Homage to Texas, the Great People of Dallas and the Staff of the Dallas Fed

March 6, 2015 Dallas Speech in PDF

Thank you Ralph (Hawkins). I am honored to be speaking to the Dallas Regional Chamber of Commerce as I finish my 10-year tenure as president and CEO of the Federal Reserve Bank of Dallas.

Coming to Dallas

I first came to Dallas in 1973 and I remember one thing above all: A palpable sense that this was a “can-do” town in a “must-do” state.

Before settling here, I worked on Wall Street and lived in Washington, D.C., serving in the U.S. Treasury. I learned from each of those experiences and enjoyed them. But having experienced the dynamism of Dallas, I couldn’t wait to return here and make this my home. I specifically recall taking my firstborn son, Anders, on a ferry to see the Statue of Liberty in 1979. We returned to Manhattan as the sun was setting. The Big Apple glimmered in the gold light of the setting sun. But holding my little boy in my arms, I thought to myself: This is a glorious city, but New York is fast losing its right to name itself the Empire State. New York is the past; Texas’ Lone Star illuminates the real empire state. It was at that very moment that I decided Dallas is where I ought to plant my roots and raise my son and those children who will follow him.

I was right. And I thank Ray Hunt and others who are here today, and Jim Collins, Stanley Marcus, Charlie Pistor, Johnny Johnson, Irvin Levy, Bob Strauss and others who have since departed this earth but are still vivid in my memory and hold a special place in my heart, for encouraging me out of the wilderness, bringing me to economic nirvana.

The Sweet Ambrosia of Texas Brag: In Context

Now, whenever foreigners—columnists from the New York Times, for example—think I am simply intoxicated with the ambrosia of Texas Brag, I like to walk them through the facts, not the lore.

Here is a fact—a number—that focuses the mind.

$1,605,576,000,000: That is the estimated gross state product of Texas, the amount of output we produced in 2014. It is roughly equivalent to the output of Canada, our great neighbor to the north.

And with each passing day, Texas gains momentum.

We estimate that the real Texas economy grew by $382 billion, or 36 percent, between 2005 and 2014. That increment equates to adding more than the entire output of the country of Norway, my maternal homeland and now one of the world’s richest nations measured on a per capita basis. Or to bring it closer to home, that’s almost the equivalent of gaining the sum total of the economic capacity of New Mexico, Oklahoma and Arkansas.

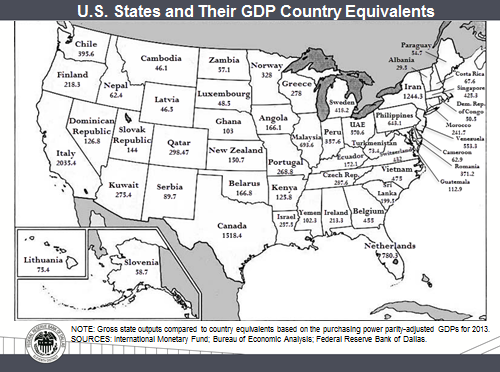

These sorts of comparisons provide for great cocktail conversation. So might this: a tongue-in-cheek map of the United States that has been assembled by my staff that compares the output of each state of the union with an international counterpart.

Rhode Island—whose wonderful Bryant University awarded me an honorary doctorate last June—produces the economic equivalent of the Democratic Republic of the Congo. And New Mexico produces the economic equivalent of Serbia, Oklahoma equates to Belarus, and Arkansas produces the equivalent of Kenya. It is noteworthy to me that the old Empire State, New York, today produces the economic equivalent of Iran. To be sure, California still out-produces us by a significant margin. But I rather like pointing out that it can be compared to Italy, for unless it corrects its course of over-taxation and regulation, it will surely end up with an economy very much like that of the Repubblica Italiana.

Jobs Are Paramount

We in Dallas understand that the route to dignity is a job. Working women and men are proud women and men. Nobody wants to be dependent on handouts from the state; they want to pull themselves up by the bootstraps of hard work.

