Taking the Long View: Creating a Better Future for Our Children and Grandchildren

April 16, 2018

Turn on the television or pick up a newspaper and you’ll likely see a discussion of what’s happening now—the latest scandal, current geopolitical developments, stock market movements, the latest GDP numbers or corporate earnings announcements. This focus on the here and now is so ingrained that we may not be aware of the short-term nature of the news flow. In the midst of this, it is sometimes easy to lose focus on the fact that short-term events often occur as a result of more persistent underlying forces that can take many years to unfold.

What does all this have to do with the work of a central banker? I spend a good part of my time trying to understand economic conditions and make sound monetary policy decisions based on my analysis of those conditions. In this job, I am keenly aware that short-term cyclical developments are only part of the story in understanding the U.S. and global economies.

The Cyclical Versus the Secular

The U.S. economy has historically moved in cycles. That is, it typically behaves in patterns that tend to be, with variations, repeating. There are stretches of time when GDP grows, and these tend to be followed by periods of GDP decline, followed eventually by a return to growth, followed again by a period of decline, and so on. These cycles often repeat themselves although the exact length, magnitude and character of the pattern varies based on a variety of underlying factors.

Economists use models and other analytical techniques to assess and attempt to forecast the performance of the economy in these cycles. Based on these models, economists look for markers and other data that indicate where we are in the cycle as well as the strength and character of the economy’s performance. GDP, unemployment, various gauges of manufacturing and service sector activity, and inflation measures are examples of economic indicators that are regularly monitored. These measures are widely reported and tend to fluctuate based on factors such as industry developments, commodity prices, market developments, global developments as well as monetary and fiscal policies, and the stage of the current economic cycle.

In contrast to cyclical events, longer-term secular trends are usually not discussed on the evening news. They are much slower moving underlying trends that usually develop over an extended period of time. They may not be visible or widely reported and can take years to unfold. Examples could include demographic and migration trends, changes in consumer and industry behaviors due to automation and labor-saving technologies, and elements of global economic integration and development.

In my experience, while cyclical fluctuations often attract our attention, the underlying secular trends usually help explain these shorter-term developments. Underlying structural forces may not capture the headlines because they are slower moving and may not have a material impact for several years. However, these forces are ultimately enormously powerful.

The purpose of this essay is to first discuss the shorter-term cyclical aspects of the U.S. economy and then focus on the longer-term structural trends. In my judgment, it is critical that we more fully understand and address these secular trends if we are to have a more prosperous economic future.

The Near Term

Dallas Fed economists expect U.S. GDP growth of 2.5 to 2.75 percent in 2018. This growth is underpinned by a strong household sector, improved business investment and stronger growth outlook outside the U.S.

Based on this forecast, Dallas Fed economists expect unemployment to dip from 4.1 percent to approximately 3.7 percent during the year. We also expect other measures of labor force slack to tighten. In particular, we focus on U-6, which comprises the unemployed, plus “marginally attached workers” (workers who indicate that they would like a job but have stopped looking for one), plus people who are working part time who would prefer to work full time. This measure now stands at 8.0 percent, near its prerecession low, and we expect it to improve further during 2018. We also consider estimates of the numbers of disabled workers, previously incarcerated individuals as well as other sources of available workers who could potentially return to the workforce in a strengthening job market.

Based on their analysis of the labor market, our economists continue to believe that, while improvements can be made in increasing employment, we are likely at or already past “full employment” in the U.S. Dallas Fed surveys suggest that businesses are increasingly struggling to find workers to fill low- and middle-skills positions. For example, in one of our recent surveys, 61 percent of Texas small-business respondents suggested they are unable to find workers to fill these types of positions.[1] Due to this labor force tightness, it is our view that cyclical wage pressures should build during 2018.

Regarding inflation, we believe that cyclical inflationary pressures are building. However, our economists also believe that these forces are being at least partially offset by the impacts of automation and, to a lesser extent, globalization. Discussions with our business contacts continue to indicate that, due to the impact of automation and business model disruption, pricing power of businesses is more limited than we’re historically accustomed to seeing at this stage in an economic expansion.

While we expect GDP growth to be strong in 2018, we also expect that this growth will moderate in 2019 and 2020. In fact, Dallas Fed economists are forecasting GDP growth of less than 2 percent in 2020 as the short-term stimulus of the recent tax legislation and budget agreement begin to fade and monetary policy and financial conditions become less accommodative.

