Don’t look to oil companies to lower high retail gasoline prices

The rise of U.S. retail gasoline prices in March 2022 has triggered a debate about whether U.S. oil companies are doing enough to rein in high gasoline prices and whether these companies should be held accountable for not increasing the production of crude oil.

We take a closer look at the premises underlying this debate. We show that, even though the price of oil makes up over half of the retail price of gasoline, oil companies play an extremely limited role in how retail gasoline prices are set.

While U.S. retail gasoline prices in many regions have remained stubbornly high since March, this situation reflects frictions in the retail gasoline market rather than the supply of oil or the price of oil.

We discuss why, in many regions, pump prices have not fallen as quickly as oil prices have recently and explain why this asymmetry need not be an indication of price gouging.

Finally, we examine the obstacles to substantially increasing U.S. oil production. We make the case that even under the most favorable circumstances, higher production growth is unlikely to materially lower global oil prices—and, thus, U.S. retail gasoline prices—in the foreseeable future.

Gasoline retailing involves a complex supply chain

Before a gallon of gasoline is pumped into a car’s tank, it has traveled through a complex supply chain.

Independent oil and gas companies—those without refining assets—are responsible for 83 percent of U.S. oil production and about half of the oil consumed in this country. Oil is sold in competitive markets at prices reflecting global supply and demand. It is refined into gasoline, diesel and other fuels whose prices are similarly set in competitive markets.

Fuels are then sent to more than 400 U.S. distribution facilities, from which they are sold and delivered to retailers and end users at another price depending on local conditions. Gas station operators set retail prices based on their expected acquisition cost for the next delivery of fuel from the local distributor, federal and state tax rates, and a markup that covers operating expenses, such as rent, delivery charges and credit card fees.

Since only 1 percent of service stations in the U.S. are owned by companies that also produce oil, U.S. oil producers are in no position to control retail gasoline prices.

How the cost of oil feeds into the gasoline price

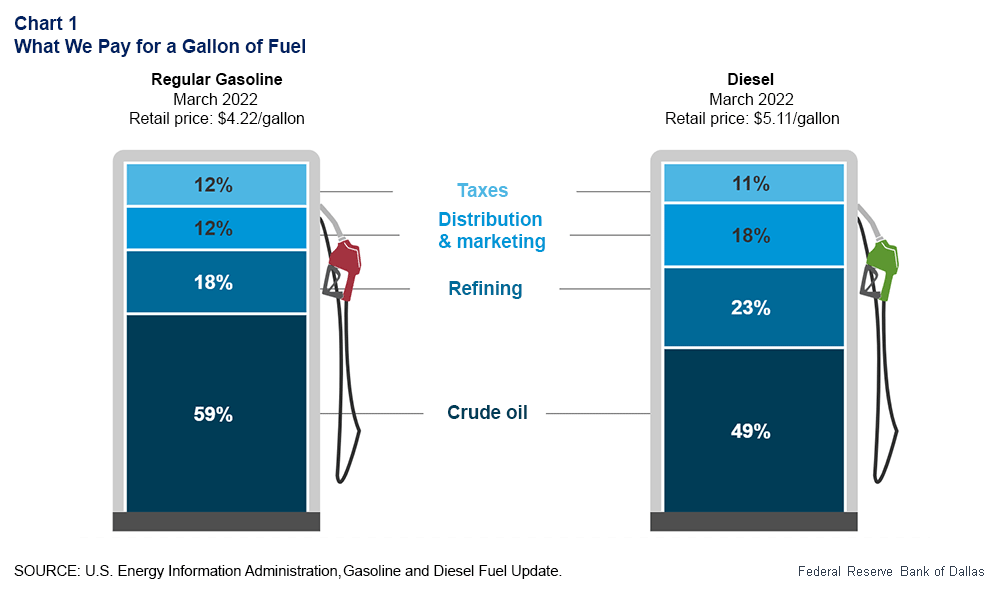

The price of oil constituted 59 percent of the retail price of gasoline in March 2022, according to the Energy Information Administration (Chart 1).

This fact is important for understanding the transmission of oil price shocks to retail gasoline prices.

