Texas’ cheap housing edge slipping away as resilient demand outpaces supply

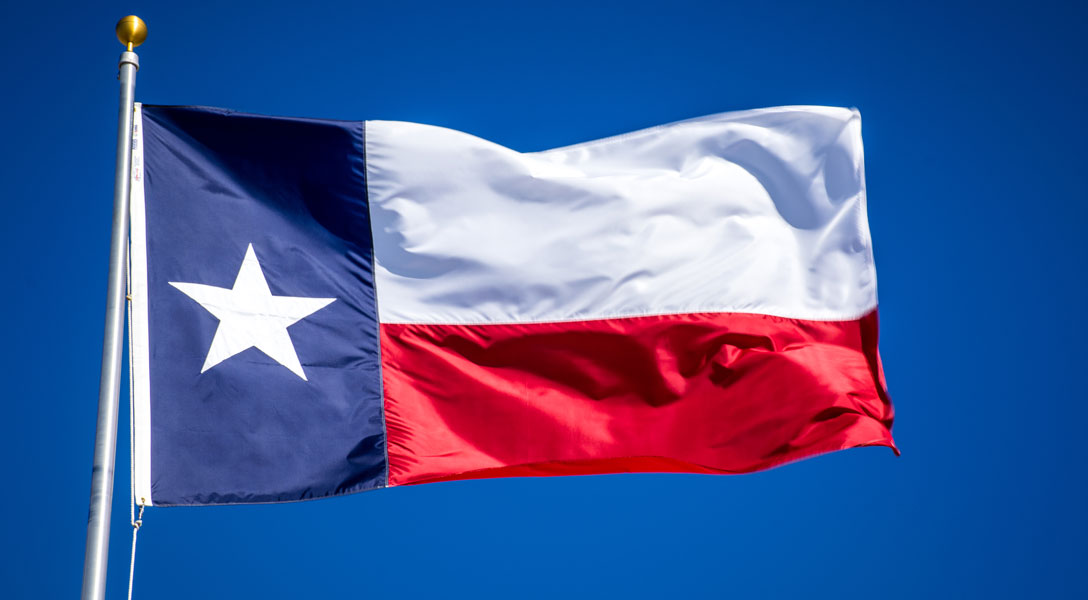

Texas home prices have headed steadily higher, a byproduct of rising housing demand and pandemic-related supply shortages. More recently, tightening monetary policy has led to surging mortgage rates and added to homebuyer costs in the state and across the country.

Housing affordability has declined in Texas, a top destination for domestic and international migrants drawn by its historically low cost of living. However, recent moderating demand—a consequence of escalating costs—and rising housing inventory may curb further erosion of affordability.

