Pace of Texas economic growth slows as supply-chain, staffing woes persist

The Texas economy continued expanding in December and January, though the pace of growth decelerated relative to overall fourth-quarter activity. Supply-chain disruptions and labor shortages constrained activity, putting added upward pressure on prices and wages.

Results from the Dallas Fed’s Texas Business Outlook Surveys (TBOS) indicate that the recent omicron COVID-19 surge is exacerbating these supply-side issues.

Texas Job Growth Slows but Stays Strong

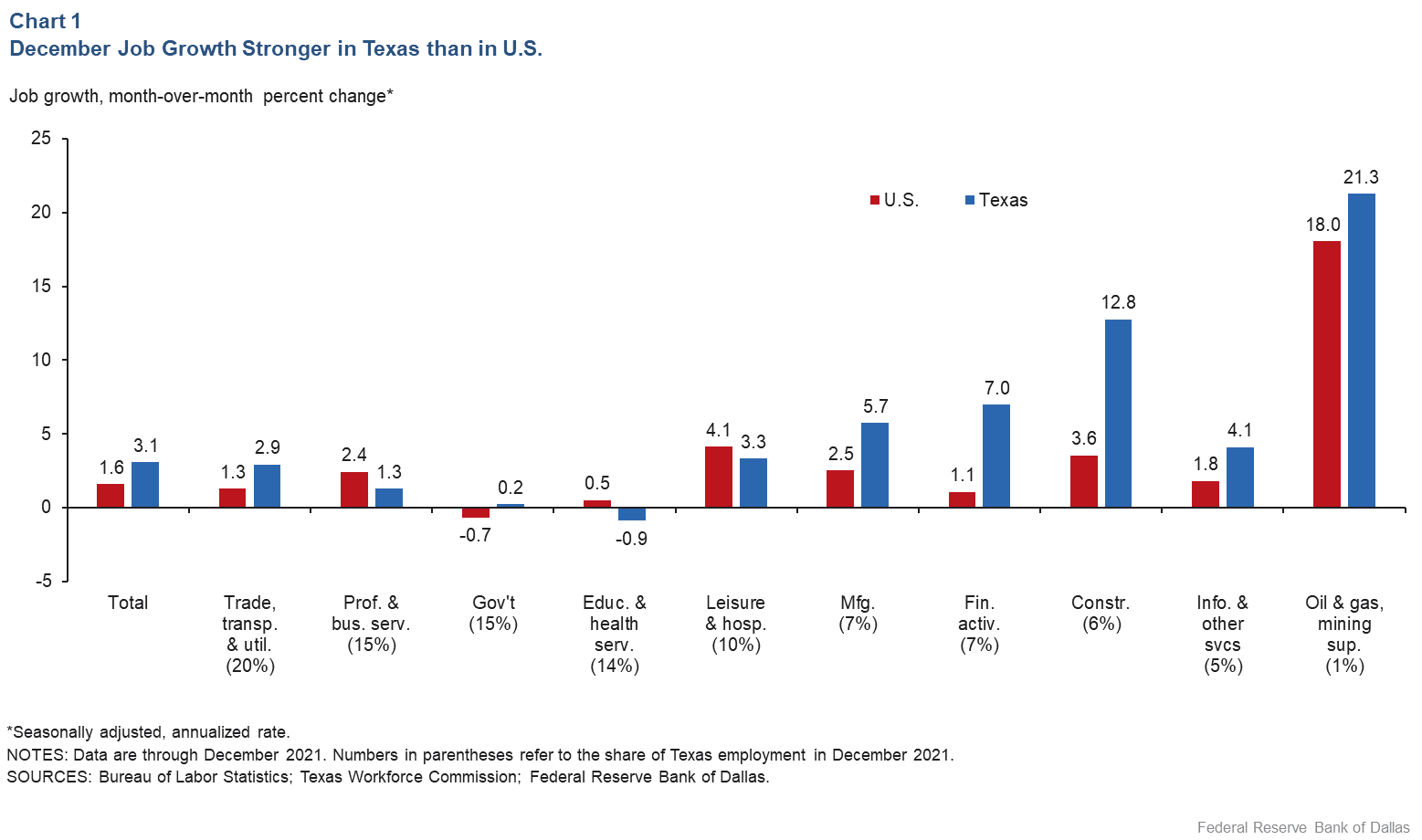

The Texas economy added 33,000 jobs in December, representing a 3.1 percent annualized growth rate (Chart 1). This was down from 7.9 percent in November but well above the state’s long-run trend of 2 percent growth. Texas continued to exceed the pace of U.S. job growth in December.

For all of 2021, Texas job growth of 5.1 percent outpaced U.S. growth of 4.5 percent. Texas is one of four states to surpass its February 2020 prepandemic employment level, along with Utah, Idaho and Arizona.

