Meet Vince

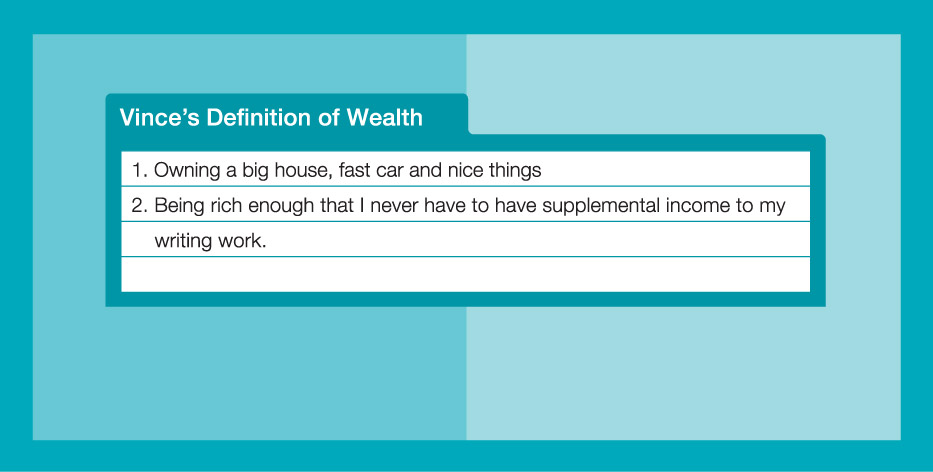

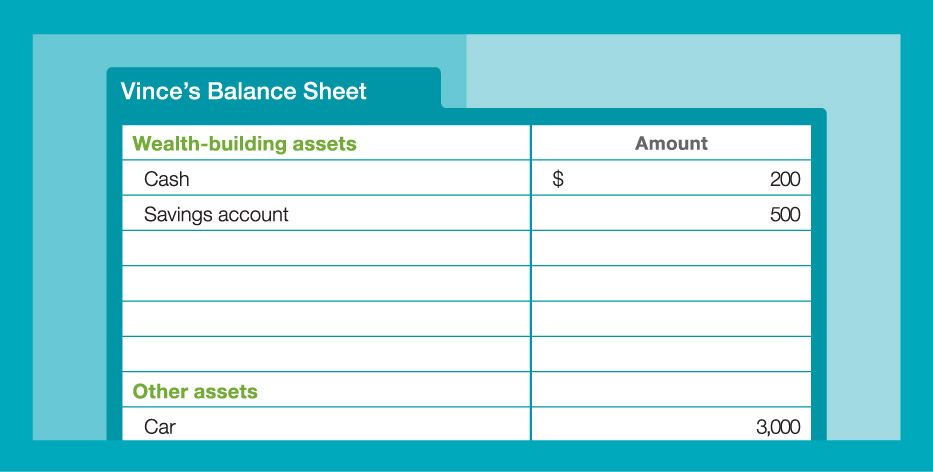

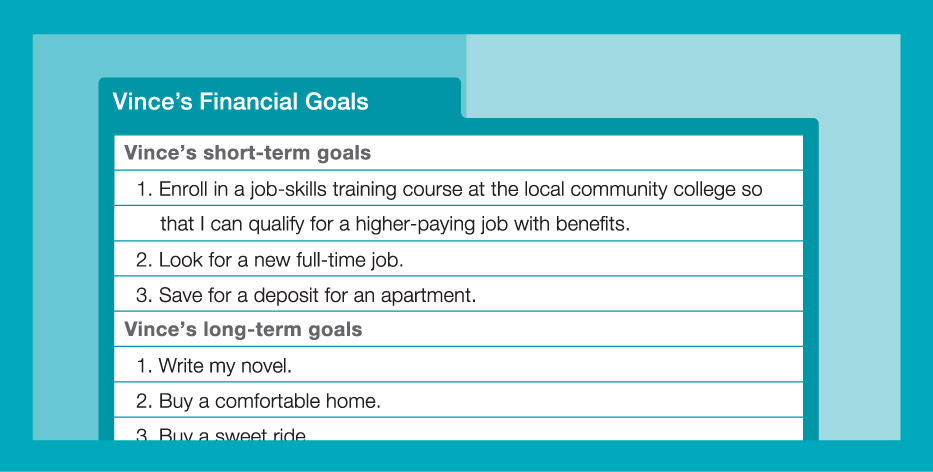

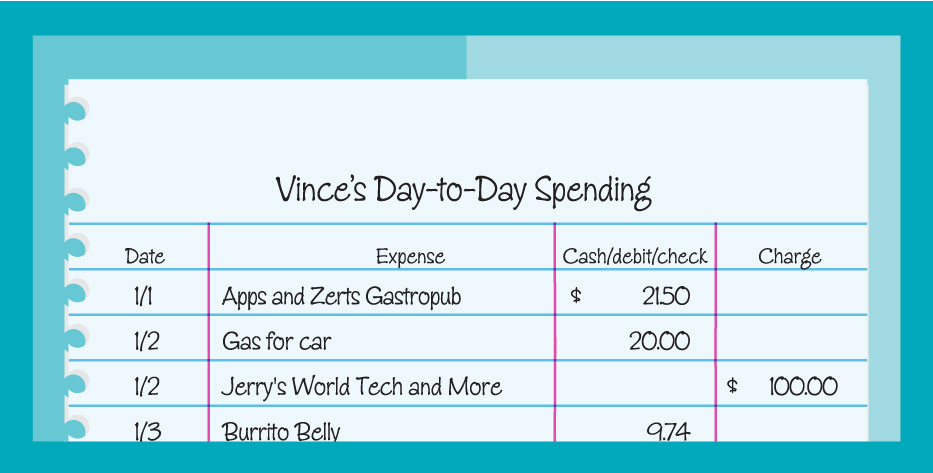

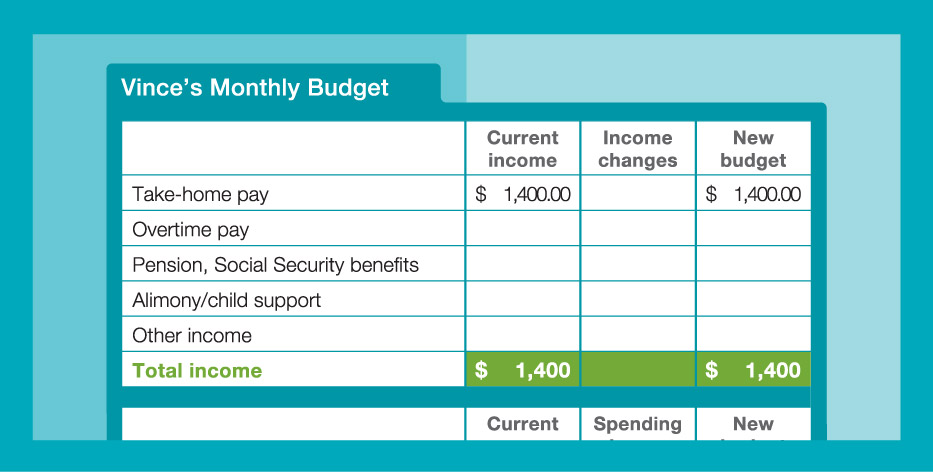

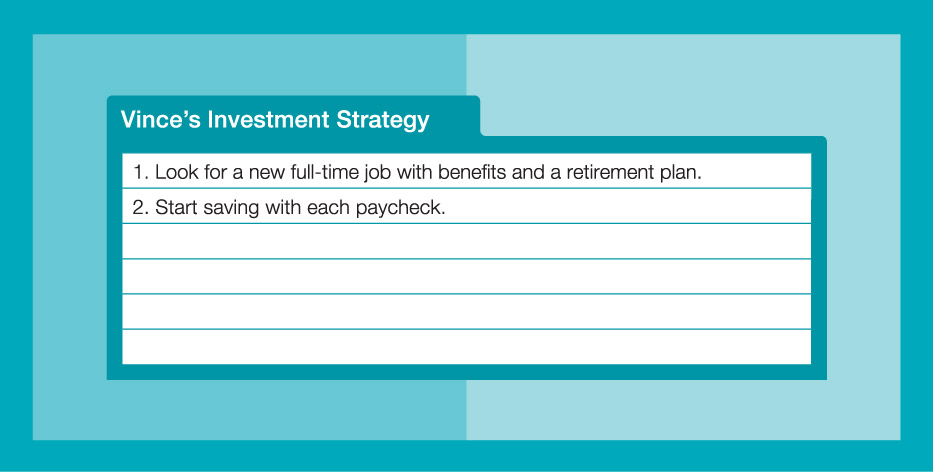

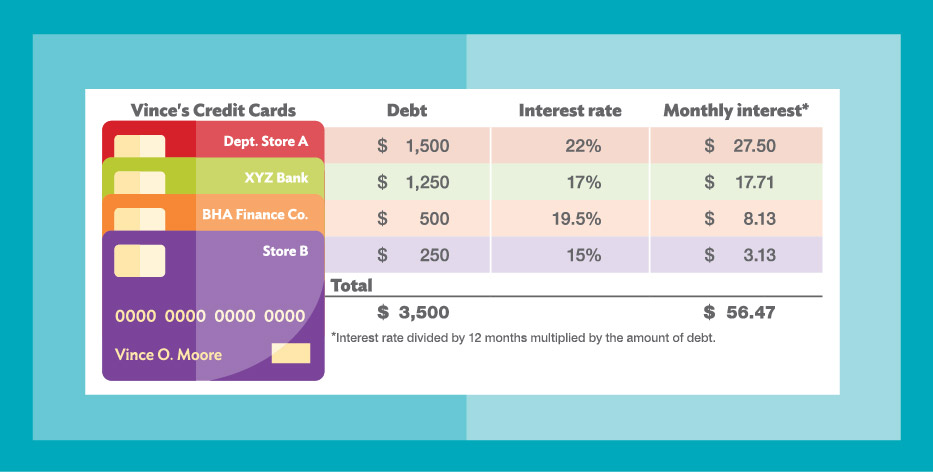

This is Vince, a 42-year-old writer who hopes to someday be the author of a great novel. After a period of unemployment, he lost his apartment and now rents a room in his sister’s home. Vince hopes to pursue his writing career and currently works as a bartender on weekends. He has racked up a sizable amount of credit card debt and hopes to move out of his sister’s home soon. He has decided to commit to building wealth the old-fashioned way, through budgeting to save, saving and investing, and building his credit.

Take a look at the forms below to see how Vince put Building Wealth into practice.

You can learn more by following his journey throughout the chapters and review.

All of these tools are available for you to complete on your own either online (web) or by downloading a spreadsheet (xls) or blank PDF document (pdf).

From the Introduction