Austin Economic Indicators

November 2, 2023

| Austin economy dashboard (September 2023) | |||

| Job growth (annualized) June –Sept. '23 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

| 3.4% | 3.4% | $33.71 | 1.7% |

In September, Austin’s employment sector expanded significantly, accompanied by a decline in the unemployment rate and slower wage growth. In addition, office vacancies increased, and home prices rose.

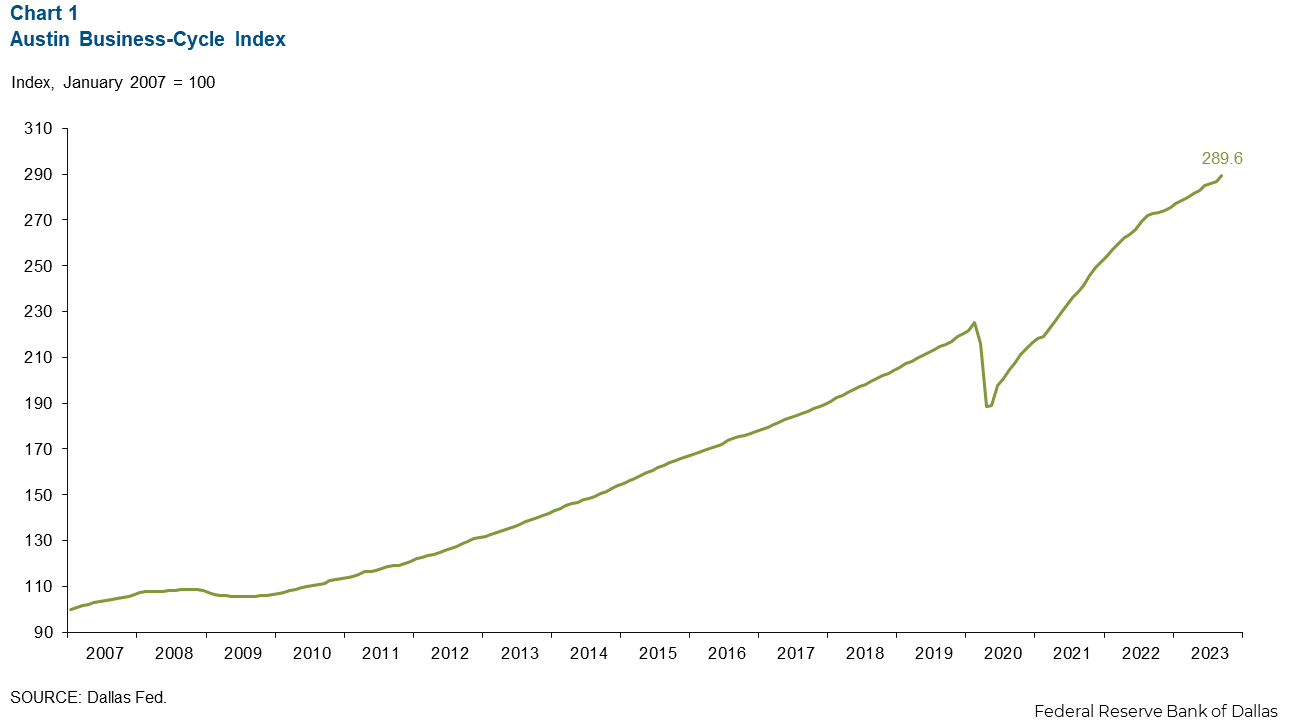

Business-cycle index

The Austin Business-Cycle Index, a broad measure of economic activity, grew an annualized 12.2 percent in September, much slower than the 3.8 percent gain in August (Chart 1).