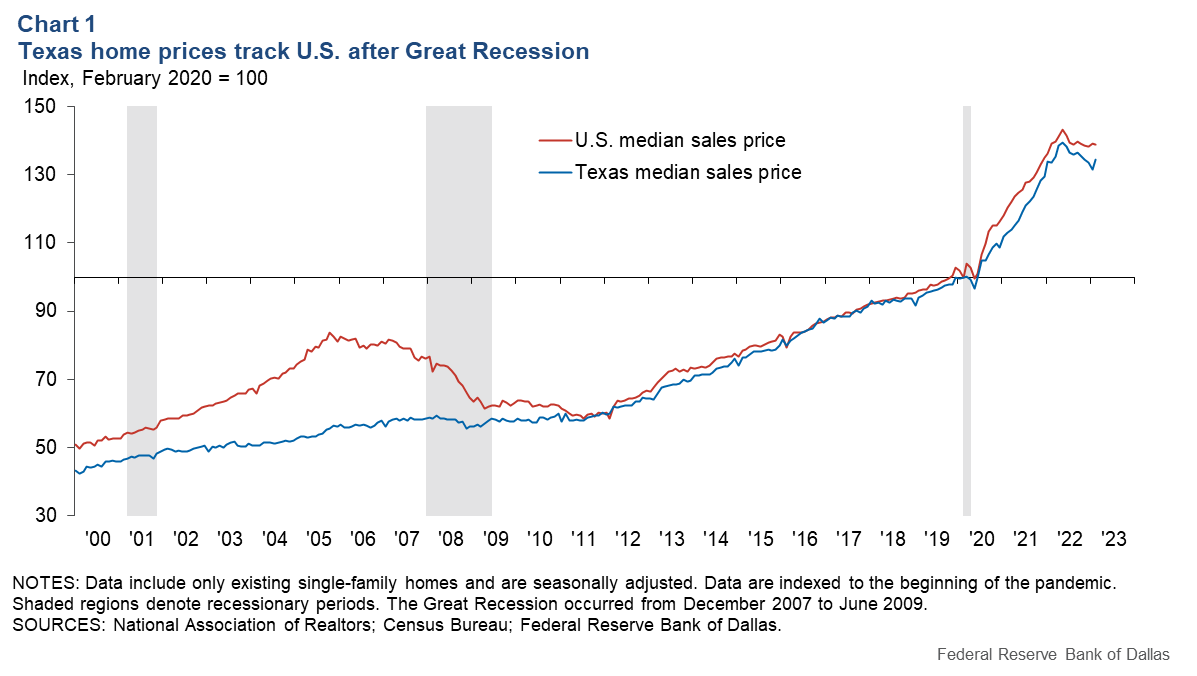

Home prices surge

Texas house prices were largely flat from 2000 through 2005 as national prices marched steadily upward. A widening price differential between the state and the nation helped Texas avoid a housing boom and subsequent bust that precipitated the Great Recession of 2007–09 (Chart 1). Following that downturn, Texas home prices have kept pace with the nation as demand has outstripped housing supply.

Less-pricey housing contributes to a lower cost of living in Texas relative to other large states, such as California and New York, helping to attract new residents. Between 2010 and 2020, Texas added more people than any state, and about half of the population increase was due to migration. The pandemic accelerated in-migration to Texas—migration rose nearly 60 percent in the five quarters following the onset of the pandemic compared with the five quarters preceding it.

The rise of remote work may have spurred the relocations. In addition, Texas had less-stringent COVID-19 restrictions, which resulted in schools opening and business lockdowns ending earlier than in other states. Many of the new residents moved from expensive coastal cities such as San Francisco, Los Angeles and New York. Among Texas metro areas, Dallas–Fort Worth and Austin drew the most migrants and experienced the largest surges in house prices.

New housing supply came on the market, with building permits for single-family homes reaching record highs. Nevertheless, inventories slipped lower, and prices rose, suggesting supply increases fell short of demand. In addition, homebuilding was slowed by material price volatility, and construction trades wages increased because of a tight labor market.

