Labor shortages, supply chain woes slow Texas recovery

The Texas economy is on the path to a solid recovery, although the pace of growth has eased since March, recent data suggest.

High-frequency indicators, such as initial unemployment claims, consumer spending, dining out and daily COVID-19 cases, show continuing improvement. Texas Business Outlook Surveys (TBOS) data for May point to slowing but still-solid expansion in manufacturing and continued robust growth in services.

Supply-side complications, such as difficulty finding workers, widescale shortages of materials, long lead times and transportation issues, are restraining growth.

Activity in the Texas residential real estate sector is red hot. Home sales remain elevated, and home prices continue to rise swiftly. Apartment rents and demand are also growing rapidly following some weakness in 2020.Employment growth moderates

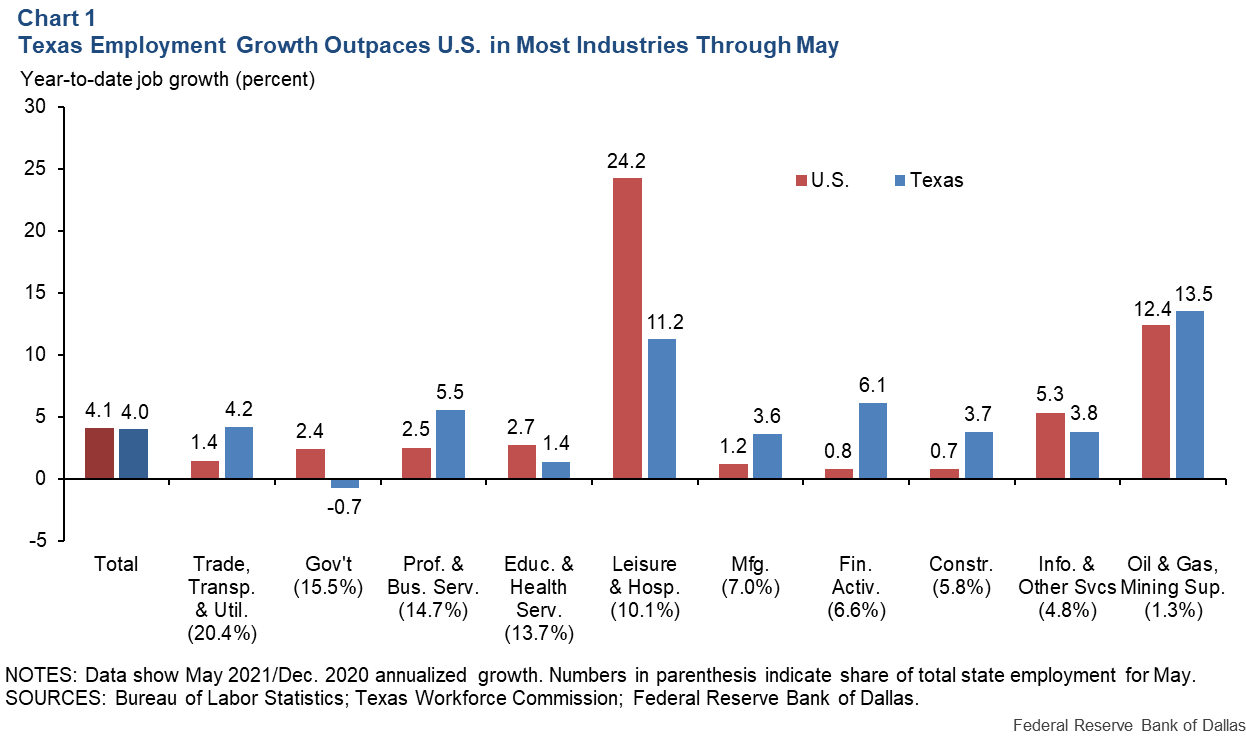

Texas jobs have expanded at a robust 4.0 percent year to date through May though growth moderated in April and May (Chart 1). The latest activity, observed in May, reflected sluggish growth in goods sector employment—consistent with widespread supply chain disruptions and labor shortages. So far this year, employment growth among major Texas metros has also been healthy, led by Austin at an annualized 6.1 percent.