Labor market

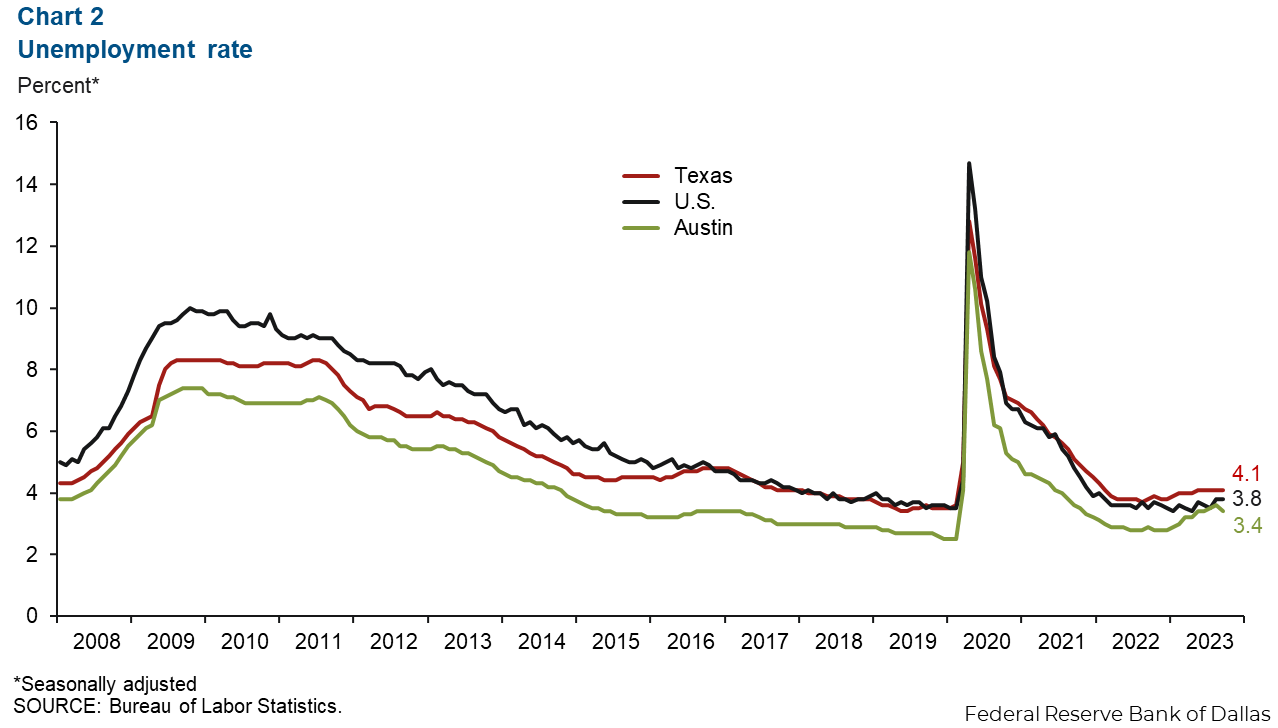

Unemployment rate declines

Austin’s unemployment rate dipped to 3.4 percent in Austin, remaining below the state rate of 4.1 percent and the national rate of 3.8 percent (Chart 2). In September, the local labor force increased an annualized 2.9 percent.

