 percent that are not implicitly protected from failure.

As pointed out by Simon Johnson, the MIT economist and former chief economist at the International Monetary Fund, all one has to do is ask people in the credit markets if they think lenders to the biggest banks have some degree of protection offered by the government, and you will hear a resounding “yes.”[6]

At the Dallas Fed, we believe that whatever the precise subsidy number is, it exists, it is significant and it encourages the biggest banking organizations, along with their many nonbank subsidiaries (investment firms, securities lenders, finance companies), to grow larger and riskier.

This entire arrangement is patently unfair. It makes for an uneven playing field, tilted to the advantage of Wall Street against Main Street, placing the financial system and the economy in constant jeopardy.

The Problem Magnified, Not Solved

The Dodd–Frank Act was a well-intentioned response to the problem. We respect its drafters and those who crafted it in an earnest attempt to address much needed reform in the financial services industry. However, its stated promise to end too big to fail rings hollow. Running 849 pages and with more than 9,000 pages of regulations written so far to implement it, Dodd–Frank is long on process and complexity but short on results. Consequently, nearly three years after Dodd–Frank was signed into law, very little positive reform has been implemented.

Regulators cannot enforce rules that are not easily understood. Nor can they enforce these rules without creating armies of new supervisors. This venerable Committee on Financial Services aggregates information from the Federal Register that estimates the cumulative hours needed for the affected agencies, like the Fed, to fulfill new requirements called for by Dodd–Frank. This Committee presently estimates that it will take 24,180,856 hours each year to comply with new rules already finalized for implementation of the act.[7] And we have yet to complete the rulemaking process!

I work every day with my colleagues at the Fed to craft the monetary conditions to help the economy create jobs. This is not the kind of job creation I would hope for.

I doubt anyone seriously believes that an additional several thousand pages of regulations, on top of the nine thousand already written, will provide clarity, procedural focus and the proper incentives to end TBTF and to “Just Say No” to more government bailouts.

Complex regulations create barriers to entry and encourage firms to morph into even more complex and opaque structures. Further, regulatory supervision, by definition, is always at least one step behind the actions taken by market participants. The more complex the rules, the more difficult it is to bridge the gap due to the complexities of financial markets. None of this is helpful for financial stability.

Bailout Concerns Linger

Briefly, I believe the current legislative solution to ending TBTF has actually exacerbated the issue and potentially codified TBTF, rather than eliminated it.

As soon as a financial institution is designated “systemically important” as required under Title I of Dodd–Frank (and becomes known by the acronym “SIFI”), it is viewed by the market as being the first to be saved by the first responders in a financial crisis. In other words, these “SIFIs” occupy a privileged space in the financial system (one pundit referred to the acronym as meaning “Save If Failure Impending”). As a corollary, a banking customer has a disincentive to do business with smaller competitors, because a non-SIFI does not have an implied government funding lifeline. Even if a SIFI ends up funding itself with more equity capital than a smaller competitor, the choice remains for where you would like to hold important financial relationships: with an institution with a government backstop or one without? Thus, the playing field remains uneven; the advantages of size and perceived subsidy accrue to the behemoth banks that will continue to grow larger and become even more of a systemic risk. Dodd–Frank does not eliminate this perception and in many ways perpetuates it as reality.

Further, some have held out hope that a key provision of Title I requiring banking organizations to submit detailed plans for their orderly resolution in bankruptcy, without government assistance, will provide for a roadmap to avoid bailouts. However, these “living wills” are likely to prove futile in helping navigate a real-time “systemic” failure. Given the complexity and opacity of the TBTF institutions and the ability to move assets and liabilities across subsidiaries and affiliates (as well as off-balance sheet, including through huge and fast-moving derivative positions), a living will would likely be ineffective when it really mattered. I do not have much faith in the living will process to make any material difference in TBTF risks and behaviors—a bank would run out of liquidity (not capital) due to reputational risk quicker than management would work with regulators to execute a living will blueprint.