The Texas unemployment rate dipped to 6.5 percent in May. Unemployment among minorities and those without a college degree has improved in recent months, as leisure and hospitality and others in the service sector fully reopen; however, jobless levels remain stubbornly high.

The three-month moving average unemployment rate for non-Hispanic Black Texans was 10.1 percent in May and 7.8 percent for Hispanics. The unemployment rate for Texans without a high school diploma was 10.0 percent, compared with 7.1 percent for high school/GED graduates. The long-term unemployment rate—those unemployed more than 26 weeks—is creeping up as well.

Labor demand outpaces supply

Labor demand appears to be elevated at a time of limited supply, according to the May TBOS. About half of Texas firms are trying to fill open positions, with a majority of those looking for workers finding the search difficult, particularly for low-skill positions.

Nearly all respondents (98 percent) looking to fill low-skill jobs cited difficulty in their search, up from 81 percent in early 2019. To improve hiring, more than 70 percent of TBOS respondents seeking new workers said they raised wages across skills levels.

Wages are rising at above-average rates in the Dallas Fed Eleventh District as well as the Richmond, New York and Philadelphia districts. The Conference Board/Burning Glass Help Wanted OnLine Index for Texas, a measure of online job postings in the state, rose in May, remaining near multiyear highs and above its February 2020 level.

Expanded unemployment benefits set to end

Approximately 960,000 Texans received federal unemployment benefits as of May 29. This included self-employed and gig workers. An additional 210,000 recipients received a $300 per week federal supplemental pandemic aid payment in addition to regular state-administered benefits.

With Texas opting out of federal COVID-19 unemployment assistance after June 26, this withdrawal of funding amounts to a statewide income loss of $2.9 billion per month. Those losing all benefits would, on average, need a job that pays about $17.33 an hour to replace benefits, excluding transportation and child care costs associated with a return to work.

The impact of the action on the Texas labor market is unclear. While it may ease labor shortages, the aid loss could also curtail overall spending. Consumer spending, roughly 13 percent above prepandemic levels in late May, has been impacted less than expected during the COVID-19 outbreak because of federal stimulus payments and expanded jobless benefits.