Fewer affordable homes

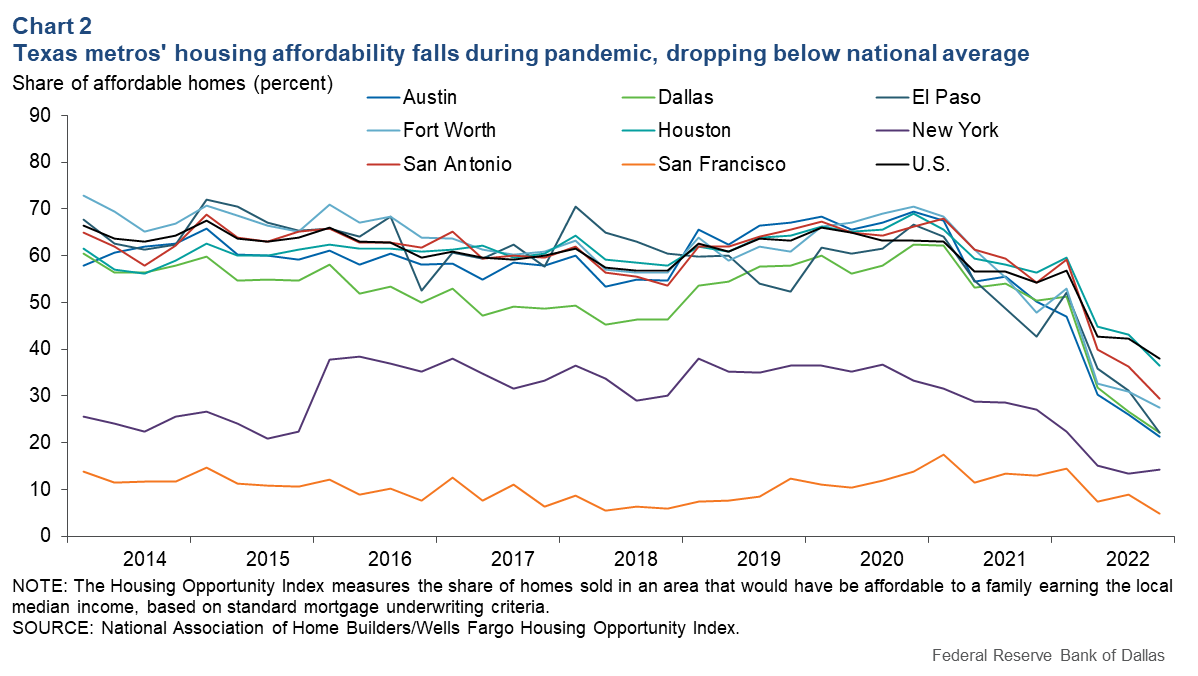

Steeply appreciating home prices eroded some of Texas’ cost-of-living advantage, especially in its major metros. The National Association of Home Builders/Wells Fargo Housing Opportunity Index measures home affordability. It indicates the share of homes sold in a metropolitan area that would have been affordable to a family earning the local median income.

Fewer than one-third of homes were affordable for a family earning the area median income in Austin, Dallas, Fort Worth and San Antonio in fourth quarter 2022, down from around 60 percent in 2014 (Chart 2). The decline was also apparent along the border in metros such as El Paso, Brownsville, Laredo and McAllen (the latter three metros not shown), likely due to pandemic relief stimulus and a relatively quick economic recovery there.

Higher housing costs in Texas pose financial challenges for residents and could slow future population and business migration. With affordability trailing the national average, housing in major metros will increasingly become attainable chiefly to those relocating from coastal cities. Many potential buyers may seek less-expensive options, such as living near or outside of big Texas metros or in smaller communities.

Financing costs rise

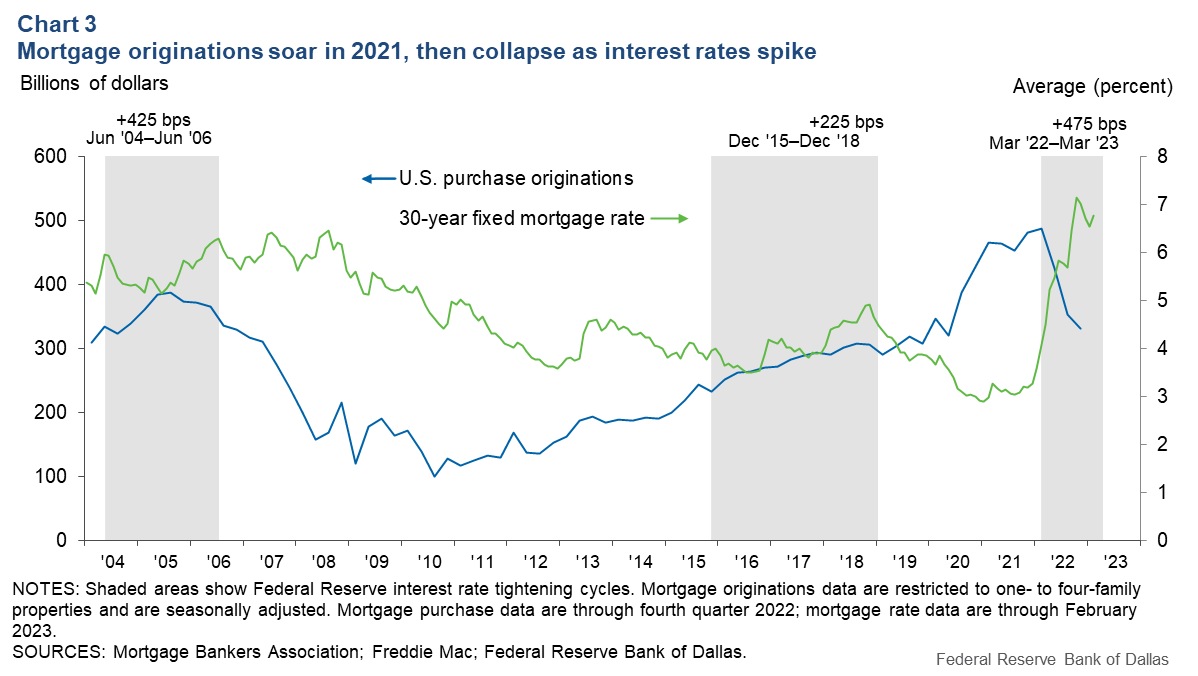

Besides high home prices, increasing mortgage rates have further burdened potential buyers. About 78 percent of buyers financed home purchases with a mortgage in 2022.[1] The rates for mortgages have risen in response to increases in the Federal Reserve’s policy rate—the federal funds rate—that were undertaken to combat inflation. The federal funds rate increased 4.75 percentage points (475 basis points) from March 2022 to March 2023.

