Mexico’s economic momentum continues in second quarter

| June 2023 economic report | |||

| GDP, real Q2 '23 |

Employment, formal June '23 |

CPI July '23 |

Peso/dollar June '23 |

| 3.6% q/q | 71,010 jobs m/m | 4.8% y/y | 17.2 |

Mexico’s GDP grew an annualized 3.6 percent in the second quarter, a slight deceleration from the previous quarter’s growth of 4.1 percent, but above analysts’ expectations of 3.4 percent. This is the seventh consecutive quarter the Mexican economy has grown. The slower pace was led by a deceleration in services. However, growth in both manufacturing and agriculture picked up. Given stronger-than-expected growth so far this year, the consensus forecast for 2023 GDP growth (fourth quarter, year over year) compiled by Banco de México rose in July to 1.7 percent (Table 1).

| Table 1 Consensus forecasts for 2023 Mexico growth, inflation and exchange rate |

|||

| June | July | ||

| Real GDP growth in Q4, year over year | 1.4 | 1.7 | |

| Real GDP growth in 2023 | 2.3 | 2.5 | |

| CPI December 2023, year over year | 4.7 | 4.6 | |

| Peso/dollar exchange rate at end of year | 18.3 | 17.9 | |

| NOTE: CPI refers to the consumer price index. The survey period was July 20–28. SOURCE: Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Julio de 2023 (communiqué on economic expectations, Banco de México, July 2023. |

|||

Recent data are mixed for the Mexican economy. Exports, industrial production and employment grew, but retail sales declined. Inflation eased, and the peso strengthened further against the dollar.

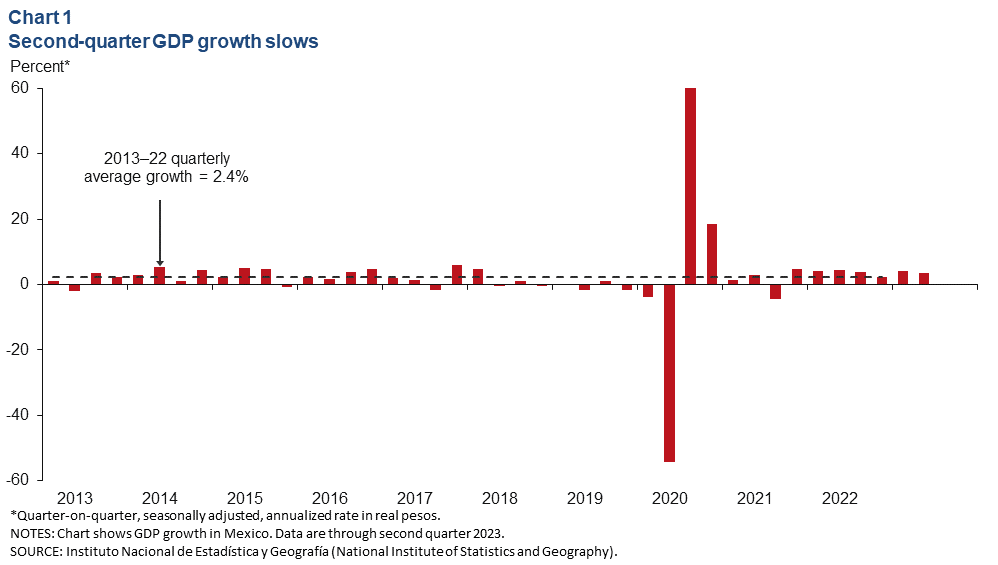

Output grows in second quarter

According to the most recent estimate, Mexico’s second-quarter GDP rose an annualized 3.6 percent (Chart 1). On a nonannualized basis, the goods-producing sectors (manufacturing, construction, utilities and mining) grew 0.8 percent, up from the previous quarter’s growth of 0.7 percent, while activity in the services-providing sectors (wholesale and retail trade, transportation and business services) grew 1.0 percent after rising 1.5 percent in the first quarter. Agricultural output expanded 0.8 percent.

