The State of the West (With Reference to George Shultz, Eisenhower, Buzz Lightyear, George Strait, the San Francisco Fed and Adam and Eve)

November 15, 2012 Stanford, California

Thank you, John [Shoven].

I am delighted to be back on the Stanford campus, where after wandering in the cold, forbidding pedagogical climes of Harvard and Oxford, I finally came to the student nirvana of the Stanford Business School. It was here where I was taken under the wings of intellectual giants such as Lee Bach, Alain Enthoven, Jack McDonald, Bill Sharpe and others, whose devotion to teaching was equal to their scholarly accomplishments.

I should note that, despite my having taken a degree here, the Graduate School of Business has gone on to be ranked first or close to first among business schools in America and the world by most all who compile such metrics. Particularly important to me, in 2011 the Aspen Institute ranked Stanford No. 1 worldwide for incorporating issues concerning social and environmental stewardship into its curriculum.[1] Indeed, as I see it, the tradeoffs that one has to manage between fiscal responsibility and social and environmental stewardship are at the nexus of the potential and of the problems confronting the West today.

A Tip of the Hat to George Shultz

Before addressing the state of the West, however, I want to say that I am humbled to have been asked to follow George Shultz on this program. I can’t think of any living individual—or many in the history of our country—who have served in as many cabinet and senior policy posts, and have done so with such distinction and integrity, as George. We can all tell many stories about George Shultz. My favorite dates to 1971, when he was director of the Office of Management and Budget during the Nixon administration. George had assumed the office just as federal government outlays had for the first time in American history exceeded $200 billion, with the deficit for fiscal year 1971 set to come in at a startling $23 billion, or 2.1 percent of our nation’s gross domestic product.

Alarmed at this development, George called into his office the venerable Sam Cohen—a living encyclopedia of U.S. budgetary history—and asked, “Between you and me, Sam, is there really any difference between Republicans and Democrats when it comes to spending money?” Cohen’s reply was classic: “Sir, there is only one difference: Democrats enjoy it more.”

I am a central banker. I checked partisanship at the door when I joined the Federal Reserve Bank of Dallas seven years ago and haven’t looked back. During today’s brief comments and in the Q&A session that follows, I will refrain from talking about politics per se. This is despite the fact that, presently, everyone and their brother wants to discuss the aftermath of the recent elections and speculation about who will do what to whom in addressing the fiscal cliff and the upcoming debt ceiling.

Eisenhower’s Warning

I’ll just say this: Our Congress—past and present—has behaved disgracefully in discharging its fiscal duty. Its members have not shown themselves to be true born leaders. We all know it is far past due for our federal politicians—Democrats who may “enjoy it more” and Republicans who are distinguished only by that single difference—to begin acting like the responsible fiduciaries of the nation’s fiscal accounts they are supposed to be, rather than as the parasitic wastrels they have unwittingly let themselves become.

In his terrific new book, Ike’s Bluff, Evan Thomas writes that in President Eisenhower’s farewell address from the White House, he warned, “We cannot mortgage the material assets of our grandchildren without risking the loss also of their political and spiritual heritage. We want democracy to survive for all generations to come.”[2]

The jig is up. Our fiscal authorities have mortgaged the material assets of our grandchildren to the nth degree. We are at risk of losing our political heritage of reaching across the aisle to work for the common good. In the minds of many, our government’s fiscal misfeasance threatens the world’s respect for America as the beacon of democracy.

Buzz Lightyear Monetary Policy Is Not the Answer

Only the Congress of the United States can now save us from fiscal perdition. The Federal Reserve cannot. The Federal Reserve has been carrying the ball for the fiscal authorities by holding down interest rates in an attempt to stoke the recovery while the fiscal authorities wrestle themselves off the mat. But there are limits to what a monetary authority can do. For the central bank also plays a fiduciary role for the American people and, given our franchise as the globe’s premier reserve currency, the world. We dare not become the central bank counterpart to Congress by adopting a Buzz Lightyear approach of “To infinity and beyond!” by endlessly purchasing U.S. Treasuries and agency debt so as to encumber future generations of central bankers with Hobson’s choices when it comes to undoing what seems contemporarily appropriate.