Gasoline’s slow decline from price peak not a sign of price gouging

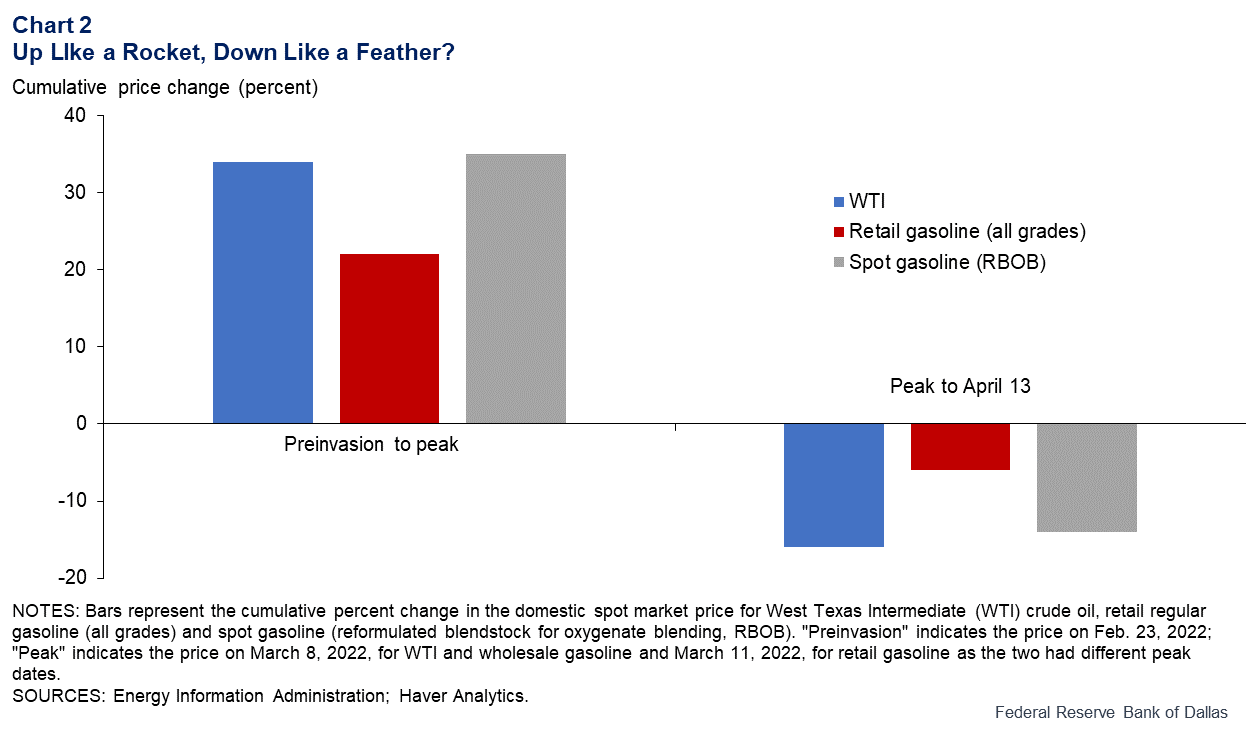

Much has been made of the fact that gasoline prices were quick to increase following the Russian invasion of Ukraine but have not come down as quickly as the price of crude oil since then (Chart 2).

Given that crude oil accounts for 59 percent of the cost of gasoline, a 34 percent increase in the price of oil should imply a 20 percent increase in the retail gas price. Likewise, a 22 percent decline in the price of oil should translate to a 13 percent decline in the pump price. However, that did not happen at the national level.

As Chart 2 shows, the spot price of gasoline (the price of gasoline at the refinery gate), as proxied by the prompt contract for New York Mercantile Exchange RBOB gasoline, generally rose and fell with the price of West Texas Intermediate crude oil. However, the response of U.S. pump prices has been highly asymmetric. While the price of retail gasoline cumulatively rose about as much as expected following Russia’s invasion of Ukraine, recent national retail gasoline prices dropped only 6 percent from the March peak, far less than the expected 13 percent.

This indicates that retail gasoline prices remaining persistently high was not the result of an oil shortage or high oil prices. Rather, the elevated retail gasoline prices must be attributed to events in the U.S. retail gasoline market beyond the control of oil producers.