Longer-Term Structural Trends

While the near-term cyclical outlook is solid, underlying structural trends are more concerning. I make a point of discussing secular trends in every speech because, as policymakers, if we focus on them, we can impact how they will unfold over the medium and longer term. If we pay insufficient attention to these issues, we may find that they ultimately overwhelm shorter-term cyclical factors and lead to less growth and prosperity in the U.S. economy. I will discuss four overarching secular trends.

Demographics

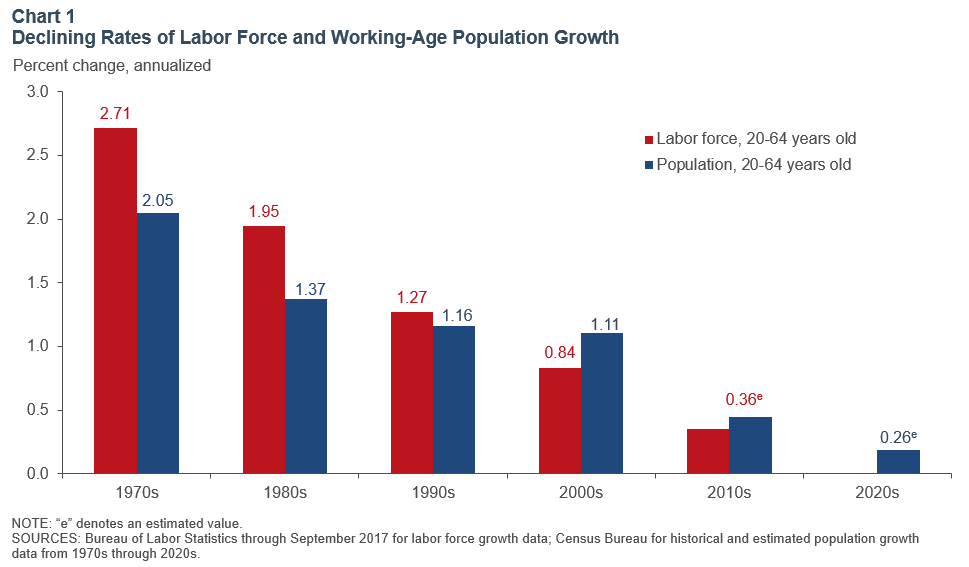

The U.S. population is aging. In fact, the median age of the population has gone from 35.3 years in 2000 to 37.9 in 2016.[2] The share of population 65 years or older has risen to 15.7 percent from 12.6 percent 10 years ago.[3] Chart 1 shows the ongoing trend of aging demographics—leading to declines in labor force and population growth in the U.S.

GDP growth is made up of growth in the workforce plus the rate of improvement in labor productivity. If workforce growth is slowing, unless we can make up for it through more rapid improvement in labor productivity, we will see lower rates of GDP growth. This slower GDP growth is crucial because it has significant implications for future living standards in the U.S. Because government debt to GDP is historically elevated, growth will be needed to service and pay off this debt and meet future entitlement obligations.

The labor force participation rate has declined from 66 percent in 2007 to approximately 63 percent today. Dallas Fed economists believe the bulk of this decline is due to aging of the workforce. In fact, we expect this trend to continue so that the labor force participation rate should decline to 61 percent over the next 10 years.[4]

This demographic challenge is occurring, to varying degrees, across most advanced economies. For example, Germany and Japan have more challenging demographic trends than the U.S.[5]

