At the heart of Texas: Cities’ Industry Clusters Drive Growth

Tyler–Longview: Health care growth builds on manufacturing, energy legacy

- Print version

- Additional tables: Tyler–Longview location quotients, employment shares, average annual earnings, demographics

At a glance

Population (2017): |

445,208 (metros combined) |

Population growth (2010–17): |

4.7 percent (Texas: 12.1 percent) |

Median household income (2017): |

Tyler, $54,339; Longview, $48,259 (Texas: $59,206) |

National MSA rank (2017): |

Tyler, No. 199*; Longview, No. 204* |

| *The Tyler and Longview metropolitan statistical areas (MSAs) encompass Smith, Gregg, Rusk and Upshur counties. | |

- The discovery of oil in East Texas helped move the region from a reliance on agriculture to a manufacturing hub with an energy underpinning.

- Health care leads the list of largest employers in Tyler and Longview, the county seats of adjacent Smith and Gregg counties.

- Proximity to Interstate 20 has supported logistics and retailing in the area. Brookshire Grocery Co. is based in Tyler, which is also home to a Target distribution center. Dollar General is building a regional distribution facility in Longview.

History: East Texas oilfield changes agricultural economies

The East Texas communities of Tyler and Longview, though 40 miles apart, are viewed as sharing an economic base and history. Tyler’s early economy relied on agriculture and immigration from the Old South before the Civil War. Longview’s growth took off with westward expansion of the Southern Pacific Railroad in the early 1870s.

The discovery of the East Texas oilfield in the 1930s provided an economic respite for both cities from the Great Depression and shaped their subsequent commercial development.

Tyler is widely known for its rose industry and annual Texas Rose Festival. Local growers turned roses into a major business after peach blight wiped out more than 1 million fruit trees in 1900. The arrival of oil led first to the growth of metal and fabricating industries, and by the mid-1960s, Tyler’s 125 manufacturing plants employed 8,000 workers.

Longview, a cotton and timber town before the oil boom, attracted newcomers from throughout the South for its industrial plants. The Texas Eastman Co., an offshoot of the Eastman Kodak Co. (best known for predigital photography supplies and equipment), located in Longview and was the state’s largest inland chemical complex in the 1950s. The Jos. Schlitz Brewing Co. opened what became the state’s largest brewery and associated factory in 1966, producing 4 million barrels of beer annually. The plant closed after its subsequent owner, the Stroh Brewery Co., exited the beer business in 1999.[1]

Although Tyler and Longview are separate metropolitan statistical areas, the neighboring communities’ commercial activities overlap and complement one another.

Industry clusters: Health care emerges amid manufacturing

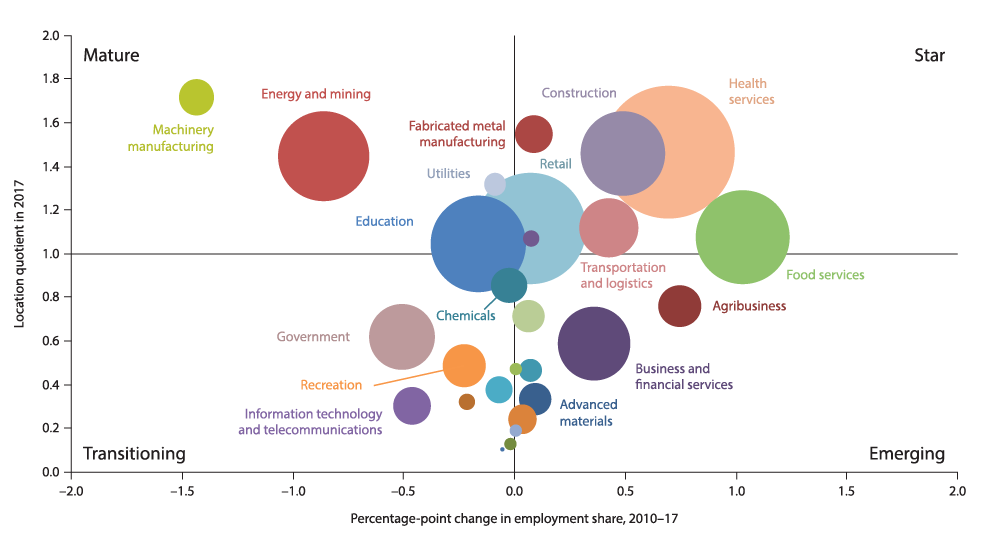

Location quotients (LQs), which compare the relative concentration of various industry clusters locally and nationally, are a convenient way of assessing key drivers in an economy. An LQ exceeding 1 indicates that a specific industry cluster carries more relative weight locally than nationally. Industry cluster growth is measured by the percentage-point change in its share of local employment between 2010 and 2017 (Chart 13.1).[2]

NOTE: Bubble size represents cluster share of metropolitan statistical area employment.

