The United States Is Not Europe and Texas Ain't France: America as the Thoroughbred Economy

October 10, 2012 Washington, D.C.

Thank you, Michael [Tanner].

You and your colleagues have had a long day. So far today, you’ve had 21 speakers and panelists addressing Europe’s crisis and lessons for the United States. Being the Cato Institute, devoted as you are to advocating for “free, open and civil societies” based on “the principles of limited government, free markets, individual liberty and peace,” the conference has done a pretty thorough job of highlighting how the financial burden of the American welfare apparatus—Medicare, Medicaid, Social Security and other entitlements that encumber our nation’s balance sheet—must be resolved if we are to avoid arriving at the same destination as Europe.

It would take a strong person to spend an entire day listening to the tales of cautionary woe about Europe’s pathology so near to our dysfunctional Capitol and resist the urge to rush home and slit his wrists. I am going to try to end today’s discussion on a more pleasant plane, acknowledging our problems here, yet pointing to some factors that give me hope. I will spend little time talking about monetary policy. After I am done with these comments, I’ll be happy to avoid answering any questions you might have on that front.

It is a sad day when the Financial Times opens its Monday edition with the first sentence of its lead article declaring, “The U.S. is the brightest spot in the world economy,” then qualifies the comment by pointing out that we shine only within a global economy that is “on the ropes.”[1] This was followed yesterday by a Wall Street Journal report from Tokyo under a banner headline—“Global Recession Risk Rises.” The article says, “The IMF upgraded growth prospects for only one major nation compared with its July forecast. It projected that the U.S. would grow 2.2 percent this year, 0.1 percentage point”—zero point one—“higher than previously estimated.”[2] One is tempted to conclude, as I have remarked on many occasions, that we are but the “best-looking horse in the glue factory” of hapless economies.

I have a preferred equine analogy for the American economy. It looks like this:

© Bob Coglianese

It is of the Triple Crown winner, Secretariat, a chestnut thoroughbred with a strong, muscular physique, leading the pack by a record-breaking 31 lengths at the Belmont Stakes for a victory that would shock the world. I am convinced that with proper care and feeding, American businesses can pace us to win the equivalent of the Triple Crown of the global economy. And I believe we have laboratories within our own borders, such as Texas, that provide us with examples of how Congress might help businesses do so and help our nation avoid the European trap.

If we can liberate the private sector from the shackles of uncertainty about fiscal policy and overregulation and take the best from states that have succeeded in attracting job-creating businesses, I am convinced that, like Secretariat at Belmont, the United States can win the longest of races by an astonishing margin. And in doing so, we can show the way for others.

How might this be done? What is holding us back?

It helps to retrace a little recent history.

On this 50th anniversary of the Cuban missile crisis, it is important to remember that we won. We won the Cold War. We spent a generation of blood and treasure to move from the constant threat of mutually assured destruction to mutually assured competition. As we did in the aftermath of many of our nation’s great struggles—World War I and World War II—we emerged from a titanic struggle with the Soviet Union as the victor and world leader. We not only liberated Eastern Europe when the Berlin Wall came down, but also incentivized the forces of economic reform in China, Vietnam, India and elsewhere. We got exactly what we fought for: A world economy expanded by billions of new consumers and producers of goods and services rather than weapons of war.

What followed the fall of the Soviet threat was an opening up of the world economy, aided by trade liberalization championed by two presidents—a Republican named George H.W. Bush, and a Democrat, Bill Clinton—who together shaped and delivered the Uruguay Round, the North American Free Trade Agreement, the World Trade Organization and myriad other arrangements to allow for the freer flow of goods, communications and capital. This is worth remembering: Under both Republican and Democratic leadership, we did what was economically sensible.

