Texas economy moderates toward more normal growth in 2024

Texas economic growth remains healthy while gradually reverting to a more historically normal pace of expansion following the pandemic when a bust in the first half of 2020 preceded a subsequent boom.

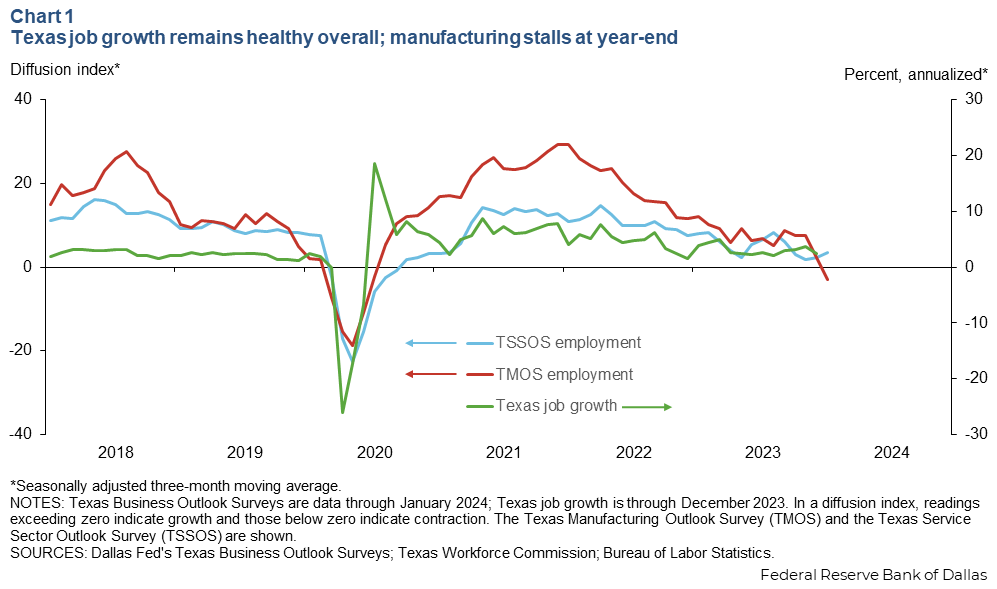

State job growth decelerated in fourth quarter 2023, and the latest readings from the Texas Business Outlook Surveys (TBOS) suggest that slowing continued in January and was more pronounced in manufacturing than in the service sector.

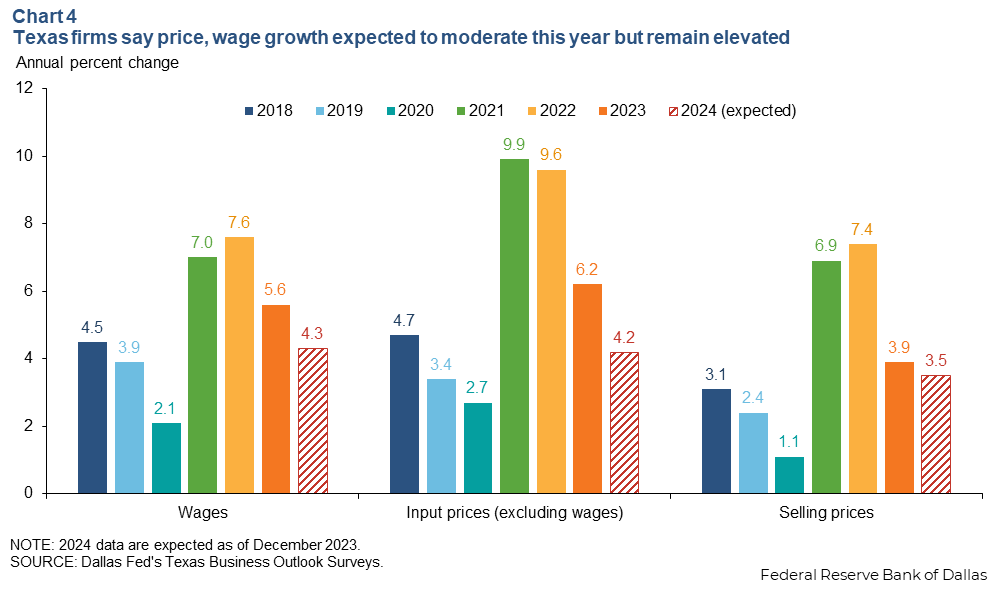

Labor market tightness is retreating, with fewer firms citing labor shortages as a concern and more reporting an improvement in the availability of applicants and in the ability to retain workers. Texas firms expect wage and cost pressures to ease in 2024 while remaining slightly elevated.

