Tools for Saving

A good first step toward saving is to open a savings account at a bank or credit union. With a savings account, you can:

- Save money on check cashing fees and money orders.

- Take advantage of compound interest, with no risk.

- Keep your money safer than in your pocket or at home.

- Take advantage of direct deposit of your paycheck.

- Monitor your balance online (and on your smartphone).

- Access your money from anywhere at any time.

- Easily move money from one account to another.

- Build a banking relationship, which is important to your credit history.

- Have your savings insured by the FDIC (NCUA for credit unions) up to $250,000.

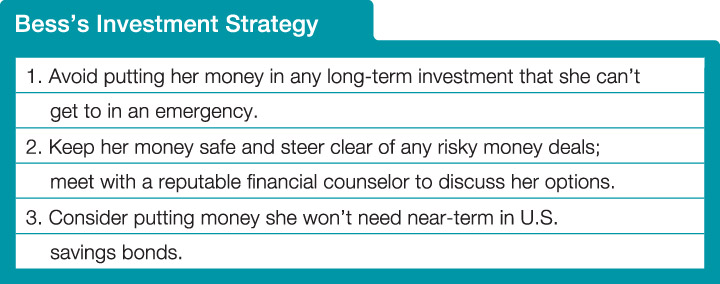

Financial institutions offer a variety of insured savings accounts, each of which pays a different interest rate. Among them are:

- General savings accounts, which earn interest and allow access to funds at any time and movement of money from account to account.

- Money market accounts, which earn interest, may offer check-writing services and impose no fees with a minimum balance.

- Certificates of deposit (CDs), which are purchased for a specified term and return principal and interest at the end of the term (early withdrawal penalties apply).

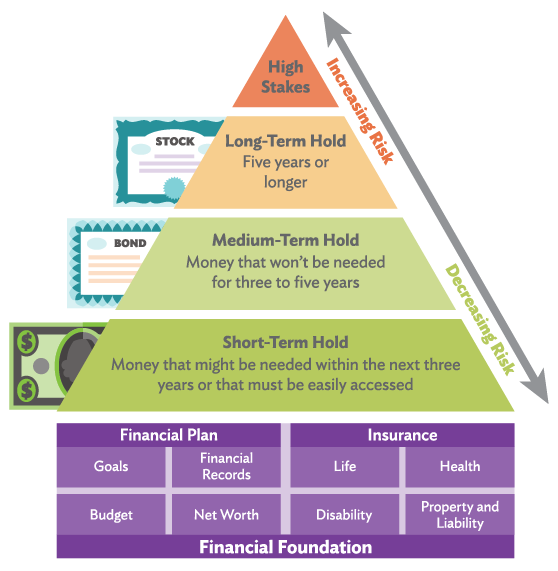

Tools for Investing

Once you have a good savings foundation, you may want to diversify your assets among different types of investments. Diversification can help smooth out potential ups and downs of your investment returns. Investing is not a get-rich-quick scheme. Smart investors take a long-term view, putting money into investments regularly and keeping it invested for five, 10, 15, 20 or more years.

Here are some options for investing your money.

Bonds—Lending Your Money

When you buy bonds, you are lending your money to a federal or state agency, municipality or other issuer, such as a corporation. A bond is like an IOU. The issuer promises to pay a stated rate of interest during the life of the bond and repay the entire face value when the bond comes due or reaches maturity. The interest a bond pays is based primarily on the credit quality of the issuer and current interest rates. Firms like Moody’s Investor Service and Standard & Poor’s rate bonds. With corporate bonds, the company’s bond rating is based on its financial picture. The rating for municipal bonds is based on its financial picture. The rating for municipal bonds is based on the creditworthiness of the government or other public entity that issues it. Issuers with the greatest likelihood of paying back the money have the highest ratings, and their bonds will pay an investor a lower interest rate. Remember, the lower the risk, the lower the expected return.

A bond may be sold at face value (called par value) or at a premium or discount. For example, when prevailing interest rates are lower than the bond’s stated rate, the selling price of the bond rises above its face value. It is sold at a premium. Conversely, when prevailing interest rates are higher than the bond’s stated rate, the selling price of the bond is discounted below face value. When bonds are purchased, they may be held to maturity or traded.

U.S. savings bonds

U.S. savings bonds are government-issued and government-backed. Unlike other investments, you can’t get back less than you put in. Savings bonds can be purchased in denominations ranging from $50 to $10,000. There are different types of savings bonds, each with slightly different features and advantages. Series I bonds are indexed for inflation. The earnings rate on this type of bond combines a fixed rate of return with the annualized rate of inflation.

