Mexico’s economy contracts at end of 2021

February 10, 2022

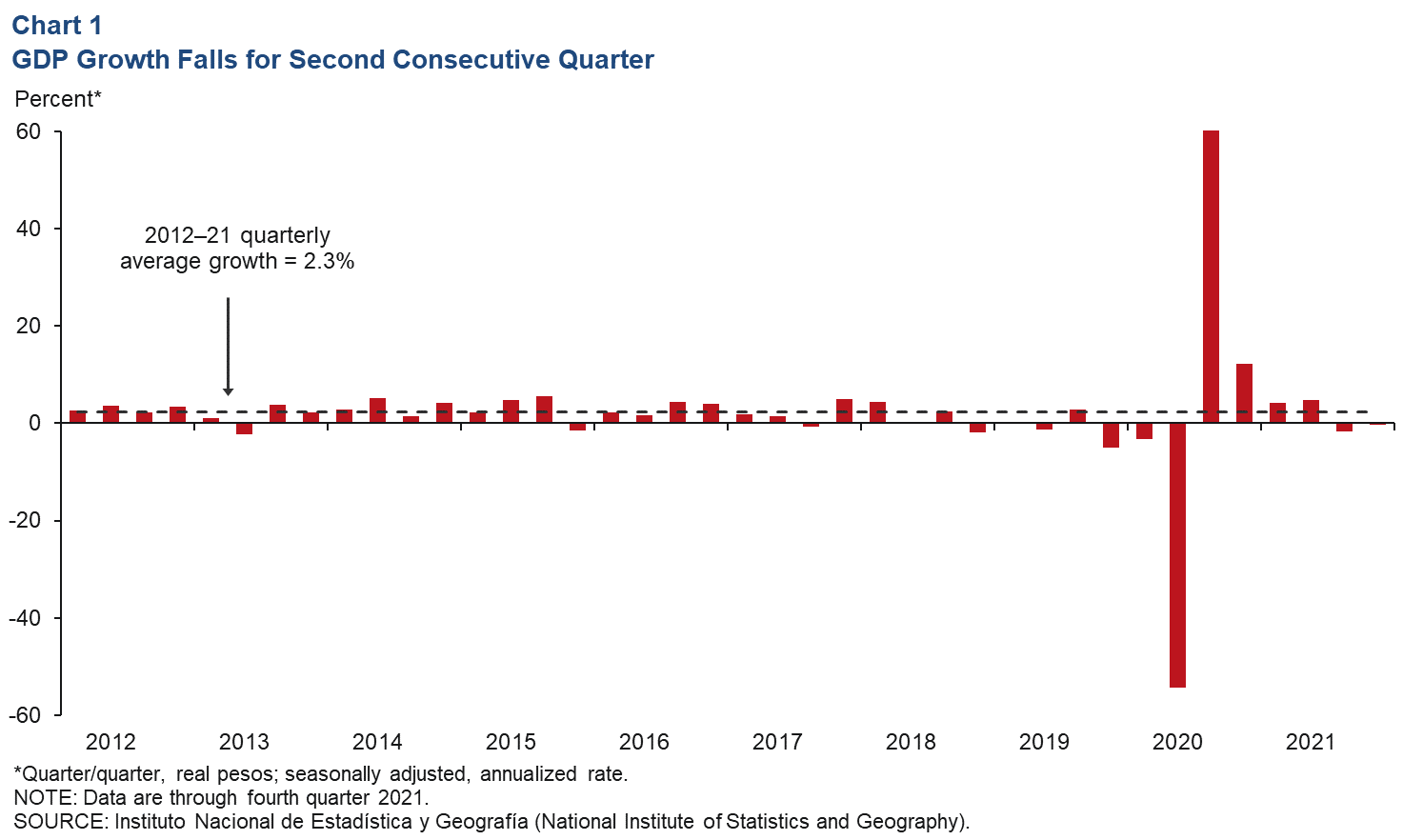

Mexico’s GDP contracted an annualized 0.4 percent in fourth quarter 2021 after falling 1.7 percent in the third quarter, resulting in a preliminary estimate of 1.6 percent for 2021 GDP growth (fourth quarter/fourth quarter). The consensus forecast for 2022 GDP growth, compiled by Banco de México, ticked up from 2.5 percent in December to 2.6 percent in January (fourth quarter/fourth quarter).[1]

The latest data available show that exports, retail sales and employment grew, while industrial production was largely unchanged. The peso recovered some in January, while inflation remained elevated, prompting the central bank to further raise the policy rate.