So my only comment today regarding the recent federal elections is this: Pray that the president and the Congress will at last tackle the fiscal imbroglio they and their predecessors created and only they can undo. And if our nation’s authorities need to draft George Shultz back into service to get the job done, I am all for sending the young man back to Washington.

The Uncertain State of the American West

And now, to address the state of the West. The invitation for this symposium notes that, “the American West is the most dynamic region in the nation.” It goes on to posit that “The Western United States has been the source of innovation and growth and can be an engine of economic recovery.” (Italics mine)

It is noteworthy that the latter sentence confidently refers to the past—“has been”—but is somewhat conditional looking to the future, using “can be” in asserting our role as an engine of recovery.

To understand the present West, I thought it would be worthwhile to look at some graphs and trends. For the West is a many-splendored thing. Parts of it are, indeed “dynamic”; other parts are languishing. Parts are indeed engines of growth; others are sputtering and in decline, detracting from the economic recovery.

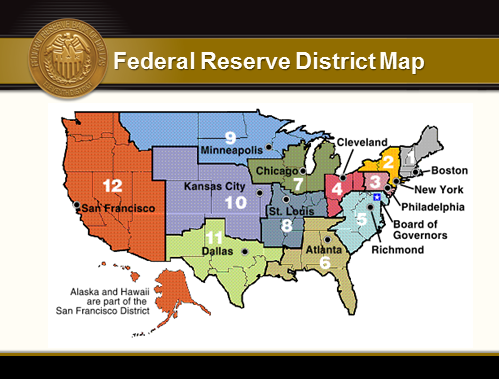

For the purpose of this conference, the organizers define the West as encompassing the Ninth, Tenth, Eleventh and Twelfth Federal Reserve districts—specifically the states and territories where the Federal Reserve’s business is administered by the Minneapolis, Kansas City, Dallas and San Francisco Federal Reserve banks.[3]

Jobs, Jobs, Jobs

As you know, when it comes to monetary policy, the Federal Reserve banks and the Board of Governors labor under a dual mandate: We conduct policy with an obligation to preserve price stability and to engender full employment. Given that, at present, inflation and inflationary expectations are tame but the nation is beset by un- and underemployment of disproportionate size, I thought we might look at trends in employment in assessing just how dynamic the West really is as an engine of economic prosperity. A job, after all, is the source of income and the root of security and wealth for a productive people: Without income a person cannot consume and invest, engaging the driving engines of economic growth. Most importantly, a job is the route to dignity as we have historically defined it in America.