Adding insult to injury, Title II of Dodd–Frank describes and designates the Orderly Liquidation Authority (OLA) as the resolution mechanism to handle the disposal of a giant, systemically-disruptive financial enterprise. The three letters themselves evoke the deceptive doublespeak of an Orwellian nightmare. The “L,” which stands for liquidation, will in practice become a simulated restructuring, as would occur in a Chapter 11 bankruptcy.

In reality, rather than fulfill Dodd–Frank’s promise of “no more taxpayer-funded bailouts,” the U.S. Treasury will likely provide, through the FDIC, debtor-in-possession financing to the failed companies’ artificially-kept-alive operating subsidiaries for up to five years, but perhaps longer. Under the single point of entry method, the operating subsidiaries remain protected as the holding company is restructured. So if a company does business with the operating subsidiaries, say, through derivatives transactions, then this company is even more confident that their counterparty is TBTF. Some officials refer to this procedure as a “liquidity provision” rather than a bailout. Call it whatever you wish, but this is taxpayer funding at far-below-market rates.

At the Dallas Fed, we would call this form of “liquidation” a nationalized financial institution. During the five-year resolution period, this nationalized institution does not have to pay any taxes of any kind to any government entity. To us, this looks, sounds, and tastes like a taxpayer bailout, just hidden behind different language. If it waddles like a duck and quacks like a duck, it's a duck.

Moreover, if the reorganized company cannot repay the Treasury for its debtor-in-possession financing, Title II suggests that the repayment should be clawed back via a special assessment on the company’s SIFI competitors. But that assessment is then written off as a tax-deductible business expense, thereby reducing revenue to the Treasury. This is a "rob Peter to pay Paul" chain of events, with the taxpayer playing the role of Peter. Although I have not seen the Congressional Budget Office run the numbers for the plausible scenarios, I suspect that the impact on our federal deficit and debt would be significant, not to mention the potential effects from the concomitant recession that would likely occur. This does not sound like a “no taxpayer-funded bailouts” solution. One form of explicit intervention appears to have been replaced by Title II of Dodd–Frank, a disguised form of taxpayer bailout.

Title II promotes and sustains an unnatural longevity for zombie financial institutions—and this is an acute issue in other financial systems, including parts of Europe today. Title II imposes a competitive disadvantage onto small- and medium-size financial institutions, and it does so for potentially several years at taxpayer expense. It is these smaller financial institutions that, by the way, provide the primary financial lifeline so vital to the small- and medium-size businesses in your Congressional districts that, in turn, provide the bulk of innovation and job creation in the United States.[8]

This Committee’s Subcommittee on Oversight and Investigations held a hearing on May 15, 2013, in this very room that focused on Title II in great detail. The four witnesses who testified that day gave a very informative and expert critique of the shortcomings of Title II, and I respectfully refer you to that hearing.[9]

A Simple Proposal

Where does the current reform effort leave us and how should we forge a path forward? Despite the plethora of new rules and regulations created by Dodd–Frank, market discipline is still lacking for the largest financial institutions, as it was during the last crisis. Why should a prospective purchaser of bank debt or other type of counterparty practice due diligence if, in the end, regardless of new layers of regulation and oversight, it is widely perceived that the issuing institution and its subsidiaries will not be allowed to fail? There is a great deal of moral hazard at all levels of decision-making in our current financial system. We must change this status quo.

The return of marketplace discipline and effective due diligence of banking behemoths is long overdue. My colleagues and I at the Dallas Fed offer a modest proposal to that end, with a goal of leveling the playing field for all.

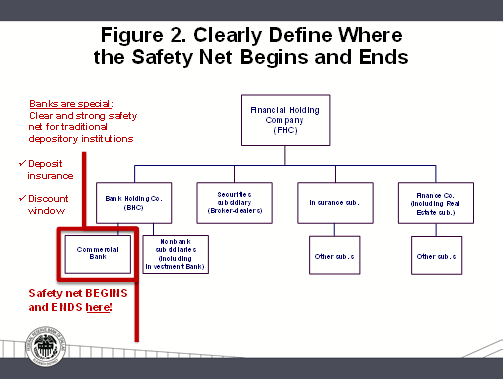

Here is a simple graphic of the basic organizational structure of a typical financial holding company (Figure 2). Note the highlighted commercial bank operation within that structure. To begin with, we would roll back the federal safety net—deposit insurance and the Federal Reserve’s discount window—to where it was always intended to be, that is, to traditional commercial bank deposit and lending intermediation and payment system functions.[10] Thus, the safety net would only be available to traditional commercial banks and not to the nonbank affiliates of bank holding companies or the parent companies themselves. This is how the law needs to be applied, even in times of crisis.[11]

