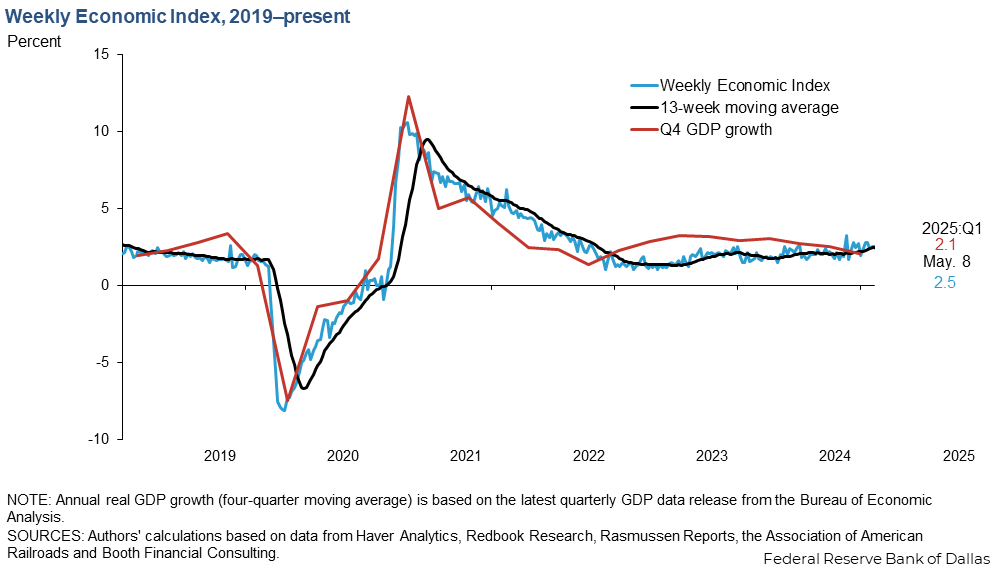

Weekly Economic Index

The Weekly Economic Index (WEI) provides a signal of the state of the U.S. economy based on data available at a daily or weekly frequency. It represents the common component of 10 different daily and weekly series covering consumer behavior, the labor market and production. It is updated Thursday at or shortly after 10:30 a.m. CT, using data available up to 8 a.m. CT.

Feb. 19, 2026: Update

- The WEI is currently 2.58 percent, scaled to four-quarter GDP growth, for the week ended Feb. 14 and 2.43 percent for Feb. 7. The 13-week moving average is 2.31 percent. This is compared with 2.33 percent four-quarter GDP growth through third quarter 2025. Electricity output and fuel sales were not released this week due to the Washington’s Birthday holiday.

WEI Authors

The WEI was developed by Daniel J. Lewis, a former economist at the Federal Reserve Bank of New York; Karel Mertens, senior vice president and director of research at the Federal Reserve Bank of Dallas; and James H. Stock, professor of economics at Harvard University.

Contact Information

For any data-related questions, please contact:

Tyler Atkinson: tyler.atkinson@dal.frb.org

Isaiah Spellman: isaiah.spellman@dal.frb.org