Not everything Is bigger in Texas: The varied fortunes of four smaller metros

While Texas’ major metropolitan areas power the bulk of the state’s commercial activity, some smaller metros have worked to establish their place as part of the state’s economic mosaic. In some cases, they are a hub of essential services for a wide geographic area, while in others, they may act as important complements to major regional metropolitan areas.

Amarillo, Beaumont–Port Arthur, Lubbock and Tyler–Longview are small metro areas in the state that illustrate some of these characteristics. The four are profiled in the recently released second edition of At the Heart of Texas: Cities’ Industry Clusters Drive Growth.

These metros are among 19 small Texas metropolitan areas—defined as those with populations below 800,000—and were featured in the publication because they fulfill important geographic and commercial roles in the state.

The period since the end of the Great Recession has been challenging for many small metros in the U.S., but most of the state’s small metros have managed to maintain or expand their populations and payrolls.

Metros serve as important activity hubs

Cities have served as centers of population, trade, culture and learning long before research illustrated how agglomeration fuels economic growth. Overall, cities tend to grow faster, are more productive and offer better pay when compared with rural areas; however, city size also plays a critical role in an area’s economic expansion.

Edward Glaeser in his book, Triumph of the City, refers to cities as “mankind’s greatest invention” and argues that there is a close relationship between urbanization and economic prosperity.