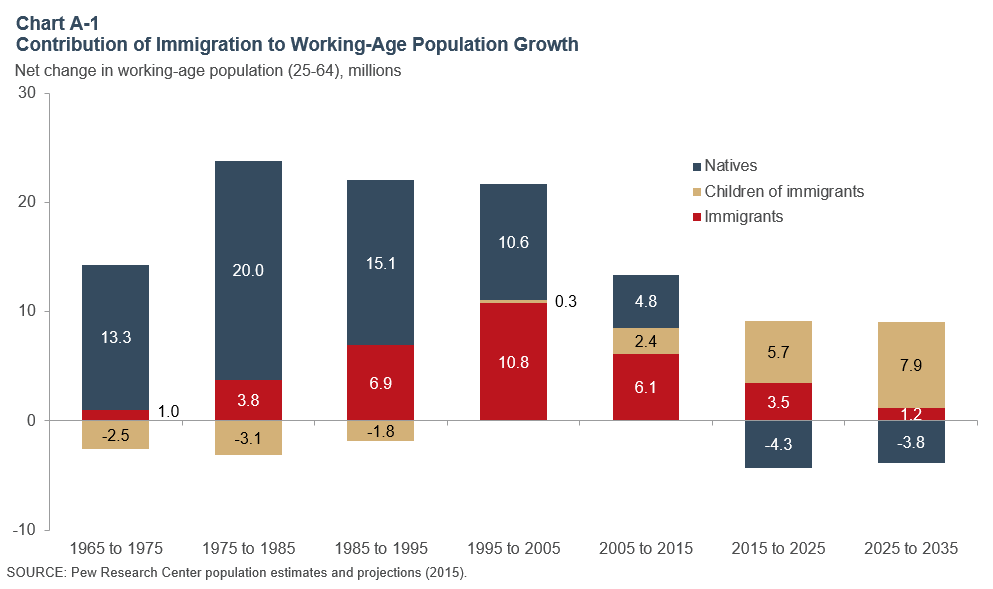

What can we do about this demographic challenge? First, we could implement programs and policies that encourage higher birth rates among our population. This could help address workforce growth 25 years from now. We can adopt policies that encourage people not in the workforce to join the workforce; these policies could include improved child care, better transportation services for at-risk populations, and incentives for discouraged workers to rejoin the workforce. Another supplement to workforce growth is immigration. Immigrants and their children have made up over half the workforce growth in the U.S. over the past 20 years, and this proportion is likely to be even higher over the next 20 years. (See Appendix for a further discussion of the role of immigration in the economy.)

Technology-Enabled Disruption and Its Implications for Educational Achievement and the Skills Gap

Workers are increasingly being replaced by automation. Consumers are increasingly able to use technology to shop for goods and services. Business models are being disrupted by new approaches to delivering goods and services at lower prices and potentially better convenience. As a result, business pricing power is increasingly being challenged. In response, businesses are investing more in technology and merging with other companies to achieve greater scale in order to protect gross profit margins. These trends appear to be accelerating globally.[6]

Despite rapid technological change, productivity growth has remained sluggish. Output per worker grew on average by approximately 1.9 percent per year in the 1990s, slowed to 1.3 percent in the 2000s and has slowed further to 1.0 percent since 2010. One explanation may be that technology is having a profound impact on the workforce. In particular, it is changing the nature of middle-skills jobs.

If you are one of the 46 million workers in this country with a high school education or less, or have a “routine” type of middle-skills job, you are likely finding that your job is being either restructured or eliminated as a result of technology. These workers may find another job in a strong job market, but unless they have gotten retrained, they are likely to see their incomes and productivity decline. This may be one reason that we haven’t seen a bigger productivity-growth payoff from recent advances in technology. We measure productivity growth workforce-wide rather than by company or industry. While most industries are materially improving their productivity, workers with less education may be finding their real wages and productivity declining in a new age where skills training and educational achievement levels are increasingly critical to adapting to the job market.

Regarding education, the U.S. is a leader in many areas versus the rest of the world. Unfortunately, several studies suggest that the skill levels and educational achievement levels of our workforce have lagged other developed countries for the last several years. In surveys of 29 participating Organization for Economic Cooperation and Development (OECD) countries, the U.S. ranked 20th in assessments of adult literacy and math skills.[7] In addition, according to recent OECD surveys, the U.S. ranks 24th out of 35 developed countries in measures of math, science and reading skills among 15-year-olds.[8]

Research by Eric Hanushek of Stanford University with Ludger Woessmann of the University of Munich suggests that improvements in U.S. math and science skills could translate into meaningful improvements in potential GDP growth.[9] While these efforts are likely to take years, they could have substantial potential to improve future growth and prosperity in the U.S.

In order to address this powerful structural driver, the U.S. must do more to improve early childhood literacy and college readiness, and do more to strengthen skills training at our high schools and community colleges.

The Potentially Unsustainable Path of Government Debt to GDP

U.S. government debt held by the public now stands at 75 percent of GDP,[10] and the present value of unfunded entitlements is estimated at approximately $49 trillion.[11] The recent tax legislation and bipartisan budget compromise legislation are likely to exacerbate these issues. While increasing the level of debt to GDP is a stimulus to economic growth in the short run, that stimulus can turn into a growth headwind when the government takes steps to moderate debt growth, as it certainly must consider doing in the years ahead. As a consequence of this level of debt, the U.S. is much less likely to have fiscal capacity to fight the next recession.

Further, due to this level of government debt as well as historically high levels of corporate debt as a percentage of GDP, the economy is becoming much more interest rate sensitive. That is, increases in interest rates have greater potential to require a higher proportion of cash flow in order to service corporate and government debt obligations. Structural reforms and other actions that flatten the path of future government debt growth may be advisable at this stage of the economic cycle.

