Southern New Mexico Economic Indicators

Fourth Quarter 2023

| Las Cruces economy dashboard, December 2023 | |||

| Job growth (annualized) Sept.–Dec. '23 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings y/y |

| 2.6% | 4.5% | $25.99 | -2.8% |

Las Cruces’ economy rebounded in fourth quarter 2023 after weakening in the third. Employment grew broadly, and the unemployment rate held steady. Hourly earnings declined in Las Cruces and New Mexico in 2023. Crude oil and natural gas production increased, and potash prices fell, while copper prices were stable.

Labor market

Payrolls expand

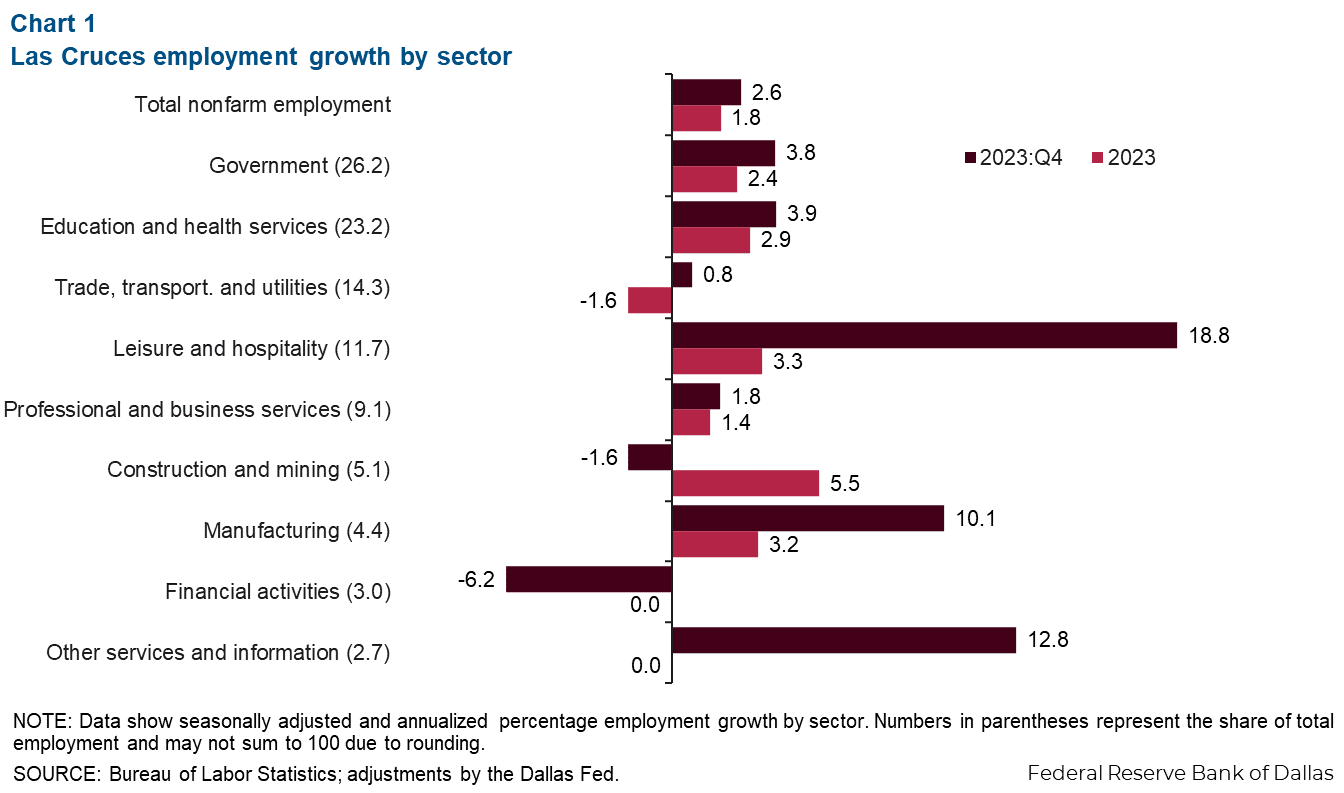

Las Cruces employment rose an annualized 2.6 percent (500 jobs) in the fourth quarter (Chart 1). Employment gains were broad based across sectors, with the fastest growth seen in leisure and hospitality (388), other services and information (64), and manufacturing (83). Payrolls contracted in financial activities and construction and mining.

