If you make a good income each year and spend it all, you are not getting wealthier. You are just living high.

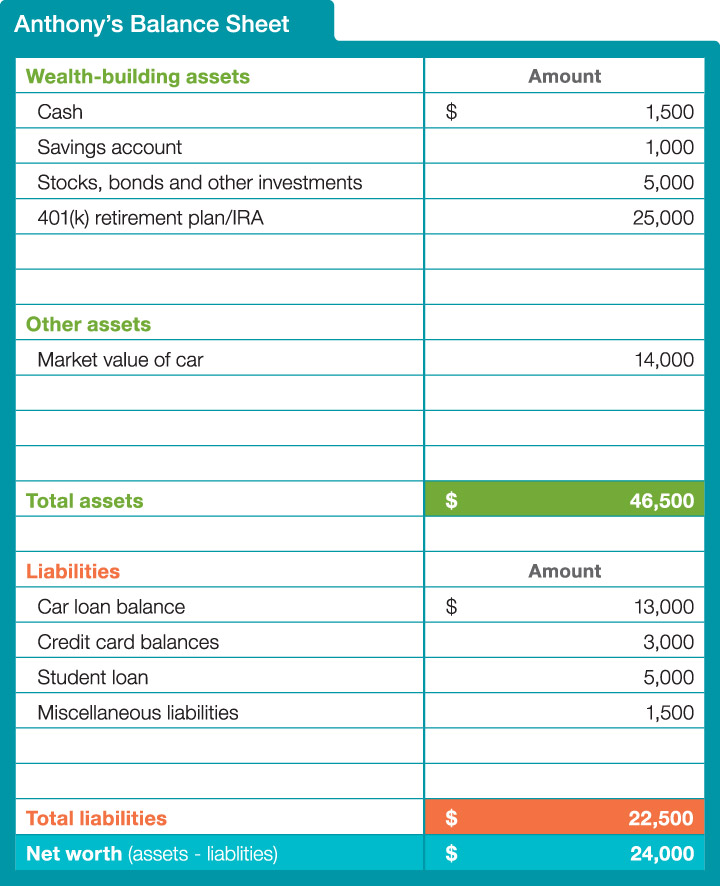

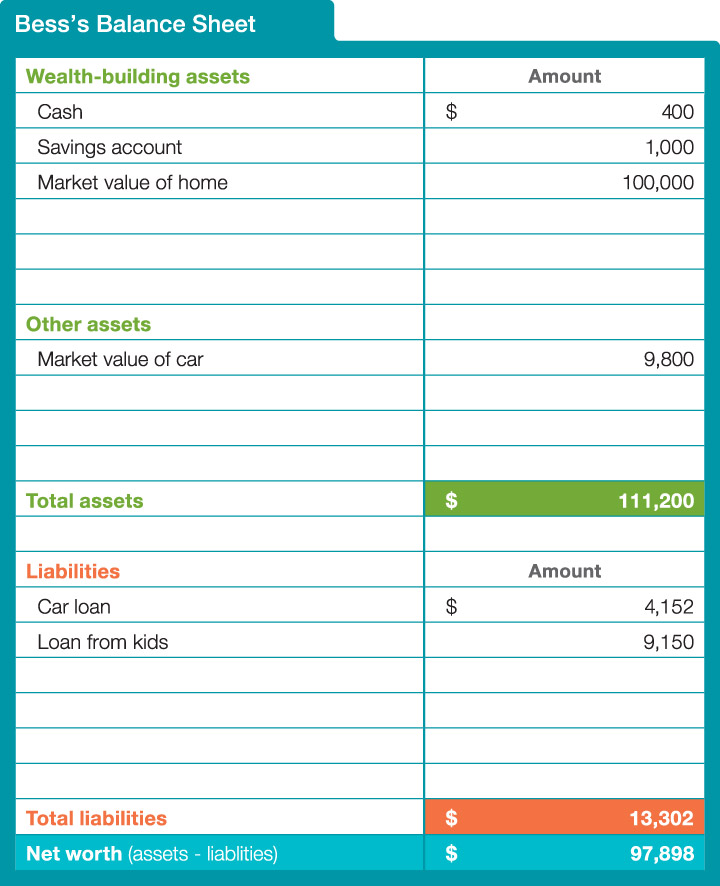

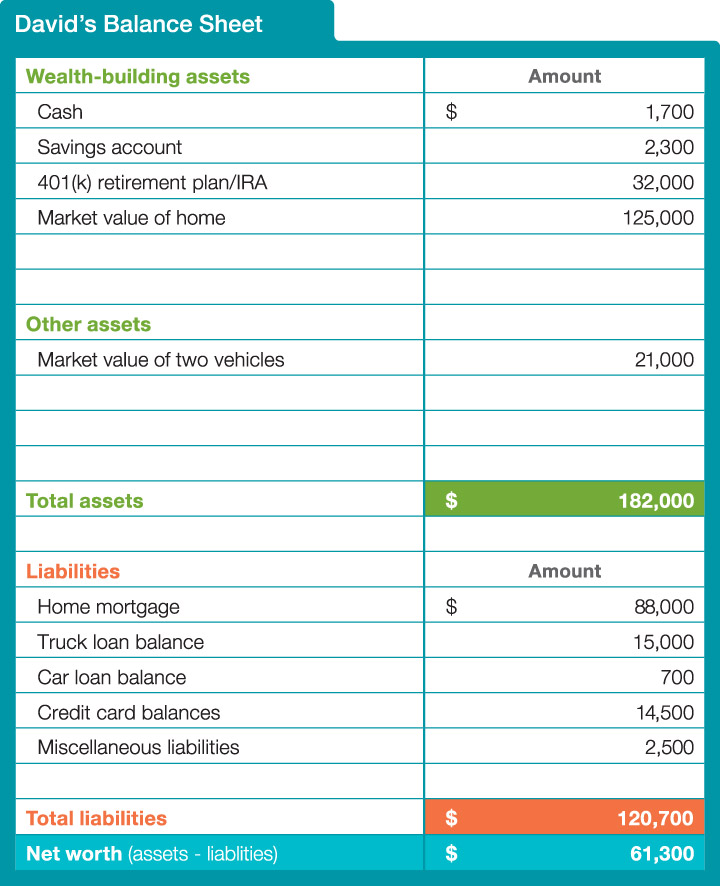