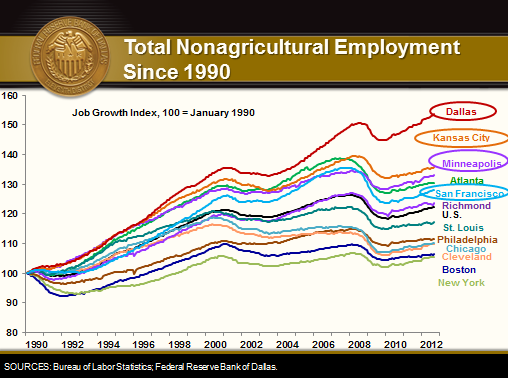

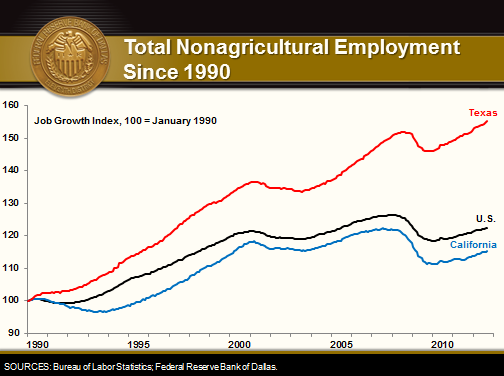

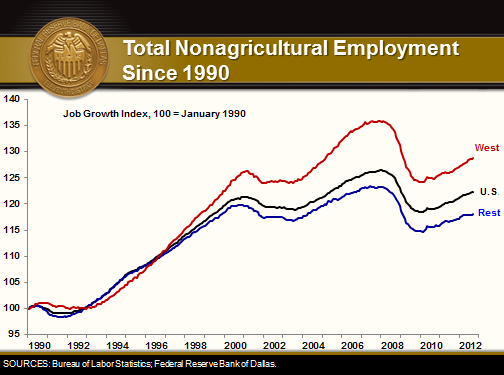

The West as delineated by the four Federal Reserve Districts has indeed been the engine of economic growth for the nation, as evident in this graph that charts nonagricultural employment going back 22 years:

It is fair to say that in terms of job creation, the West is the best compared to all the rest and has compensated for the underperformance of the East. As the chart shows, the rate of job creation in the Ninth, Tenth, Eleventh and Twelfth Federal Reserve districts has outpaced that of all the other eight Federal Reserve districts combined since 1997.

If you break employment growth down by Federal Reserve District, the employment dynamic since 1990 looks like this:

The four Federal Reserve Districts that define the West, plus the areas covered by the Federal Reserve Banks of Atlanta and Richmond, have each outperformed the nation in job creation. Of note to those who might later read this speech in Gotham and remain devotees of the perspective captured by Saul Steinberg’s iconic “View of the World from Ninth Avenue” cover of The New Yorker, this graph does not present a happy picture: Total employment growth in the Empire State over the 22-year period has been 6 percent, a compound annual growth rate of 0.26 percent, one-eighth that of Texas over the same period.

Note the Disparities, However

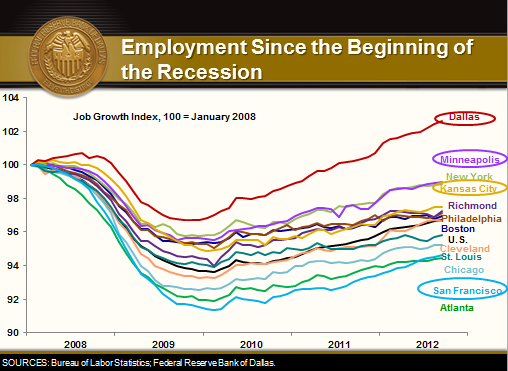

If you zoom in on the employment dynamics that have ensued with the onset of the financial crisis, you begin to see important disparities in employment growth within the West.

The Dallas Fed’s district is the only one to have punched through employment levels that prevailed at the end of 2007. The Minneapolis and Kansas City districts rank second and fourth in post-recession performance, while employment within the San Francisco Federal Reserve District has failed to recover with the same vigor.

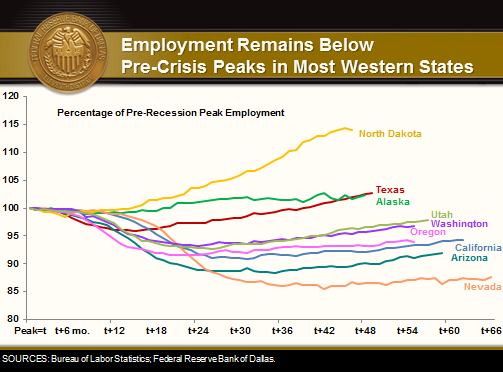

A more revealing divergence is evident when you go back to 1990 and plot employment growth of individual states, rather than Federal Reserve districts. For illustrative purposes, and because they bear a disproportionate weight, covering almost 30 percent of the nation’s population and over 75 percent of the West’s, I am going to focus on the specifics of the Eleventh and Twelfth Federal Reserve districts—the areas covered by the Dallas Fed and the San Francisco Fed.

