Mexico’s economic growth continues; outlook improves, inflation moderates further

| May 2023 economic report | |||

| GDP, real Q1 '23 |

Employment, formal May '23 |

CPI May '23 |

Peso/dollar May '23 |

| 4.1% q/q | 133,000 jobs m/m | 5.8% y/y | 17.7 |

Mexico's proxy for monthly GDP grew an annualized 5.4 percent in April 2023, an acceleration from revised first-quarter growth of 4.1 percent. Given stronger-than-expected growth so far this year, the consensus forecast for 2023 GDP growth (fourth quarter/fourth quarter) compiled by Banco de México rose in May to 1.1 percent (Table 1).

| Table 1 Consensus forecasts for 2023 Mexico growth, inflation and exchange rate |

|||

| April | May | ||

| Real GDP growth (Q4/Q4) | 0.7 | 1.1 | |

| Real GDP (average year/year) | 1.6 | 2.0 | |

| CPI (Dec. '23/Dec. '22) | 5.1 | 5.0 | |

| Exchange rate—pesos/dollar (end of year) | 19.1 | 19.0 | |

| NOTE: CPI refers to consumer price index. The survey period was May 17-30.

SOURCE: Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Mayo de 2023 (communiqué on economic expectations, Banco de México, May 2023). |

|||

Recent data are mixed for the Mexican economy. While employment and retail sales grew, industrial production was flat and exports ticked down. Inflation moderated, and the peso strengthened further against the dollar.

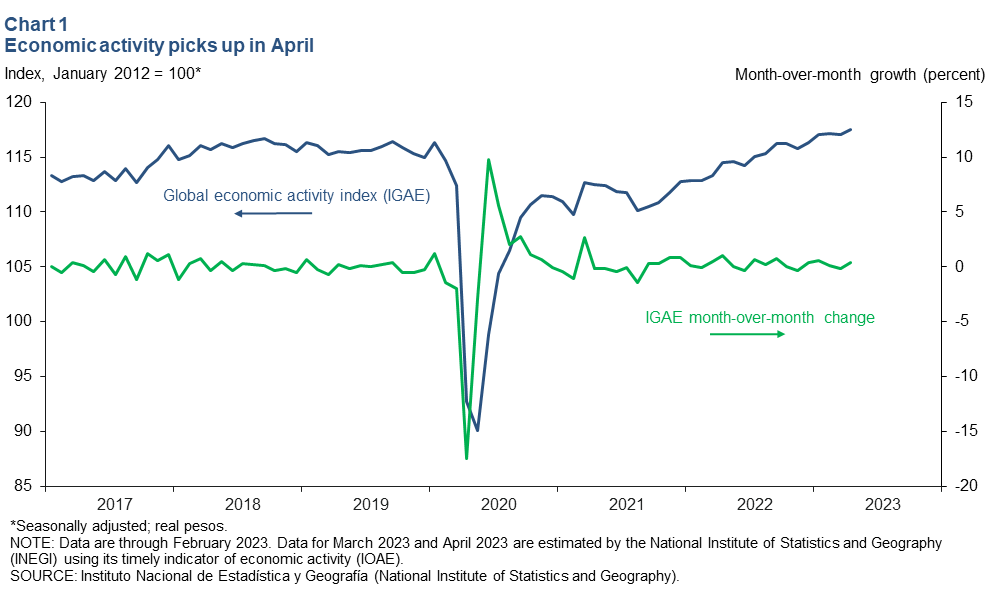

Economic growth continues

Mexico’s global economic activity index (IGAE)—the monthly proxy for GDP growth—rose 0.4 percent month over month in April, a 5.4 percent annualized increase (Chart 1). On a nonannualized basis, the goods-producing sector (manufacturing, construction, utilities and mining) grew 1.0 percent, while activity in the services-providing sector (wholesale and retail trade, transportation and business services) was flat in April.