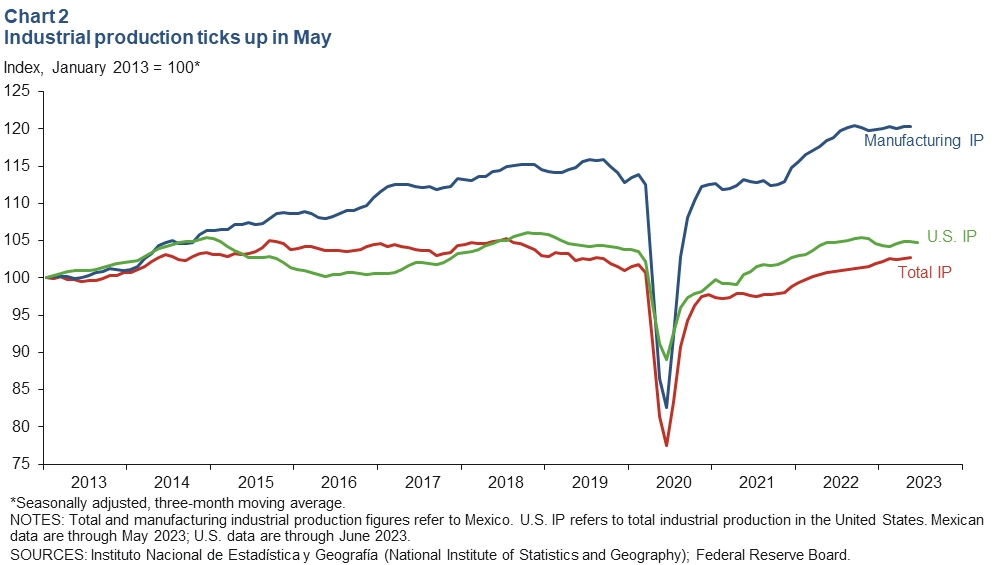

Industrial production rises in May

The three-month moving average of Mexico’s industrial production (IP) index, which includes manufacturing, construction, oil and gas extraction and utilities, rose 0.2 percent in May, while the smoothed manufacturing IP index ticked down 0.1 percent (Chart 2). North of the border, the smoothed U.S. IP index dropped 0.2 percent in June after rising 0.1 percent in May. U.S. and Mexican IP have become more correlated with the rise of intra-industry trade between the two countries since the early 1990s. If U.S. consumer demand decelerates further this year in an environment of elevated inflation and higher credit costs, Mexico’s manufacturing sector could slow.

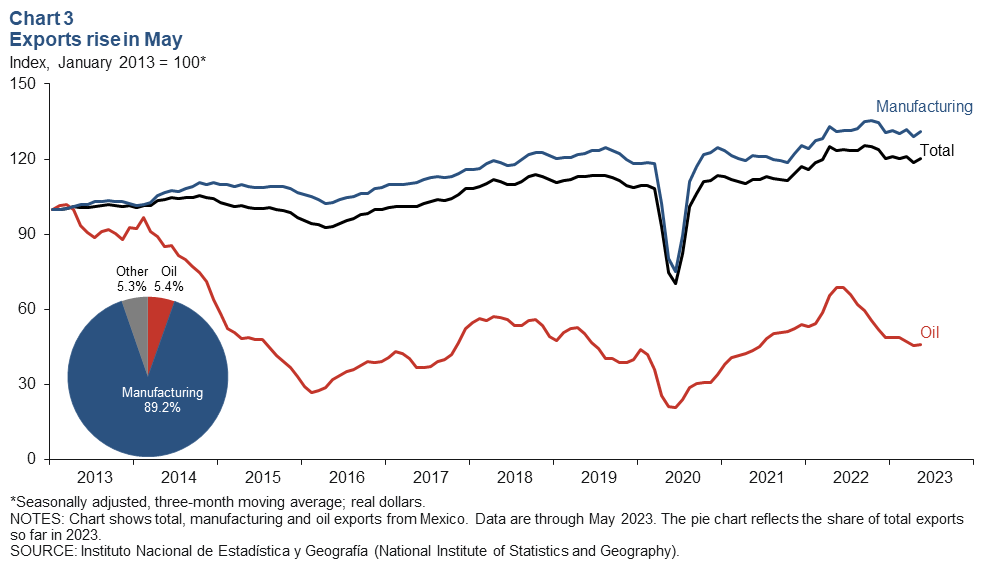

Exports grow in May

The three-month moving average of total real Mexican exports increased 1.1 percent month over month in May, while the much larger manufacturing sector increased 1.3 percent (Chart 3). Oil exports also grew 1.1 percent. Year to date through May, total exports dropped 0.9 percent, with manufacturing exports up 1.3 percent and oil exports down 25.9 percent compared with the same period in 2022. The overall decline is likely due to slowing global demand.