If you have paper U.S. savings bonds, you can register them online at TreasuryDirect, www.treasurydirect.gov. Then, you won’t have to worry about losing the paper copy.

Treasury bills, bonds, notes and TIPS

The bonds the U.S. Treasury issues are sold to pay for an array of government activities and are backed by the full faith and credit of the federal government.

- Treasury bills are short-term securities with maturities of three months, six months or one year. They are sold at a discount from their face value, and the difference between the cost and what you are paid at maturity is the interest you earn.

- Treasury bonds are securities with terms of more than 10 years. Interest is paid semi-annually.

- Treasury notes are interest-bearing securities with maturities ranging from two to 10 years. Interest payments are made every six months.

- Treasury-Inflation Protection Securities (TIPS) offer investors a chance to buy a security that keeps pace with inflation. Interest is paid on the inflation-adjusted principal.

Bills, bonds and notes are sold in increments of $1,000. These securities, along with U.S. savings bonds, can be purchased directly from the U.S. Department of the Treasury through Treasury Direct at www.treasurydirect.gov.

Some government-issued bonds offer special tax advantages. There is no state or local income tax on the interest earned from Treasury and savings bonds. And in most cases, interest earned from municipal bonds is exempt from federal and state income tax. Typically, higher income investors buy these bonds for their tax benefits.

Stocks—Owning Part of a Company

When you buy common stock, you become a part owner of the company and are known as a stockholder, or shareholder. Stockholders can make money in two ways—receiving dividend payments and selling stock that has appreciated.

- A dividend is an income distribution by a corporation to its shareholders, usually made quarterly.

- Stock appreciation is an increase in the value of stock in the company, generally based on its ability to make money and pay a dividend. However, if the company doesn’t perform as expected, the stock’s value may go down.

There is no guarantee you will make money as a stockholder. In purchasing shares of stock, you take a risk on the company making a profit and paying a dividend or seeing the value of its stock go up. Before investing in a company, learn about its past financial performance, management, products and how the stock has been valued in the past. Learn what the experts say about the company and the relationship of its financial performance and stock price. Successful investors are well-informed.

Mutual Funds—Investing in Many Companies

Mutual funds are established to invest many people’s money in many firms. When you buy mutual fund shares, you become a shareholder of a fund that has invested in many other companies. By diversifying, a mutual fund spreads risk across numerous companies rather than relying on just one to perform well. Mutual funds have varying degrees of risk. They also have costs associated with owning them, such as management fees, that will vary depending on the type of investments the fund makes.

Before investing in a mutual fund, learn about its past performance, the companies it invests in, how it is managed and the fees investors are charged. Learn what the experts say about the fund and its competitors.

Stocks, bonds and mutual funds can be purchased through a full-service broker if you need investment advice, or from a discount broker or even directly from some companies and mutual funds.