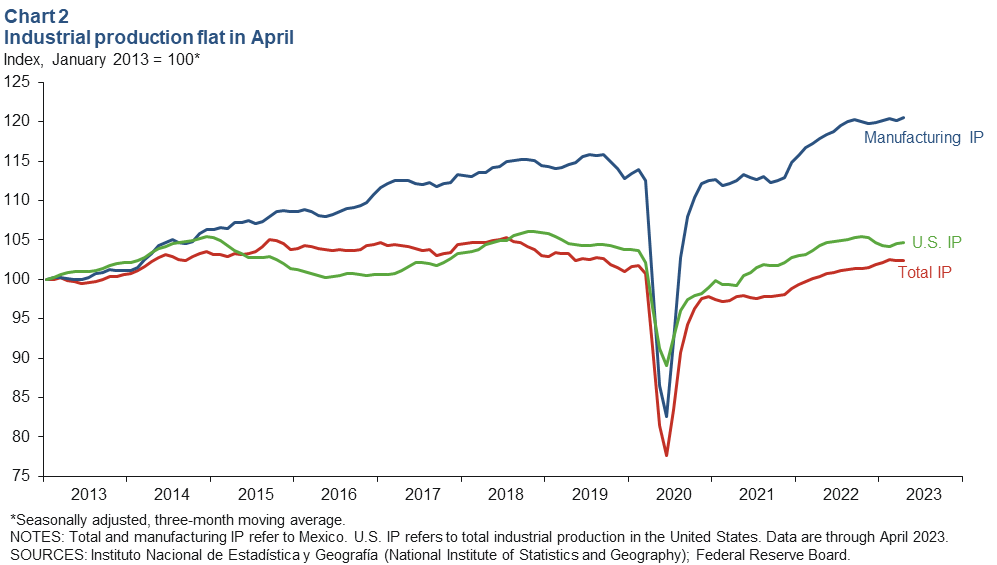

Industrial production unchanged in April

The three-month moving average of Mexico’s industrial production (IP) index—which includes manufacturing, construction, oil and gas extraction, and utilities—was flat in April, while the smoothed manufacturing IP index ticked up 0.3 percent (Chart 2). North of the border, the smoothed U.S. IP index moved up 0.2 percent in April after rising 0.3 percent in March. U.S. and Mexican IP have become more correlated with the rise of intra-industry trade between the two countries since the early 1990s. If U.S. consumer demand decelerates further this year in the face of high inflation and the cost of credit, Mexico’s manufacturing sector could slow.

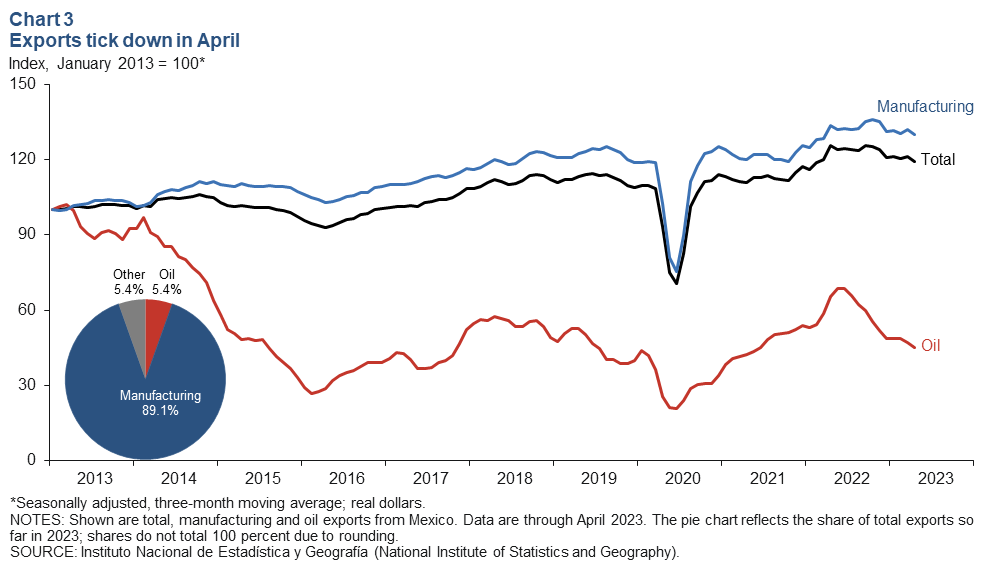

Exports turn down in April as oil exports decline

The three-month moving average of total real Mexican exports fell 1.5 percent month over month in April, while oil exports declined 3.8 percent and the much larger manufacturing sector fell 1.6 percent (Chart 3). Year to date through April, total exports dropped 0.6 percent, with manufacturing exports up 1.4 percent and oil exports down 24.3 percent compared with the same period in 2022. The overall decline is a result of slowing global demand.