The Eleventh District covers 27 million people living in Texas, northern Louisiana and southern New Mexico. Over 96 percent of the output of the Dallas Federal Reserve District is produced by the 26 million people of one state, Texas. By contrast, California accounts for 61 percent of the San Francisco Fed’s district output and 37 million souls, or roughly 58 percent of the district’s estimated population of 64 million. The remainder of the district’s output and population is spread across eight states: Alaska, Arizona, Hawaii, Idaho, Nevada, Oregon, Utah and Washington (plus three Pacific territories).

Over the past 22 years, Texas has grown employment at an average annual rate of 2 percent. It has been bettered by Nevada at an average annual growth rate of 2.8 percent, Utah at 2.6 percent, Arizona at 2.4 percent and Idaho at 2.3 percent. Alaska has compounded job creation at 1.6 percent, Washington at 1.4 percent and Oregon at 1.2 percent. And California? California has experienced an average annual employment growth of 0.64 percent (zero-point-six-four percent). It has bettered New York, but that is nothing to write home about except as a tale of woe.

Most recently, from the onset of the recession of 2008 to present, only one state in the Twelfth District has returned to prerecession employment levels: Alaska. The only other Western states to punch through prerecession employment levels have been North Dakota (in the Minneapolis Fed’s district) and … Texas. One might quickly deduce that these states all share a common characteristic: They are all big oil and gas producers. But as we shall see, while this certainly helps, it is only part of the picture as regards Texas.

Comparing Texas and California

I am going to narrow this down a little to focus specifically on Texas and California, the megastates of the West.

I think it fair to say that, as regards job creation, Texas has been “dynamic,” per this conference’s flyer. A better descriptive word starting with ‘dy’ for California would be “dysphoric,” an adjective derived from dysphoros, classical Greek for “hard to bear” and more commonly translated into English to describe “a state of feeling unwell or unhappy,” according to Webster’s Ninth New Collegiate Dictionary.

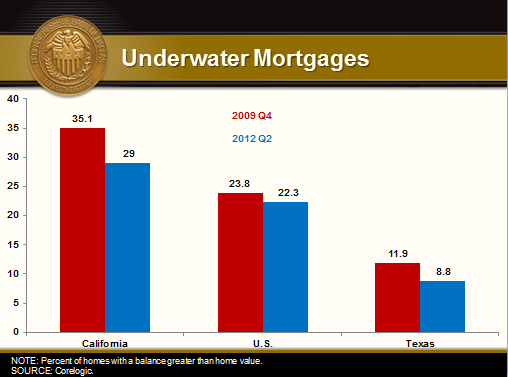

A snapshot of the unhappy state of affairs in California is provided by a much discussed metric: the percentages of homes that remain “underwater,” as shown by this graph comparing California with the rest of the U.S. and Texas.

There are many other economic indicators that illustrate the dire economic condition of California and the more felicitous economy of Texas. You all know what they are; I won’t dwell on them for fear of being pelted by bread rolls or worse at this pleasant luncheon.

The question is: Why? Why has the Golden State lost its luster and become a place where the economic burdens of its people have become hard to bear, when once it was the very exemplar of happy, hearty dynamism that is the West? How could it be that the hardscrabble Lone Star State has come to replace California as the engine of the West’s economic growth?

Don’t Blame the Fed…

There are many reasons, to be sure. But one thing I can tell you with absolute certainty is that California’s underperformance has nothing to do with the Federal Reserve. After all, Texas works with the same monetary policy as California and the other states of the union. Texans pay the same interest rates on mortgages and on commercial and industrial and consumer loans; they work under the same federal regulatory regime governing banks and financial institutions and operate with the same stock market as the rest of the nation.