The result was a long-lived expansion. But it ended in tears. Success led to complacency; complacency led to a tolerance and even encouragement of excess. We spent more than we could afford; our government—Republicans and Democrats alike—continued, at an accelerated pace, down the path of promising more in social programs and other spending programs than we could sustain. And on the regulatory front, we turned a collective blind eye to economic malpractice, resulting in the spectacular failure of Enron and culminating with the collapse of megabanks for which even a cursory glance at their balance sheets would have revealed, in the words of one of my colleagues, “nothing on the right was right and nothing on the left was left.” What started out as a widely heralded period of Great Moderation and seemingly endless growth metastasized into a cancer of excess and speculation, resulting in a crash from which we are now only slowly—very, very slowly—recovering.

The wreckage and its aftermath have been widely discussed and analyzed in countless fora and publications. This afternoon, I want to quickly highlight some key outcomes that are often overlooked.

First among them is that American businesses have emerged from the crisis revamped and hyper-efficient. When producers of goods and services cannot price what goes out the door as richly as the cost of what comes in the door, as was beginning to occur in the summer of 2008, or when demand for one’s product collapses, as happened post-Lehman, and firms can’t grow their top line—they batten down the hatches, looking to preserve their margins by cutting costs and ramping up productivity. Over the past four-plus years, U.S. businesses have cut operating costs to the bone. They have taken advantage of the cheap and abundant money made possible by the Federal Reserve to rejigger their balance sheets, exploiting the lower cost of debt and the Fed-driven bull market for stocks. American businesses—large and small, public and private—have done this with an alacrity that has dismantled the momentary notion that the European business model was superior, or that the Chinese adaptation of economic management was somehow better suited for a globalized economy. The private sector in the United States has adjusted to the new world faster than you can say, “Japan is No. 1.” American business is now more fit to compete than ever before.

Second, despite a lot of fire breathing and beating of the breast, our government has for the most part preserved the open-trade environment fashioned under our 41st and 42nd presidents. Protectionism has been held at bay. Our businesses have the entire world to source from and sell to. They also have the option to invest in job-creating ventures in more places than ever before, an option necessitating that our government reboot tax policy if it wishes for American businesses to invest in job creation at home.

Third, we have more than enough fuel in reserve to finance a prolonged period of job creation and economic expansion. The Fed has $1.4 trillion in excess private bank reserves on deposit at the 12 Federal Reserve Banks; there are additional cash resources lying fallow in nondepository financial enterprises; there is an additional $2 trillion or so of cash or cash-equivalent assets sitting on the sidelines in the coffers of businesses, above and beyond their operating needs and present plans for capital expenditure (capex). The cost of money is nil. Interest rates for creditworthy businesses are the lowest in the history of the republic. Hawks like me worry that our central bank has done far more than what was required and are concerned about the difficulties we will encounter when we need to tighten policy and exit from über-easy monetary policy. But this much I know: Presently, American businesses—big and small, public and private—have money burning a hole in their pockets. They have the financial wherewithal to expand and hire.

So here we are: American businesses are muscular and fit, rich and ready to roll. Now, what do we need to induce them to hire and put the American people back to work in order to restore economic growth and prosperity?

Obviously, we need to have demand to sell into. One does not need to read the Financial Times or the Wall Street Journal to know that the global economy has slowed and that exports will not drive U.S. final demand for the foreseeable future. At home, our government is drowning in debt and is hyper-leveraged. The cost of its debt burden is being mitigated by accommodative monetary policy, but our federal government has reached its limit as a direct source of aggregate demand or investment impetus. Even if we wanted to, we cannot look to government to propel the economy forward. This leaves domestic consumption and investment by the private sector as the best hope for us to remain “the brightest spot in the world economy.”

But, as any student of elementary economics knows, you can’t grow consumption unless you grow income. You can’t grow income unless you put the American people back to work. And you can’t put the people back to work unless businesses invest and expand their payrolls. But here is the rub: You can’t expect businesses to expand payrolls or job-creating capex unless they decide to use the abundant cash and cheap credit they have ready access to; they will not invest if they are totally uncertain about the return they might earn on that investment.