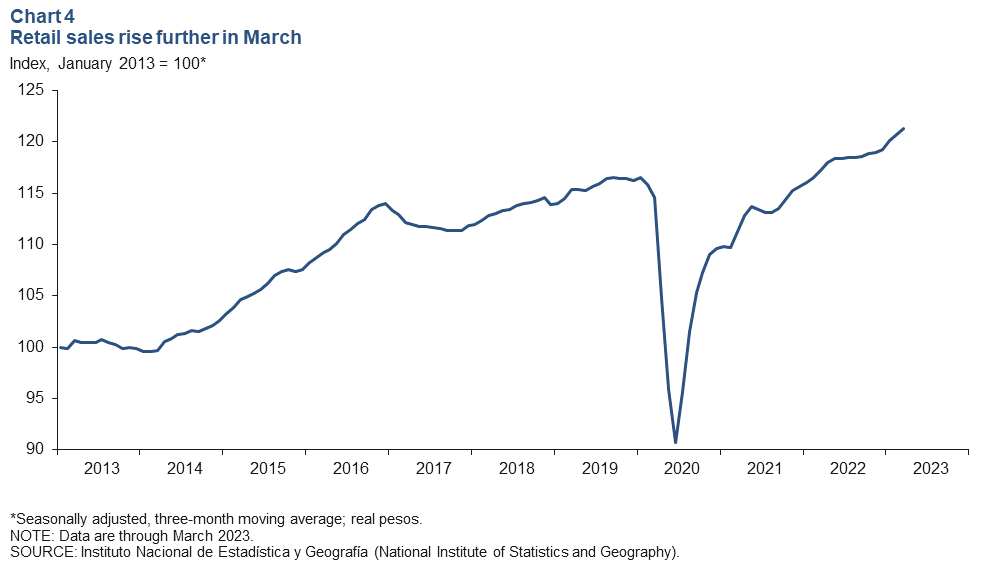

Retail sales remain elevated in March

The three-month moving average of real retail sales rose 0.5 percent in March, the latest data available (Chart 4). Year over year, the smoothed retail sales index was up 3.5 percent. Sustained growth in remittance flows may be contributing to the elevated level of Mexican retail spending despite high inflation domestically. A strong domestic market means Mexico is in a better position to weather a drop in manufacturing exports.

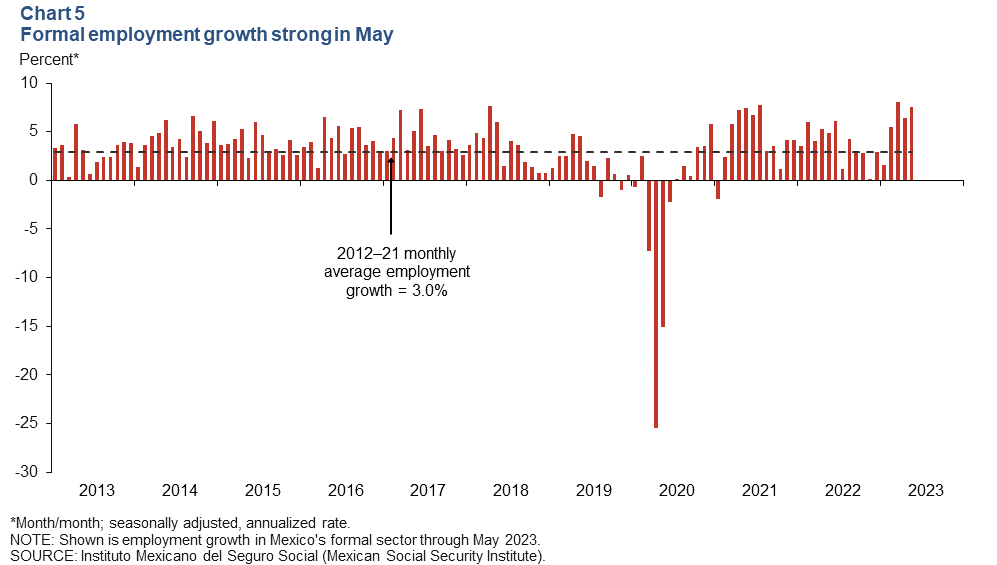

Strong job gains continue

Formal sector employment—jobs with government benefits and pensions—climbed an annualized 7.6 percent in May (133,000 jobs) after rising 6.5 percent in April (Chart 5). Total employment, representing 58.5 million workers and including informal sector jobs, grew 4.3 percent year over year in first quarter 2023. In April, the unemployment rate was 2.8 percent—unchanged from March.