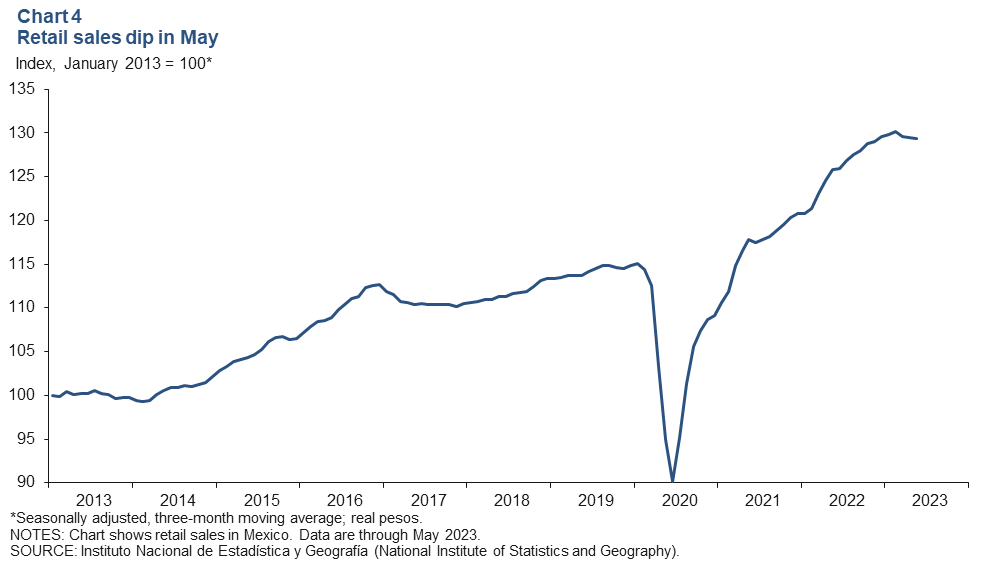

Retail sales drop in May

The three-month moving average of real retail sales declined 0.1 percent in May, the latest data available (Chart 4). Year over year, the smoothed retail sales index was up 2.8 percent. Sustained growth in remittance flows may be contributing to the elevated level of Mexican retail spending despite high domestic inflation. Mexico’s domestic market has been relatively strong and could help mitigate a fall in manufacturing exports if the U.S. economy slows down.

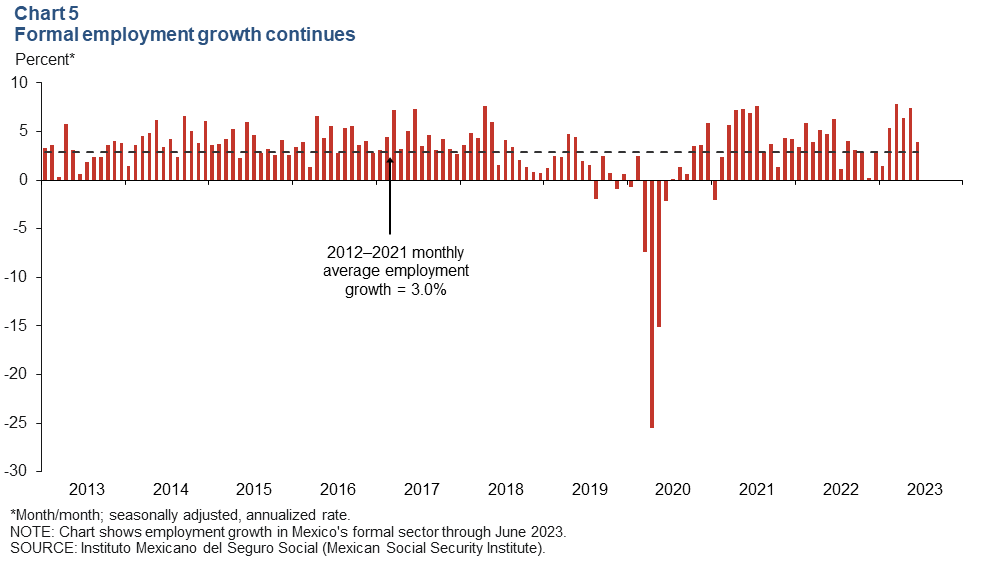

Job gains continue through June

Formal sector employment—jobs with government benefits and pensions—climbed an annualized 3.9 percent in June (71,010 jobs) after rising 7.4 percent in May (Chart 5). Total employment, representing 58.5 million workers and including informal sector jobs, grew 4.3 percent year over year in first quarter 2023. In May, the unemployment rate was 3.0 percent, up from April’s 2.9 percent.