As in the rest of the world, new COVID-19 cases in Mexico rose strongly in recent months. In January, the number of new infections was more than double its previous peak in mid-August. New cases per day have started to decline in recent weeks but remain elevated. The vaccination rate has improved to encompass 60 percent of the population.

Output falls in fourth quarter

According to preliminary estimates, Mexico’s fourth-quarter GDP fell 0.4 percent, largely due to a contraction in service sector output, which represents 62 percent of the economy (Chart 1). The goods-producing sector (manufacturing, construction, utilities and mining) grew 0.4 percent, but output from service-related activities (wholesale and retail trade, transportation and business services) contracted 0.7 percent. Agriculture increased 0.3 percent in the fourth quarter.

Exports continue to improve

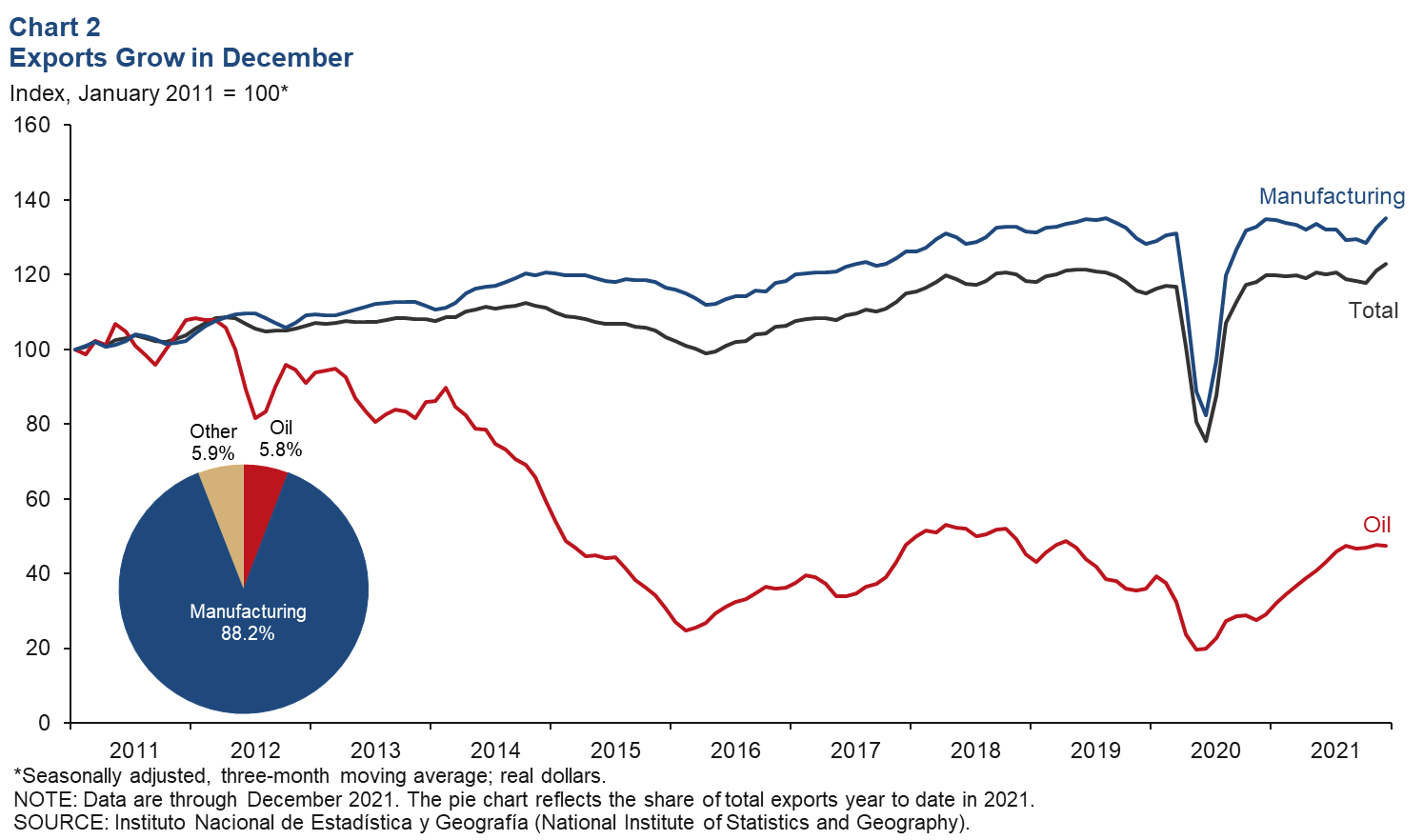

The three-month moving average of total exports grew 1.6 percent in December as oil exports fell 0.8 percent, but the dominant manufacturing category increased 1.9 percent (Chart 2). On a month-over-month basis, total exports contracted 0.6 percent in December; oil exports fell 8.5 percent, and manufacturing exports were flat. Mexico’s total monthly exports in December were 14.9 percent higher than prepandemic levels in February 2020.