In response, banks and other lenders passed the increased cost of funds to borrowers, including those seeking mortgages. Just before the pandemic, the Fed had raised the federal funds rate gradually in response to robust economic growth fueling inflation. The Fed dropped the benchmark back to near zero in March 2020—from an effective rate of near 2.4 percent a year earlier—with the arrival of the pandemic. The move was intended to help stimulate economic activity and prevent a potential crisis as businesses shut down and unemployment rates skyrocketed.

The historically low interest rates helped maintain home price growth during the pandemic. However, the economy overheated over time amid relatively easy credit and extensive federal stimulus programs. Supply-chain disruptions added to market strains, resulting in the highest inflation in more than 40 years. Mortgage rates increased accordingly, and home sales financed with mortgages in the nation plummeted (Chart 3).

The elevated home prices and mortgage interest rate increases deterred some potential homebuyers. For example, the median existing-home price rose in the Dallas–Fort Worth–Arlington metropolitan statistical area from $269,272 in October 2019 to $388,496 in October 2022, while interest rates on a typical 30-year fixed mortgage jumped from 3.7 to 7.0 percent.

Meanwhile, median household income in the area ticked up from $72,642 to $74,673. The Atlanta Fed Home Ownership Affordability Monitor projected that the total median monthly payment rose from $1,606 to $2,870 over the three years, a 79 percent increase.[2] The annual total payment as a share of the area median income grew from 26.5 to 46.1 percent, pricing many potential buyers out of the market.

Young, first-time buyers remain in the market

Declining affordability put a sudden brake on home sales across the nation. Part of the slowdown is attributable to reluctance among existing homeowners to trade their current low mortgage rate for a higher one if they “moved up” or acquired a new residence.