The first thing an aspiring MBA candidate or any entrepreneur learns is that business is the art of decisionmaking under conditions of uncertainty. Businesses can manage around a reasonable amount of uncertainty. But under conditions of total uncertainty, they cannot make the kinds of strategic decisions that result in significant expansion.

American businesses face the uncertainty of the European miasma much discussed here today. And they are increasingly uncertain about the once “sure thing” of China as a source of seemingly endless future demand. The slowing globalized economy—a “world economy on the ropes”—is without a doubt a great source of uncertainty and a retardant to job creation and expansion. But I would argue that nimble business operators can manage that risk. What they cannot manage is the mordant fiscal predicament hanging over their heads. A feckless American government—specifically, a Congress that hasn’t created a budget for more than three years—is poised to drive us off the so-called fiscal cliff. It has contrived a tax code and regulatory structure that would baffle a financial Houdini, has compounded the uncertainty facing businesses to a stifling degree. At present, no business—big or small, public or private—knows what its tax rates will be going forward. No business knows the social overhead needed to cover their employees. No business knows the degree to which federal spending programs will be changed or truncated, and how that will impact it or its customer base.

Without some certainty about your cost factors or reasonable understanding of the prospects for demand for your products, you go into a defensive crouch. You can’t budget; you can’t plan. You can’t run the risk of hiring and expanding beyond your replacement needs. Uncertainty of the kind I have just described cripples job creation, capital investment and the ability of businesses to realize their potential.

Here is a direct quote from the October survey of 691 small and medium-sized businesses by the National Federation of Independent Business (NFIB), released just yesterday:

“Uncertainty appears to dominate the outlook. … Spending and hiring are on hold … owners are in maintenance mode. ... Record numbers of consumers feel that the government is doing a poor job [per the University of Michigan survey] and record numbers of small-business owners report the political climate as a reason not to expand.” The text of the release goes on to say, “Only 8 percent [of those surveyed] complained that they didn’t get all the credit they wanted. Two percent say credit is their top business problem compared to 21 percent each citing taxes, regulations and red tape, and poor sales.”[3]

With regard to job-creating capital expenditures, two recent studies are worth contemplating. The first is a survey of CFOs conducted last month—before the last meeting of the Federal Open Market Committee—by Duke University’s Fuqua School. Of the 887 CFOs surveyed, only 14.5 percent listed “credit markets/interest rates” as among the top three concerns facing their corporations, with 84 percent saying they would not change their investment plans if interest rates dropped by 2 percent. In contrast, 43 percent listed consumer demand among their top three concerns, while 41 percent cited federal government policies.[4]

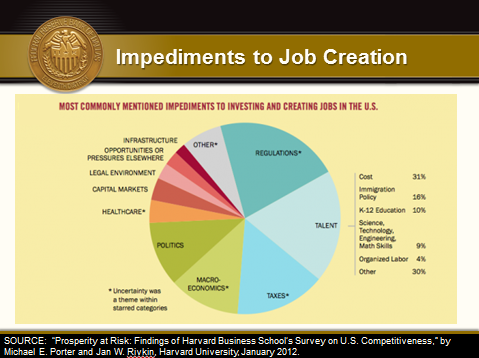

The second was a study conducted earlier in the year by Professors Michael Porter and Jan Rivkin, surveying nearly 10,000 Harvard Business School alumni, with a special focus on 1,700 respondents who were “personally involved in decisions about whether to place business activities and jobs in the U.S. or elsewhere.” Here is a pie chart from the study, summarizing the most commonly mentioned impediments to investing and creating jobs in the U.S.