Industrial production little changed

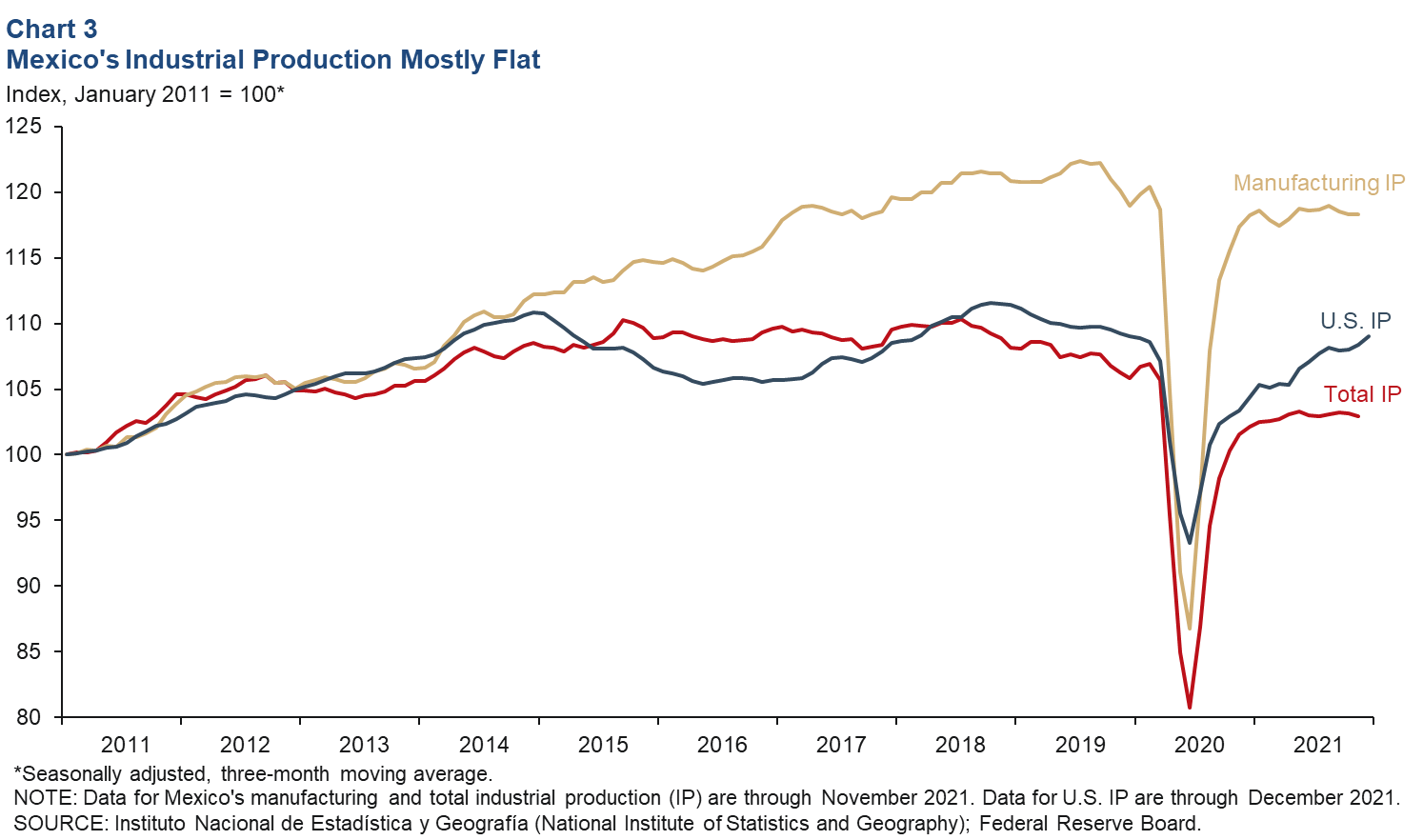

The three-month moving average of Mexico’s industrial production (IP) index—which includes manufacturing, construction, oil and gas extraction, and utilities—and manufacturing IP were relatively flat in November (Chart 3). On a month-over-month basis, IP was down 0.1 percent in November, while manufacturing IP was flat. North of the border, U.S. IP decreased 0.1 percent in December after increasing 0.7 percent in November. The three-month moving average of U.S. IP was up 0.6 percent in December. The correlation between IP in Mexico and the U.S. increased considerably with the rise of intra-industry trade between the two countries since the early 1990s.