Globalization

World economies and financial markets are increasingly integrated and interconnected. This trend is not new, but it certainly has been intensifying over the past many years. Companies increasingly think about their labor force and capital investment decisions in a global manner. Investors increasingly think globally about where to allocate capital. This helps explain why lower labor costs in one country can have an impact on inflation and labor market developments in other countries and it also helps explain why interest rate levels, stock market valuations and occasional market turmoil in one country can ripple through currencies and global markets very rapidly.

Trade is certainly part of this globalization trend. With the World Trade Organization, North American Free Trade Agreement and other trade agreements, global trade has increased. In many cases, this increase in trade, along with technological advances, has been good for the U.S. in terms of consumer benefits and improving corporate efficiency and profits, but, at the same time, it has led to painful job disruption and dislocations in many cities and towns in our nation.

Today, a new trend has emerged which is likely surpassing globalization in terms of job disruption—technology-enabled disruption (described above). That is, if your job is being disrupted today, it is far more likely due to technology-enabled disruption rather than globalization.

Dallas Fed economists believe it makes sense to segment U.S. trading relationships into those which are primarily final goods versus intermediate goods. For example, our trade deficit with China is primarily final goods. Conversely, our trading relationship with Mexico and Canada are primarily intermediate goods. Intermediate goods trading relationships are more indicative of integrated supply chain and logistics arrangements. Dallas Fed research indicates that intermediate goods relationships have allowed U.S. companies to add jobs and increase their global competitiveness.

In this regard, Dallas Fed economists believe that, at this stage in our history, globalization is more likely an opportunity for the U.S. to grow as opposed to a “threat.” With less than 5 percent of the world’s population, we believe that trade is critical to future growth in the U.S. Emerging markets and other growing economies are increasingly important sources of demand for U.S. goods and services.

It is critical that we accurately diagnose globalization and untangle it from the impacts of technology-enabled disruption. Dallas Fed economists believe that updating and modernizing trade agreements is highly appropriate, but our research also indicates that trade is a critical opportunity for the U.S. to grow faster and improve the future prosperity of our nation.

Implications

Popular press and current national discussions tend to focus heavily on shorter-term cyclical developments. Because the near-term outlook for GDP growth is positive, this may lull observers into believing we are on a path to sustained improvement in the economic performance of the U.S. economy. This belief may well distract policymakers and the public from focusing on the powerful structural trends that are likely to create challenges for growth in the medium and longer term.

Leadership is required to take a longer-term view and take steps to create a better economic future for our children and grandchildren. The Dallas Fed forecasts that 2018 will be a solid year for economic growth in the U.S. However, unless our nation initiates structural reforms that improve workforce growth, education and skill levels of our labor force, moderate the expected path of government debt growth, and adopts policies that allow us to capture the opportunities provided by globalization, we are likely to see sluggish rates of GDP growth in the medium and longer term.

APPENDIX

The Impact of Immigration on U.S. Workforce and Demographic Trends

Dallas Fed research indicates that immigration has been a key element of economic growth in the U.S. However, immigration is not a purely economic issue—which is why it is a highly sensitive and controversial subject. The purpose of this note is to discuss the economic aspects of immigration as a key element in growing the workforce and to explore alternative immigration policies. This discussion is particularly important today in light of the aging U.S. workforce.

Immigrants and their children have made up more than 50 percent of working-age population growth in the U.S. over the past 20 years.[12] As shown in Chart A-1, we expect immigrants and their children to make up an even larger share of working-age population growth over the next 20 years as the retirement of baby boomers leads to a net decline in the working-age population of native-born workers.