Note the slices with asterisks, signifying that uncertainty is a theme within the categories of taxes, macroeconomics, regulations and health care. And note this direct quote from the report: “We asked an open-ended question: What are the greatest impediments to investing and creating jobs in the United States? … In the realm of taxes … respondents were deterred from investing in the United States not simply by a high statutory corporate tax rate, but also by the sheer complexity and uncertain future of the tax code. Similarly, with respect to regulations, respondents identified uncertainty as a barrier nearly as often as they pointed to regulatory burden and they highlighted the bureaucratic complexity commonly associated with compliance and permitting.”[5]

I did not see any direct reference in the text of Porter and Rivkin’s study to monetary policy as an inhibitor of investment plans.

If 42 percent of the NFIB’s businesses and 41 percent of those surveyed by Duke University cite federal government policies and red tape as their biggest inhibitor to job-creating expansion; if Porter and Rivkin’s work makes clear that uncertainty and complexity about taxes and regulation are deterrents to investing in the U.S.; if small and medium and large businesses feel they have sufficient financial access or wherewithal to conduct their affairs, then I don’t think it takes a genius to conclude what needs fixing if we are to treat the problem of unemployment and anemic economic growth in this country.

The fix lies not within the purview of the Federal Reserve. The fix lies solely in the hands of a government that has the power to shape taxes and spending programs to incent businesses to go out and hire rather than ball up into a defensive crouch, or worse, go elsewhere in the world that we worked so hard to liberate, to create jobs for others rather than for our own people.

The private sector and American business community are poised to expand. But they will not do so as long as we have a government that cannot resist the temptation to devise a politically convenient patchwork instead of laying out a convincing, reliable, long-term program that job creators and consumers can count on and plan around.

This is a point that I believe is widely neglected. Short-term fixes to our fiscal and regulatory pathology will not solve the problem of unemployment and economic sluggishness. The great inhibitor of job creation is the uncertainty over taxes and spending and regulation that plagues businesses. Even if businesses do not like the rules that govern their behavior, knowing those rules with certainty gives them something to plan around and navigate through. Presently, they haven’t the foggiest idea what the rules will be.

There are many macroeconomists and politicians who look at the fiscal cliff and, worried that inaction will plunge us into recession by both raising taxes and dramatically cutting spending, suggest that one-year or other short-term fixes will stave off recession. That is true from a macroeconomic standpoint; I have no quarrel with this logic. But it will come at a cost: Short-term fixes only push out the envelope of uncertainty. If the fix is for nine months or one year, then businesses will wait for nine months or a year before making major commitments to hire or invest. We might heave a collective sigh of relief that we did not drive off the cliff, but to job creators, this is just another reason to stall until a long-term, dependable resolution is crafted. A far better outcome will be for fiscal authorities to provide a convincing, long-term solution to our fiscal woes. Until then, our economy will perform well below capacity. We may outpace our hapless friends in Europe or elsewhere—we may remain the best-looking horse in the glue factory—but we will not realize our thoroughbred potential.

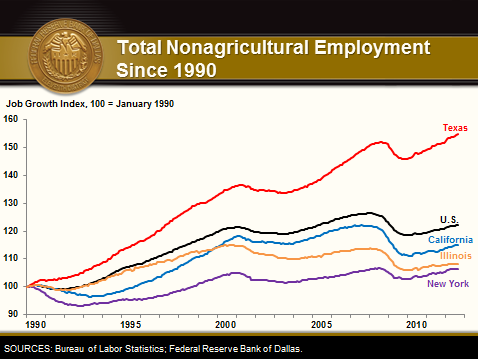

Luckily, we have some examples of success in the American economic laboratory. I live within one: Texas. Here is a graph charting 22 years of job creation in Texas versus the other large states and the United States as a whole.