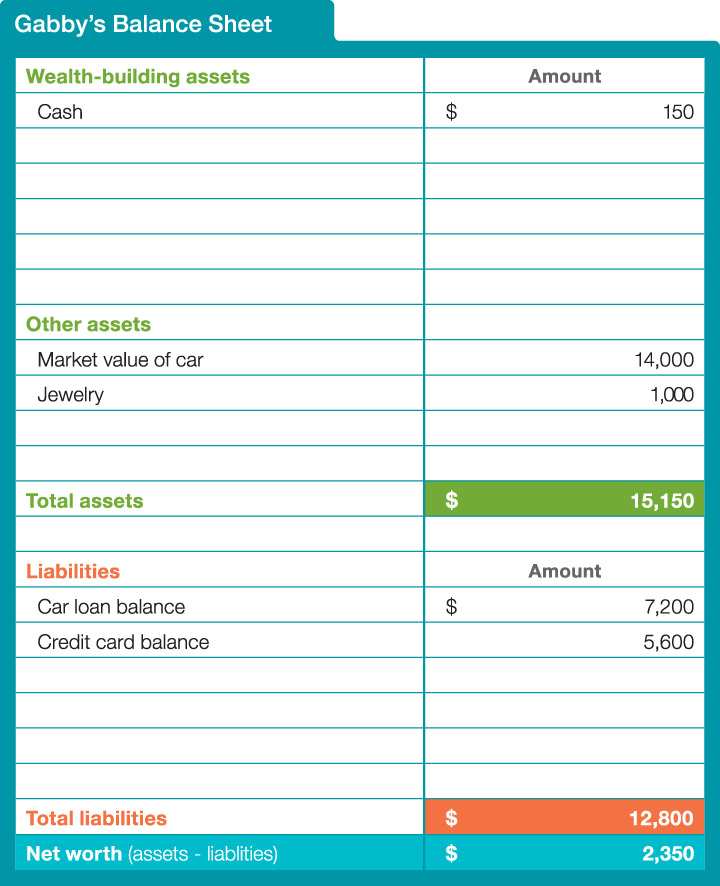

To create personal wealth, you must understand the language. The first lesson is to understand the meaning of assets, liabilities and net worth.

What is your net worth?

