WARN layoff notices signal easing Texas labor market

Even with Texas employment growing rapidly and jobless rates remaining low in 2023, mass layoffs may be heading higher, according to notices of pending workforce reductions filed with state officials.

The federal Worker Adjustment and Retraining Notification (WARN) Act requires employers to inform state officials when they plan facility closures or mass layoffs. The notices can signal the shutdown of a job site of at least 50 workers, a layoff of a third of a location’s workforce involving fewer than 500 workers or outright dismissal of more than 500 employees.

Given these numerical guidelines, employers filing WARN notices are typically medium and large companies. Such advance notice can signal a rise in unemployment and can be a tool for predicting possible economic downturns. The current level of notices in Texas suggests the unemployment rate is poised to rise and employment growth may ease.

The WARN law seeks to provide workers with sufficient time to search for new jobs and for state authorities to initiate services such as job placement, retraining and information about unemployment insurance benefits. WARN notification generally occurs within 60 days of an action, but sometimes unfolds with less lead time in situations such as natural disasters, bankruptcy or pandemic.

The average time between a layoff notice and worker separation was 63 days in 2012–23. The 2020 pandemic year was an outlier, with state and local officials mandating business, school and government closures. The result was so massive and abrupt that firms dismissed employees and gave notice to state officials on average eight days after layoffs.

WARN notices can signal structural change

In some cases, WARN layoff notices reflect structural changes in an economy rather than cyclical ones. An example is an industry shrinking due to technological change.

Paper and typewriter manufacturers shutting down in the 1980s and 1990s due to development of the personal computer illustrates such a change. Consumers replaced typewriters with a new technology that allowed greater productivity and electronic data and document storage, while at the same time curtailing demand for paper.

Trade can also cause a structural change when an industry is uncompetitive with the rest of the world. U.S. textile manufacturing plants shutting down is an example of structural change in the 1980s and 1990s. As labor was relatively more expensive in the U.S. and trade policy changes allowed access to imports from developing countries, plant closings and mass layoffs occurred.

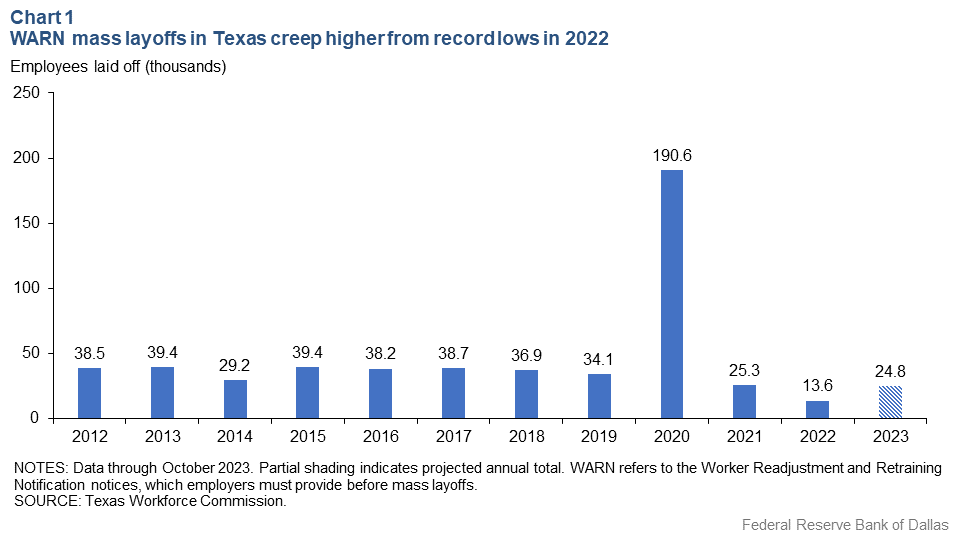

WARN notices reach record lows after pandemic

WARN layoffs in Texas averaged 36,801 annually in 2012–19. The number of notices jumped sharply in 2020 to 190,643 because of the pandemic, and notices subsequently dropped below the historical average and reached record lows during the following two years (Chart 1).