Retail sales increase in November

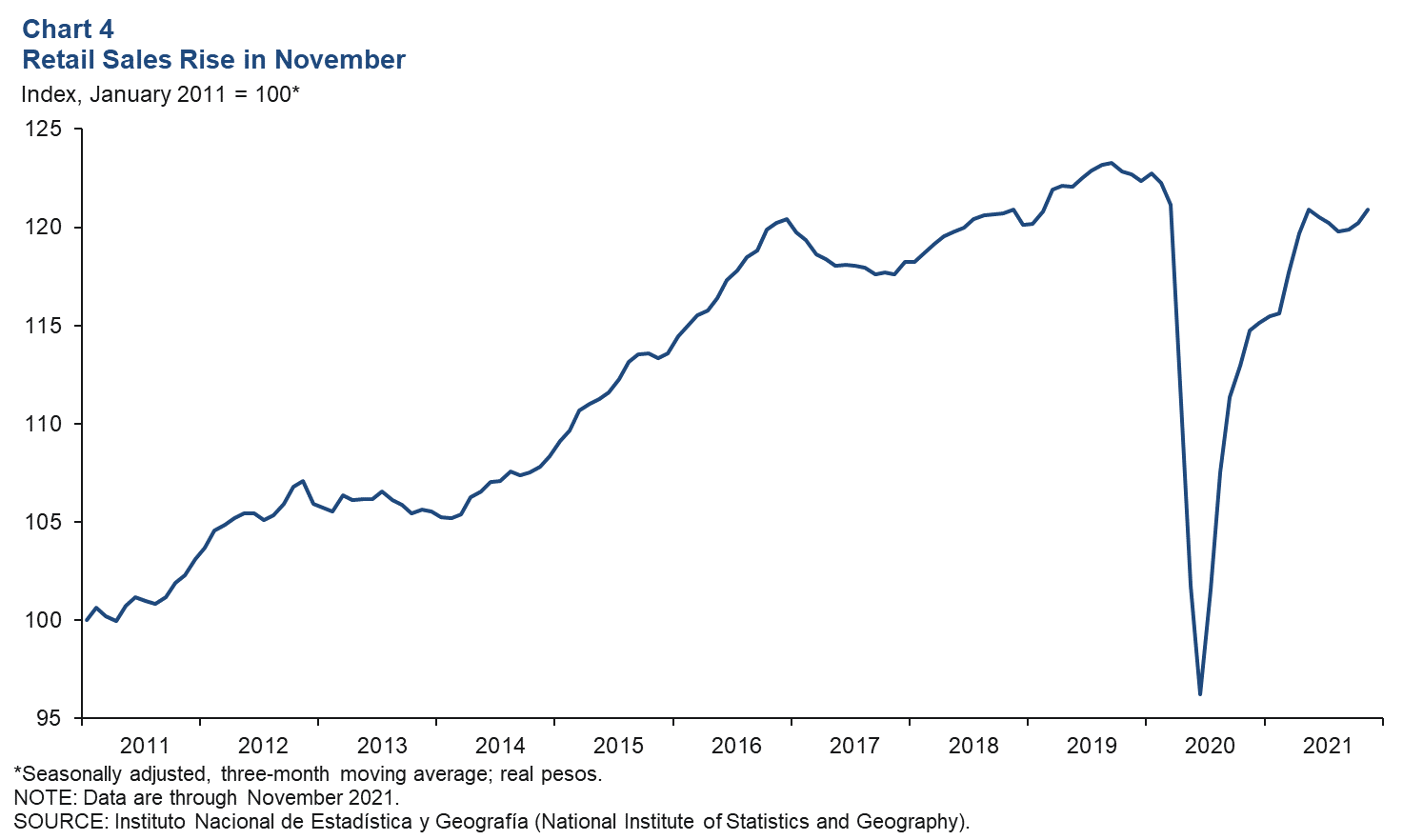

The index of real retail sales in Mexico increased 0.6 percent based on a three-month moving average through November (Chart 4). On a month-over-month basis, retail sales increased 0.9 percent in November, slightly higher than October’s 0.2 percent growth. November retail sales were up 0.3 percent from prepandemic levels in February 2020.