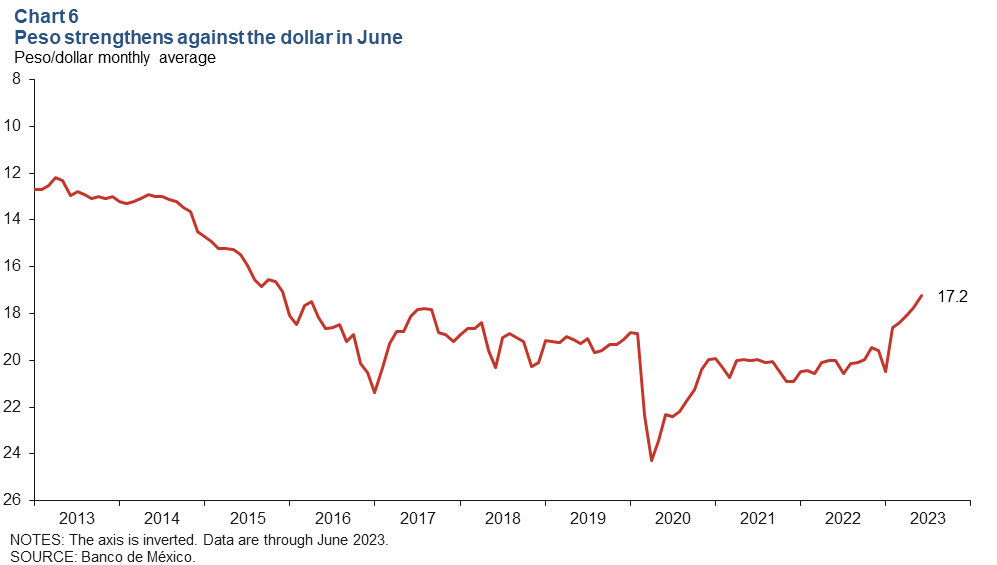

Peso gains ground against U.S. dollar in June

The Mexican currency averaged 17.2 pesos per dollar in June, better than May’s average of 17.7 pesos and the strongest average since December 2015 (Chart 6). The peso has remained relatively stable the past two years in the face of high inflation, uncertainty and global headwinds. Aggressive interest rate hikes by Mexico’s central bank in anticipation of and in response to U.S. interest rate hikes and global inflation contributed to this stability. In addition, Mexico’s solid macroeconomic framework, fiscal discipline and prospects for nearshoring investment likely contributed to the peso appreciation.

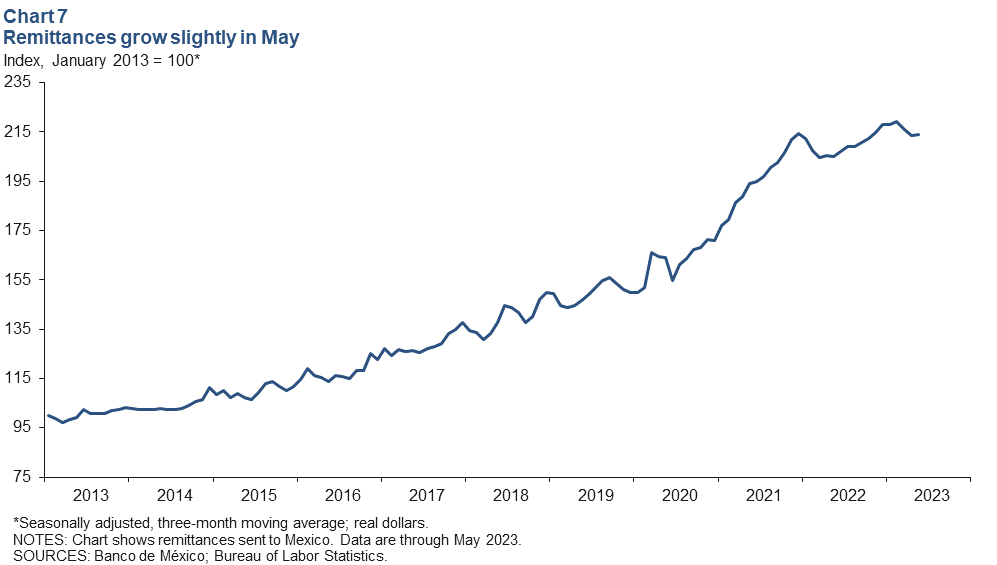

Growth in remittances resumes in May

The three-month moving average of real remittances to Mexico increased 0.1 percent in May after declining 1.1 percent in April (Chart 7). Even with the recent month-over-month dips, remittances are close to record highs as U.S. job growth remains strong, boosting the capacity of Mexicans working abroad to send money back home.