Announced layoffs increased in 2023, though from very low levels in 2022. The number of layoff notices climbed 51.7 percent through the first 10 months, while actual separations—the subset of notices covering workers subsequently terminated—rose 32.2 percent relative to 2022.

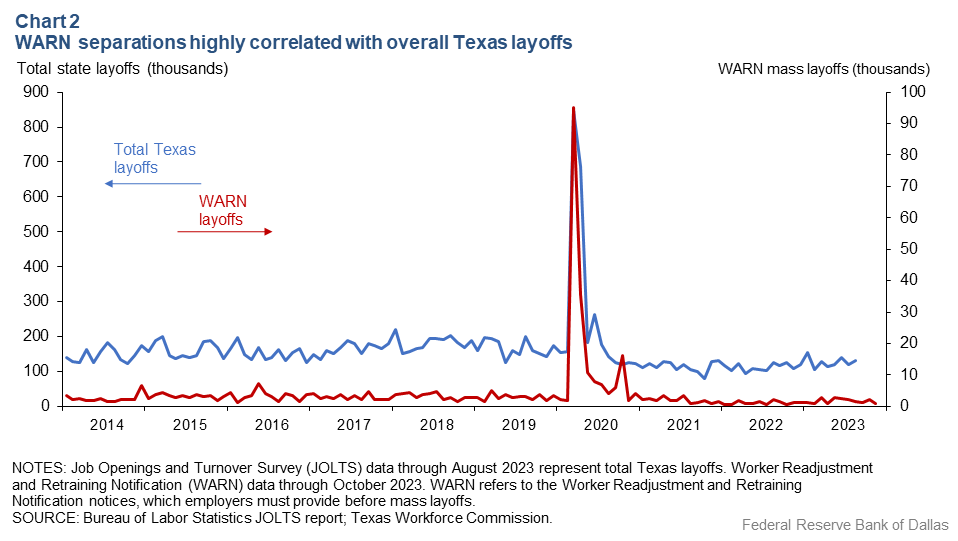

WARN mass layoffs are correlated with some broader measures of layoffs (Chart 2). For example, the Bureau of Labor Statistics Job Openings and Labor Turnover Survey (JOLTS) produces monthly data at the state level for “involuntary separations,” another term for layoffs.

In an average year, about 155,000 workers per month are laid off in Texas, according to JOLTS. WARN layoffs account for only 2.2 percent of the total Texas layoffs reported by JOLTS during 2012–23. (During the pandemic, WARN terminations reached a historical high of 11.7 percent of total dismissals in September 2020.) WARN layoffs are a small share of the total because the law only covers dismissals involving 50 people or more.