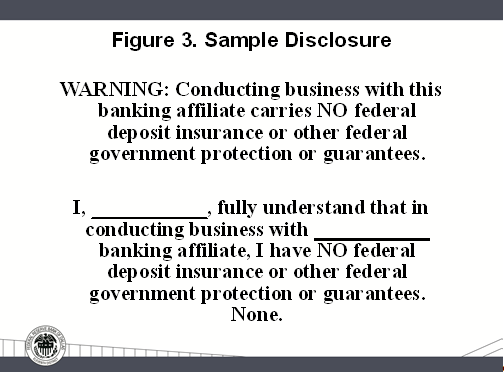

Second, customers, creditors and counterparties of all nonbank affiliates and the parent holding companies would sign a simple, legally binding, unambiguous disclosure acknowledging and accepting that there is no government guarantee—ever—backstopping their investment (Figure 3). They are on their own, and they know it. A similar disclaimer would apply to banks’ deposits outside the Federal Deposit Insurance Corp. (FDIC) protection limit and other unsecured debts.

Knowing where the federal government guarantees begin and end would properly realign incentives and reinvigorate a degree of creditor discipline that has been dormant at large, complex financial institutions for far too long.

Third, we recommend that the largest financial holding companies be restructured so that every one of their corporate entities is subject to a speedy bankruptcy process, and in the case of the banking entities themselves, that they become an appropriate size, complexity and geographic footprint that is “too small to save.”[12] Addressing institutional size is vital to maintaining a credible threat of failure, thereby providing a convincing case that policy has truly changed. This step gets both bank incentives and structure right, neither of which is accomplished by Dodd–Frank.

Our third step would provide a more level playing field with reduced regulatory costs for all competitors, encourage greater innovation by all members of the banking industry and minimize the downside consequences to the economy of megabank failures. The downsized, formerly too-big-to-fail banks would then be small and simple enough (just like the other 99.8 percent) that, with adequate planning, the FDIC could close and then reopen the bank in short order with new management and new private-sector ownership. “Closed on Friday and reopened on Monday” is the customary process administered by the FDIC that we would like to see applicable for all depository financial institutions.

No bank would remain so significant and interconnected to the financial system that its demise would spell the unraveling of the financial system. In these new circumstances, all banks that warranted closure would fail the old fashioned way; they would be gone, with their stockholders’ equity written down to zero, their bondholders saddled with haircuts and their insured depositors left unharmed.

What’s The Way Forward?

The aim of our three-step proposal is simple: All banks would be subject to regulatory oversight that fits its business model—and most important, all banks would be subject to the market discipline exercised by owners and creditors. Given this more explicit treatment of creditors of regulated commercial banks, creditors of unregulated shadow banks should begin to understand that government guarantees don’t apply to their transactions with the affiliates of regulated commercial banks nor with unregulated financial companies that offer similar products and services. Market discipline could then begin to reinforce and even somewhat replace regulatory discipline.

Some argue that these three steps are already at work within the current regulatory and legal framework. Others cautiously warn that we should wait to see how all of the rules and regulations of Dodd–Frank are implemented before we attempt any improvements. Both perspectives might underappreciate the urgency we feel to correct the current imbalance and perversion of capitalism before the next crisis, not after.

Arguments to “give Dodd–Frank a chance” or to simply address TBTF with higher capital requirements (and not complementary structural changes) fall short of necessary action. Living wills and higher capital requirements are potentially very helpful tools but are not sufficient to ensure the survival of a company, and they will not eliminate massive losses that can choke off liquidity and disrupt financial markets and the economy.

