Banking Conditions Survey

Solid Loan Demand Growth Continues amid Pricing Increases

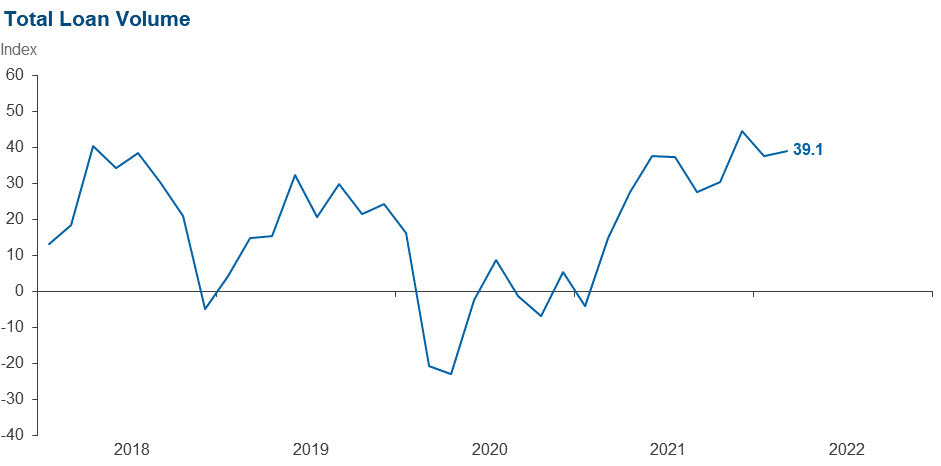

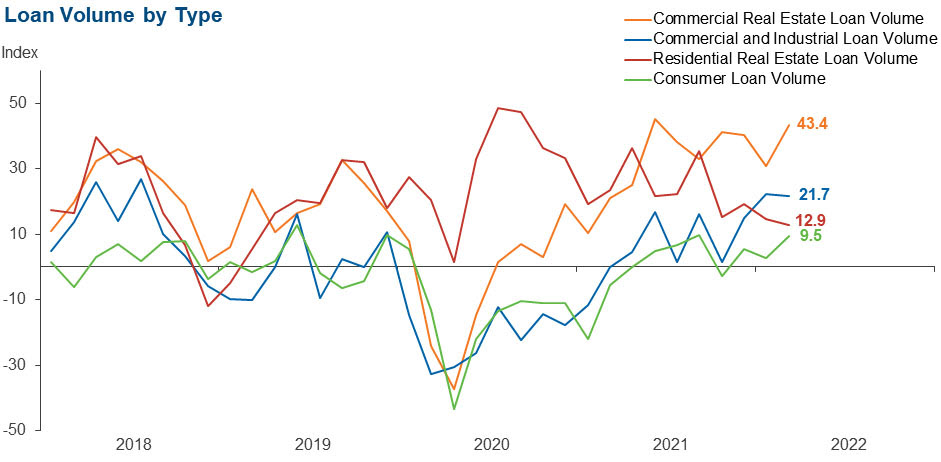

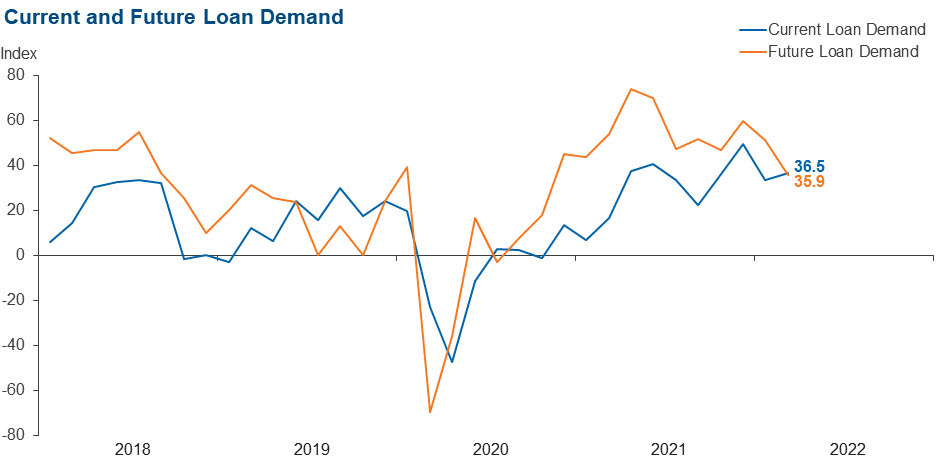

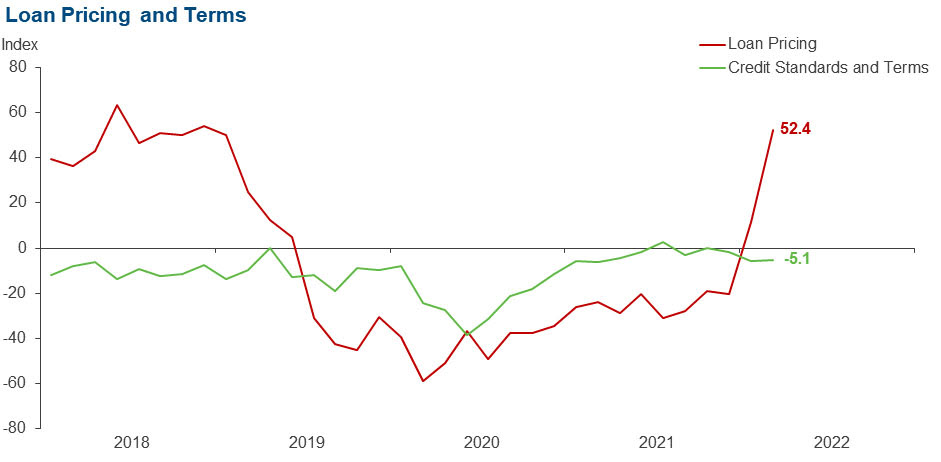

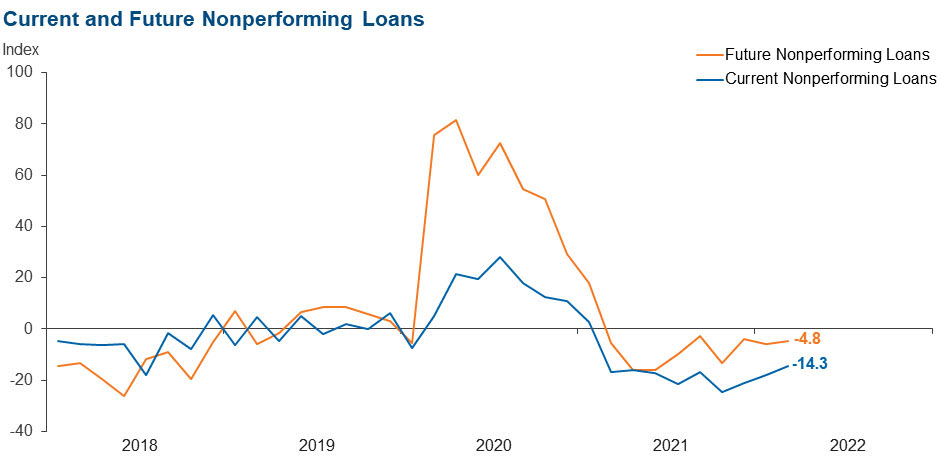

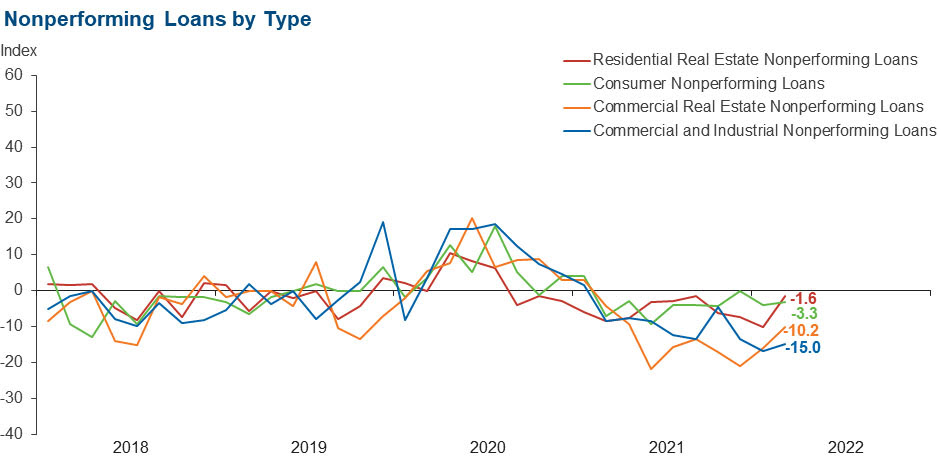

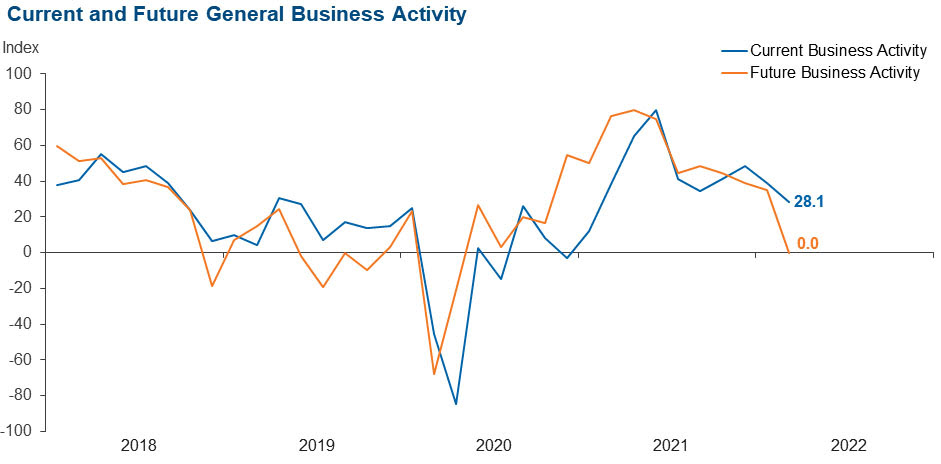

Loan demand and loan volumes continued to increase at a robust pace over the past six weeks, despite a sharp rise in loan pricing. Loan volume increases spanned lending types, and growth remained strongest for commercial real estate loans. Nonperforming loans continued to decrease, and credit standards and terms tightened slightly. Contacts expressed concerns about the effects of interest rate increases, inflation, rising wages and staffing shortages. Respondents expect increases in loan demand and decreases in nonperforming loans over the next six months. While general business activity continued to improve over the previous reporting period, expectations for six months from now were mixed.

Next release: May 16, 2022

Data were collected March 22–30, and 64 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 39.1 | 37.5 | 54.7 | 29.7 | 15.6 |

Loan demand | 36.5 | 33.3 | 50.8 | 34.9 | 14.3 |

Nonperforming loans | –14.3 | –18.1 | 9.5 | 66.7 | 23.8 |

Loan pricing | 52.4 | 11.4 | 52.4 | 47.6 | 0.0 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –5.1 | –5.8 | 5.1 | 84.7 | 10.2 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 21.7 | 22.4 | 31.7 | 58.3 | 10.0 |