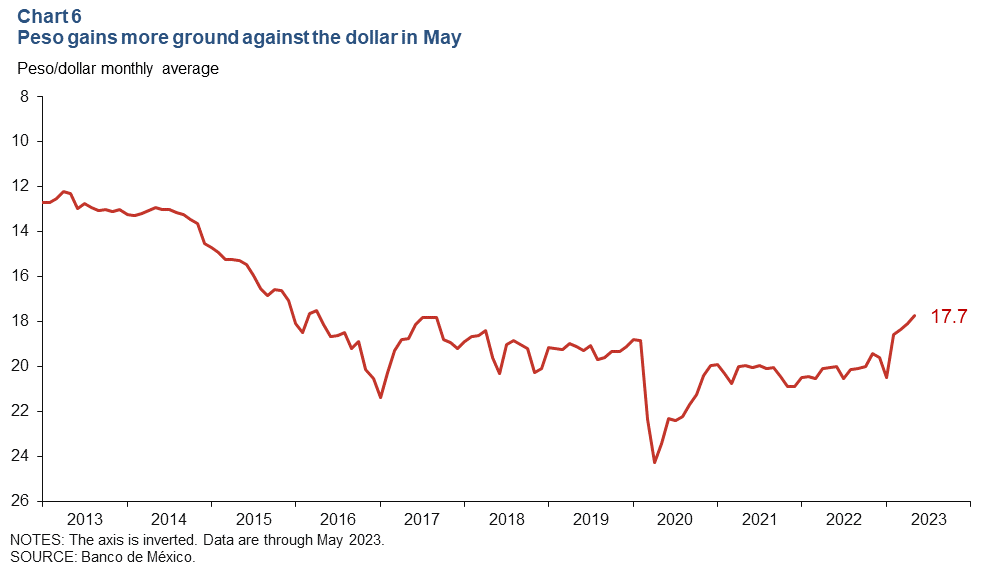

Peso continues strengthening against dollar in May

The Mexican currency averaged 17.7 pesos per dollar in May—better than April’s average of 18.1 pesos and the strongest average since March 2016 (Chart 6). In May, the peso was 6.2 percent stronger than its prepandemic value. The peso has remained relatively stable the past two years in the face of high inflation, uncertainty and global headwinds. Aggressive interest rate hikes by Mexico’s central bank in anticipation of and in response to U.S. interest rate hikes and global inflation have contributed to this stability. In addition, Mexico’s solid macroeconomic framework, fiscal discipline and prospects for nearshoring investment have likely contributed to the peso appreciation.

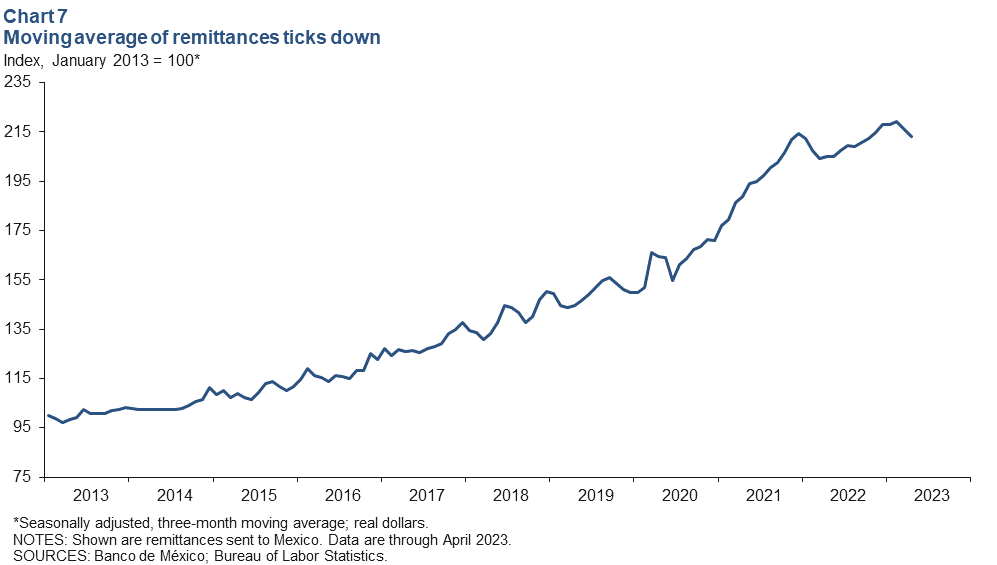

Remittances dip further in April

The three-month moving average of real remittances to Mexico fell 1.2 percent in April after declining 1.6 percent in March (Chart 7). However, even with the month-over-month dips, remittances are close to record highs as U.S. job growth remains strong, boosting the ability of workers with relatives in Mexico to send money back home.

