Did expanded Child Tax Credit enable parents in financially vulnerable households to work during pandemic?

The Child Tax Credit (CTC), a tax provision designed to improve the financial resiliency of American families, was temporarily expanded under the 2021 American Rescue Plan Act (ARPA) in response to the COVID-19 crisis. CTC funds reached approximately 35 million families that year and are estimated to have reduced the child poverty rate by about 25 percent.

What’s less clear is whether and how CTC expansion affected recipients’ work. Social scientists have found in other contexts that safety-net programs sometimes reduce recipients’ incentive to work and thereby provide a headwind to U.S. economic growth. Yet a survey from just before the initial ARPA checks were issued in July 2021 suggested that the checks could incentivize work, with nearly 94 percent of respondents saying they planned to either continue working or increase their employment. Did this actually happen?

Our research puts that question to the test by examining labor market response to the CTC immediately following the first ARPA check issuance. We find the employment effect of CTC on households is close to zero on average—similar to what other researchers have found. Drilling deeper, however, we identify a work-encouraging effect for a specific group of recipient families—those with at least one unemployed parent.

Findings mixed on expanded CTC’s employment effects

The CTC was significantly expanded, from $2,000 to $3,600 per child, in March 2021. Starting July 15, 2021, eligible families began to receive monthly checks from the IRS for every child in the household. Households were provided a monthly credit of $300 for each child under 6 years old and $250 for those between 6 and 17. The last monthly CTC checks arrived in February 2022. Many households received another significant portion of the CTC as a part of their tax returns to cover unpaid benefits from January to June 2022.

In November 2020, a few months after COVID-19 sent the economy into a brief recession, half of adults laid off in the prior 12 months said they would be unable to cover a $400 emergency expense. Such an inability would imply difficulty in affording expenses such as child care that for many adults are preconditions for work. This suggests the $300 monthly CTC check could boost financial resiliency and potentially remove hurdles to returning to work, such as child care and transportation costs, for these financially vulnerable families with children.

The policy debate over the expansion of CTC centers on whether—and how much—a more generous credit would affect labor force participation. Theoretical models predict that low-income households, whose modified adjusted gross income was less than the first CTC threshold (about $25,000 in 2020), could experience an employment change in either direction depending on whether the tax credit primarily reduces the incentive to work or mainly increases the ability to work by helping families pay for work-related costs. So far, the findings from simulation and empirical estimates are mixed as well. Some estimate an insignificant short-term change in labor market outcomes, while others predict a long-term reduction in employment incentive.

In our research, we take a different approach. We divide parents into two subgroups based upon whether the spouses are working. Consistent with existing empirical findings, we find an insignificant employment response to the temporary expansion of CTC on average. Breaking the research down by subgroup, however, we find a significant work-encouraging effect from the CTC among families that had at least one unemployed parent—a cohort that was unusually large in the pandemic period.

Under broad strokes, the CTC’s effects are hard to detect

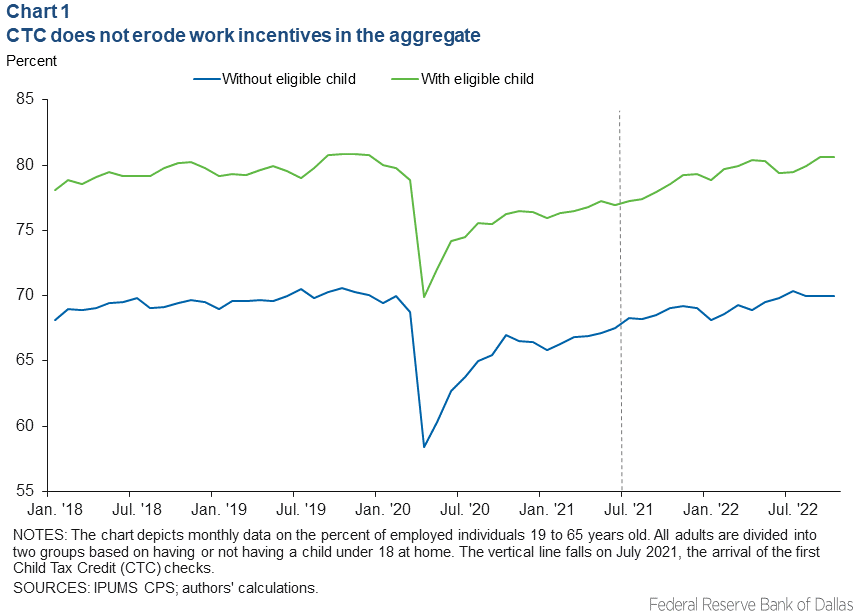

We start by looking at two broad sets of individuals—families with and without CTC-eligible children. The initial checks arrived in July 2021, so if significant employment changes took place around this critical time for eligible parents but not for other adults, it could be the result of the CTC.[1]

The first step is to compare the two groups’ rate of employment (Chart 1). On the whole, the data show that couples who are parents have a higher rate of employment than childless couples. Yet the trends of the two groups follow each other closely. Both groups saw a sharp decline in employment after the onset of COVID-19 and gradually recovered over time.

The second step is to investigate the changes after the first CTC check was issued in July 2021 (the vertical line in Chart 1). The two groups still share largely similar patterns, suggesting the first CTC check did not, in the aggregate, substantially erode the incentive to work among parents who received it.

