Your Credit History Is Important

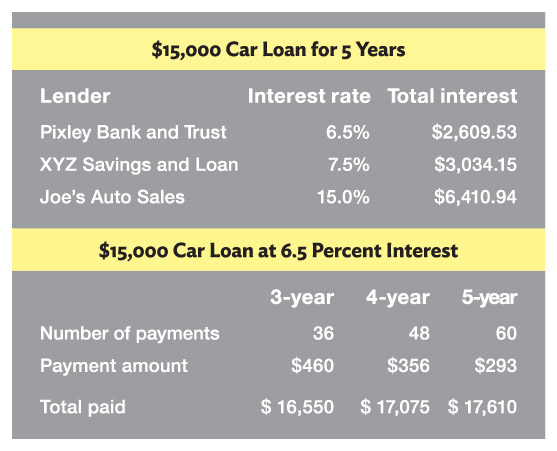

It’s difficult to pay cash for your car, home and college education, so these are typically bought using credit. That is why it’s important to have a plan to build and maintain a good credit history. Good credit saves money; bad credit costs money. Think of credit as a tool to be used wisely. Employers, landlords and insurance companies may use credit history to determine whether you are a good risk. A good credit history will result in getting the lowest interest rates for loans and other services, which will put you in a better position to increase your savings and increase your wealth.

Remember the definition of net worth (wealth)?

ASSETS – LIABILITIES = NET WORTH

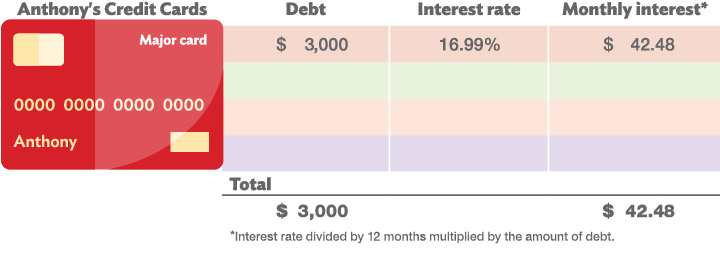

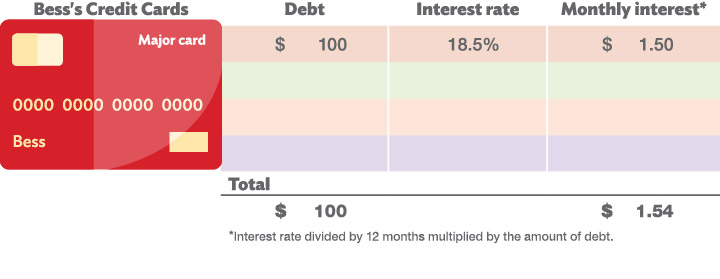

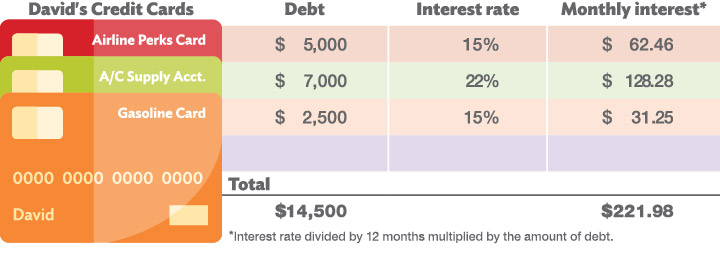

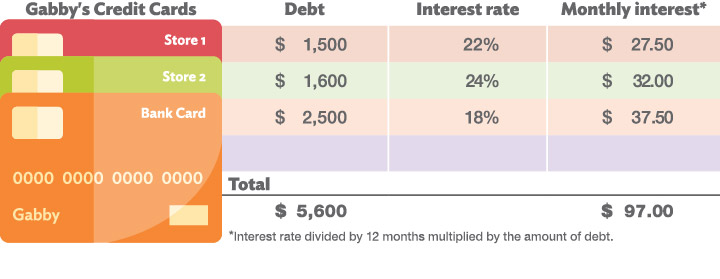

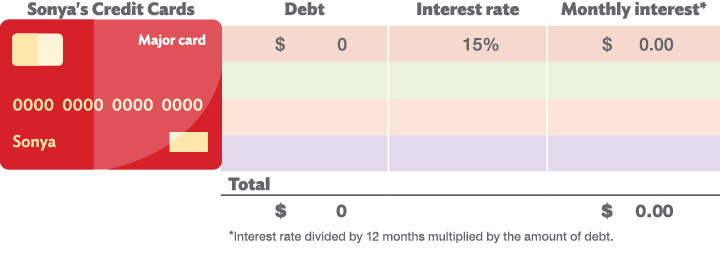

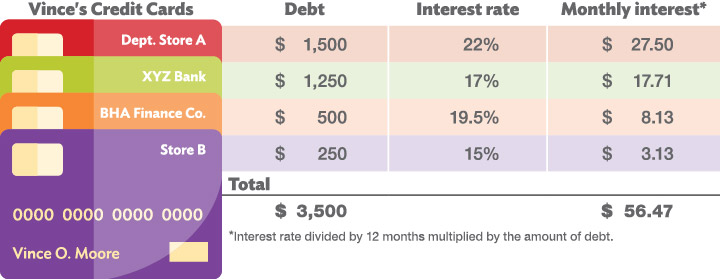

Liabilities are debts. Debt reduces net worth. Plus, the interest you pay on debt, including credit card debt, is money that cannot be saved or invested—it’s just gone.

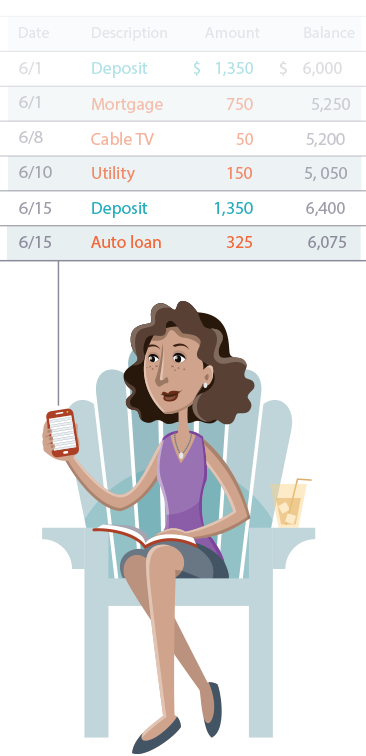

If credit is not used wisely, debt can easily get out of hand and may result in late payments. The most important part of your credit history is your track record of paying your bills on time.