In 2023, Las Cruces’ employment growth was a more moderate 1.8 percent (1,400 jobs) due to job losses in the third quarter. Employment gains last year were driven by education and health services (514), government (487), leisure and hospitality (297) and construction and mining (207). Meanwhile the trade, transportation and utilities sector shed 187 jobs, reflecting a 1.6 percent decline. Payroll employment expanded 2.4 percent in New Mexico and grew 2.0 percent in the U.S. in 2023.

Unemployment holding steady

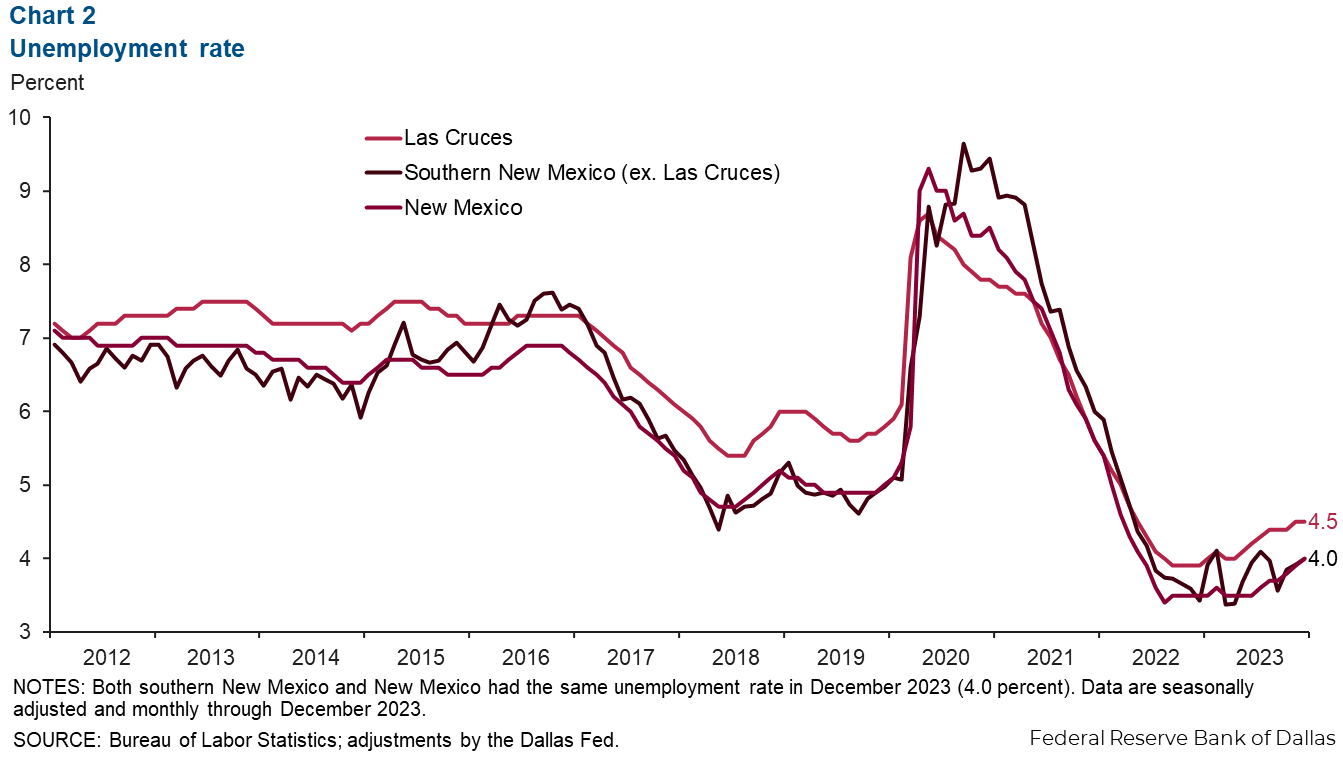

Las Cruces’ unemployment rate was little changed in the fourth quarter, ending the year at 4.5 percent (Chart 2). Unemployment in New Mexico and southern New Mexico (excluding Las Cruces) rose to 4.0 percent in the fourth quarter, while the U.S. ended 2023 with a 3.7 percent jobless rate. Last year, unemployment rose 0.6 percentage points in Las Cruces and southern New Mexico, higher than the U.S.’ 0.2-percentage-point increase.