Rule of 72

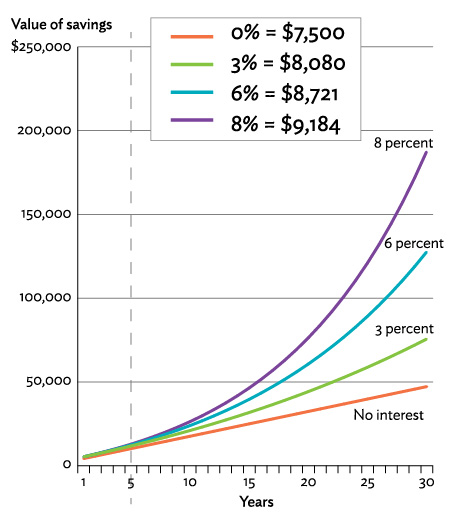

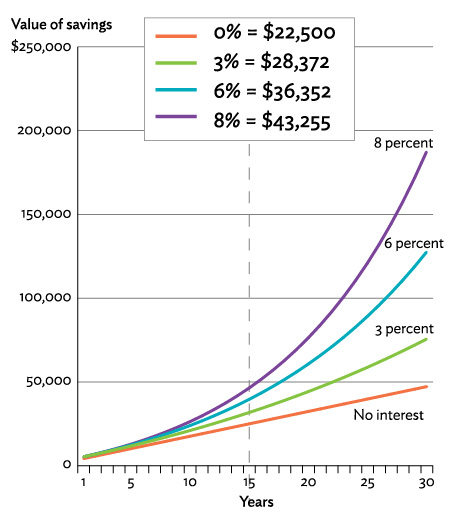

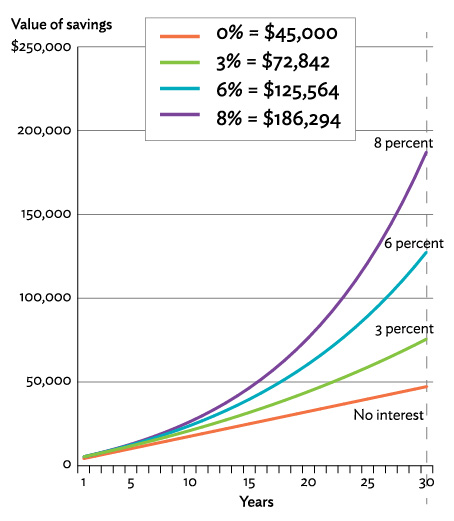

The Rule of 72 can help you estimate how your investment will grow over time. Simply divide the number 72 by your investment’s expected rate of return to find out approximately how many years it will take for your investment to double in value.

Example: Invest $5,000 today at 8 percent interest. Divide 72 by 8 and you get 9. Your investment will double every nine years. In nine years, your $5,000 investment will be worth about $10,000, in 18 years about $20,000 and in 27 years, $40,000.

The Rule of 72 also works if you want to find out the rate of return you need to make your money double. For example, if you have some money to invest and you want it to double in 10 years, what rate of return would you need? Divide 72 by 10 and you get 7.2. Your money will double in 10 years if your average rate of return is 7.2 percent.

Invest for Retirement

Have you ever thought about how much money you will need when you retire? Will you save enough today to meet your future needs at prices higher than today’s due to inflation? Many people don’t save enough for retirement.

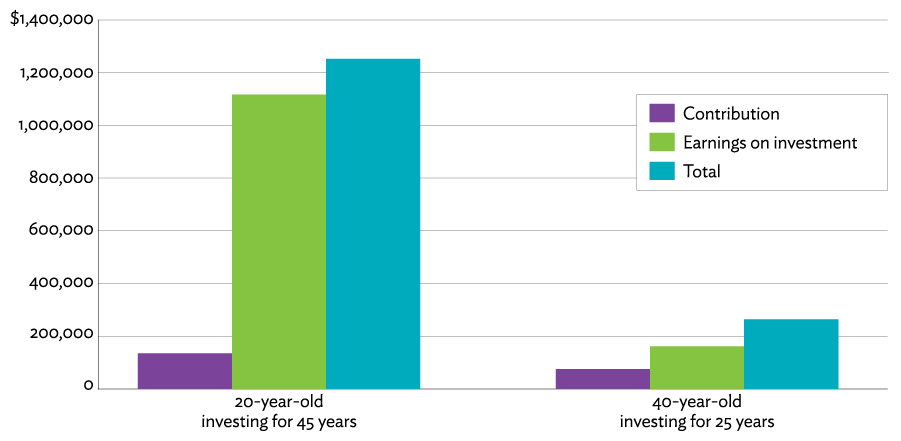

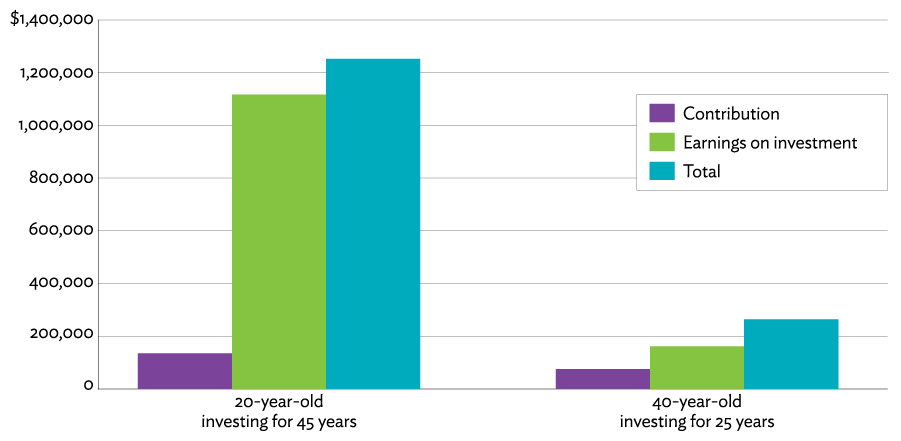

This chart illustrates why it’s better to start saving and investing for retirement early in your career. A 20-year-old who begins investing $3,000 each year toward retirement will have a nest egg over $1.2 million at age 65 if that investment earns an average annual rate of return of 8 percent. If you wait until you are 40 to start investing, the results are much lower.