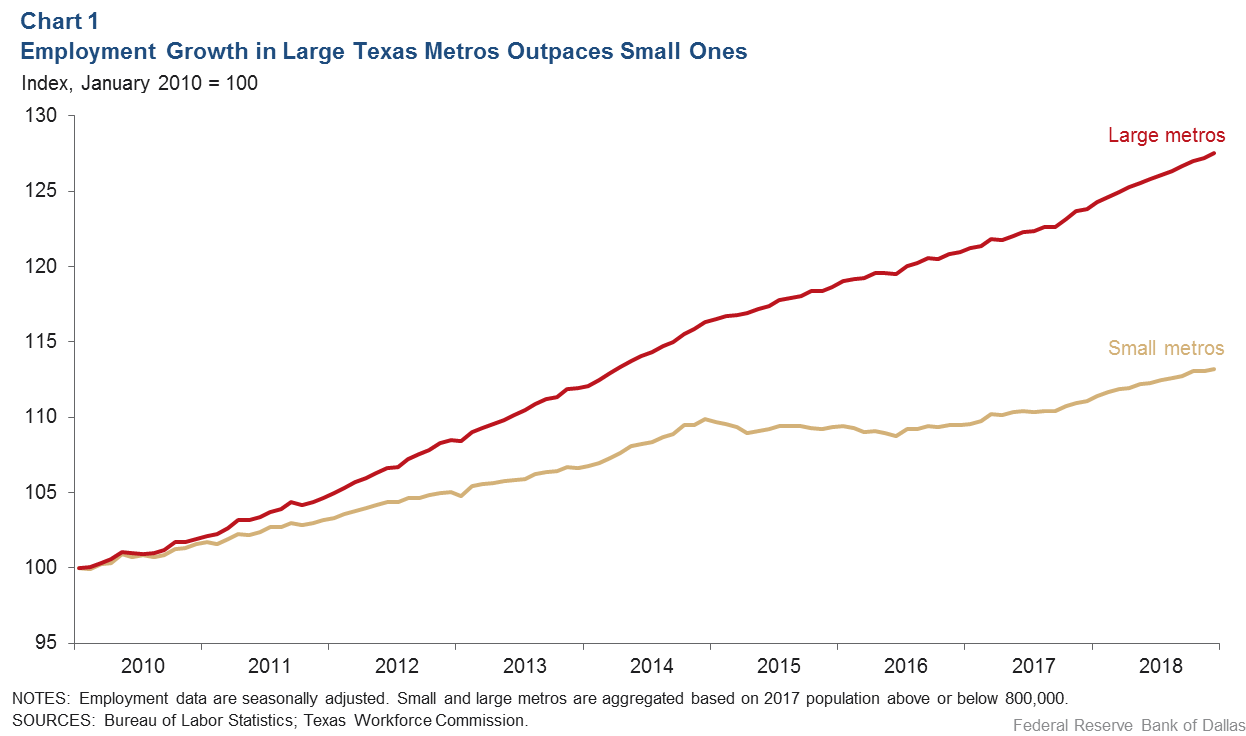

Lofty population gains in Texas’ major metros have been in large part due to migration, particularly from other U.S. states. Employment expansion within big Texas metros, at 30 percent (2010–18), outpaced that of smaller ones, at 15 percent (Chart 1). A 2018 Brookings report underscores that large U.S. metros have thrived over the past decade, while small metropolitan areas have seen little growth in their economies, a trend that largely held true in Texas.

Smaller metros carve out specialized roles

Every metro of size finds a specialty that differentiates it. Among the state’s biggest metros, Houston is a global oil hub; Austin is a technology, education and government center; Dallas and Fort Worth together serve as an important finance, business services, transportation and manufacturing location.

Texas’ smaller metros that have continued growing often draw on individual locational characteristics.

Among the “At the Heart” metros, Amarillo and Lubbock, in the Panhandle/high plains, are each tied closely to the agriculture industry while also carving out separate identities. Beaumont–Port Arthur and Tyler–Longview draw upon neighboring mega-metropolis’ economic strengths—in Southeast Texas, Houston’s energy and mining presence and in North Texas, Dallas–Fort Worth’s transportation and logistics cluster.

High Plains’ self-reliant economies

Amarillo and Lubbock, with no large metro areas in close proximity, are self-reliant and support surrounding rural communities, given their fairly sizable and in most cases high concentration (relative to the national average) of education, health care, retail, construction and government sectors.

Rapidly expanding clusters in each include transportation and logistics, defense and security, food services (restaurants), utilities, and energy and mining (reflecting the region’s prominence as a producer of wind energy).

Amarillo and Lubbock each has a unique contributor to economic activities. The defense and security sector in Amarillo, making up 1.4 percent of total jobs, includes the Pantex facility, the nation’s leading assembly center of nuclear arms. In Lubbock, Texas Tech University is a major part of the education sector, the area’s second-largest employment cluster, accounting for 13.1 percent of jobs.

Developing economic leverage from urban proximity

The histories of Beaumont–Port Arthur and Tyler–Longview are distinct, though they share a significant similarity. The discovery of oil—Spindletop in 1901 in southeast Texas and the East Texas oilfield in the 1930s in northeast Texas—profoundly affected the future growth of each area.

Beaumont–Port Arthur developed into a refining and petrochemical center, drawing on the dominance of energy and mining-related companies, attributable to the presence of two large seaports and proximity to Houston—the nation’s energy capital.

For Tyler–Longview, the still-important energy sector (8.2 percent of area jobs) helped pave the way for its two largest concentrations of employment: machinery manufacturing and fabricated metals manufacturing. Tyler and Longview, about 40 miles apart and very much competitive with one another, jointly serve as a transportation and logistics hub for East Texas, leveraging DFW’s standing as a national distribution center.

Drawing on the economic prowess of a large neighboring metro also has its drawbacks. For instance, while payrolls in health services expanded solidly in Amarillo, Lubbock and Tyler from 2010 to 2017, in Beaumont–Port Arthur, the sector has experienced losses in hospital and nursing and residential care employment. This is in part because its residents can readily access specialized medical services available in Houston.

Commanding an earnings premium in leading sectors

Overall wages in Texas’ small metro areas tend to be below those of the U.S. and the state, reflecting lower productivity relative to large urban centers and cost-of-living differences.

However, an earnings premium in dominant industry clusters—sectors that carry more relative weight locally than nationally—is evident in the four smaller metros. Theory suggests that productivity is higher in exportable sectors, which trade goods or services outside their geographic area and bring revenue into the local economy, yielding higher wages.