Earnings

Las Cruces’ average hourly earnings continued to trail the U.S. average at the end of 2023 (Chart 3). In the fourth quarter, hourly earnings declined in Las Cruces. Average hourly earnings in Las Cruces were $25.99 in December, below New Mexico’s $27.16 and the nation’s $34.36. In 2023, hourly earnings fell 2.8 percent in Las Cruces and 2.1 percent in New Mexico, while they rose 4.3 percent nationally.

Commodity markets

Oil production increases

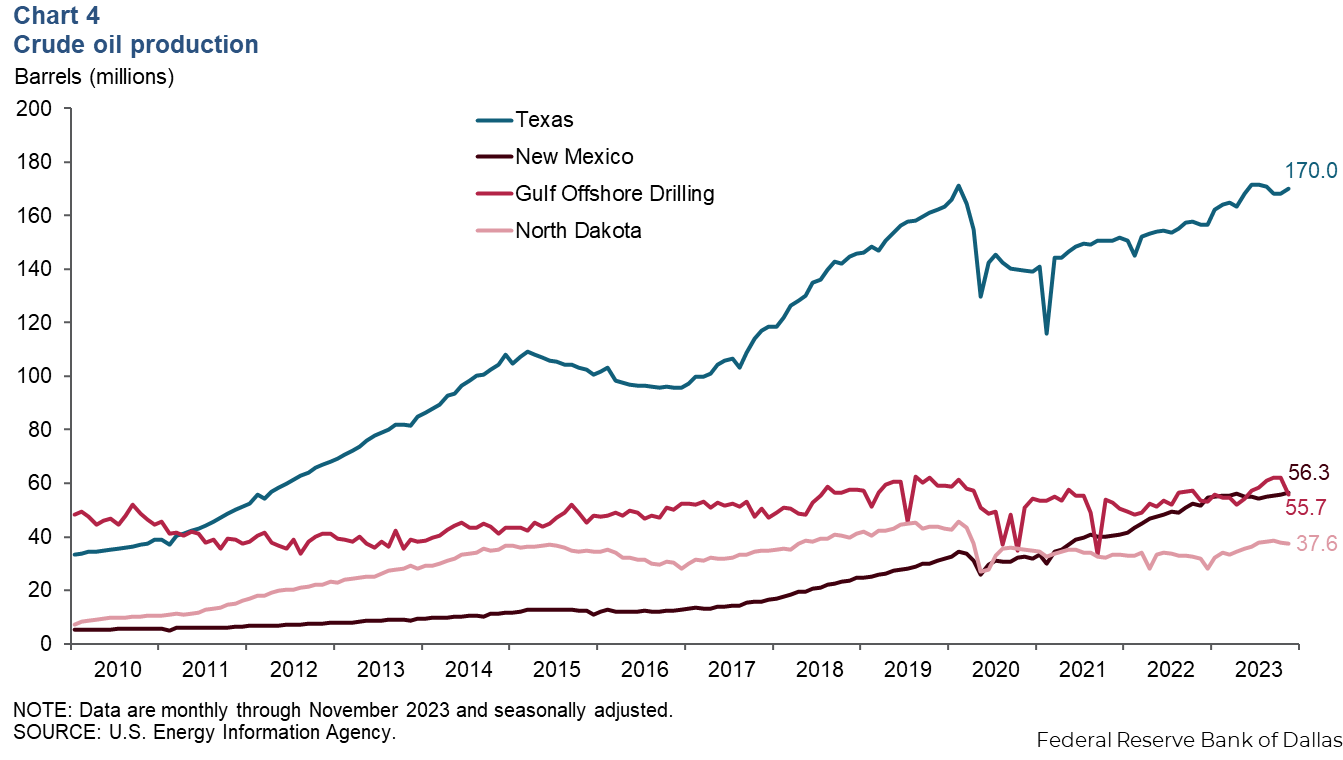

New Mexico is a major energy-producing state, with much of the production occurring in the southeast part of the state. In November 2023, crude oil production in New Mexico reached 56.3 million barrels, eclipsing offshore drilling in the Gulf of Mexico (Chart 4). Year over year in November, crude oil production in New Mexico was up 9.5 percent.