The growth in Texas was broad based geographically and by activity. Payrolls in the goods-producing sector grew an especially strong 10.2 percent, accelerating from 7.0 percent in November. Energy led the jobs expansion in December, up 21.3 percent at an annualized rate, though energy employment as a whole remained 20 percent below prepandemic levels. The larger service-providing sector grew at a more moderate 2.0 percent annualized rate, down from its 8.0 percent rate in November.

Texas Business Outlook Surveys Suggest Slowing Growth

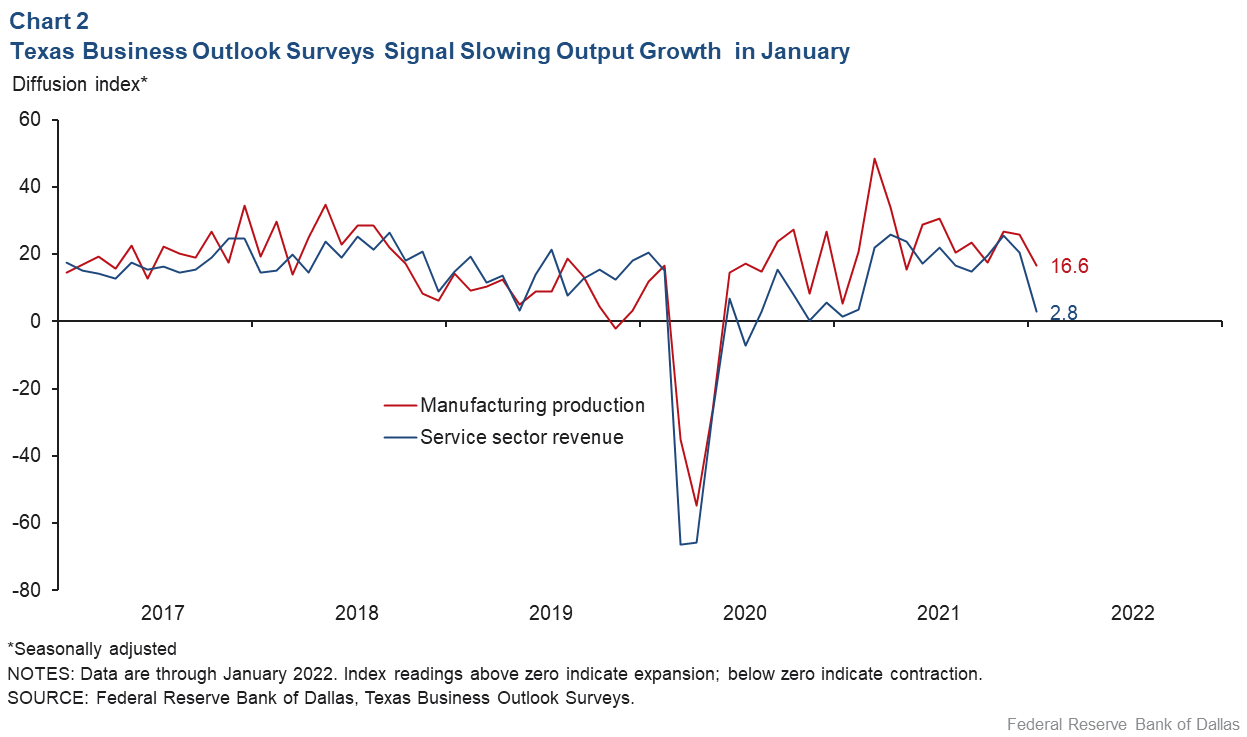

Output growth decelerated in December and January but remained positive, according to results from the Texas Business Outlook Surveys (Chart 2). Some of the survey results are depicted in diffusion indexes in which readings greater than zero signal expansion over the previous survey period and readings below zero indicate contraction.

The headline manufacturing production index remained above average but slipped steadily from roughly 27 in November to 26 in December and 17 in January. The headline services revenue index also remained positive but dropped considerably more—from 26 in November to 20 in December and 3 in January.

The sentiment-based general business activity index fell to near-zero readings in both sectors—firms were evenly split in January in their evaluation of whether activity deteriorated or improved over the past month. Uncertainty rose in the manufacturing and service sectors. However, robust employment growth continued, and expectations for production and revenue expansion in mid-year 2022 remain solid.

Omicron Variant Poses Downside Risks

The recent omicron COVID-19 surge constrained business activity in the region. In mid-January, COVID-19 cases peaked at 72,200 new cases per day (based on a seven-day moving average), more than triple the state’s previous peak in January 2021.

Seventy percent of firms responding to TBOS special questions in January reported that the COVID-19 surge negatively affected their business. Among those reporting negative impacts, 83 percent cited increased absenteeism, and more than 40 percent reported problems that included new or worsened hiring difficulties and/or supply-chain disruptions and reduced productivity due to alternative work arrangements.