CTC likely helped financially strained parents work

A key motivation behind the CTC is to help financially strained families cover expenses that may prevent them from entering the labor force. These expenses could include transportation, food and child care. According to the Census Bureau’s Household Pulse Survey in September 2021, for example, 26 percent of families with a child (or children) under 5 put their CTC checks toward child care that month.

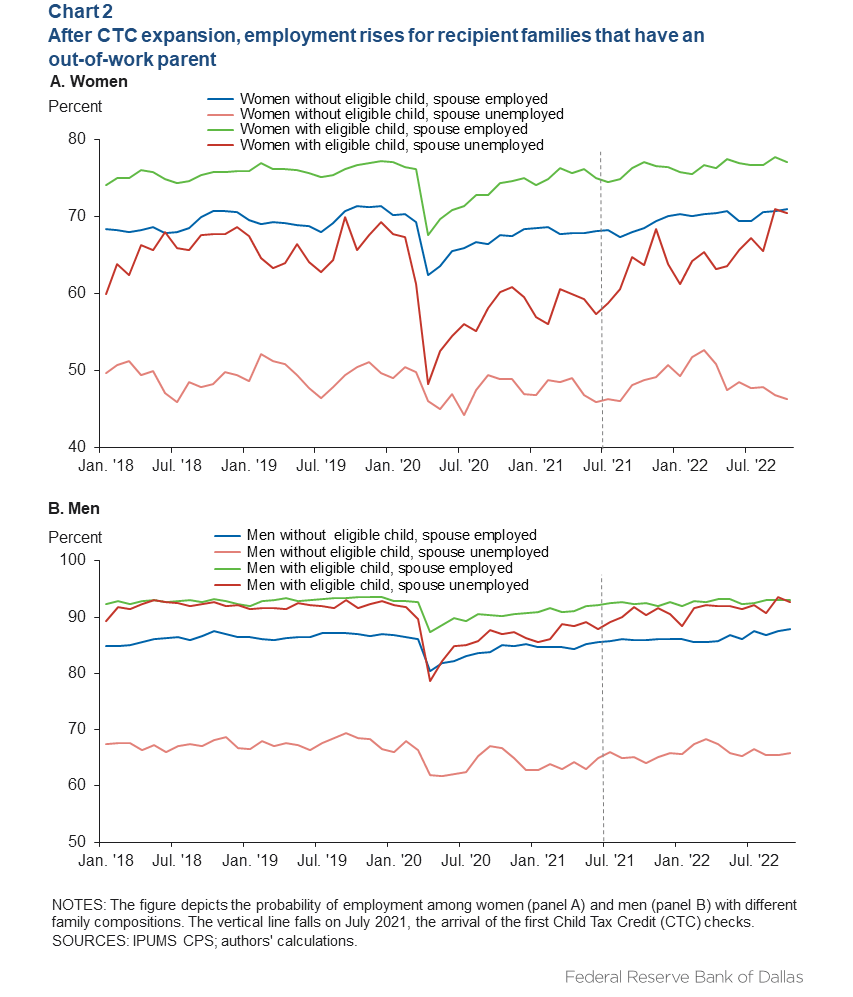

The families for which a $300 check makes a significant difference are also the families that were more likely to change their behavior when receiving the monthly CTC checks. To zoom in on these most-affected households, we divide parents into the two subgroups based on whether the spouse is employed (Chart 2).

The first subgroup we consider is women with employed spouses. Panel A of Chart 2 shows that, regardless of CTC eligibility, women in this group shared a similar path of recovery whether or not they had a CTC-eligible child. This echoes the earlier findings that the overall impact of CTC on work was small.

However, when looking at the second subgroup of women—those with an unemployed spouse—the results change. Shortly after the issuance of the CTC check, women in this group saw a dramatic increase in employment if they had an eligible child but a negligible change in employment if they didn’t have an eligible child.[2] The finding suggests the CTC likely played a role in helping women with an unemployed spouse to increase their labor force participation. (The same pattern is found for both women and men.)[3]One might argue that this effect is caused not by the initial CTC check but by child care centers coincidentally reopening for business around the same time. However, if that were the explanation, one would expect to see an effect in the same direction in our first group as in our second, which was not the case. Moreover, there is little evidence of a notable acceleration in child care center reopenings during the precise time period CTC expansion checks were received. For these reasons, child care reopenings—while important for the lives of many working families—do not appear to explain our results.

Preliminary findings show benefits for one cohort

To be sure, many factors go into determining whether the CTC should exist and how generous it should be, including the overall contours of the federal budget and the desired level of support for underserved communities. But one such factor is the extent to which the CTC facilitates work—for example, by helping recipients cover expenses such as child care that are prerequisites for employment—as opposed to discouraging work. Our results provide preliminary evidence that, on net, the pandemic-era CTC expansion did not discourage work and, in fact, helped some financially vulnerable families overcome hurdles to labor force participation.

Notes

- In this blog, we define CTC-eligible as having children under 18. Many other factors, including family income and having a Social Security number, also affect CTC eligibility. However, families of 88 percent of children qualify for the CTC, so the most important predictor of whether a family got the CTC is the presence of an eligible child.

- See note 1.

- ARPA also expanded the Earned Income Tax Credit, but only for those without children. This policy change can only reduce the size of the effect we can detect for the CTC.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.