Texas subprime borrowers rely on unconventional home loans

Homeownership in Texas has changed substantially since the Great Recession, especially for riskier borrowers. Traditional lenders have become more risk averse after the housing crisis that spurred the recession, and there has been a significant drop in the number of subprime borrowers in Texas who have a mortgage. Those who do often turn to non-traditional lenders for loans.

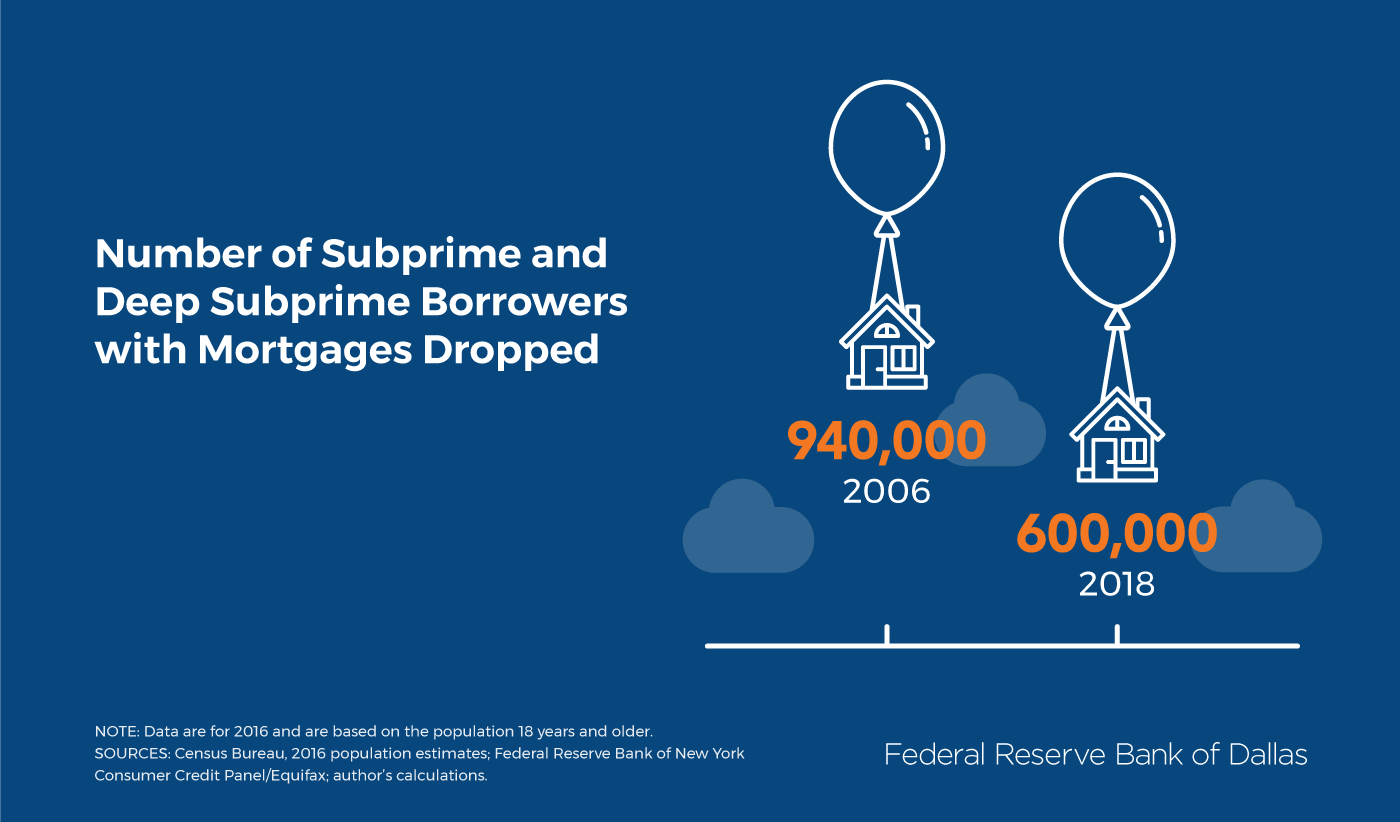

In 2006, there were close to 940,000 subprime (Equifax Risk Score of 550–619) and deep subprime borrowers (score below 550) who had a mortgage; by 2018, this number dropped to fewer than 600,000. The number of prime mortgage holders (risk score of 680 or above) grew by 36 percent between 2006 and 2018, increasing from 2.6 million to almost 3.6 million borrowers.

Median mortgage amount hinges on risk score

Between 2006 and 2018, the median mortgage amount increased considerably for prime borrowers. While home prices have increased during this period, it appears that subprime and deep subprime borrowers are not buying more expensive homes. The median amount for subprime borrowers dipped, and the median amount for deep subprime borrowers only increased slightly (Table 1).

Table 1: Median Mortgage Amount Increases for Prime Borrowers; Little Change for Others

| Equifax Risk Score of Texas borrowers | Median mortgage amount | Percent change | |

| 2006 (in 2018 dollars) | 2018 | ||

| Prime (680 and above) | $131,468 | $145,443 | 10.6 |

| Subprime (550–619) | $107,146 | $102,014 | -4.8 |

| Deep subprime (below 550) | $103,282 | $105,874 | 2.5 |

| SOURCES: Federal Reserve Bank of New York Consumer Credit Panel/Equifax; author’s calculations. | |||

Meanwhile, the state’s mortgage market appears to have found stability in recent years. The number of home foreclosure filings in Texas is much lower now than during the recession, despite a recent uptick. It may be tempting to conclude that the housing market is in some kind of equilibrium, with prime borrowers accessing better homes and foreclosures on the decline. But that is not the whole story.

Low- and moderate-income borrowers look for other options

While the Dallas Fed report, “Consumer Credit Trends for Texas,” does not look at the types of institutions lending to mortgage borrowers, others have. Recent data from the Consumer Finance Protection Bureau indicate that independent mortgage companies (also called “nonbanks”) serve a greater share of low- and moderate-income (LMI) borrowers than other institutions, such as banks and credit unions. This is relevant because nonbanks are more vulnerable to economic stress than banks, as noted by several Federal Reserve Board economists. Nonbanks are also not subject to the Community Reinvestment Act, an important oversight tool.

Given that risk scores and income are correlated, the rising popularity of nonbanks among LMI communities and the gradual disappearance of subprime consumers from the mortgage market may be trends worth watching.

This research, along with our recent findings, sparks questions such as:

- What types of institutions typically provide mortgage loans to Texans with nonprime risk scores?

- What is the right balance to strike so that all creditworthy Texans have the chance to become homeowners?

- What role does the lack of affordable housing or the rise in student loans play in the dominance of the prime mortgage borrower?

Our report does not answer these questions, but we hope that the examination of the recent past can provide insight into these questions in the future.

Author

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.