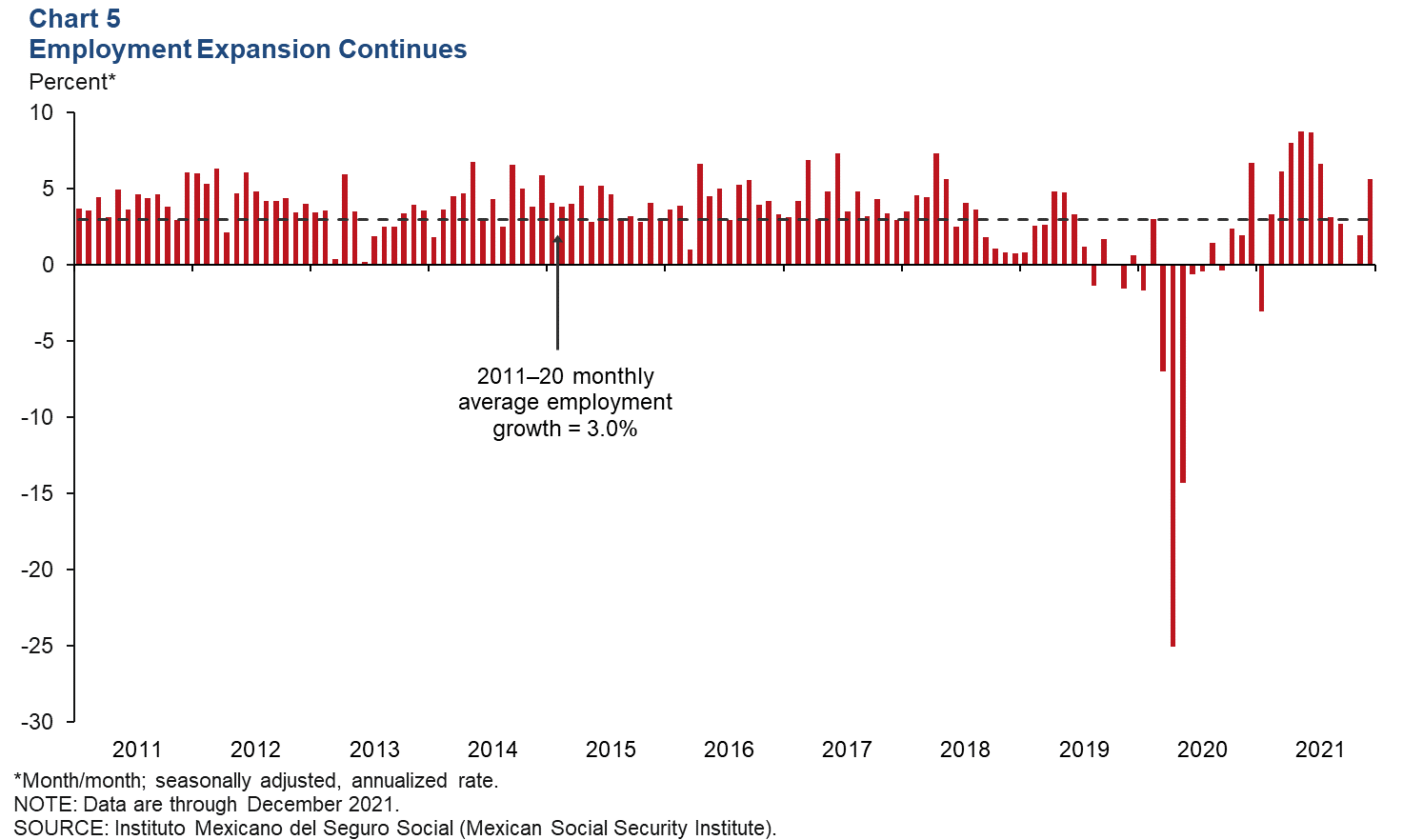

Employment growth strengthens

Formal sector employment—jobs with government benefits and pensions—grew an annualized 5.6 percent (93,600 jobs) in December after increasing 1.9 percent in November (Chart 5). Year-over-year employment grew 4.2 percent in December. Total employment, representing 56 million workers and including informal sector jobs, increased 9.9 percent year over year in third quarter 2021 based on the most recent data. The unemployment rate in December was 4.0 percent, up slightly from 3.9 percent in November.