SOURCES: Texas Workforce Commission; Bureau of Labor Statistics.

Clusters in the top half of Chart 13.1 are generally vital to the area’s economy and can be expanding rapidly (“star”) or growing slowly (“mature”) relative to other industries. Those in the bottom half are less dominant locally than nationally. “Emerging” clusters are fast growing; those growing slowly or declining are “transitioning.”

The region’s largest cluster is health services, with an LQ of 1.5 and over 34,000 employees. The two largest employers in Tyler, East Texas Medical Center and CHRISTUS Trinity Mother Frances Health System, together employ more than 6,700 people. CHRISTUS Good Shepherd Medical Center Longview is Longview’s largest employer, with a payroll exceeding 2,500.[3] The University of Texas Health Science Center in Tyler received degree-granting authority in 2005 and is a regional teaching institution as well as a health care provider.

Tyler-based Brookshire Grocery Co., with 2,460 employees, is part of the retail sector, the second-largest in the region, with an LQ of 1.1. Walmart employs 1,060 in Longview. Interstate 20, linking Tyler and Longview, helps support the retail sector and related activities.

The transportation and logistics sector, with an LQ of 1.1, includes 400 Union Pacific personnel in Longview. A Target distribution center in Tyler, with 600 workers, is among the largest employers, while Dollar General is constructing a regional distribution center that will employ 400 workers in Longview. It will join a Neiman Marcus national service center, with almost 300 workers.

The mature machinery manufacturing sector, which is tied to the area’s large energy and mining cluster, has the region’s highest LQ, 1.7. Among the largest companies are Trane Co. with 1,750 employees and Komatsu Ltd. with 400 employees.

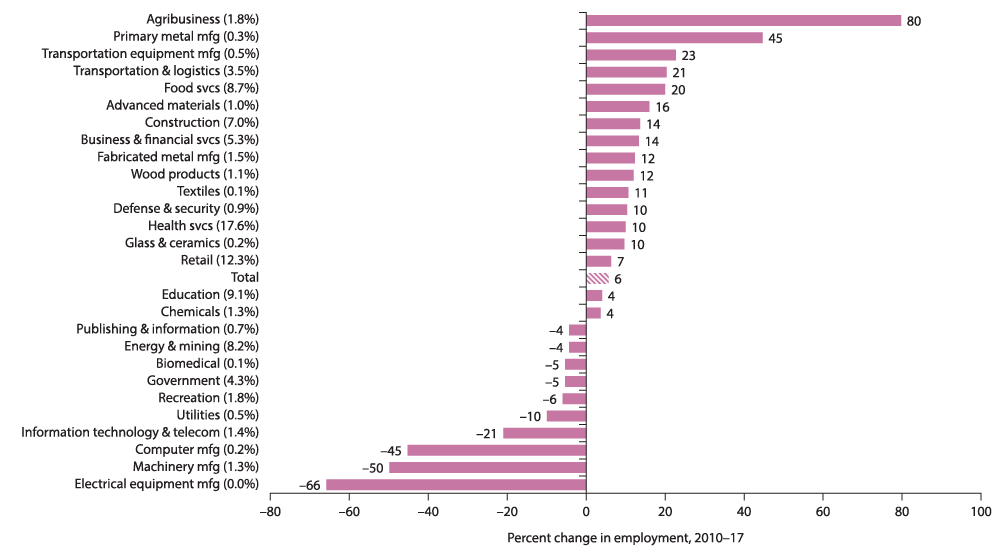

Transportation and logistics, manufacturing and construction helped drive economic growth from 2010 to 2017 (Chart 13.2). Agribusiness has seen the fastest growth during this period and includes Tyler’s famous rose industry.

NOTES: Percent change in employment is shown in whole numbers. Each cluster’s share of total jobs is shown in parentheses (rounded to one decimal place).