Roughly 14 percent of those noting a negative impact said they partially shut down operations temporarily, and 2 percent said they fully shut down temporarily. Businesses generally believe omicron-related disruptions to be transitory, as expectations for business activity six months from now did not falter.

Historic Labor Market Tightness Continues

In December, staffing shortages overtook supply-chain disruptions as the top factor restraining revenues, according to TBOS, with 46 percent of firms reporting limited operating capacity due to difficulty hiring or COVID-related absenteeism.

In January, 73 percent of TBOS firms said a lack of applicants was a key impediment to hiring, while 53 percent said workers looking for more pay than offered was a problem, up from 34 percent in April 2021. Among firms noting a dearth of applicants in January, 45 percent said the availability of applicants worsened over the prior month, up from 35 percent in October 2021 and 27 percent in July 2021.

Businesses See No Relief from Supply-Chain Disruptions

Supply-chain disruptions continue to considerably constrain the Texas economy. In December, 44 percent of TBOS firms said supply-chain disruptions restrained revenues, up from 17 percent in mid-2020, when these issues were mostly contained to segments of manufacturing and retail. The latest COVID-19 surge has added additional stress to supply chains, likely pushing out the horizon for a return to normal.

Wages, Prices Continue to Soar

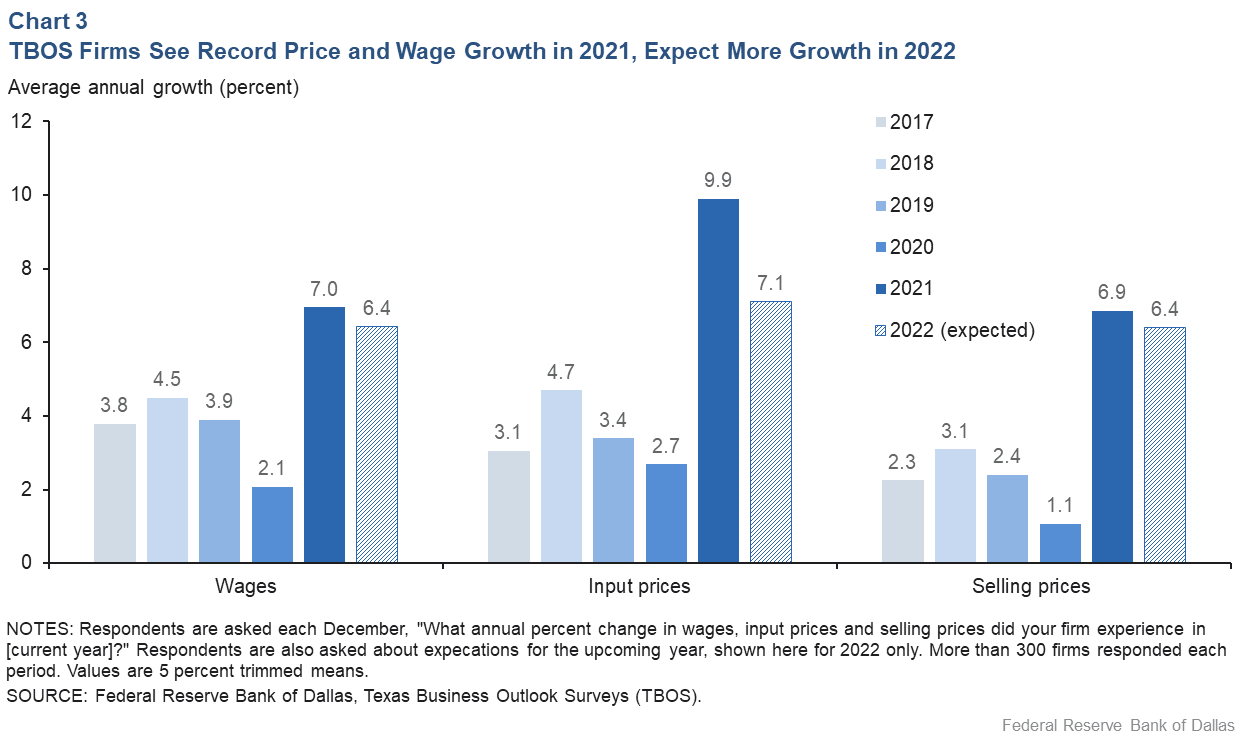

Wages and prices pushed solidly higher, partly reflecting labor market and supply-chain shortages. Extraordinary wage and price growth continued through January, as TBOS indexes remained at or near record highs. Texas business executives reported increases of 10 percent for input prices and 7 percent for both wages and selling prices on average in 2021, far exceeding the increases seen in previous years (Chart 3).

Elevated wage and price growth is likely in 2022, according to TBOS respondents. This is in line with reports from contacts that labor and supply shortages will persist. Many firms are passing through increased input costs from 2021, supporting expectations for still-higher selling prices. In May 2021, 35 percent of respondents said their firms would push through higher costs to customers in 2022. In December, the share rose to 75 percent.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.