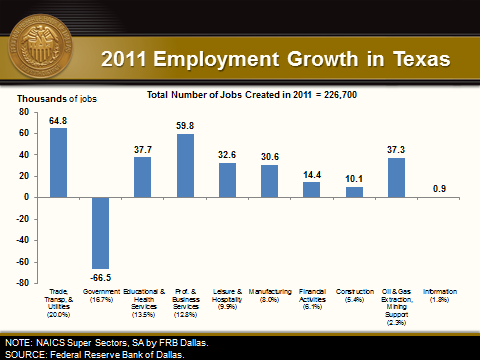

Think about it: Texas works with the same monetary policy as the other 49 states do. We pay the same interest rates on mortgages and on commercial and industrial and consumer loans; we work under the same federal regulatory regime governing banks and financial institutions and operate with the same stock market as the rest of the nation. To be sure, we have some natural advantages: We produce more oil than Norway and more natural gas than Canada. But here is the dirty little secret: Like the United States, we are a diversified economy. As this chart of where jobs were created in 2011 demonstrates, Texas is diversified pretty much along the lines of the United States. The oil and gas and mining sector accounts for only 2.3 percent of our employment. The sector created over 37,000 jobs in 2011, but the trade, transportation and utilities; professional and business services; and educational and health services sectors created more.

Working under the same federal fiscal and monetary policy as the rest of the United States, Texas has created over 50 percent more jobs than it had in 1990, whereas New York has expanded its nonfarm employment by a paltry 6 percent, Illinois by 8 percent and California by 14 percent.

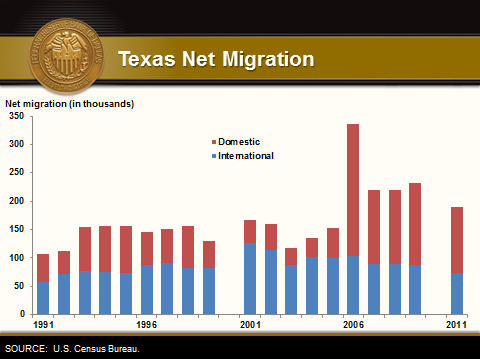

True, we lag the other states shown on this chart in social services. We are the antithesis of the welfare state. And yet we are the indisputable leader of job creation in the nation, outpacing the United States by 2.5 to 1 over two decades. We draw massive inflows of business investment, and we attract significant numbers of immigrants from within the United States and from abroad.

Look at this chart of immigrant flows for Texas.

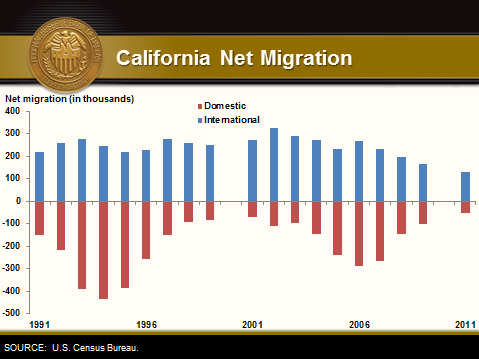

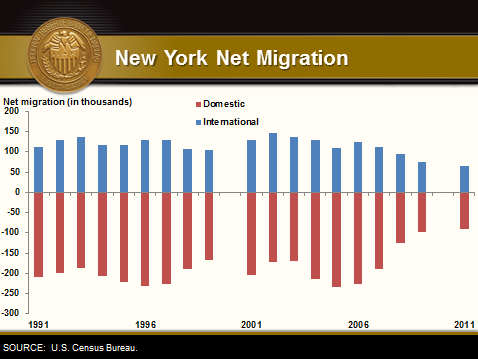

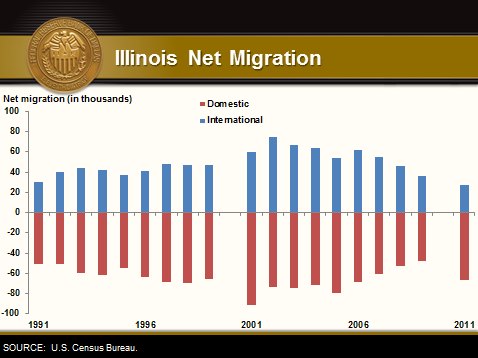

And now compare it with these charts of flows for California, New York and Illinois.