Texas job growth eases heading into 2024

Texas job growth edged lower to 2.4 percent in fourth quarter 2023 from 3.0 percent in the third quarter (Chart 1). The construction and energy sectors continued to post strong gains through year-end, while manufacturing job growth largely abated. In services, fourth-quarter job growth was broad based, led by health care and leisure and hospitality.

In 2023, employment grew 3.1 percent in Texas, down from 4.3 percent in 2022 and well above the U.S. growth of 2.0 percent.

January data from the Texas Service Sector Outlook Survey (TSSOS) show continued employment growth, albeit at a slower pace than last year. Meanwhile, the Texas Manufacturing Outlook Survey (TMOS) employment index (three-month moving average) slipped into contractionary territory in January for the first time since 2020. Other Federal Reserve Banks’ regional surveys also reported manufacturing weakness in January. However, upward movement in forward-looking TMOS indexes in January suggests the slump may be short-lived. Additionally, while 20 percent of manufacturers said in December that they were overstaffed, nearly all said they were opting not to undertake layoffs, suggesting they expect to need workers in the near future.

Weakening demand continues to weigh on outlook

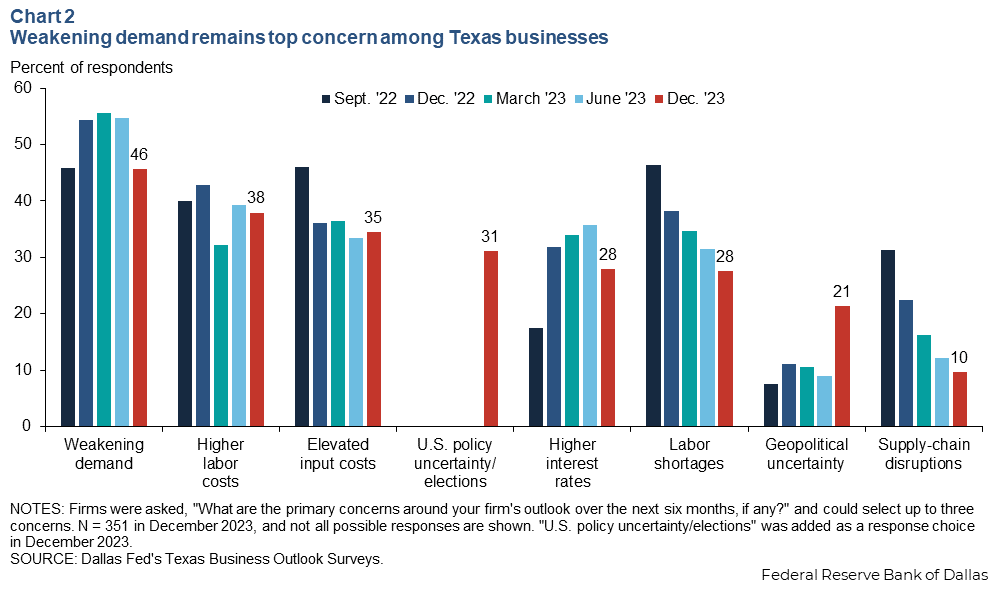

Weakening demand was still the top outlook concern for 2024 among Texas businesses in December (Chart 2). Elevated labor and input costs remain primary concerns, with a sharply higher share of firms citing geopolitical and domestic policy uncertainty. Labor shortages, higher interest rates and supply-chain disruptions are lessening worries.

Labor market coming into better balance

Texas firms are less apprehensive about labor shortages, which in December were largely contained to health care, retail, and leisure and hospitality.