…and Don’t Attribute It Just to Oil

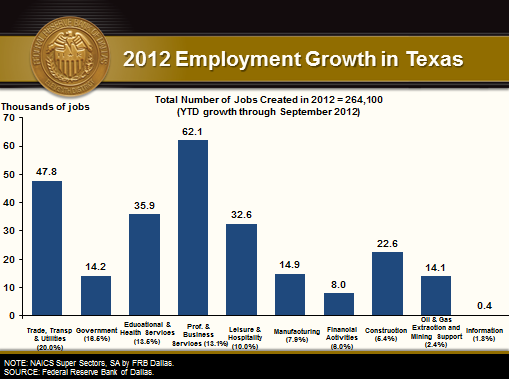

Nor can Texas’ relative outperformance be attributed, as it stereotypically is, to oil and gas. To be sure, Texas produces more oil than Norway and more natural gas than Canada. But here is the dirty little secret: Like California, Texas has a widely diversified economy. As the following chart of where jobs have been created thus far in 2012 demonstrates, Texas is diversified more than most people think. The oil and gas and mining sector accounts for only 2.4 percent of its employment and produces approximately 8 percent of the state’s tax revenue. Utilizing the latest technology to develop new oil and gas and gas liquid fields, the energy sector has created over 14,000 jobs in Texas thus far in 2012. But professional and business services have created 62,100; trade, transportation and utilities—47,800; educational and health services—36,000; leisure and hospitality—33,000; construction—23,000; and even the government has created more than the oil and gas sector, with 14,200 jobs. All in, the non-energy sectors of the economy have created nearly 640,000 jobs since the recovery began in Texas in November 2009.

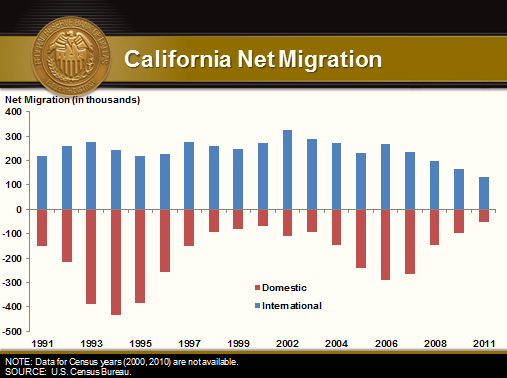

True, Texas lags California and most other states in social services. We are the antithesis of the welfare state. And yet, we are the indisputable leader of job creation in the nation, outpacing the United States by a factor of more than 2-to-1 over two decades. We draw massive inflows of business investment, and we attract significant numbers of immigrants from within the United States, even more so than we draw in from across the border and abroad.

All My Exes Live in Texas

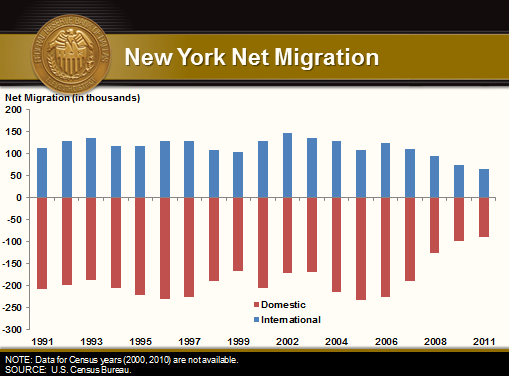

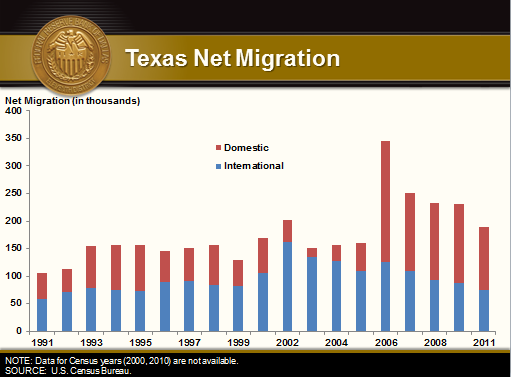

Look at these charts of net migration for California and Texas (I have thrown in New York for added measure):