SOURCES: Texas Workforce Commission; authors’ calculations.

The energy and mining sector remains active, reflecting the legacy of the massive East Texas oilfield and the recently tapped Haynesville shale formation, which mostly holds natural gas. It has been a source of jobs that paid an average of $70,500 in 2017, nearly 60 percent above the average pay of $44,500 for all jobs in the area (Table 13.1). Reflecting relatively weak natural gas and oil prices as well as soft demand in the 2015–16 period, energy wages stagnated. Meanwhile, pay in the primary metal manufacturing sector averaged $56,900 in 2017, jumping nearly 30 percent since 2010.

| Cluster | Tyler–Longview | U.S. | |||||

| 2010 | 2012 | 2014 | 2016 | 2017 | 2017 | ||

| Machinery manufacturing | 72,482 | 76,313 | 80,825 | 77,205 | 75,603 | 70,059 | |

| Fabricated metal manufacturing | 56,522 | 58,523 | 59,808 | 59,363 | 62,161 | 55,830 | |

| Health services | 51,350 | 50,858 | 48,471 | 51,036 | 52,093 | 56,001 | |

| Construction | 47,234 | 48,449 | 49,471 | 50,177 | 49,319 | 60,742 | |

| Energy and mining | 69,041 | 76,254 | 76,629 | 70,970 | 70,490 | 80,900 | |

| Utilities | 84,274 | 84,227 | 87,420 | 94,030 | 92,473 | 107,188 | |

| Transportation and logistics | 52,299 | 56,168 | 56,731 | 56,100 | 53,444 | 53,761 | |

| Retail | 30,904 | 30,172 | 30,432 | 29,290 | 29,798 | 31,216 | |

| Food services | 15,066 | 14,698 | 15,042 | 15,514 | 15,809 | 18,963 | |

| Primary metal manufacturing | 43,880 | 40,915 | 42,499 | 40,324 | 56,922 | 67,868 | |

| Education | 37,147 | 35,506 | 35,154 | 36,250 | 35,995 | 49,322 | |

| Clusters with location quotient > 1 | 46,251 | 47,835 | 47,751 | 44,543 | 44,481 | – | |

| Clusters with location quotient < 1 | 46,632 | 46,344 | 47,502 | 51,565 | 52,503 | – | |

| Average earnings (total) | 44,792 | 45,631 | 45,564 | 44,105 | 44,467 | 55,375 | |

| NOTES: Clusters are listed in order of location quotient (LQ); clusters shown are those with LQs greater than 1. Earnings are in 2017 dollars. SOURCES: Texas Workforce Commission; Bureau of Labor Statistics; authors’ calculations. |

|||||||

Demographics: lower labor force participation, less education

The Tyler–Longview labor force participation rate of 58.9 percent in 2016 trailed both the state (64.5 percent) and the nation (63.1 percent).

A larger share (15.5 percent) of the local population is age 65 or older, relative to the state at 12.0 percent. Notably, the prime-age portion of the population (ages 25 to 54) in Tyler–Longview, 37.4 percent, is three percentage points lower than the statewide figure. This age distribution reflects a population that is growing older, partly because younger workers are moving to larger cities.

The local population is less educated than the Texas average. The share of the population over age 25 with a bachelor’s degree or more is 22.4 percent compared with 28.9 percent statewide. Meanwhile, 27.4 percent of the local population has a high school diploma or equivalent, more than two percentage points higher than for the state.

The data reflect the significant regional presence of traditional blue collar industries, including manufacturing, construction and energy and mining sectors. They typically have not required workers with advanced levels of education.

Tyler–Longview’s expanding distribution sector should benefit from the state’s increasing population and demand for goods and services. The health care sector can expect further growth as the UT Health Science Center in Tyler expands.

—Michael Weiss

Notes

- The history of Tyler and Longview has been adapted from the Texas State Historical Association’s Handbook of Texas, tshaonline.org/handbook/online/articles/hdt04, and tshaonline.org/handbook/online/articles/hdl03.

- The percentage shares of individual clusters do not add to 100 because some industries are counted in multiple clusters, and some industries are not counted at all based on cluster definitions. (See the appendix for more information.)

- “Tyler Texas Community Profile, Smith County’s Largest Employers,” Tyler Economic Development Council Inc., 2017, and “Real East Texas Longview Major Employers,” Longview Economic Development Corp., 2018.