Yes, we have a low propensity of social services. But we excel at creating the single most important driver of human dignity and pride: jobs. If you believe people vote with their feet, the balance we have struck between job creation and social services seems appropriate enough to attract the diaspora of the other megastates. We must be doing something right in Texas.

The 22-year time span of the spaghetti graph I showed earlier covers legislatures that, under both Democratic and Republican leadership and Democratic and Republican governors, have created a pro-business, pro-growth environment. I would suggest that if you want to see an economy that has avoided the traps of an overburdened social structure like that which you have discussed today, and if you want to consider a fiscal and regulatory regime that attracts rather than chases away business and jobs, you might look to Texas.

You might then compare it to California, which has the opposite approach and is paying a price for it.

A friend of mine from Los Angeles recently encapsulated the difference between California and Texas in a short story that you Cato-ites might find amusing:

“The governor of California is jogging with his dog along a nature trail. A coyote jumps out and attacks the governor’s dog, then bites the governor. The governor starts to intervene, but reflects upon the movie Bambi and then realizes he should stop because the coyote is only doing what is natural.

“He calls animal control. Animal control captures the coyote and bills the state $200 for testing it for diseases and $500 for relocating it. He calls a veterinarian. The vet collects the dead dog and bills the state $200 for testing it for diseases. The governor goes to the hospital and spends $3,500 getting checked for diseases from the coyote and getting his bite wound bandaged.

“The running trail gets shut down for six months while the California Fish and Game Department conducts a $100,000 survey to make sure the area is now free of dangerous animals. The governor spends $50,000 in state funds implementing a ‘coyote awareness program’ for residents of the area. The Legislature spends $2 million to study how to better treat rabies and how to permanently eradicate the disease throughout the world.

“The governor’s security agent is fired for not stopping the attack. The state spends $150,000 to hire and train a new agent with additional special training, re: the nature of coyotes. People for the Ethical Treatment of Animals (PETA) protests the coyote’s relocation and files a $5 million suit against the state.

“The governor of Texas is jogging with his dog along a nature trail. A coyote jumps out and tries to attack him and his dog. The governor shoots the coyote with his state-issued pistol and keeps jogging.

“The governor spent 50 cents on a .380-caliber, hollow-point cartridge. Buzzards ate the dead coyote.

“And that, my friends, is why California is broke and Texas is not.”

We don’t have to follow the path of California. Or that of Europe. Texas has no monopoly on good government. It is but an example, however imperfect, of what I believe Cato holds dear in its vision for an operating economy. And if the United States Congress would look to it and other states that have found the secret to unleashing the best of the animal spirits of the marketplace, there is no question in my mind that America can outshine the rest of the world and lead it back to economic growth and expanding prosperity. To unlock that brighter future, Congress must set aside its partisan bickering and short-term political myopia and get down to crafting a tax, spending and regulatory regime that not only reins in deficit spending and runaway unfunded liabilities, but also focuses on incentivizing America’s businesses to create jobs. If they do, we will end up like Secretariat at Belmont, winning the race for prosperity by 31 lengths or more.

Thank you.

Notes

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.

- “U.S. Defies Threat of Global Recession,” by Chris Giles, Financial Times, Oct. 8, 2012.

- “Global Recession Risk Rises,” by Sudeep Reddy and Bob Davis, Wall Street Journal, Oct. 9, 2012.

- See Small Business Economic Trends survey, National Federation of Independent Business, October 2012, www.nfib.com/research-foundation/surveys/small-business-economic-trends.

- See Duke University/CFO Magazine Global Business Outlook Survey, Duke University’s Fuqua School of Business, www.cfosurvey.org.

- “Prosperity at Risk: Findings of Harvard Business School’s Survey on U.S. Competitiveness,” by Michael E. Porter and Jan W. Rivkin, Harvard University, January 2012.

About the Author

Richard W. Fisher served as president and CEO of the Federal Reserve Bank of Dallas from April 2005 until his retirement in March 2015.