Banks are levered institutions and are vulnerable given that they are usually levered with short-term debt like deposits and repo-like funding vehicles. Thus, capital helps to maintain confidence that the institution can sustain some losses and still remain open for business tomorrow. But once investors and creditors begin to fear that losses have been understated or forthcoming at that institution or similar institutions, confidence begins to rapidly diminish, and almost no amount of capital is sufficient to forestall a collapse of confidence and a liquidity crisis. When confidence begins to wane, liquidity dries up quickly. And the plunge in confidence is contagious, often having little to do with the underlying situation of each company. That’s where the lender of last resort function of the Federal Reserve comes into play—the central bank lends to solvent companies, those with positive capital and good collateral. But such capital is only a small element in saving a company from extinction. Confidence matters even more.

Within the category of capital, it is loss-absorbing capital that buttresses confidence the most. Equity capital is the first to absorb losses; hence, it is the most expensive capital to raise. Debt doesn’t absorb losses except in bankruptcy, at which point the company is dead. Risk-weighted capital is somewhat meaningless—and sometimes deeply misleading—in the context of loss absorbency; any asset that incurs losses must be written off against equity capital, whether the loss was in business loans, mortgage loans, municipal bonds or agency debt. If losses thin out the capital cushion to the point of undermining confidence, the future viability of the company slips. Nobody knows the magic capital ratio that will prevent a loss of confidence, and I do not believe regulators will suddenly become better equipped to set higher magical ratios in the future for the largest, most politically-connected banking institutions. Capital is necessary for viability (nonfailure), and I support higher capital requirements (particularly for any institution that could become of systemic importance), but it is not sufficient.

We concede that our proposal doesn’t have all the answers either. It would not eliminate financial crises—that would be an impossible or even foolish goal—but it should reduce their frequency and severity. Nor will it alter the human DNA of those who serve as “first responders” during the next crisis. Our proposal should make the magnitude of the problems regulators face, and the tasks they need to perform, far more manageable. Under our plan, supervisory agencies would oversee several thousand community banks, a few hundred moderate-size banks (by today’s standards) and no megabanks. The nonbank and shadow bank components of a large financial holding company would still operate but without subsidy and access to the safety net and with long-overdue market discipline imposed by at-risk creditors.

There will always be some banks that are larger than the rest, and consequently, there will be temptation for regulators to label the “biggest few” as systemically important. The fluctuating nature of human resolve and political fortitude, as well as the problem of “regulatory capture,” has been present in U.S. bank policy at least since the intervention/bailout of Continental Illinois and its creditors in 1984. Our proposal may not prohibit regulators from intervening to support the unsecured creditors of a failing banking institution. But our proposal reduces the dimensions of the problem—asset size and systemic interconnectedness—by an order of magnitude and thereby should diminish the tendency to intervene out of fear of unknown systemic risks. Our plan would dramatically reduce the costs of nonintervention.

The elimination of TBTF along the lines we have proposed will not, as the megabanks suggest, diminish our nation’s competitive advantage in global financial markets. If anything, our proposal may help drive innovation in our financial system by leveling the playing field.

The former safety net implicitly covered too much of a selective part of the credit intermediation system, promoting perverse risk-taking incentives. We believe that had the Dallas Fed plan I have articulated today been in place a decade ago, it would have altered the insidious behaviors that contributed to the crisis, avoiding the bailouts and their aftermath, the cost of which our nation’s citizens will endure for years to come.[13] We believe that had our plan helped guide the restructuring of the banking and financial services industry before the crisis began, neither Citigroup, Bank of America, nor others would have been positioned to receive hundreds of billions of dollars of extraordinary government assistance; the parts of these companies that got into trouble would have been sold off, closed or run through a standard bankruptcy process. The taxpayers would never have been involved.