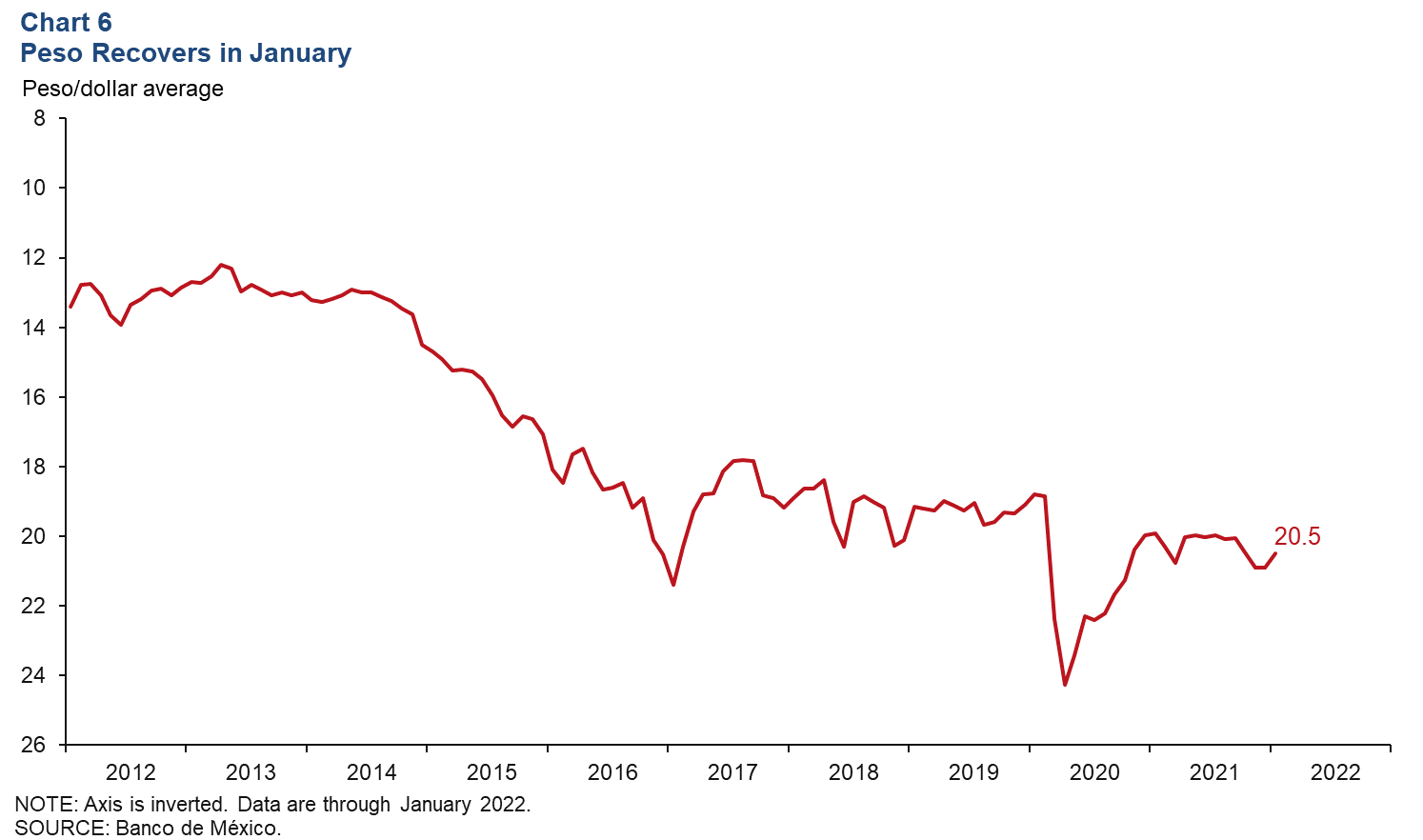

Peso gains ground against the dollar

The Mexican currency averaged 20.5 pesos per dollar in January, up 1.9 percent from December. However, the peso is down 8.0 percent from the prepandemic level in February 2020 (Chart 6). The peso has been under pressure due to persistently higher average inflation in Mexico than in the U.S. and, more recently, increased uncertainty regarding domestic and global growth.