Invest in an IRA: The Sooner You Start, the Better

Here are some options for how you can invest for retirement.

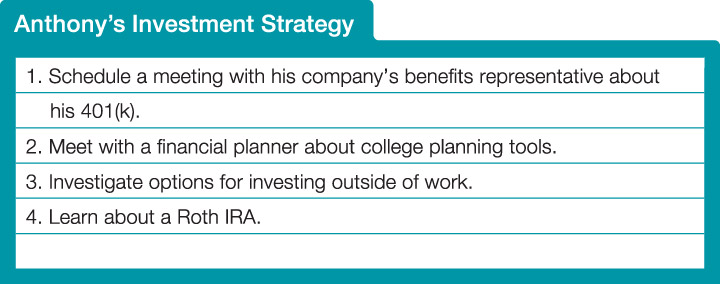

Individual retirement accounts

An individual retirement account (IRA) lets you build wealth and retirement security. The money you invest in an IRA grows tax-free until you retire and are ready to withdraw it. You can open an IRA at a bank, brokerage firm, mutual fund or insurance company.

IRAs are subject to certain income limitations and other requirements you will need to learn more about, but here is an overview of what they offer, with the maximum tax-free annual contributions as of 2021.

Traditional IRA

You can contribute up to $6,000 a year to a traditional IRA, as long as you earn $6,000 a year or more.

- A married couple with only one person working outside the home may contribute a combined total of $12,000 to an IRA and a spousal IRA.

- Individuals 50 years of age or older may make an additional “catch-up” contribution of $1,000 a year, for a total annual contribution of $7,000. Money invested in an IRA is deductible from current-year taxes if you are not covered by a retirement plan where you work and your income is below a certain limit.

A traditional IRA is tax-deferred, meaning you don’t pay taxes on the money until it is withdrawn. All withdrawals are taxable, and there generally are penalties on money withdrawn before age 59½.

However, you can make certain withdrawals without penalty, such as to pay for higher education, to purchase your first home, to cover certain unreimbursed medical expenses or to pay medical insurance premiums if you are out of work.

Roth IRA

A Roth IRA is funded by after-tax earnings; you do not deduct the money you pay in from your current income. However, after age 59½ you can withdraw the principal and any interest or appreciated value tax-free.

401(k) plans

Many companies offer a 401(k) plan for employees’ retirement. Participants authorize a certain percentage of their before-tax salary to be deducted from their paycheck and put into a 401(k). Many times, 401(k) funds are professionally managed and employees have a choice of investments that vary in risk. Employees are responsible for learning about the investment choices offered.

By putting a percentage of your salary into a 401(k), you reduce the amount of pay subject to federal and state income tax. Tax-deferred contributions and earnings make up the best one-two punch in investing. In addition, your employer may match a portion of every dollar you invest in the 401(k), up to a certain percentage or dollar amount.

As long as the money remains in your 410(k), it’s tax-deferred. Withdrawals for any purpose are taxable, and withdrawals before age 59½ are subject to penalty. Take full advantage of the retirement savings programs your company offers—and understand thoroughly how they work. They are great ways to build wealth.

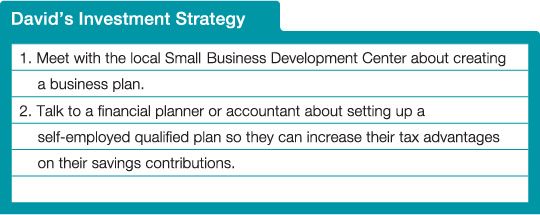

Qualified plans

If you’re self-employed, don’t worry. There is a retirement plan for you.

A qualified plan (formerly referred to as a Keogh plan) is a tax-deferred plan designed to help self-employed workers save for retirement.

The most attractive feature of a qualified plan is the high maximum contribution—up to $58,000 annually. The contributions and investment earnings grow tax-free until they are withdrawn, when they are taxed as ordinary income. Withdrawals before age 59½ are subject to a penalty.

Check the IRS website—www.irs.gov—for current information on tax-deferred investments.