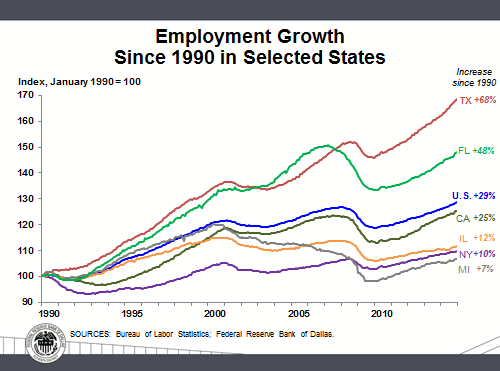

The Federal Reserve is charged with a “dual mandate”: Preserving price stability and creating the monetary conditions to enable full employment. Here is the record of Texas in creating jobs, going back to 1990:

Texas has outperformed the rest of the U.S. in the pace of job creation by a greater than 2-to-1 margin for more than two decades. For every 100 jobs that existed here 25 years ago, we have 68 net new jobs today. The former center of the industrial revolution driven by Henry Ford and the auto magnates, Michigan, has created only seven net new jobs; New York has created 10; the Land of Lincoln, Illinois, has created 12. Even California, the epicenter of cyberspace, has created only 25 jobs for every 100 that existed in 1990.

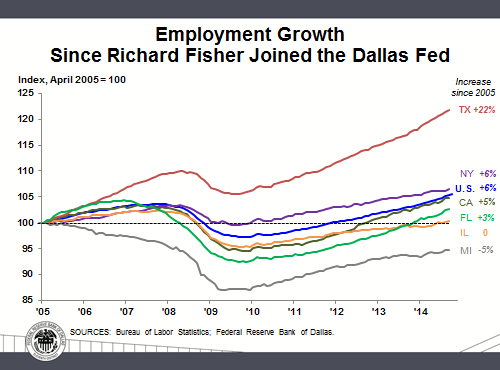

And here is a slide my staff has given me as a parting gift: The growth in jobs since I assumed the helm at the Dallas Fed almost a decade ago.

Of course, I’d like to take credit for this spectacular outperformance by Texas in enabling the people of Texas to realize their economic potential. But I can’t. I can only say that I have been lucky to have helmed the Dallas Fed during a time when Texas and its great cities like Dallas have blossomed and clearly outpaced the rest of America. Since April 2005, Texas has created more than 2.2 million of the 7.1 million jobs gained by the country as a whole. That means Texas accounted for almost a third of net job gains seen in the U.S. over the past 10 years, while only constituting 8.5 percent of the country’s population.

“Bull Droppings”

My “foreign” friends will say “but you only create low-paying jobs in Texas” or “they are all in the oil and gas sector.” The Wall Street Journal, cleaning up my two-word response to this assertion last month, quoted me as saying this myth was “bull droppings.”[1]

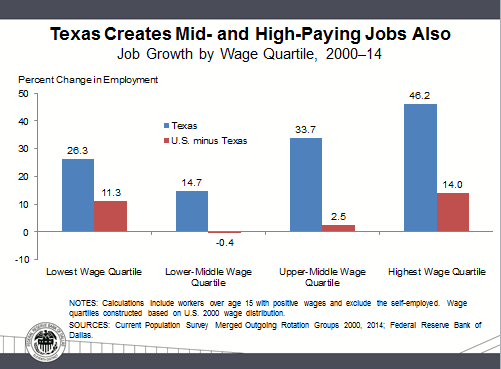

Here are the facts: Between 2000 and 2014, the United States economy ex-Texas (that is, were we allowed to secede statistically—and only statistically, mind you—from the union) has experienced job destruction in the two middle-income quartiles of workers, the muscle and fiber of our country. As you can see from this chart, Texas has indeed outperformed the rest of the U.S. in creating low-income jobs. But we have also outperformed in creating jobs in every income quartile.