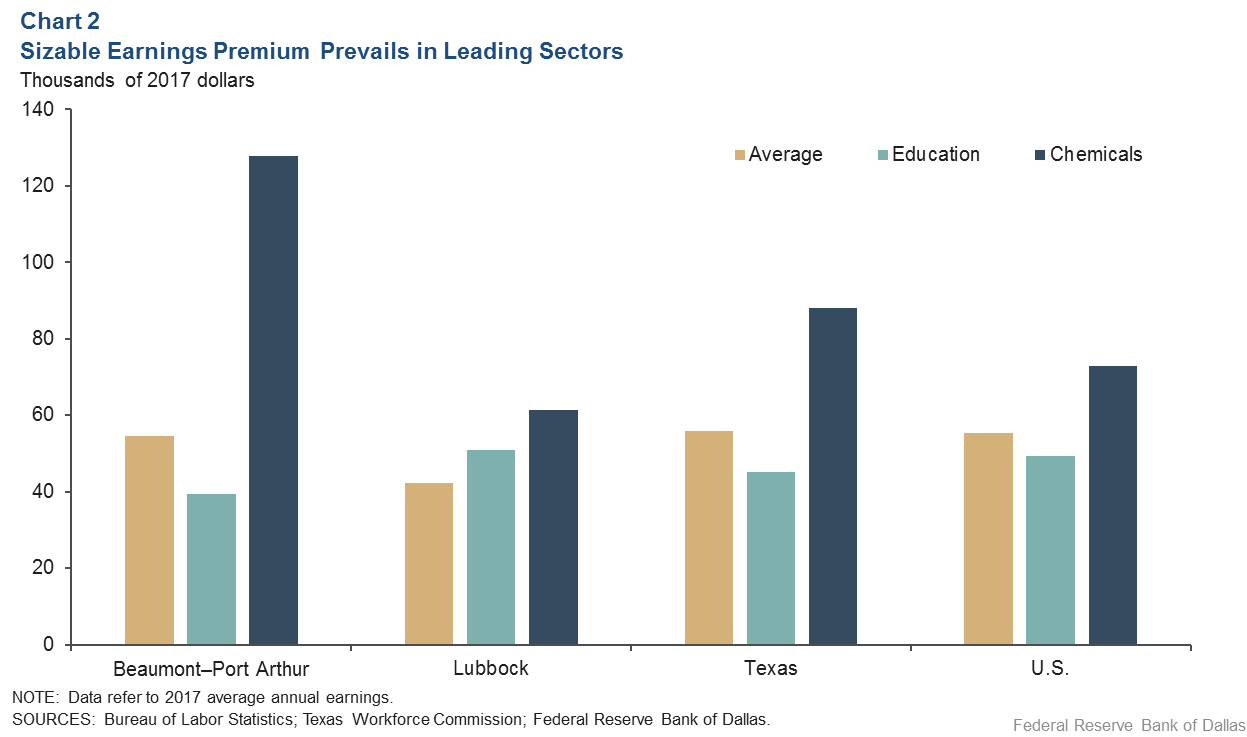

The dominance of Texas Tech in Lubbock’s economy has boosted average pay in education services. Education earnings there not only exceeded the U.S. and Texas averages in 2017, but were also at least $10,000 above the comparable figures for Tyler and Amarillo—both metros are home to one or more higher-education institutions (Chart 2).

Likewise, average pay in the chemicals industry—Beaumont–Port Arthur’s most concentrated cluster—is nearly $55,000 more than the U.S. figure due to the highly specialized jobs at chemical plants in the area.

Though major metros power the Texas economy, many smaller ones continue to grow and provide regional economic opportunity to more rural areas. A November 2018 Brookings report noted that small cities also aid rural communities by supplying them with access to specialized skills, knowledge, capital and markets, and thus suggested that policies focusing on bolstering smaller metros will result in spillover benefits to a wider geographic area.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.