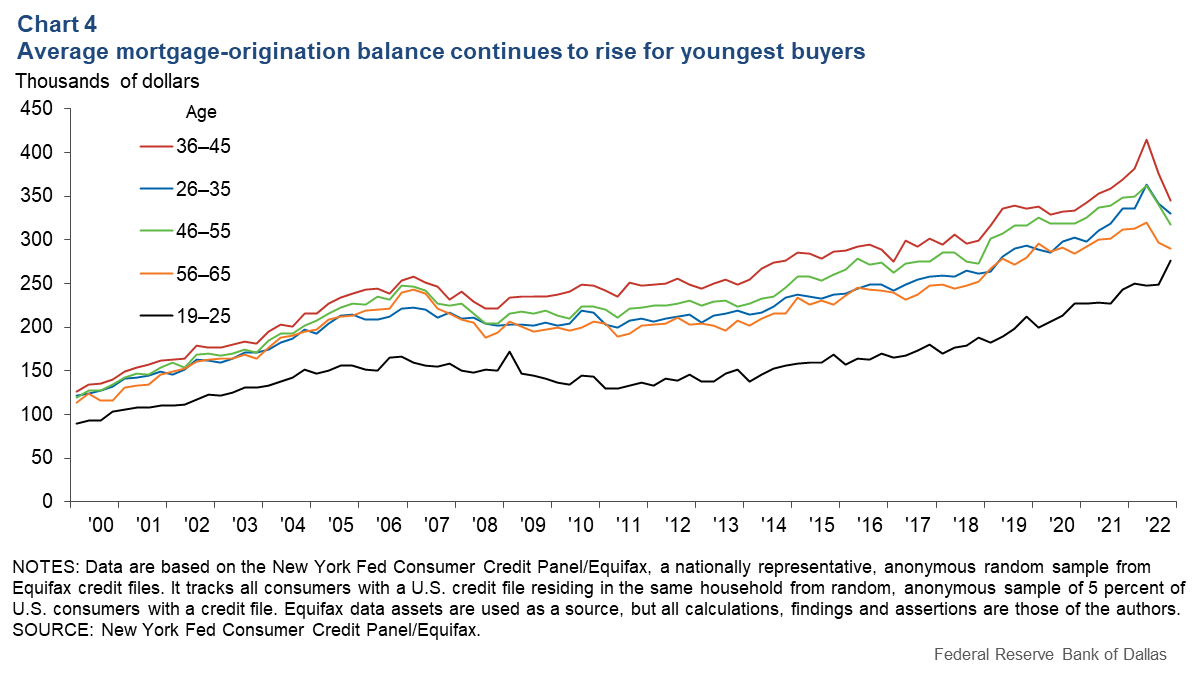

Buyers who are undeterred contend with a larger down payment or a cheaper home. The average mortgage-origination balance has declined from a peak in second quarter 2022, based on an analysis of data from the Federal Reserve Bank of New York Consumer Credit Panel/Equifax (Chart 4).[3]

Notably, this pattern didn’t emerge for the youngest buyer group. Individuals ages 19 to 25 continue to take out larger mortgage loans despite the recent rate increases.

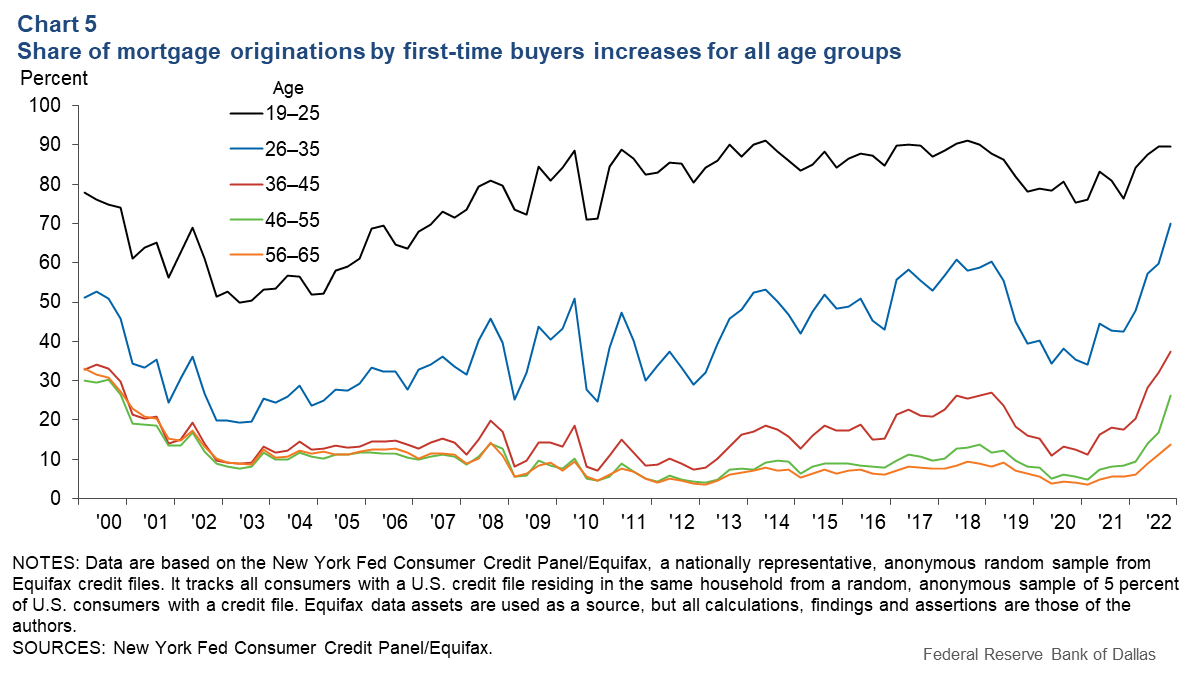

Additionally, first-time homebuyers have accounted for an increasing share of buyers with a mortgage, regardless of age, since early 2021 (Chart 5).[4]

Not surprisingly, the share of new buyers requiring a mortgage is usually higher for younger people (age 35 and younger) due to fewer financial resources. However, older first-time buyers (age 36 and older) have also represented a growing share of new buyers in their age group since interest rates started rising steeply in 2022.

Several factors help explain why young and first-time buyers seem less sensitive to rising housing costs. Unlike older purchasers, who are more financially established, these individuals have limited resources and likely face a more constrained supply of affordable homes. Existing homeowners can hold off taking on a more expensive mortgage because many of them do not need to relocate. By comparison, first-time buyers do not have such flexibility.

