Opportunity Zones in Texas: Promise and Peril

Avoiding Pitfalls: Potential Best Practices

Recognizing that gentrification will likely be an issue in some Opportunity Zone communities, how might investors and community developers mitigate this risk while simultaneously maximizing economic benefit in these low-income communities? Community-based organizations and policymakers have put forth a few ideas:

- Integrate investments thoughtfully within the broader economic environment: O-Funds will not deploy capital in a vacuum. Each community will have different infrastructure, different priorities and policies, and different funding streams at play, which will have implications for how new equity investments are absorbed and used. Jeremy Nowak, co-founder of New Localism Advisors and the Reinvestment Fund, suggests that cities should think of O-Funds as “one of many tools in an economic development toolbox” and “embed this investment tool within broader community and economic development strategies.” For instance, a city might want to engage its existing community colleges and align workforce development programs to ensure a strong regional talent pipeline for future business development. And if an OZ tract already has existing federal or state investments (such as NMTCs, Promise Zones, Empowerment Zones or Low Income Tax Credits) as well as philanthropic money, O-Funds could be layered on top of these resources to maximize impact. As the Beeck Center at Georgetown University notes, OZs “should be additive to existing efforts and not cannibalize existing or prospective community development investments.”[1]

- Focus on inclusivity: “Make sure there are policies at the local level to really ensure equitable economic growth—though these policies will look different across markets,” says Olivia Barrow, policy analyst at Enterprise Community Partners. Certain policies may be in place in cities that can mitigate displacement. Inclusionary zoning, for instance, is a tool that either mandates or encourages development or preservation of affordable homes when new market-rate housing is built. Although cities in Texas cannot mandate inclusionary zoning, some cities, such as Austin, offer incentives to developers in the form of density bonuses or fee waivers to be inclusive of low- and moderate-income residents.[2]

- Encourage performance tracking at the local level: While there are no federal reporting requirements for O-Funds, for states concerned about where equity is allocated and how to measure its efficacy, one tactic could be creating incentives for investment that are tied to performance measurement and reporting. According to Katie Kramer, vice president of the Council of Development Finance Agencies, if a community wants to offer incentives to direct capital to particular projects that align with its economic priorities, it has the opportunity to tie in reporting measures to hold these investments accountable. “If you’re going to layer on additional incentives to be able to attract [O-Fund investment],” Kramer says, “really think about how you can also encourage them to perform in a certain way.”[3]

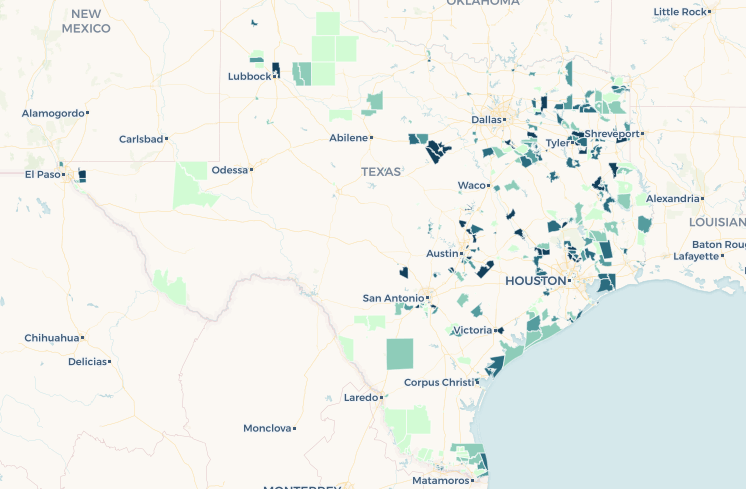

This list of strategies is by no means exhaustive and will likely grow as new guidance is issued by Treasury. Moreover, best practices will likely differ by locality, so advice should remain flexible, rather than be prescriptive.As a final note, the Urban Institute released a dataset focused on helping communities understand current investment levels across tracts and developed an investment score based on current levels of commercial, multifamily, single family and small business lending in each tract.[4] Using this dataset, the Dallas Fed created an interactive map of OZs by investment score, along with flags for gentrification risk as discussed above.

Map 2. Opportunity Zones by Investment Score

Notes

- “In the Land of OZ (Opportunity Zones) Who Will Benefit?” by Lisa Hall, Beeck Center for Social Impact and Innovation, Georgetown University, March 13, 2018.

- For example, see “Downtown Density Bonus Program,” Office of Planning and Zoning, City of Austin.

- “Insight from the Council of Development Finance Agencies,” webinar by Katie Kramer for Enterprise Community Partners, April 25, 2018.

- See methodology. Note that the Urban Institute also created a gentrification flag, called “socioeconomic indicator,” which this map does not use, because it resulted in what we believed to be an undercount of gentrifying areas.