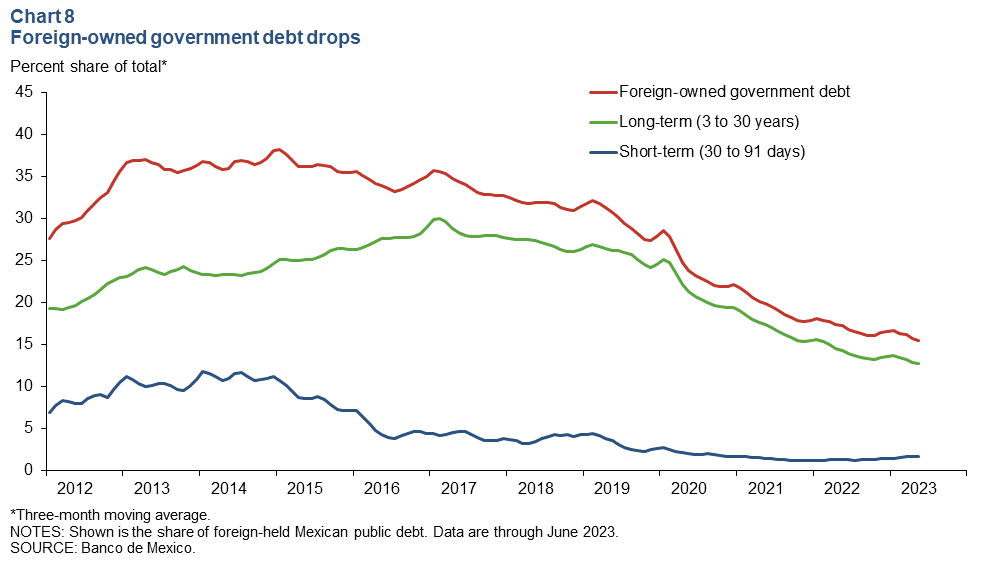

Foreign-owned debt keeps decreasing in June

The portion of Mexican government securities owned by foreign investors dropped to 15.5 percent in June based on a three-month moving average (Chart 8). The extent of government debt held by nonresidents is an indicator of Mexico’s exposure to international investors and a sign of confidence in the Mexican economy. The measure has been on a downward trend since 2015. Long-term government securities make up 81.8 percent of foreign-owned Mexican public debt.

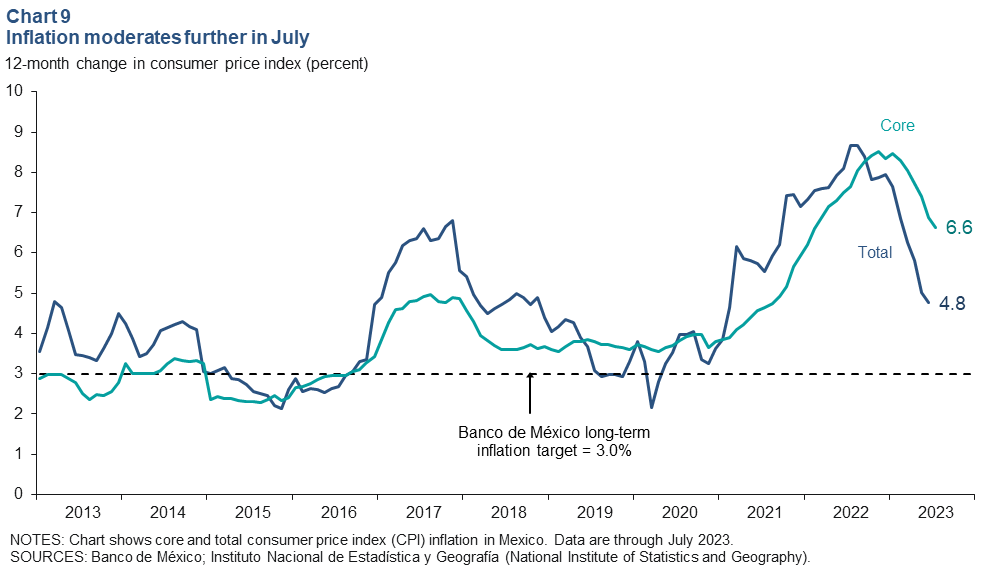

Inflation continues easing in July

Mexico’s consumer price index (CPI) increased 4.8 percent in July, narrower than June’s 5.0 percent rise and the lowest inflation rate since March 2021 (Chart 9). CPI core inflation, which excludes food and energy, also slowed, to 6.6 percent. In June, Mexico’s central bank kept its benchmark interest rate steady at 11.25 percent. The central bank noted in a statement that both headline and core inflation have continued slowing. However, the bank added, risks to inflation remain to the upside with core inflation stubbornly high; therefore, the benchmark interest rate will continue at its current level for an extended period.

About the authors