Natural gas production rises

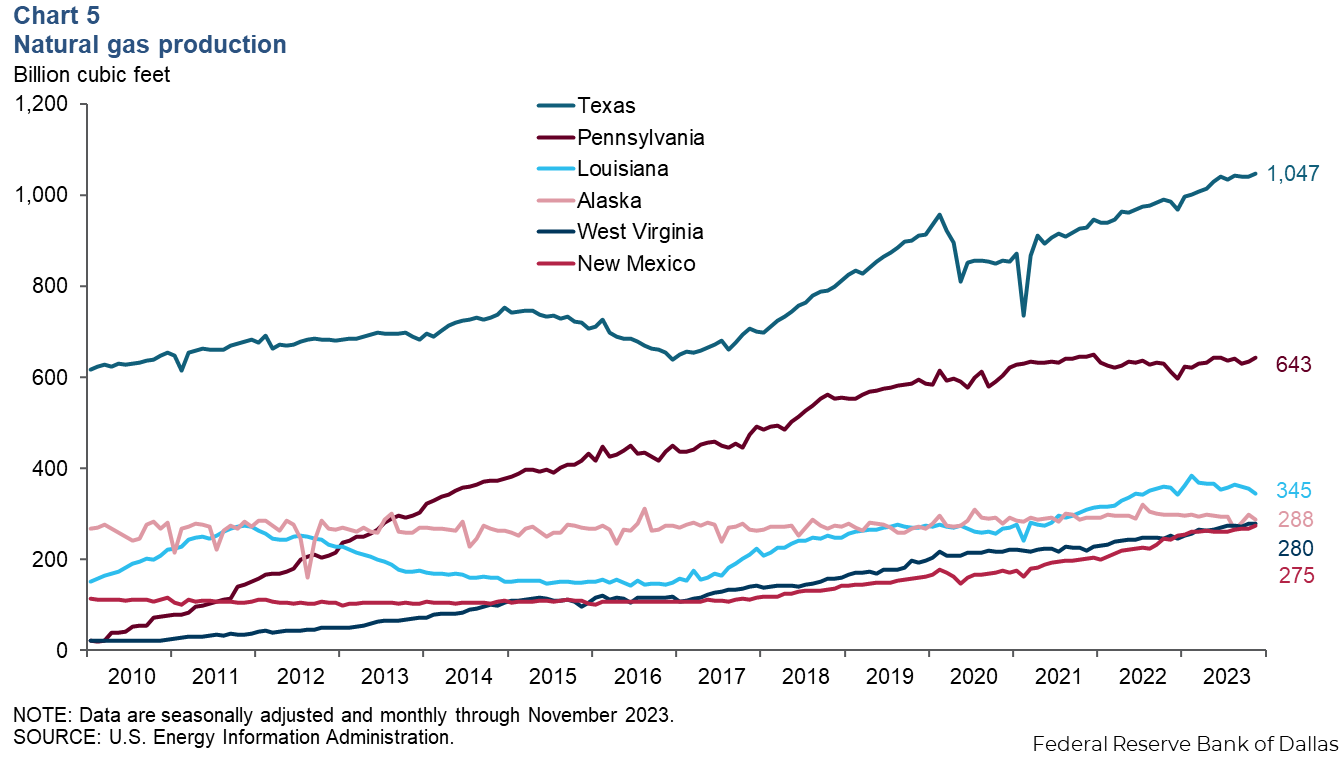

New Mexico’s production of natural gas has also been increasing steadily. The state was sixth in natural gas production in November 2023 and appears to be on track to surpass fifth-ranked West Virginia. Since November 2022, natural gas production in New Mexico has risen 12.8 percent to 275 billion cubic feet (Chart 5).