Nonperforming loans | –15.0 | –16.7 | 3.3 | 78.3 | 18.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –5.0 | –4.6 | 0.0 | 95.0 | 5.0 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 43.4 | 30.9 | 51.7 | 40.0 | 8.3 |

Nonperforming loans | –10.2 | –16.1 | 1.7 | 86.4 | 11.9 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.7 | –9.0 | 5.2 | 87.9 | 6.9 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 12.9 | 14.5 | 33.9 | 45.2 | 21.0 |

Nonperforming loans | –1.6 | –10.1 | 6.5 | 85.5 | 8.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 0.0 | –4.4 | 0.0 | 100.0 | 0.0 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 9.5 | 2.8 | 22.2 | 65.1 | 12.7 |

Nonperforming loans | –3.3 | –4.1 | 4.8 | 87.1 | 8.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 1.6 | –1.4 | 1.6 | 98.4 | 0.0 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 35.9 | 51.4 | 54.7 | 26.6 | 18.8 |

Nonperforming loans | –4.8 | –5.7 | 12.9 | 69.4 | 17.7 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | 28.1 | 38.9 | 42.2 | 43.8 | 14.1 |

Six months from now | 0.0 | 35.2 | 31.1 | 37.7 | 31.1 |

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- Macro factors outside of our control [are issues of concern].

- The financial industry has been dealing with wage pressure brought on by competition for talent for the past two years, and now heightened inflation has compounded the problem.

- Wage inflation and labor shortage are issues in the marketplace. Rising rates will begin to impact some business loans in both production of new loans and in the credit quality of the existing portfolio.

- Inflation seems to be on the minds of consumer and business customers. We are seeing steady price increases in our area, especially in the hospitality sector. We still see signs of a very tight labor market, with businesses, especially restaurants, shortening hours due to staff shortages.

- Increased and uncertain regulation, inflation and the supply chain [are issues of concern].

- The war seems to have caused a pause in new development. Inflation, especially gas prices, has affected consumers. The crystal ball for bankers is at best cloudy.

- We are remaining watchful in several areas including the impact of inflation on members’ ability to borrow/spend, rate of FOMC [Federal Open Market Committee] increases, and heightened pace and breadth of new regulatory initiatives from the CFPB [Consumer Financial Protection Bureau] and other agencies.

- Interest rates are affecting loan volumes.

- The combination of the war in Europe, inflation, interest rate increases, and an adverse regulatory environment is causing me concern about the prospect of the economy over the next 12 to 18 months.

- Inflated residential and commercial real estate values continue to be a concern.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.