First-time or young homebuyers also tend to have less experience in negotiation and end up paying relatively higher prices. They likely have saved less for a down payment and possess less equity in other assets than experienced or older buyers.

Thus, despite their limited choices, these liquidity-constrained homebuyers borrow larger mortgage amounts than their older counterparts if they need a place to live close to work or school and don’t rent. The patterns for Texas are similar to those in the nation.

A foreclosure crisis unlikely

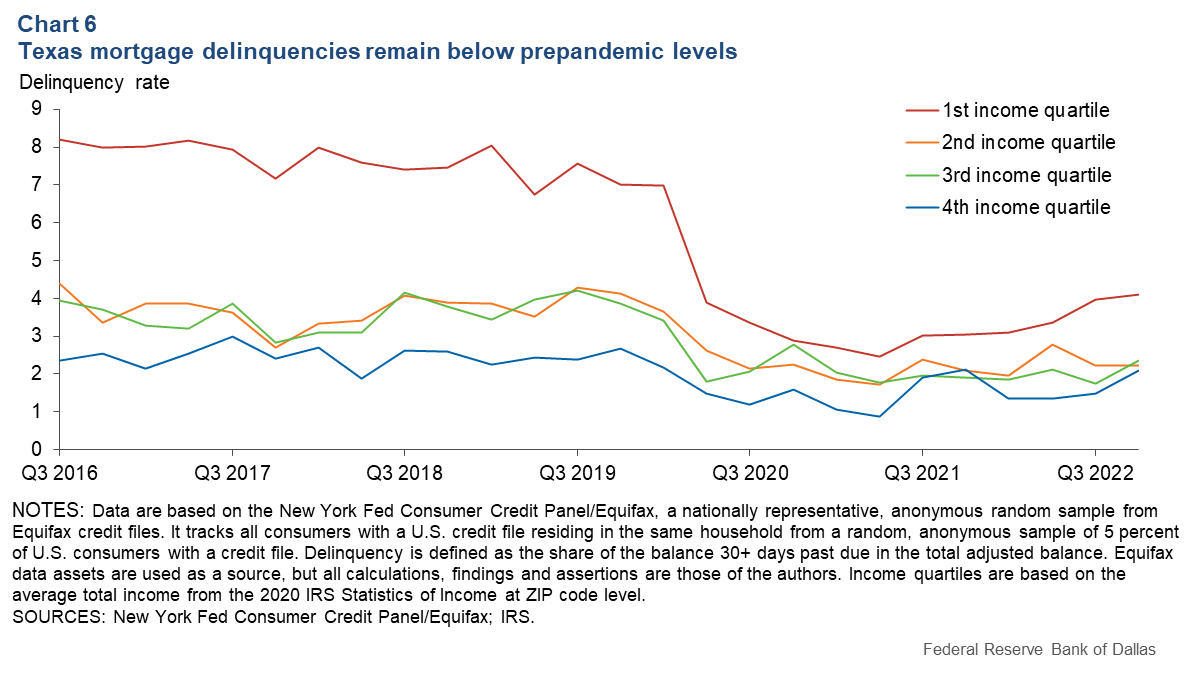

Mortgage market conditions don’t resemble those that accompanied the Great Recession, when millions of borrowers defaulted and lost their homes as prices collapsed. In contrast, mortgage performance has not deteriorated through the pandemic, not even among low-income homeowners (Chart 6). Generous government stimulus and expanded forbearance options helped. And while delinquencies have risen in recent months, they remain below prepandemic levels even for the lowest-income areas in Texas.

There are several reasons borrowers appear relatively more resilient than during the last bust.

First, homeowners have substantial equity in their homes. With current prices holding up at relatively high levels due to low inventories, homeowners are unlikely to discard that equity by walking away after failing to make a payment. Instead, they may simply sell their homes. Also, about 39 percent of U.S. homes and 43 percent of Texas homes are owned without a mortgage.