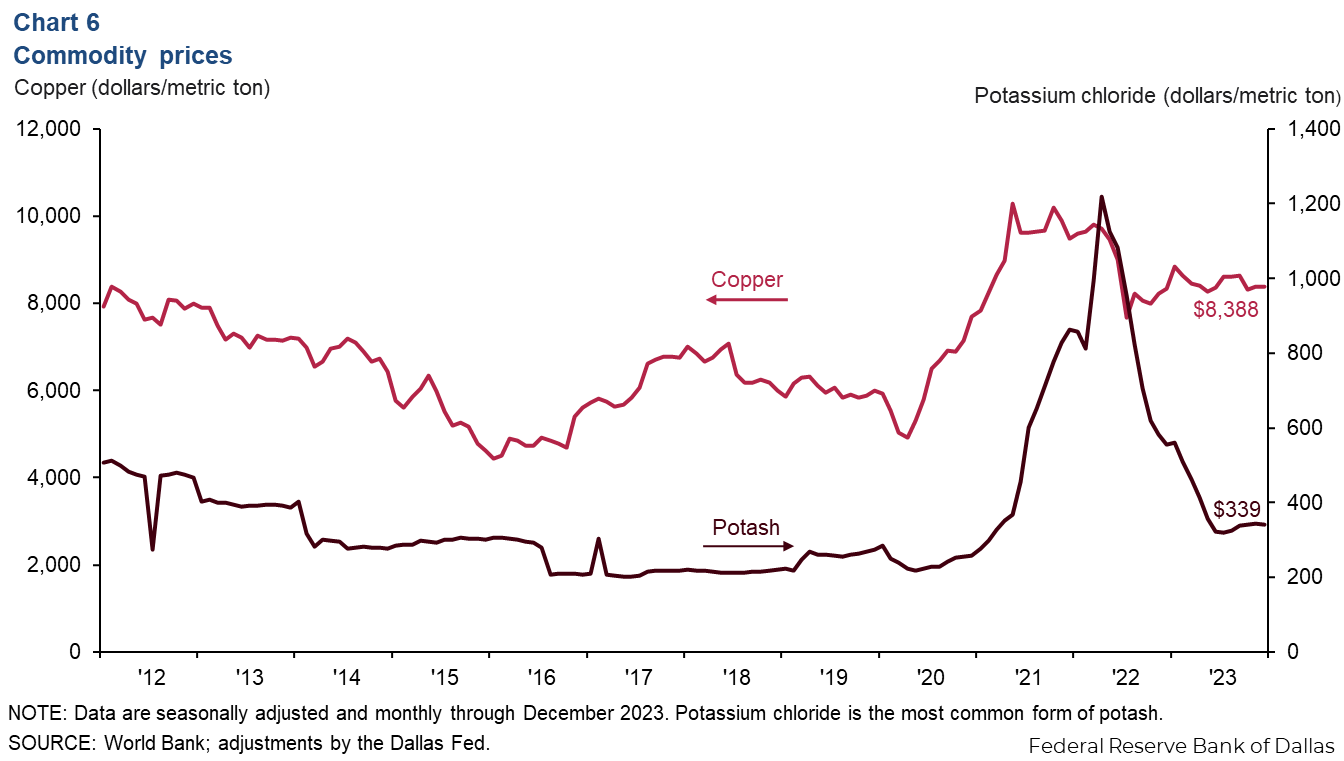

Potash prices plateau, while copper prices tick up

In addition to oil and natural gas, southern New Mexico’s economy is dependent on commodities such as potash, copper and silver. Potassium chloride is the most common form of potash. The price of potash, which is used in fertilizer, increased dramatically after Russia, a major producer, was hit with sanctions after it invaded Ukraine in early 2022. Potash prices peaked in April 2022 and have declined significantly since then. In 2023, potash prices fell 38.9 percent. In recent months, potash prices have plateaued and in December were $339 per metric ton. Meanwhile, copper prices rose slightly in December to $8,388 per metric ton. In 2023, copper prices were little changed, rising 0.6 percent (Chart 6).

NOTES: Data may not match previously published numbers due to revisions. All New Mexico counties within the Federal Reserve’s Eleventh District are counted as part of southern New Mexico. Las Cruces is excluded from southern New Mexico to better gauge unemployment levels outside the region’s largest population center.

About Southern New Mexico Economic Indicators

Questions or suggestions can be addressed to Robert Leigh at robert.leigh@dal.frb.org. Southern New Mexico Economic Indicators is released quarterly.