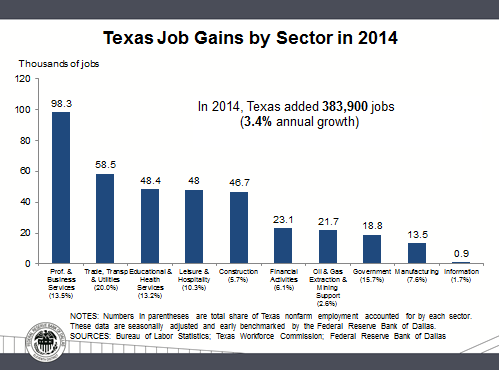

And Texas has seen job creation across a widely diverse swath of industrial groups, as is evident from this slide of jobs created by sector last year:

2014: A Year of Records for Texas

2014 was a year of records: State output climbed to new heights; employment growth was broad-based across industries and income groups; the state reached new highs for income per person; Texas was again the top migration destination from other U.S. states; we had the highest percentage of home mortgages with positive equity; construction contract values reached a new record; and oil and gas production soared along with refining capacity and exports of petroleum products.[2]

Texas grew 3.4 percent from December 2013 to December 2014, and yet, if one has been reading major U.S. newspapers recently, it has been nearly all doom and gloom for Texas. To which I suppose I should once again say: “Bull… droppings!” To be sure, hydrocarbon prices have moved sharply lower the past seven months; but Texas is a diversified economy. The state has benefited from high oil prices, being the sixth-largest oil producer and the top oil services provider in the world. So, of course, lower oil prices are a headwind to economic growth here. But my researchers at the Dallas Fed don’t see recession in the cards, simply a downgrade to growth to something more like 2 percent, which would be a slower pace of growth than the nation for the first time since 2003.

Dallas Fed Facts

The dynamism of our state is also reflected in the activity I have personally witnessed during my tenure at the Dallas Fed. The Dallas Fed operates out of its headquarters in Dallas and through its branches in Houston, San Antonio and El Paso. In April 2005 our total Bank assets were $35 billion. At the end of 2014, our assets were $160 billion. Some 600 more banks and bank branches are ordering and/or receiving currency from the Dallas Fed since 2005. The Bank’s on-site holdings of cash increased nearly 170 percent from 2005 to 2014, from $137 billion to over $368 billion.

And our loan portfolio has expanded significantly: The Dallas Fed made 1,764 loans through our discount window for a total of $68,522,804,000 during my watch as president and CEO. I approved each and every one of these loans personally. I’m happy to report that we didn’t lose a penny on a single one of them.

Last but not unimportantly, in 2005 we distributed from our operating profits at the Dallas Fed $1.1 billion to the U.S. Treasury; last year, we distributed $3.4 billion. Over the course of my decade in this job, the Dallas Fed has distributed a total of $23 billion to the U.S. Treasury. You are looking at one of 12 people—the 12 presidents of the nation’s Federal Reserve banks—who actually pay down the nation’s deficit!

The men and women of the Dallas Fed serve Texas and our nation well. I’m extremely proud of them.The Good People of the Fed

Those who have taken the time to read some of the 155 published speeches I have given over the past decade know that I like to illustrate a point and put things in context by drawing on literature. So I am going to use a literary reference to put in context the blessing and privilege of serving alongside the people I have worked with at the Dallas Fed and in our branches, the good women and men who guided me through 96 regular and special meetings of the Federal Open Market Committee under three Fed chairmen, the many conference calls Ben Bernanke held during the financial crisis, a decade of Conference of Presidents meetings where we organize the operations of the Federal Reserve System, and the day-in, day-out handling of our business operations in Dallas, Houston, San Antonio and El Paso.

One of my all-time favorite books was a gift from Anders, the son I carried in my arms on that fateful day after visiting the Statue of Liberty. It is titled The Match. It details in beautifully written, poignant prose a legendary round played at Cyprus Point in 1956 between two of golf’s greatest professionals, Byron Nelson and Ben Hogan, and the two great amateurs of the time, Ken Venturi and Harvie Ward. But it is more than a golf book. It spoke to me in a way few outside the hallowed halls of the Fed might understand.