The Mix of Immigration Flows

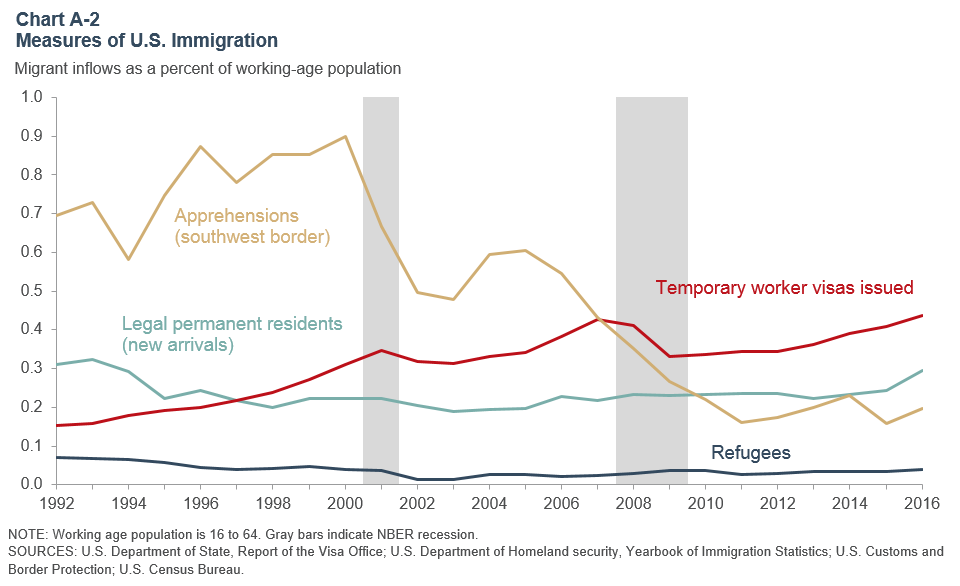

Although immigration is becoming increasingly important to workforce growth, immigration flows to the U.S. have slowed over the past 10 years. The biggest declines have been in unauthorized immigration, in part, due to housing market declines as a result of the Great Recession (which led to a decline in residential construction work opportunities) as well as more stringent enforcement policies along the Southwest border and in the U.S. interior. Improved economic conditions and falling population growth in Mexico have also played a role in dampening migration to the U.S.

Temporary worker visas have recently increased, as has the flow of new legal permanent residents. Tighter labor markets are likely playing a role in boosting the demand for hiring foreign-born workers, and there is some evidence that this demand can be channeled through legal means. See Chart A-2 for measures of immigration.

The Importance of Skilled Immigration

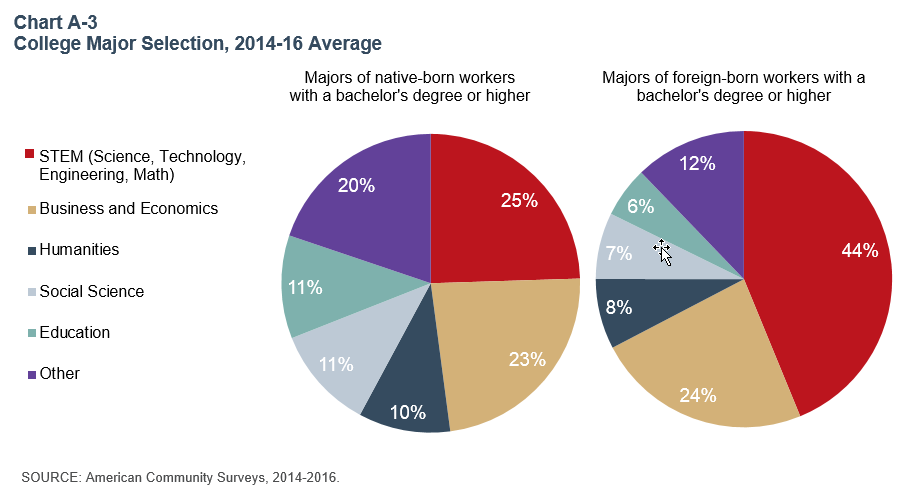

Immigration generally contributes to a larger labor force, which has benefits for economic growth, but high-skilled immigration has also been shown to positively influence productivity growth. Chart A-3 shows that nearly half of college-educated immigrants majored in science, technology, engineering or math (STEM). This far outpaces U.S.-born college-educated workers, about one quarter of which major in STEM fields. High-skilled foreign-born workers have also been shown to patent at higher rates than native workers, largely as a result of their concentration in the STEM fields.[13] This type of innovative activity has been shown to be a key factor in U.S. productivity growth in the post-World War II period.[14]

Impact of Immigration on Native Workers

Does immigration adversely affect the working conditions of native workers? Pia Orrenius, a senior economist at the Dallas Fed, finds very little empirical evidence that immigrants create adverse wage effects among high-skilled workers, while wage and employment effects on low-skilled workers tend to be small.[15] Based on her research with Madeline Zavodny, she has also advocated for greater focus in the U.S. on employment- and merit-based immigration—which tends to bring in higher skilled workers than family-based immigration policies. They argue that demand for low-skilled immigration can be met through a temporary-worker program and that this is preferable to relying on illegal immigration, which has historically tended to be the case.[16]

While immigration is a politically sensitive topic, Dallas Fed research indicates that, due to aging demographic trends, we need to come to grips with immigration reform in order to supplement labor force growth in the U.S.[17] These reforms could encourage greater emphasis on employer-based and skills-based immigration. Whatever the decisions made by policymakers, this discussion is important to creating greater GDP growth in the U.S.