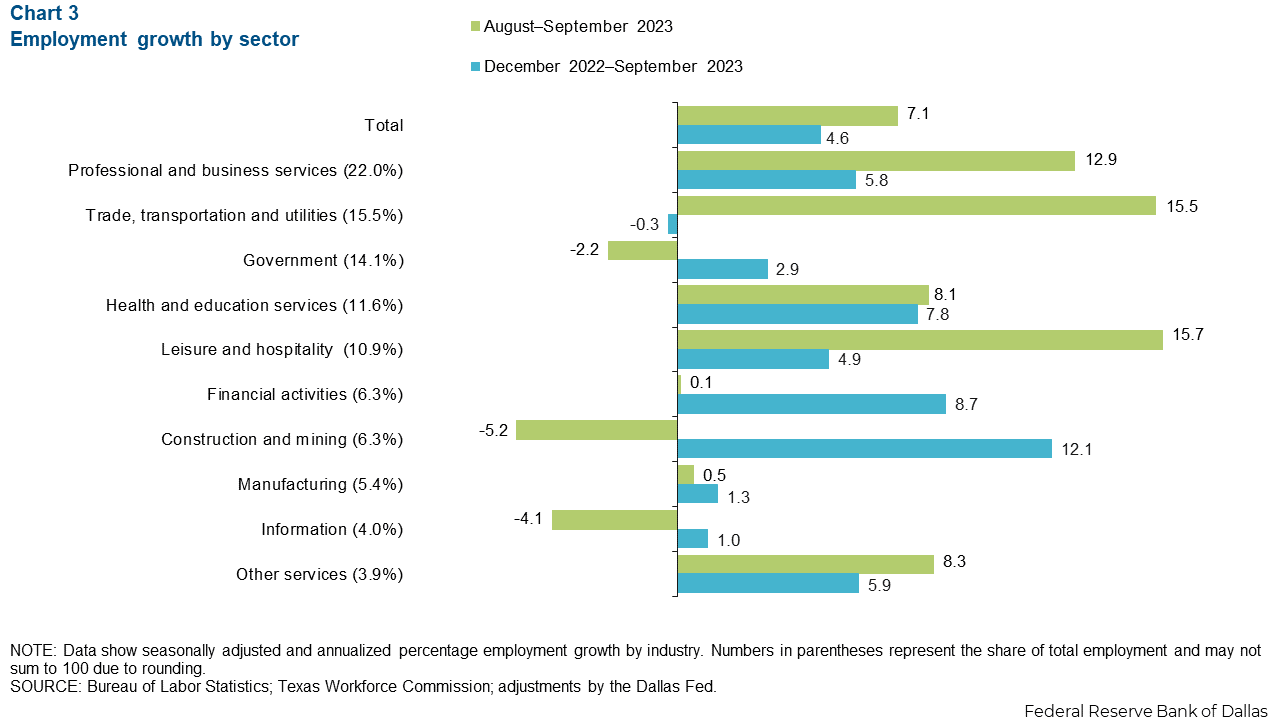

Employment sees record growth

Austin employment increased 7.1 percent in September, much greater than August’s growth of 1.8 percent (Chart 3). Sectors with the most growth included leisure and hospitality (15.7 percent, or 1,769 jobs), trade, transportation and utilities (15.5 percent, or 2,480 jobs), and professional and business services (12.9 percent, or 2,960 jobs). Three sectors saw declines: construction and mining (5.2 percent, or 379 jobs), information (4.1 percent, or 185 jobs) and government (2.2 percent, or 357 jobs). Year to date, Austin’s payrolls expanded 4.6 percent, outpacing the state’s 3.6 percent growth and the nation’s 2.0 percent gains.