In the afterword of The Match, the author, Mark Frost, laments the transformation of golf into a big-money sport from its origins and long tradition of honorable competition played by decent men simply for the honor of serving the game. “Not enough of the meaningful prizes in life are contested solely for honor anymore, for the love of the thing itself, or the undiluted satisfaction of testing your mettle against the best you can find and, win or lose, walking away the better for it because of the truths it enabled you to face and find out about yourself.”

I didn’t take the job at the Dallas Fed for money; I gave up a lot of money to take that job. But I gave up what I was doing for something far better.

For 10 years now, I have been privileged to work alongside the most decent men and women at the Fed who are there solely for the honorable tradition of central banking, for the love of the thing itself. I have tested whatever mettle I have been able to muster against the most thoughtful and brilliant, earnest, devoted and articulate people I have ever known. And I had the privilege of doing so in the most civil and dignified forum in the government of the greatest country on earth, during one of the most challenging periods in its 239-year history. I have won some arguments; I have lost plenty. I say goodbye to them now, better for the truths they enabled me to learn not only about economics and monetary policy and operating a Federal Reserve Bank but about myself. They have provided me with the most meaningful experience of my professional life.

Texas Jockeys Secretariat

On May 10, 2005, I gave my first speech in Dallas as president and CEO of the Dallas Fed to the World Affairs Council. Today, I give my last speech to you.

I conclude by saying I am a proud Dallasite and a proud Texan. But I am above all a proud American. This great country took my parents in and enabled their child—me—to live the American dream.

Having lived that dream, I harbor no doubts about my country’s future. During the recent financial crisis, I admit to having some doubts; I was given to saying that relative to all other economies, America’s was “the best-looking horse in the glue factory.” Now I phrase it differently. Just look at the job creation numbers announced this morning: The nation’s payrolls increased by 295,000 in February, and the unemployment rate has dropped to 5.5 percent, approaching what many consider the non-accelerating inflation rate of unemployment that most economists think we are capable of achieving.

If you parse the figures, you will understand what makes me grin from ear to ear: 288,000 of those jobs were created by the private sector; only 7,000 by government. Compare that to Europe or Japan or China or whomever else the naysayers have claimed will lap us. Nowhere on the planet are there businessmen and women who are the equal to ours in entrepreneurship and innovation and determination to master the process of creative destruction and make it work for the betterment of all people. And nowhere in America is that done better than right here in Dallas and in Texas.

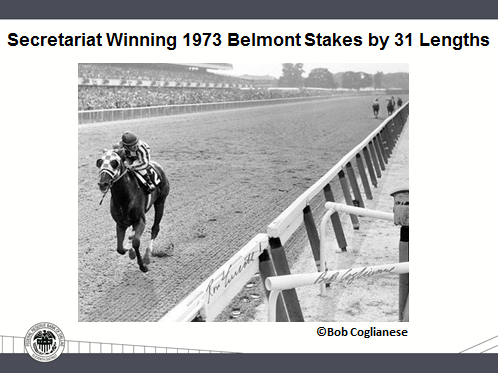

Here is the image I now have in mind for the American economy.

We are the economic equivalent of Secretariat winning the Belmont Stakes in 1973 by 31 lengths. We are the best-looking, the strongest, and the fastest horse on the global track. And sitting atop that magnificent thoroughbred, goading and guiding it to greatness, is the best jockey one can imagine: Texas.

Thank you. Thank you for allowing me the honor and privilege of serving you this past decade.

Notes

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.

- “Plunging Oil Prices Test Texas’ Economic Boom,” by Jon Hilsenrath, Ana Campoy and Ben Leubsdorf, The Wall Street Journal, Jan. 4, 2015.

- Of note, according to CoreLogic Third Quarter 2014 Equity Report, Houston and Dallas are the nation’s top major metros for the highest percentage of residences with positive equity: 97.5 and 97.0 percent, respectively.

About the Author

Richard W. Fisher served as president and CEO of the Federal Reserve Bank of Dallas from April 2005 until his retirement in March 2015.