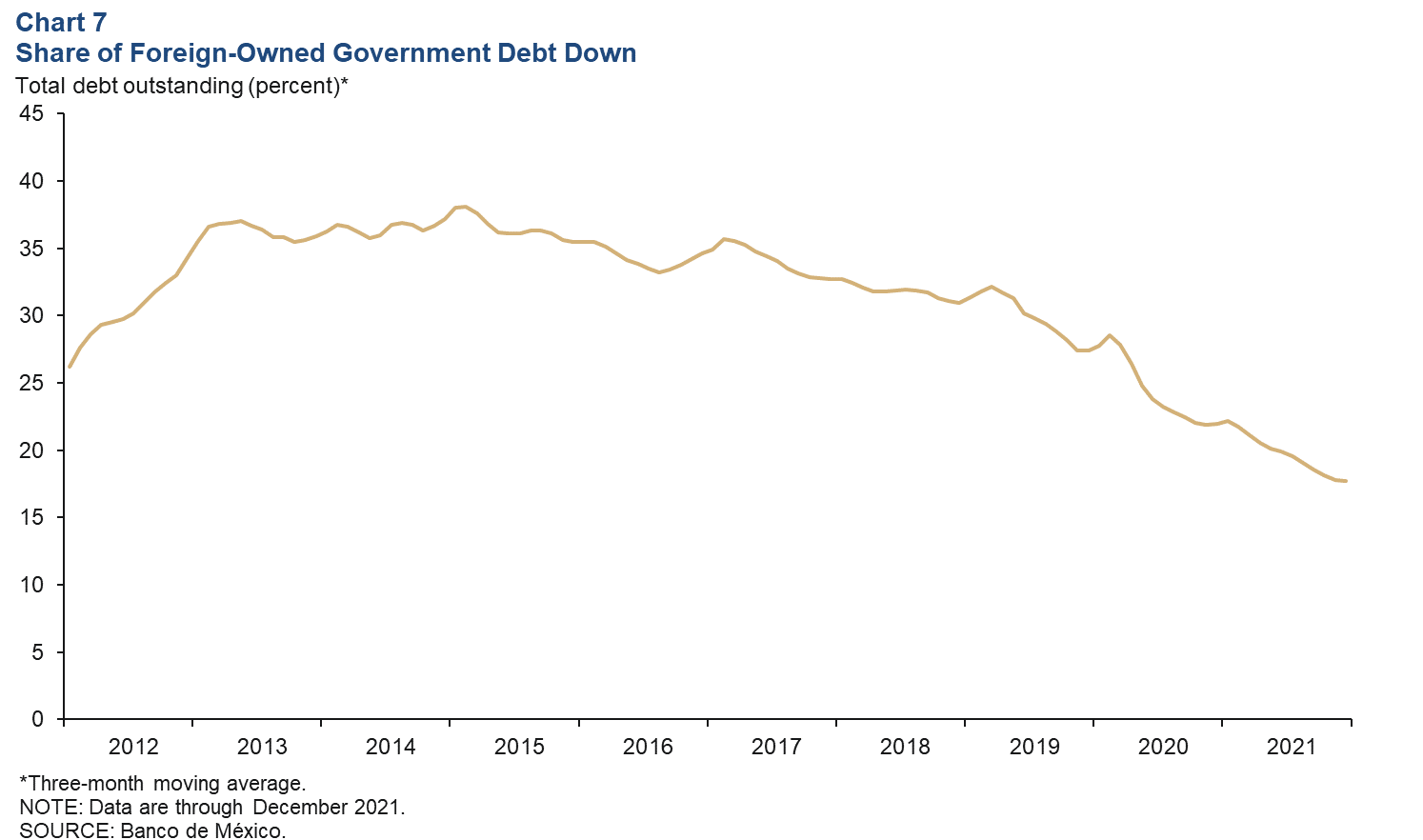

Foreign-owned government debt trends down

The three-month moving average of foreign‐owned Mexican government securities decreased to 17.7 percent in December (Chart 7). On a monthly basis, the share of foreign‐owned Mexican government securities rose to 18.1 percent in December, up slightly from October and November, but still close to a 10-year low. The extent of nonresident holdings of government debt is an indicator of Mexico’s exposure to international investors and a sign of confidence in the Mexican economy.