Notes

The views expressed are my own and do not necessarily reflect official positions of the Federal Reserve System.

I would like to acknowledge the contributions of Tyler Atkinson, Jim Dolmas, Marc Giannoni, Evan Koenig, Pia Orrenius, William Simmons and Mark Wynne in preparing these remarks.

- Based on respondents with fewer than 500 employees, Texas Business Outlook Survey, Federal Reserve Bank of Dallas, February 2018.

- “The Nation’s Older Population Is Still Growing, Census Bureau Reports,” press release, Census Bureau, www.census.gov/newsroom/press-releases/2017/cb17-100.html.

- Census Bureau data.

- Bureau of Labor Statistics data.

- For example, the share of the population age 65 or older is 21.5 percent in Germany, and 27.1 percent in Japan, according to UN World Population Prospects 2017 data.

- “Global Deals Surge Past $1tn at Fastest Ever Pace,” Financial Times, March 21, 2018.

- According to the Program for International Assessment of Adult Competencies’ Survey of Adult Skills (2012, 2015) by the Organization for Economic Cooperation and Development (OECD), the U.S. ranks 17th in literacy and 23rd in math out of 29 countries and 15th in problem-solving in technology-rich environments out of 26 countries. An average of scores across the literacy and math categories places the U.S. 20th.

- According to the Program for International Student Assessment (PISA) (2015) by the OECD, the U.S. ranks 19th in science, 20th in reading and 31st in mathematics out of 35 OECD countries. An average of scores across the three categories places the U.S. 24th.

- Hanushek and Woessmann (2016) estimate that a sustained 25-point increase in U.S. students’ average PISA scores could lead to an increase of 0.5 percentage points in potential gross domestic product growth in the longer run. See “Skills, Mobility, and Growth,” by Eric Hanushek and Ludger Woessmann, in Economic Mobility: Research & Ideas on Strengthening Families, Communities & the Economy, Alexandra Brown, David Buchholz, Daniel Davis and Arturo Gonzalez, ed., St. Louis: Federal Reserve Bank of St. Louis and the Board of Governors of the Federal Reserve System, 2016, pp. 423–49. Also, see “Human Capital in Growth Regressions: How Much Difference Does Data Quality Make?” by Angel de la Fuente and Rafael Doménech, Journal of the European Economic Association, vol. 4, no. 1, 2006, pp. 1–36; and “Growth and Human Capital: Good Data, Good Results,” by Daniel Cohen and Marcelo Soto, Journal of Economic Growth, vol. 12, no. 1, 2007, pp. 51–76.

- Data are from the U.S. Department of the Treasury and Bureau of Economic Analysis as of fourth quarter 2017.

- “The 2017 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds,” U.S. Social Security Administration, July 13, 2017; “The 2017 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds,” Centers for Medicare and Medicaid Services, July 13, 2017.

- “Immigration Projected to Drive Growth in U.S. Working-Age Population Through at Least 2035,” by Jeffrey S. Passel and D’Vera Cohn, Factank, Pew Research Center, March 8, 2017.

- “How Much Does Immigration Boost Innovation?” by Jennifer Hunt and Marjolaine Gauthier-Loiselle, American Economic Journal: Macroeconomics, vol. 2, no. 2, 2010, pp. 31–56.

- “Sources of U.S. Economic Growth in a World of Ideas,” by Charles I. Jones, American Economic Review, vol. 92, no. 1, 2002, pp. 220–39.

- “Does Immigration Affect Wages? A Look at Occupation-Level Evidence,” by Pia Orrenius and Madeline Zavodny, Labour Economics, vol. 14, no. 5, 2007, pp. 757–73.

- Beside the Golden Door: U.S. Immigration Reform in a New Era of Globalization, by Pia M. Orrenius and Madeline Zavodny, Washington, D.C.: American Enterprise Institute Press, 2010.

- “Gone to Texas: Migration Vital to Growth in the Lone Star State,” by Pia Orrenius, Alexander Abraham and Stephanie Gullo, Federal Reserve Bank of Dallas Southwest Economy, First Quarter, 2018.

About the Author

Robert S. Kaplan was president and CEO of the Federal Reserve Bank of Dallas, 2015–21.