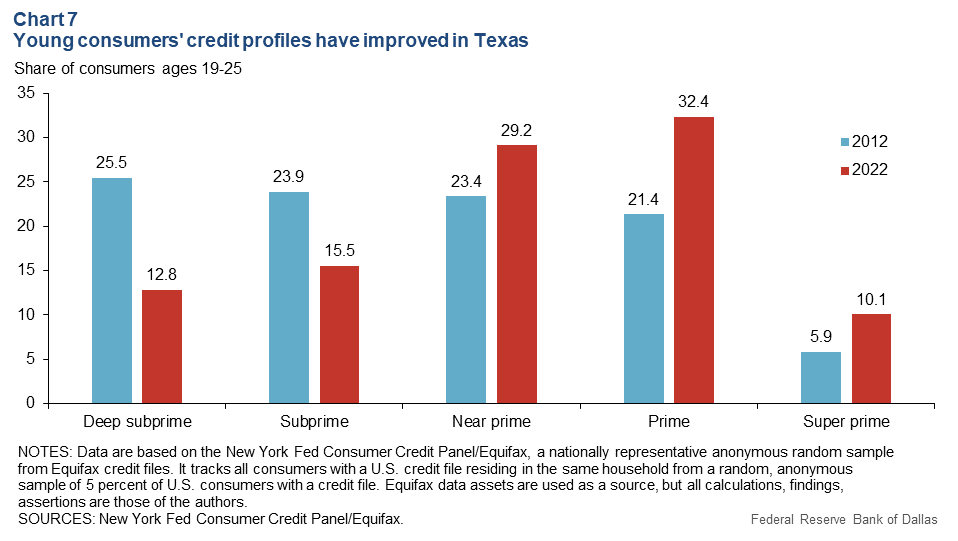

Additionally, most outstanding mortgages carry low interest rates because only a small share of new notes have been originated in recent months. Most existing mortgage-payment burdens have not increased, although homeowners might face larger property tax bills owing to home-value appreciation. Moreover, borrowers have a much-improved credit standing. Mortgage underwriting has stayed stringent since the Great Recession. Pandemic relief and a strong labor market have provided financial stability for most individuals. Although it is still too early to assess the performance of recently originated loans, Equifax Risk Scores rose for those ages 19 to 25—usually risky consumers—suggesting lower delinquencies and defaults (Chart 7).

More than 42 percent of these young borrowers belong to prime or super-prime categories with an Equifax Risk Score above 680—16 percentage points higher than in 2012. A higher credit score indicates a greater ability to meet mortgage obligations and a lower risk of default.

Will Texas regain its affordability advantage?

Whether Texas can regain its housing affordability advantage depends not only on monetary policy, but also on the dynamics of supply and demand and the health of the state economy.

Median home prices in Texas have fallen 3.4 percent from their May 2022 peak. Mortgage rates are also off their peak of around 7 percent in late 2022. Housing supplies are growing. Still, it’s too soon to say whether affordability will improve.

Since fewer existing homes are listed for sale—with owners reluctant to give up their lower-interest mortgages—home prices may not decline as rapidly as they did during the Great Recession market downturn. Additionally, homebuilders also face higher financing costs and may be unable to replenish inventory as quickly as needed.

Migration to the state has slowed but continues because Texas metros remain affordable relative to high-cost coastal cities. Relocating workers and young residents must find a place to live; these potential buyers perhaps will remain less sensitive to higher home prices, interest rates and property tax obligations in Texas.

If the economy slows down broadly and a recession occurs, the labor market may weaken, reducing consumer demand and repayment capacity. Recent data suggest that Texas’ growth has softened, but the state will likely avoid a severe recession. Additionally, a housing price correction may ease inflation pressures and the need for policy rate hikes that could further slow the economy. Borrowers with healthy balance sheets and improved credit will likely remain financially resilient in a volatile housing market in the near future.Notes

- The share of cash buyers was 32 percent in 2021 but dropped to 22 percent in 2022.

- The projection was based on the Atlanta Fed’s assumptions on underwriting standards, property and mortgage insurance, down payments and property taxes.

- The New York Fed Consumer Credit Panel/Equifax is a nationally representative anonymous random sample from Equifax credit files. It tracks all consumers with a U.S. credit file residing in the same household from a random, anonymous sample of 5 percent of U.S. consumers with a credit file. The information presented (including any applicable table, chart or graph) is based on data provided by Equifax. Equifax data assets are used as a source, but all calculations, findings and assertions are those of the authors.

- First-time homebuyers are defined as those who for the first time take out an installment loan that is a first mortgage (not home equity installment), based on the mortgage opening date in mortgage tradeline data of the New York Fed Consumer Credit Panel/Equifax.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.