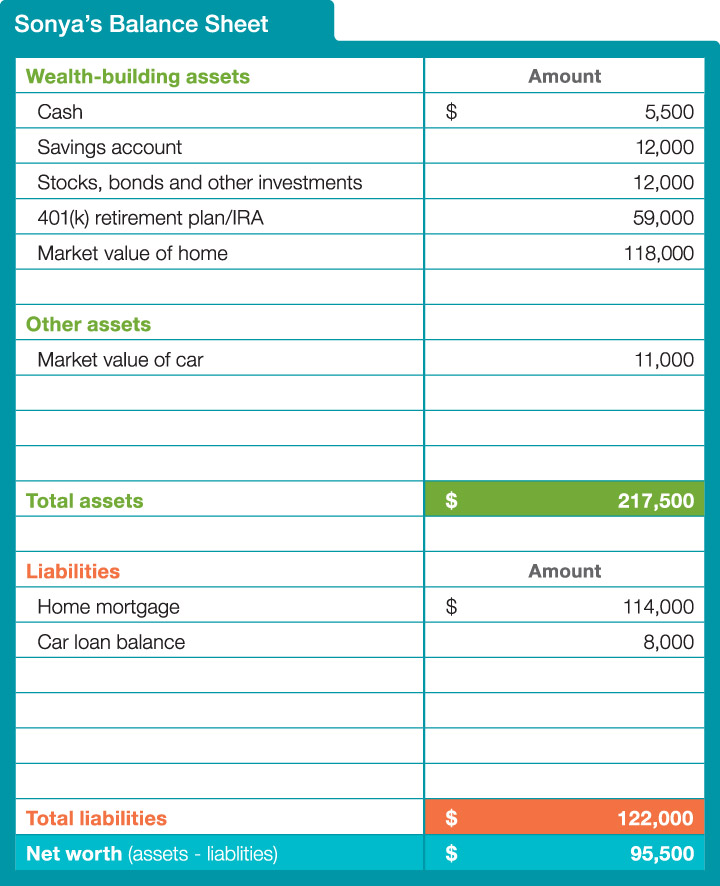

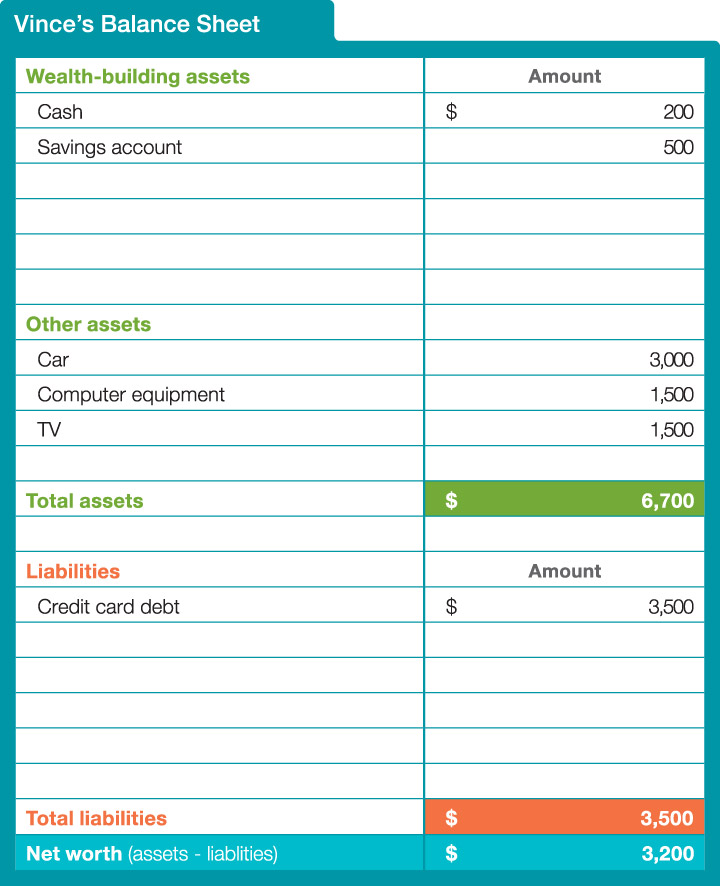

Use this formula: assets (what you own) minus liabilities (what you owe) equals net worth (your wealth).

ASSETS – LIABILITIES = NET WORTH

ASSETS – LIABILITIES = NET WORTH

A wealth-creating asset is anything an individual or business owns that has commercial or exchange value. Personal assets may include

- a savings account,

- a retirement plan,

- stocks and bonds or

- a house.

Some possessions (like your car, household furnishings and clothes) are assets, but they aren’t wealth-creating assets because they don’t earn money or rise in value. A new car drops in value the second it’s driven off the lot. Your car is a tool that takes you to work, but it’s not a wealth-creating asset.

Liabilities are your debts — what you owe. This may be

- your home mortgage,

- your credit balances,

- a car loan,

- student loans or

- medical bills.

Net worth is the difference between your assets (what you own) and your liabilities (what you owe). Your net worth is your wealth.

Home Equity

The market value of a home is an asset; the mortgage is a liability. Let’s say your house is worth $120,000, but your mortgage is $80,000. That means your equity in the home is $40,000. Equity contributes to your net worth.