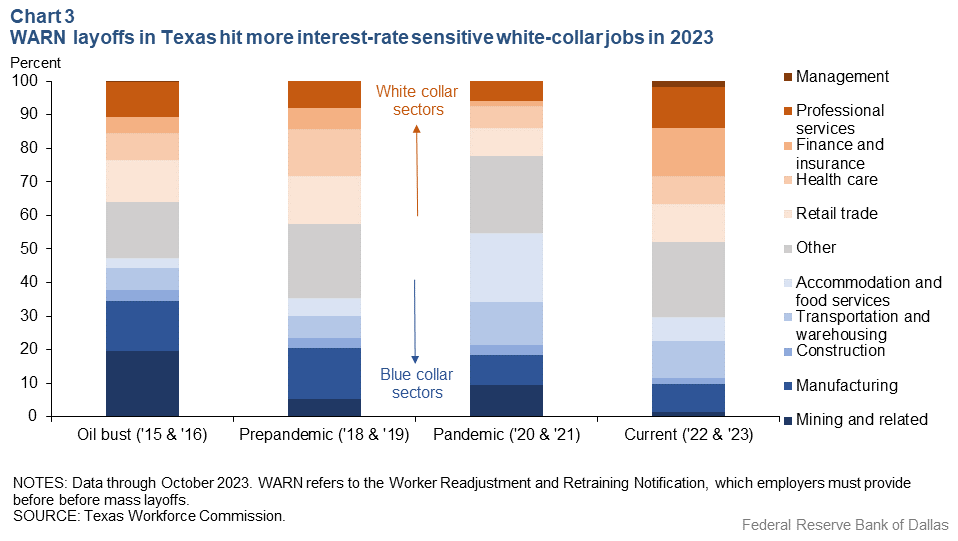

Rising job separations in interest-rate sensitive sectors

Mass layoffs tend to occur in industries experiencing adverse economic conditions or structural change. For example, the oil bust in 2015 led to substantial layoffs in the oil and gas industry. Similarly, the pandemic prompted a spike in mass dismissals in accommodation and food services, a sector primarily composed of hotels and restaurants (Chart 3).

Through the first 10 months of 2023, professional, scientific and technical services; retail trade; finance and insurance; and health care industries announced the most mass layoffs. These are sectors that greatly expanded payrolls during the pandemic.

Many of these sectors are also interest-rate sensitive and harmed by declining business investment and capital expenditures—manufacturing, high tech and financial services. Some also have a disproportionate concentration of white-collar workers with relatively high formal education who work in office environments that involve administrative or managerial duties, mainly high tech, finance and consulting.

White-collar workers are typically less exposed to the business cycle than blue-collar workers are, so it’s unusual to see mass layoffs concentrated in these occupational classifications. Notably, however, mass layoffs in 2023 remained at very low levels.

While interest rate sensitivity is a common factor among sectors experiencing layoffs during the current Federal Reserve rate-increasing cycle, which began in March 2022, there are other reasons. Labor shortages during the pandemic were most pronounced among blue-collar workers, so much so that some industries avoided laying off workers and, in some cases, hoarded employees, expecting to weather the economic downturn and avoid the cost of searching for qualified workers.

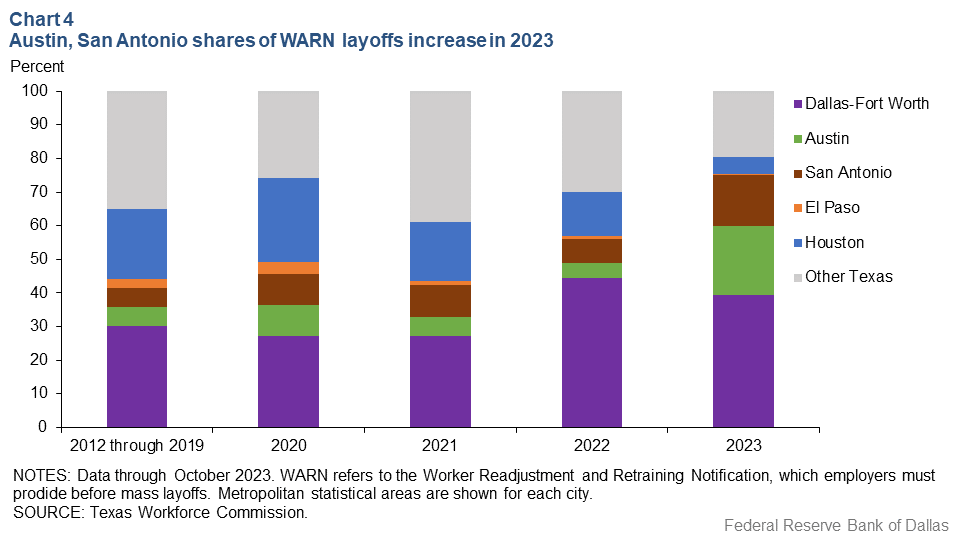

Austin experiences a greater number of mass dismissals

The top five metropolitan statistical areas (MSAs) in Texas typically account for around 65 percent of WARN layoffs in a year, with the two largest metros, Dallas–Fort Worth and Houston, with the most. However, through October 2023, there were 3,552 WARN layoffs in Austin, an unusually high level.