Upward price pressures intensify; pass-through mixed

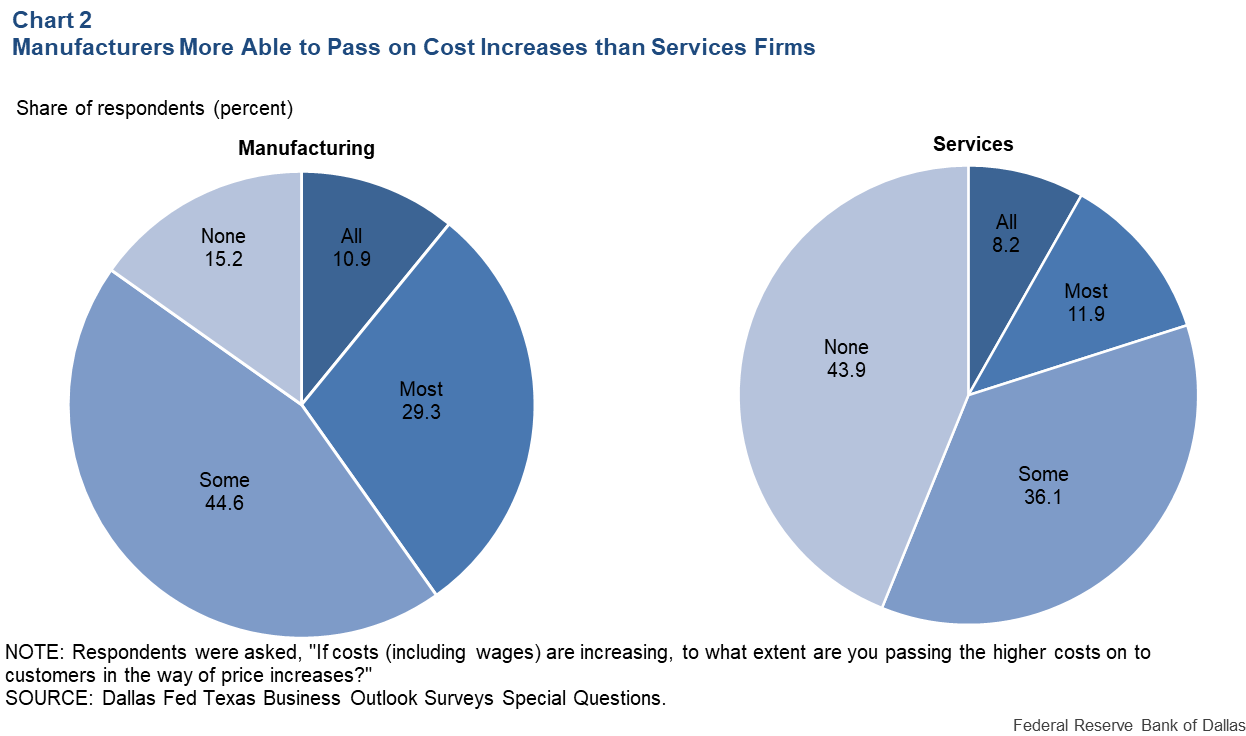

Price pressures have increased, particularly in sectors where labor and material shortages are most acute. Pass-through to customers, however, is mixed, with manufacturers reporting greater pricing power than services firms due to exceptionally strong demand and wider acceptance of price hikes.

In May, only 15.2 percent of manufacturing firms responding to TBOS could not pass on cost increases to customers, compared with 43.9 percent of services firms (Chart 2).

Among firms able to pass on higher costs, 54 percent said they are raising prices this year, 11 percent will do so next year, and 23 percent said they will undertake increases both this year and in 2022.