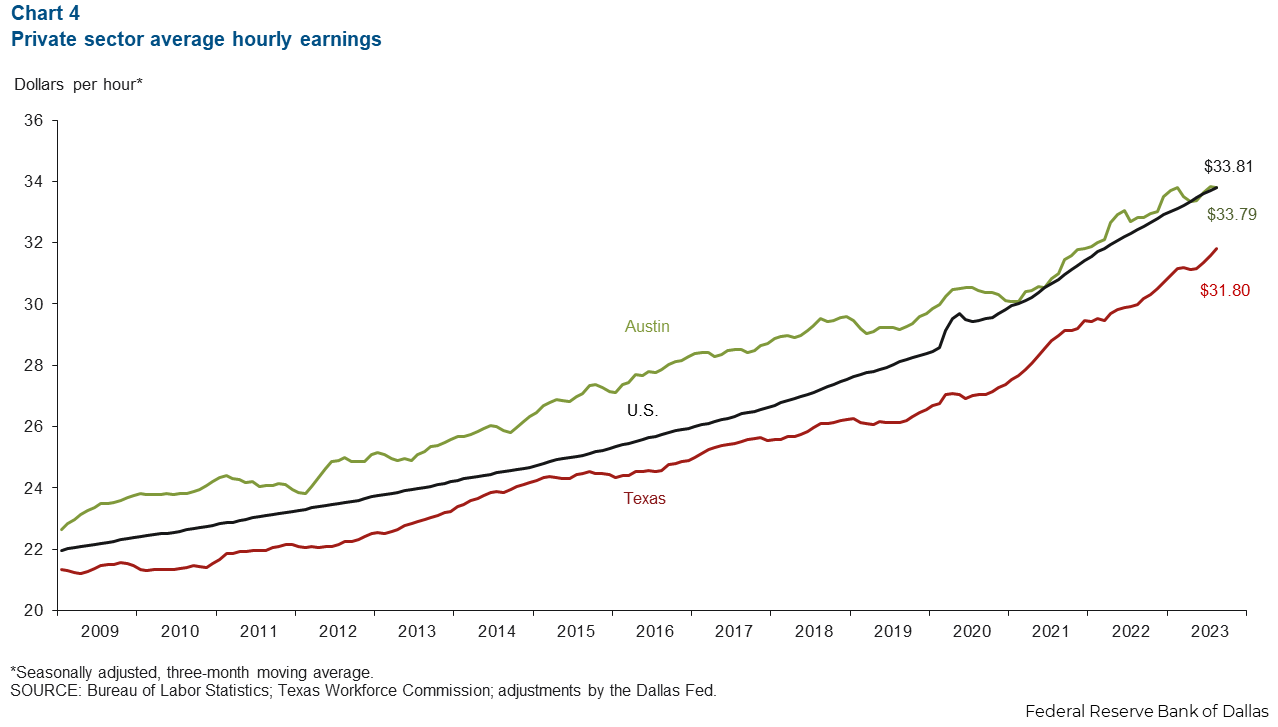

Austin wages dip below national average

Austin’s three-month moving average of wages declined an annualized 1.0 percent in September (Chart 4). The average hourly wage was $33.71 in August—below the nation’s average of $33.88 but above the state’s rate of $32.03. Year over year, Austin wage growth of 1.7 percent was slower than U.S. gains of 4.2 percent and Texas growth of 6.5 percent.

Office vacancies

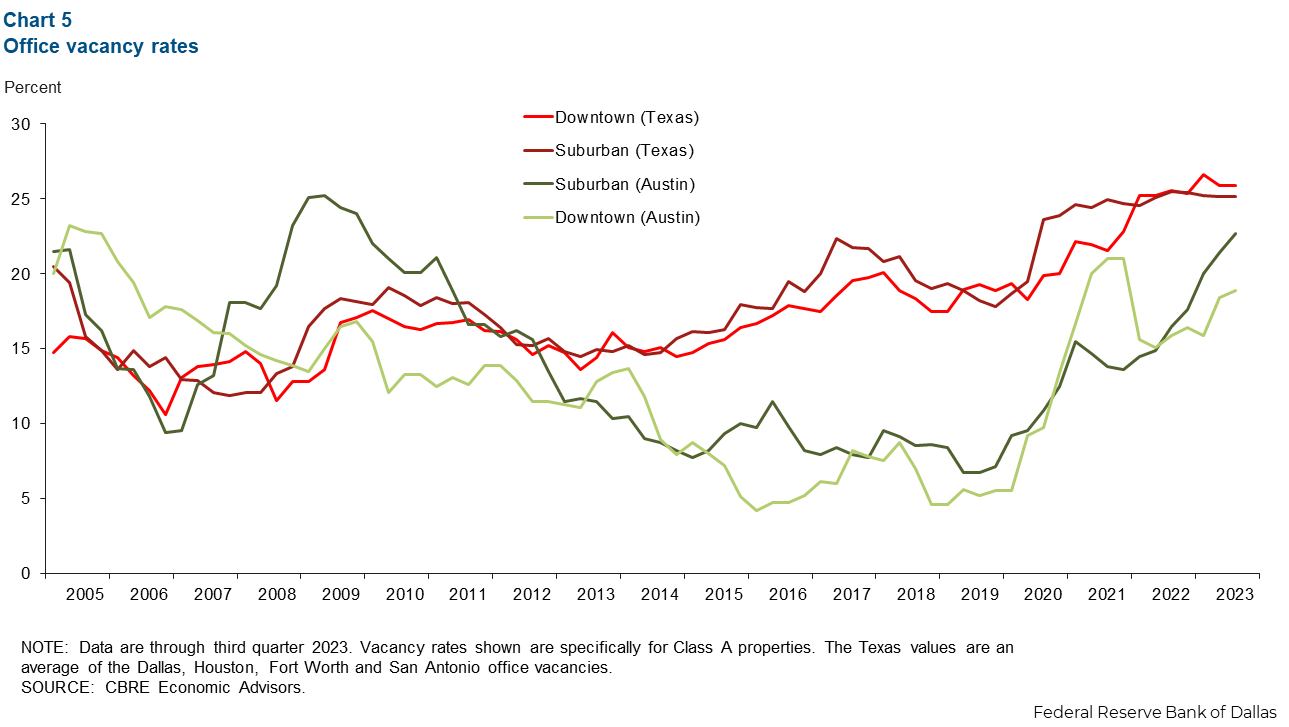

Office vacancies continue to rise

In the third quarter, Austin suburban office vacancies rose by 1.3 percent (Chart 5), while downtown vacancies increased by half of a percent. Suburban office vacancies have been steadily increasing since the beginning of 2021, but downtown vacancies have ticked back up in 2023 after declining last year.