The same could be said of Bear Stearns; the first shadow bank to require government assistance back in March 2008 would have been governed by market discipline and unable to call upon giant banking institutions to find an over-the-weekend, government-assisted acquisition because there would have been no megabanks to invite to the table. Further, the more disciplined financial marketplace that would result from the adoption of our proposal likely would have helped prevent a concentration of risks and imbalances of the magnitude that occurred at AIG. This is the ultimate test and counterfactual thought experiment for any proposal to end TBTF. The GAO and others estimate that the cost of the financial crisis, measured in lost consumption and jobs, could exceed $14 trillion, or roughly one whole year of U.S. output.[14]

We do not think Dodd–Frank would have averted the 2008–09 financial crisis and its horrendous costs and consequences had the act been in place and implemented in the years before the crisis began. Were we to have another crisis today, we believe that the cost would be even greater because, in effect, rather than in theory, Dodd–Frank entrenches and perpetuates TBTF banks that are now even bigger than they were before.

An Appeal for Action

In my introduction, I referred to Patrick Henry. In the speech I quoted, he went on to say, “It is natural to man to indulge in the illusions of hope. We are apt to shut our eyes against a painful truth, and listen to the song of that siren till she transforms us.” I implore the members of this important committee and the Congress to not succumb merely to the illusion of hope. Don’t listen to the siren song of the megabanks and their lobbyists. Take action to deal with the unfair advantages that these institutions enjoy. They will spend millions of dollars to try to perpetuate their brand of crony capitalism. Resisting their entreaties is the right thing to do. Leveling the playing field is a just cause for 99.8 percent of American banks and for all Americans.

The potential taxpayer burden of dealing with TBTF institutions might be addressed by a still-growing army of bank supervisory personnel trying to enforce the rigid, complex and probably easy-to-evade rules of Dodd–Frank. However, this would be oversight without the benefit of supplemental reinforcement from market discipline and increased due diligence.

In March of this year, the Dallas Fed released an annual report on “Vanquishing Too Big to Fail.” [15] The contents of this report explored the merits of community banks, the adverse effects of current reform efforts and the urgency of reasserting market discipline for all institutions—large and small—to compete on a more level playing field. Accompanying these essays is a series of responses to the questions and criticisms we have received about our proposal, including those raised by proponents for the megabanks. This “Q&A with Richard Fisher on TBTF” can be found at www.dallasfed.org/microsites/fed/annual/2012/ar12c/index.cfm.

Unfortunately, a subsidy once given is nearly impossible to take away. Overcoming entrenched oligopoly forces, in combination with customer inertia, may require government-sanctioned reorganization and restructuring of the TBTF firms in order to accelerate the imposition of effective market discipline.

We advocate using as little government intervention and statutory modification as possible to restructure the largest institutions to a size that is effectively disciplined by both market and regulatory forces—so that every corporate entity is subject to a speedy bankruptcy process and every banking entity is “too small to save.”

This would underscore to customers and creditors that a credible regime shift has taken place, that all banking organizations are without subsidy and are governed by the market discipline of creditors at risk of loss, and that the reign of TBTF policies has truly ended.

Notes

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.

- The recent recession began in 2007 but cascaded into crisis in fall 2008, the effects of which we still grapple with today.

- Some examples of other thoughts on ending TBTF within the Federal Reserve System, include “Regulating Large Financial Institutions,” speech by Jeremy C. Stein, Federal Reserve Board of Governors, at the "Rethinking Macro Policy II," a conference sponsored by the International Monetary Fund, Washington, D.C., April 17, 2013, www.federalreserve.gov/newsevents/speech/stein20130417a.htm; “Ending ‘Too Big to Fail’,” speech by Jerome H. Powell, Federal Reserve Board of Governors, Institute of International Bankers 2013 Washington Conference, Washington, D.C., March 4, 2013, www.federalreserve.gov/newsevents/speech/powell20130304a.htm; “Financial Stability Regulation,” speech by Daniel K. Tarullo, Federal Reserve Board of Governors, at the Distinguished Jurist Lecture, University of Pennsylvania Law School, Philadelphia, Oct. 10, 2012, www.federalreserve.gov/newsevents/speech/tarullo20121010a.htm; and “Fostering Financial Stability,” speech by Chairman Ben S. Bernanke, Federal Reserve Board of Governors, at the 2012 Federal Reserve Bank of Atlanta Financial Markets Conference, Stone Mountain, Ga., April 9, 2012, www.federalreserve.gov/newsevents/speech/bernanke20120409a.htm.