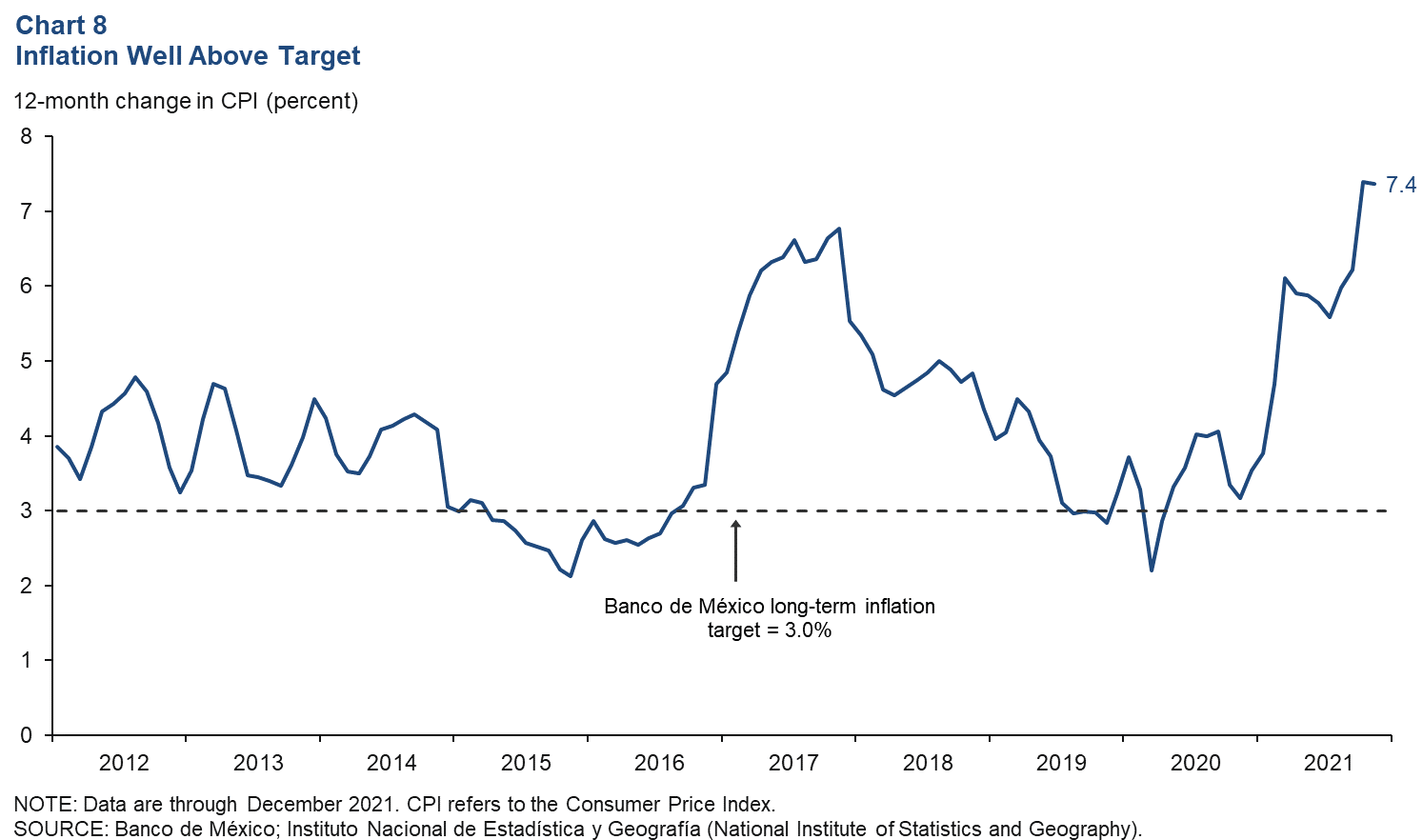

Inflation remains elevated

Mexico’s Consumer Price Index (CPI) increased 7.4 percent in December over the prior 12 months, unchanged from the growth rate in November (Chart 8). CPI core inflation (excluding food and energy) rose 5.9 percent in December over the previous 12 months. For the fifth time in 2021, Banco de México increased the benchmark interest rate. The benchmark interest rate was raised 50 basis points in December and is now 5.5 percent. In the public announcement accompanying the interest rate decision, the central bank cited persistent global and domestic inflationary pressures and above-target long-term inflation expectations as factors for the increase.

Note

- The consensus GDP forecast is calculated as a fourth quarter/fourth quarter growth rate. However, based on average year-over-year quarterly growth, the forecast is 2.2 percent for 2022. See Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Enero de 2022 (communiqué on economic expectations, Banco de México, January 2022). The survey period was Jan. 23–28.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.