Yes, Texas has a low propensity of social services, and employment growth should not be the only criterion for evaluating a state’s performance. But we must remember that economic growth is the foundation for the other goals and aspirations a society may have. You cannot pay for social services unless you have the tax revenue to do so. You cannot have tax revenue unless you have sources from whom to collect it. And the best revenue source of all is a citizenry that is fully employed and an economy that is prosperous. Moreover, we must not forget that a job is critical to a sense of self-worth, dignity and pride.

As these previous charts indicate, Texas is a leader in creating jobs. If you believe people vote with their feet, the balance Texas has struck between job creation and social services seems appropriate enough to attract the diaspora of the other megastates.

The great country western singer George Strait appears to have summed it all up with his iconic tune “All My Exes Live in Texas”: ex-businesses, ex-workers and ex-taxpayers seem to be joining his many ex-wives in migrating to our part of the West.

Adam and Eve

To be sure, Texas is hardly a paradise. We have plenty of natural beauty, but nothing we have can compare to the magnificence of California’s beaches and ocean vistas, mountains, redwood forests, and rich and plentiful ecosystems. We are admittedly miserly with our social welfare programs. We fall short in many other social metrics. And yet for the West—beyond Texas and the job-creating states in the Ninth and Tenth Federal Reserve districts—to remain the source of innovation and growth and economic prosperity that it has been, California will have to achieve the kind of balance between social and environmental responsibility and the capacity to provide for a prosperous economy that is taught at the Graduate School of Business here at Stanford.

Right now, that balance seems to have been lost. It is costing California jobs and people and is depleting its revenue coffers. We shall see if the new tax increase levied by popular acclaim on top of already highly taxed and heavily regulated business operators will improve or exacerbate that imbalance.

I have my concerns. The Federal Reserve Bank of San Francisco recently released a paper titled “Assessing State Business Climate Indexes.”[4] It confirms what you needn’t have a Stanford education to conclude: “Economies of states ranked high on the tax-and-cost indexes”—meaning lower taxes and costs of doing business—“tended to grow faster than the states ranked [poorly] on these indexes.” Of course, one need only look out the window here to see that a pretty attractive quality of life abounds in slow-growing, high-tax and expensive California. But the question is: How long can a high quality of life be maintained if too few jobs are being created and people and businesses, taxpayers all, are fleeing to other states?

As much as I respect the San Francisco Fed’s research department, I think the cartoonists at The New Yorker have said it best. This gem appeared in a recent edition and sums it all up.

Surely, the West would be better off with a strong, job-creating Texas and a strong, job-creating California, just as it has strong, job-creating economies in many if not all of the states of the Ninth and Tenth Federal Reserve districts and some parts of the Twelfth. I am hoping this conference will zero in on how this can be accomplished, for the West can only be as strong as our weakest link—and we can ill afford to have California remain so.

Thank you. Now, in the great tradition of central bankers, I would be happy to avoid answering any questions you might have.

Notes

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.- See www.beyondgreypinstripes.org/rankings.

- See Ike’s Bluff: President Eisenhower’s Secret Battle to Save the World, by Evan Thomas, New York: Little, Brown and Co., September 2012, p. 4.

- The organizers of the conference are the Stanford Institute for Economic Policy Research (SIEPR) and the Bill Lane Center for the American West.

- “Assessing State Business Climate Indexes,” by David Neumark, Jed Kolko and Marisol Cuellar Mejia, FRBSF Economic Letter, Federal Reserve Bank of San Francisco, Sept. 4, 2012.

About the Author

Richard W. Fisher served as president and CEO of the Federal Reserve Bank of Dallas from April 2005 until his retirement in March 2015.