Housing market Is red hot

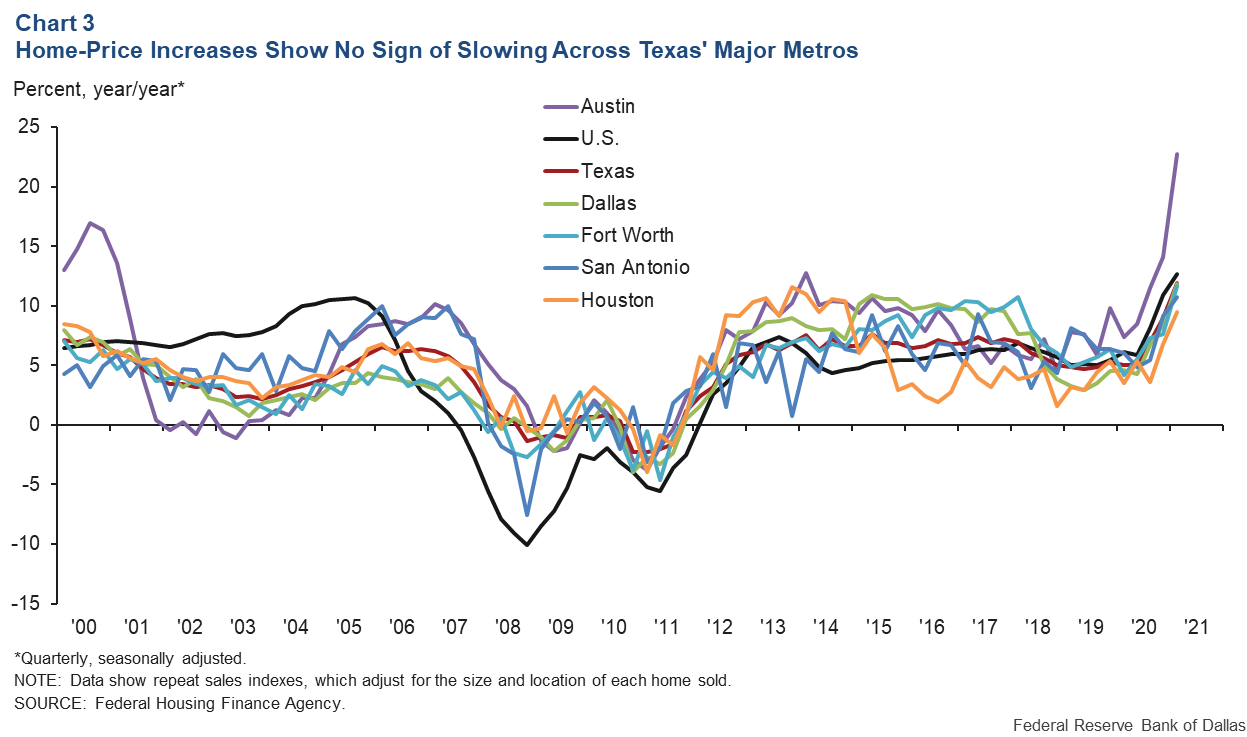

Home-price gains continued, reflecting a significant imbalance between supply and demand. All major Texas metros experienced strong home-price growth in the first quarter, according to the Federal Housing Finance Agency’s House Price Index (Chart 3).

Year-over-year home-price increases in Austin set a record in the last quarter; the real median sales price jumped from $331,000 in May 2020 to $448,000 in May 2021. With costs escalating rapidly, homebuilders are adjusting prices much more quickly than usual, and many inventory homes are selling above asking price. As a result, a majority of builders in Texas note difficulty obtaining appraisals high enough to reflect the final sale price.

Existing-home sales ticked up in May, suggesting continued strong demand and pushing Texas’ median home sales price to a new high. The median sales price in all major Texas metros is also at or near a record high. In this robust housing market, existing and new home inventories remain tight, and builders are restricting sales because of growing order backlogs, extended building-cycle times, shortages of lots, labor and materials, and escalating costs.

Multifamily housing demand surges

Apartment demand gained momentum in April and May, pushing up occupancy and rents across all major Texas metros. Year-over-year rent growth in May was 7.1 percent in Austin, 7.0 percent in Dallas–Fort Worth, 5.8 percent in San Antonio and 4.2 percent in Houston, according to ApartmentData.com.

Occupancy also remains elevated in part due to a COVID-19-related eviction moratorium. With the prime leasing season ramping up, continued upward momentum in rents is expected.

Most renters living in professionally managed market-rate apartments continue to make payments on time—96 percent of Texas renters in May had fully or partially paid rent for the month, on par with the share who paid rent in May 2020. Real estate investment activity has picked up as well, particularly for multifamily and industrial properties.

Office markets still weak, though Texas better positioned than U.S.

While activity in most sectors, including leisure and hospitality has turned the corner, office markets remain weak, with vacancy rates still edging up and rents flat to down in all major Texas metros.

Leasing activity is expected to remain sluggish over the next six to 12 months, though Texas office markets appear better positioned than those elsewhere in the country given the notable increase in high-skilled worker migration to the state since spring 2020 and a pickup in corporate relocations.

The share of workers going into the office in Austin, Dallas and Houston is nearing 50 percent, about 16 percentage points higher than an average of 10 large U.S. metros, according to building operator Kastle Systems.

Business sentiment optimistic; uncertainty increases

Outlooks remain positive, though uncertainty among manufacturers and homebuilders has increased. The 2021 Texas employment forecast of 4.1 percent suggests that it is unlikely that all jobs lost since the beginning of COVID-19 in 2020 will be recovered by year-end.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.