Moreover, the asymmetry of the response of retail gasoline prices need not be evidence of price gouging. One potential explanation is that station operators are recapturing margins lost during the upswing, when gas stations were initially slow to increase pump prices. The reluctance to lower retail prices also likely reflects concerns that oil prices—and, hence, wholesale gasoline prices—may quickly rebound, eating into station profit margins.

Another possible reason for this asymmetry is consumers’ tendency to more intensively search for lower pump prices as gasoline prices rise than when they decline. This diminished search effort provides further pricing power to gas stations, causing prices to fall more slowly than they rose. This has prompted researchers to liken the response of gasoline prices to higher oil prices to a rocket—and the response to lower oil prices to a feather.Yet another potential explanation for this asymmetry is that seasonal demand tends to increase as the weather warms, supporting higher retail prices.

Prices don’t uniformly change across the country

Interestingly, retail gasoline price responses have not been uniform across the country. In Dallas, for instance, retail prices fell at a pace that indicated a symmetric price adjustment. In contrast, prices in Phoenix are virtually the same as they were when the national retail average price peaked on March 10 (Table 1).

Table 1: Retail Price Changes Can Vary Across Regions

| City | Feb. 23 | March 10 (peak) | Percent change | April 10 | Percent change (from peak) |

| Dallas | $3.26 | $4.08 | 25.15 | $3.60 | -11.76 |

| Phoenix | $3.78 | $4.63 | 22.49 | $4.64 | 0.22 |

| SOURCE: Gas Buddy. | Federal Reserve Bank of Dallas | ||||

In the case of Phoenix, which is served by Southern California oil refineries, an unexpected refinery outage in early March prompted higher regional wholesale fuel prices just as prices elsewhere in the country started to fall.

This suggests that price-reduction policies that treat all regions of the country the same are unlikely to be effective at curing the root causes of the asymmetry in the aggregate retail price response.

Oil producers face difficulties increasing production

Consumers and policymakers often ask what domestic oil producers can do to raise output and lower gasoline prices, especially since producers’ profitability has greatly improved in 2022. Because the price of crude oil is determined in global markets, increases in domestic oil production affect the retail price of gasoline only to the extent that they lower global oil prices.

Many observers point out that oil companies currently hold nearly 9,000 permits to drill on federal lands. But holding 9,000 permits does not equate to 9,000 well locations that are worth drilling, nor would it be possible to churn through that much inventory in a reasonable time frame.

Data provider Enersection found that since 2015, an average of 1,560 wells have been drilled on federal lands annually, but only 47 percent of federal permits issued were actually utilized. This is because companies tend to acquire permits on the acreage they lease even if they are not certain whether the location is worth developing.

The latest Dallas Fed Energy Survey shows that investor pressure to maintain capital discipline—which precludes higher investment in expanding oil production—is the primary restraint on publicly traded companies. This is not simply a case of investors being selfish, but of investors who suffered persistent losses in years past wanting compensation for the risk they take. Depriving these investors of the returns they insist on, by whatever means, would likely be counterproductive because without these investors, the industry would lack the capital to maintain—never mind, increase—crude production going forward.

Additionally, producers and service companies are constrained by labor shortages, rising input costs and supply-chain bottlenecks for vital equipment such as well casing and coiled tubing. An industry that lacks experienced staff and materials cannot on short notice substantially increase drilling and production.

Complicating matters, many shale producers are running low on top-quality drilling locations. Thus, it would be unreasonable to expect a noticeable increase in oil production before 2023 at the earliest, even if investors were to agree to higher production targets.

Higher U.S. oil production might not lower retail gasoline prices

Apart from the difficulties of expanding domestic oil production, what are the odds of higher U.S. oil production growth materially lowering the prices of crude oil and gasoline?

Even under the most optimistic view, U.S. production increases would likely add only a few hundred thousand barrels per day above current forecasts. This amounts to a proverbial drop in the bucket in the 100-million-barrel-per-day global oil market, especially relative to a looming reduction in Russian oil exports due to war-related sanctions that could easily reach 3 million barrels per day.

Placing the responsibility to lower retail gasoline prices on shale oil producers is thus unlikely to work, and additional regulation of oil producers is unlikely to lower pump prices.