Austin accounted for 20 percent of the total number of WARN layoffs in the state during the first 10 months of 2023 despite making up just 9.6 percent of employment (Chart 4). By comparison,WARN layoffs in Austin accounted for only 5.7 percent of the total in 2012–19. The Austin increase is likely attributable to high-tech downsizing following a period of aggressive pandemic-era hiring, when global talent became available in the prevailing work-from-home environment.

San Antonio is the other MSA with an increasing share of WARN layoffs through October 2023, reaching a 13.9 percent share of the total from an average of 5.5 percent in the prepandemic period. In contrast, there have been relatively few WARN layoffs in 2023 in El Paso (representing 0.3 percent of the state total) and in Houston (2.2 percent of the state total). El Paso and Houston have a relatively small presence of high-tech services jobs.

Despite large concentrations of professional services and high-tech jobs, DFW hasn’t experienced an increase in mass layoffs this year. Economic activity has been strong, with substantial migration of firms and people. Since December 2019, the DFW labor force has expanded 10.9 percent, exceeding the state’s 7.8 percent growth rate.

Predictive power of WARN layoffs

Previous research has shown WARN notices on the national level may signal changes in unemployment and employment indicators, as well as data on new unemployment insurance claims.

Similarly in Texas, a significant rise in WARN layoffs indicates a rise in the unemployment rate and a fall in employment growth within two months.[1] This tendency is revealed in autoregressive statistical models on monthly, seasonally adjusted data that incorporate the rate of change to the unemployment rate and employment growth after a shock to WARN layoffs from January 2012 to July 2023.[2]

Specifically, the models find that a 1 percent WARN notice shock—a sharp increase in layoff notifications—is followed by a slight increase in the unemployment rate of around .005 percent after two months. The shock’s impact quickly wanes and disappears by the third month. The increase in the unemployment rate is consistent with the expectations that rising WARN notices typically precede broader unemployment increases.

A 1 percent bump in WARN notices also signals a slower job growth rate in the second month of around 0.01 percent, which dissipates rapidly in the third month. The decline in the change in establishment employment is consistent with employment growth’s negative correlation with rising layoffs.

Layoff notices suggest additional slowing

WARN layoff notices jumped 51.7 percent through October 2023 in Texas, while the unemployment rate rose from 3.9 to 4.1 percent. Employment growth slowed to 3.2 percent in the first 10 months relative to 4.3 percent in 2022.

WARN notices suggest the unemployment rate will rise to around 4.2 percent, while employment growth should remain below 2022 levels. Declining job openings, not rising unemployment, largely account for slowing labor markets this year. A rapidly growing workforce in a tight labor market, and not layoffs, is mostly responsible for the increase in state unemployment.

That said, slowing is expected in 2024 and small increases in the state unemployment rate would be consistent with these factors.

Notes

- We first use the "pre-whitening" statistical methodology. Texas WARN layoff notices lead to at least one-month changes in the unemployment rate and employment at the state level. Thus, if WARN layoffs increase during the current month, the unemployment rate should increase and employment should fall the following month. Because WARN notices began in 2012, they only captured one business cycle—one that is atypical due to the pandemic.

- All variables were tested for unit root stationarity and were found to be stationary at the first difference. VAR log criteria indicated three lags. Autocorrelation was not observed and the Lagrange Multiplier (LM) test for serial autocorrelation was rejected. Granger-Causality was found for the direction of WARN notices to the unemployment rate and employment. For the Cholesky ordering, WARN notices shocks are assumed to affect both the unemployment rate and employment. A dummy variable is used to control for the pandemic.