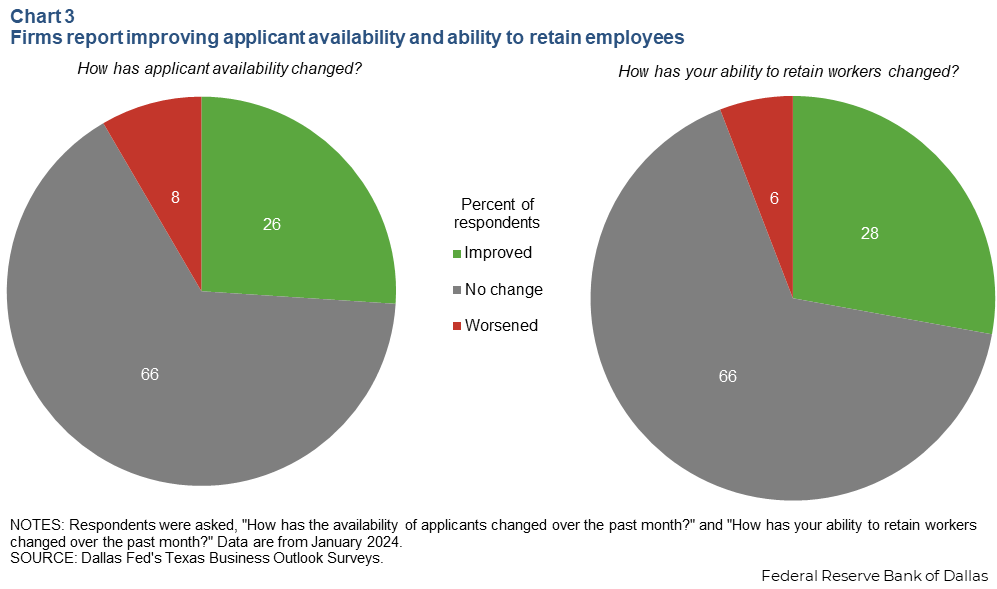

Also, applicant availability was a retreating hiring impediment; in January, 26 percent of TBOS respondents said availability had improved over the prior month, while 8 percent said it worsened (Chart 3).

A similar share reported better ability to retain existing workers, a positive sign that the “Great Resignation” of 2021 and 2022 has petered out, and the very tight labor market that continued into 2023 is lessening.

Input cost growth expected to ease; price growth likely slower to fall

Business cost growth—both labor and nonlabor—is likely to decelerate further in 2024, though not as strongly as last year. Wage growth is expected to slip to 4.3 percent in 2024 from 5.6 percent recorded in 2023, according to a TBOS special question. Nonlabor input cost growth is anticipated to fall to 4.2 percent from 6.2 percent in 2023 (Chart 4). If these expectations for 2024 are realized, it will mean cost growth will have declined to near 2018–19 levels.

Businesses expect selling-price growth to remain slightly elevated, with only a modest stepdown this year. Selling-price growth of roughly 3.5 percent, if realized, would still exceed 2018–19 average growth of 2.7 percent.

Firms may be hoping relatively higher price growth will help them recapture some margins lost amid dramatic cost surges in the past two years. TBOS firms, particularly smaller businesses, have reported declining margins on net since mid-2022. Some contacts noted a lagging ability to pass on cost increases to customers.

After a strong pandemic recovery, more normal growth in 2024

Texas’ economic expansion has downshifted but remains healthy moving through 2024. Employment growth is expected to continue in 2024, albeit at a slower pace and closer to the long-term trend.

There are some downside risks, however. Inflation remains a headwind for Texas, as growth in the Consumer Price Index for the state last year outpaced the nation (4.6 percent November/November compared with 3.1 percent for the nation). Among the largest U.S. metros, Dallas and Houston ranked second and seventh, respectively, for year-over-year price increases. Consumer resilience may be ebbing, and geopolitical risk and U.S. election uncertainty are increasing.

The outlook of Texas firms remains mixed and uncertain, as reflected in respondent comments in the latest TBOS. Some were positive, such as one warehousing and storage firm that said, “It’s a very stable business environment at the moment.” On the other hand, a textile product mill reported, “Overall, uncertainty is high, and I'm feeling less optimistic than I did last quarter.”

Still, Texas is expected to experience further growth this year, outpacing the U.S. as it typically does.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.