The Austin office market registered lower vacancy rates than the average of the other Texas metros in the third quarter. The average vacancy rates of the other Texas metros (specifically Dallas, Houston, Fort Worth and San Antonio) were 25.2 percent for suburban offices and 25.9 percent for downtown locations. Texas office vacancies peaked in 2021 but steadied out over the course of 2022 and 2023.

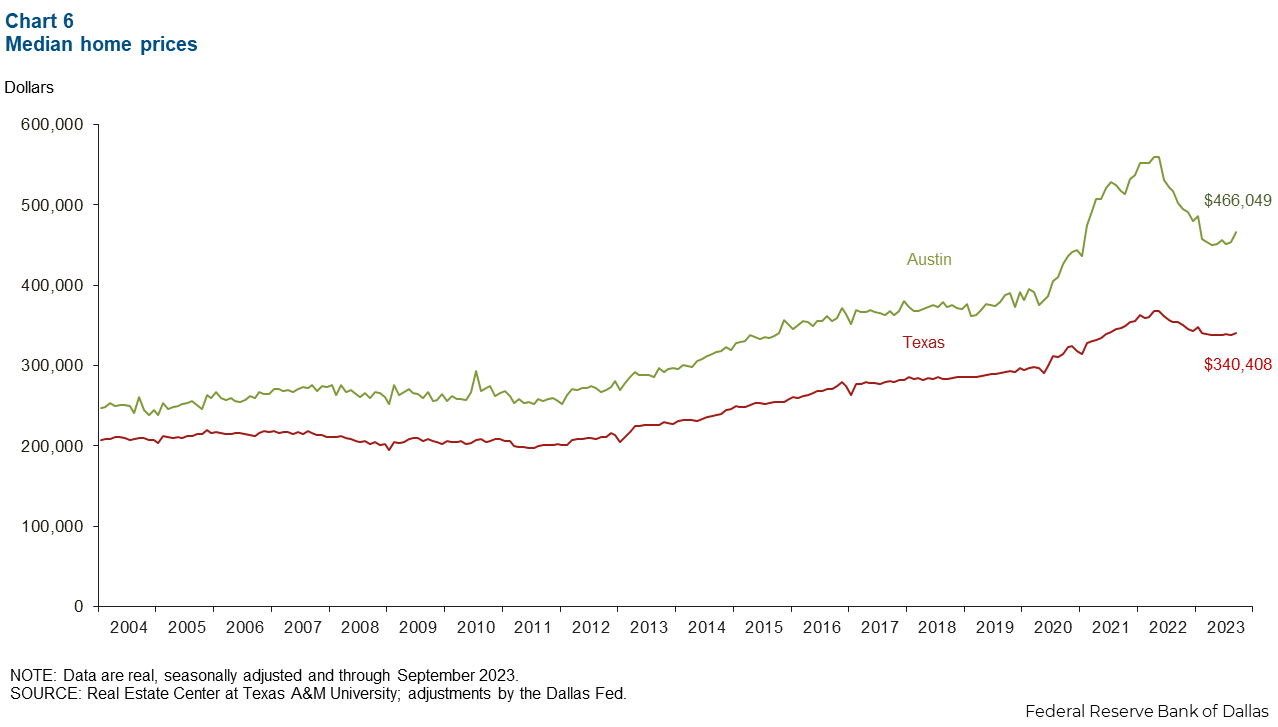

Home prices

Year over year Austin’s home prices declined 7.2 percent in September. Similarly, Texas home prices fell 3.8 percent in that same period. However, in the past month, both Austin and Texas have seen home prices increase 38.4 percent and 9.3 percent, respectively. In September, median home prices reached $466,049 in Austin and $340,408 in Texas (Chart 6).

NOTE: Data may not match previously published numbers due to revisions.

About Austin Economic Indicators

Questions or suggestions can be addressed to Vee Kalkunte at Prithvi.Kalkunte@dal.frb.org.

Austin Economic Indicators is released on the first Thursday of every month.