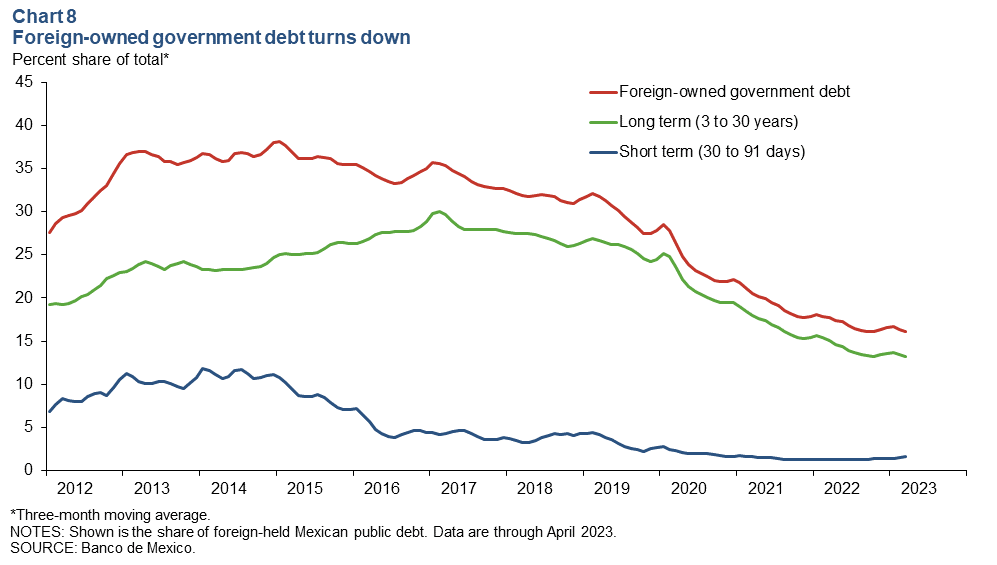

Foreign-owned debt falls in April

The three-month moving average of foreign-owned Mexican government securities dropped to 16.1 percent in April (Chart 8). The extent of nonresident holdings of government debt is an indicator of Mexico’s exposure to international investors and a sign of confidence in the Mexican economy. It’s noteworthy that the measure has been on a downward trend since 2015. Long-term government securities make up 81.9 percent of foreign-owned Mexican public debt.

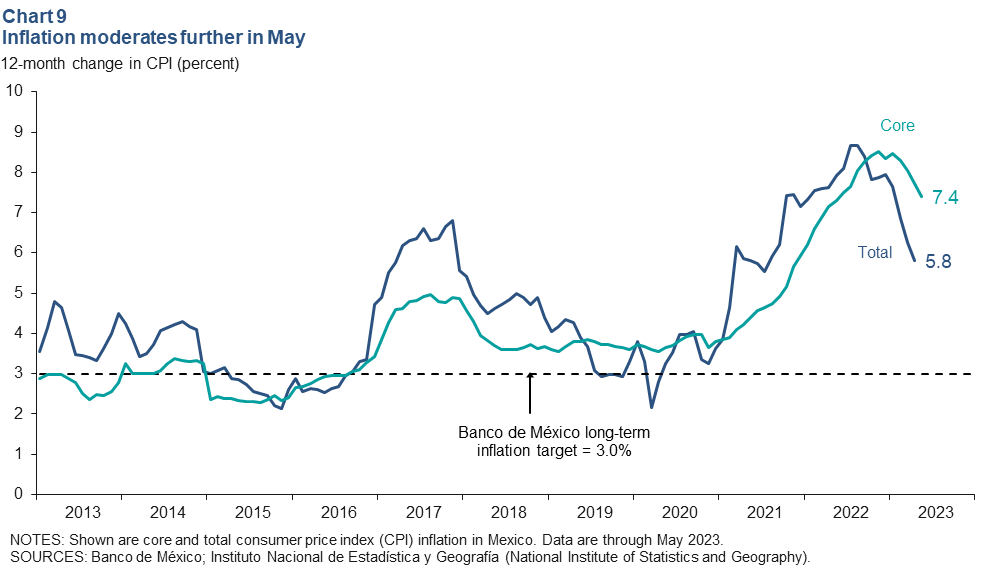

Inflation eases further in May

Mexico’s consumer price index (CPI) increased 5.8 percent in May over the prior 12 months, down from April’s 6.3 percent rise and the lowest inflation increase since August 2021 (Chart 9). CPI core inflation, which excludes food and energy, also trended lower to 7.4 percent in the 12 months ending in May. In June, Mexico’s central bank kept its benchmark interest rate steady at 11.25 percent. The central bank noted in a statement that both headline and core inflation have continued decreasing since its last meeting in May. However, the bank added that risks to inflation remain to the upside as core inflation stays stubbornly high; therefore, the benchmark interest rate will continue at its current level for an extended period.

About the authors