- For one example of the TBTF advantage observed in the spreads paid for longer-term debt, see “BIS Annual Report 2011/12,” Bank for International Settlements, June 24, 2012, pp. 75–6, www.bis.org/publ/arpdf/ar2012e.htm.

- See “Why Should Taxpayers Give Big Banks $83 Billion a Year?” Bloomberg, Feb. 20, 2013, www.bloomberg.com/news/2013-02-20/why-should-taxpayers-give-big-banks-83-billion-a-year-.html.

- See “On Being the Right Size,” speech by Andrew Haldane, Bank of England, at the 2012 Beesley Lectures, Institute of Economic Affairs’ 22nd Annual Series, London, Oct. 25, 2012, www.bankofengland.co.uk/publications/Documents/speeches/2012/speech615.pdf.

- See “Big Banks Have a Big Problem,” by Simon Johnson, New York Times, March 14, 2013, http://economix.blogs.nytimes.com/2013/03/14/big-banks-have-a-big-problem.

- See “Dodd–Frank Burden Tracker,” U.S. House Financial Services Committee, http://financialservices.house.gov/burdentracker.

- See “Does Size Really Matter?: The Evolving Role of Small Firms in the U.S. Economy,” by Nathan Sheets and Robert A. Sockin, Empirical & Thematic Perspectives, Citi Research, Dec. 10, 2012. These international economists noted that “well-established results in the empirical literature have shown a special link between small firms and small banks. As such, this sustained and sizable decline in the role of small banks as providers of credit—reflecting the ongoing consolidation of the U.S. banking system—is very likely a factor contributing to the downtrend in the share of credit provided to small firms.” Further, the authors conclude that they “would be inclined to support public policies designed to ensure a level playing field between firms of various sizes and, in addition, measures to incentivize small-business creation and the allocation of credit to young firms.” We at the Dallas Fed agree with this conclusion and promote competition across industries, including financial services.

- Hearing entitled “Who Is Too Big to Fail: Does Title II of the Dodd–Frank Act Enshrine Taxpayer-Funded Bailouts?” Testimony by Professor David A. Skeel, Professor John B. Taylor, Mr. Joshua Rosner and Mr. Michael Krimminger, May 15, 2013, www.financialservices.house.gov/calendar/eventsingle.aspx?EventID=333122.

- The Fed’s discount window offers three secured lending programs to depository institutions: primary credit, secondary credit and seasonal credit. Primary credit is a very short-term (usually overnight) loan to depository institutions in generally sound financial condition. Depository institutions not eligible for primary credit may apply for secondary credit to meet short-term liquidity needs. Seasonal credit is extended to relatively small depository institutions that have recurring intrayear fluctuations in funding needs.

- This would not prevent the Federal Reserve from serving its lender of last resort function in a liquidity crisis by lending to solvent companies with good collateral at a penalty interest rate on a temporary basis.

- This restructuring would be designed and implemented by the companies’ top management team within the timeframe established by legislation and/or regulation.

- Richard W. Fisher and Harvey Rosenblum, “How to Shrink the 'Too-Big-to-Fail' Banks,” Wall Street Journal, Mar. 11, 2013,

http://online.wsj.com/article/SB10001424127887324128504578344652647097278.html. - See “Financial Crisis Losses and Potential Impacts of the Dodd–Frank Act,” Government Accountability Office, GAO-13-180, Jan. 16, 2013, www.gao.gov/products/GAO-13-180. Also, “How Bad Was It? The Costs and Consequences of the 2007-09 Financial Crisis,” by Tyler Atkinson, David Luttrell, and Harvey Rosenblum, Federal Reserve Bank of Dallas Staff Papers, forthcoming, 2013.

- The essays included in the Federal Reserve Bank of Dallas 2012 Annual Report, can be found at www.dallasfed.org/microsites/fed/annual/2012/indexw.cfm.

About the Author

Richard W. Fisher served as president and CEO of the Federal Reserve Bank of Dallas from April 2005 until his retirement in March 2015.