Consumer Credit Trends for El Paso County

February 2020

Introduction

This report provides a look at important debt trends and loan performance in El Paso County and is a follow-up to a 2019 statewide look. It uses a 5 percent nationally representative sample of consumer-level and loan-level data from Equifax—one of the country’s three main credit bureaus. This report uses Equifax data to analyze four major types of consumer loans: auto, credit card, mortgage and student. It is part of a series of Texas county reports. This series aims to provide a comprehensive view of credit access, loan volume and delinquencies across the state. For more on methodology and background, see Consumer Credit Trends for Texas.

Equifax Risk Scores in El Paso

As shown in Table 1, compared with averages across Texas, risk scores in El Paso are more likely to be nonprime (borrowers with credit scores below 680). In fact, El Paso is the only county among the five studied where the majority of borrowers is nonprime.

El Paso Has Fewer Prime Borrowers than State Average

| Share of borrowers (percent) | |||

| Category | Equifax Risk score range | El Paso County | Texas |

| Prime | 680 and above | 49.5 | 55.6 |

| Near prime | 620–679 | 18.5 | 16.0 |

| Subprime | 550–619 | 17.3 | 15.1 |

| Deep subprime | Below 550 | 14.7 | 13.4 |

| SOURCES: Federal Reserve Bank of New York Consumer Credit Panel/Equifax; authors’ calculations. | |||

This finding reflects the county’s demographics: El Paso has a lower median age, lower median income and a higher share of Hispanic residents than the state—all traits associated with lower average credit scores.[1] Those with subprime credit are commonly offered credit at higher interest rates and/or under other less-favorable terms.[2]

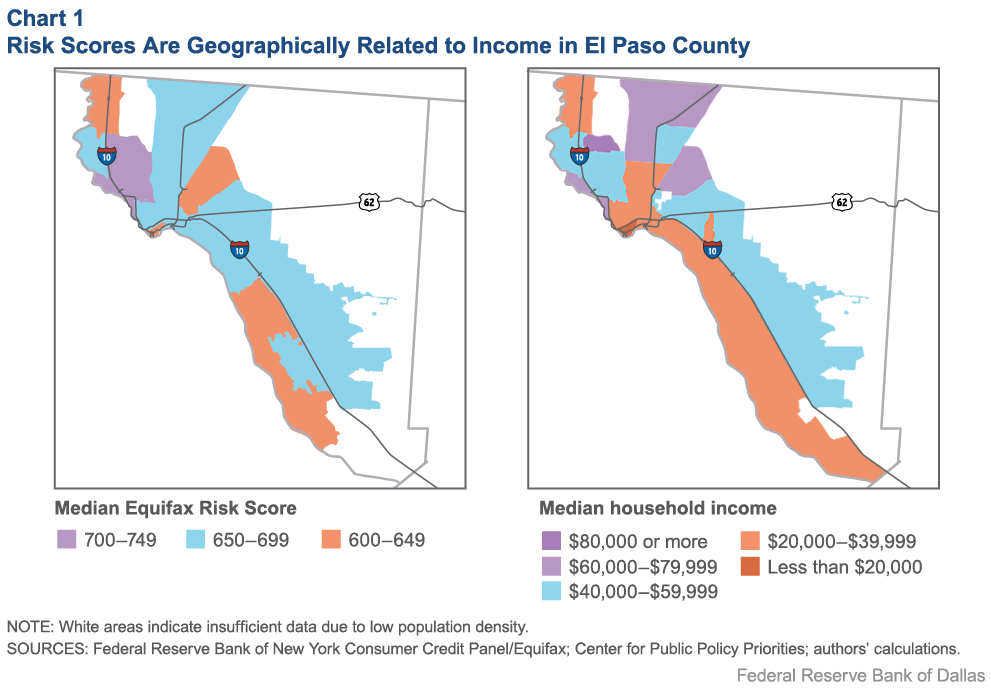

As discussed in previous reports in this series, there is a correlation between credit scores and income.[3] Chart 1 depicts this pattern for El Paso County, where ZIP codes with median household annual incomes less than $40,000 frequently overlap those ZIP codes with median Equifax Risk Scores below 650. The areas that lie slightly northwest of El Paso have higher median incomes, and in most cases, risk scores above 700.

The Credit Economy in El Paso

This report also looks at serious delinquency rates—defined as payments at least 90 days past due—for four major loan types: credit card, mortgage, auto and student.

In recent years, El Paso residents have struggled with late payments on multiple loan types, although it is not historically the county with the highest serious delinquency rates.

Credit Cards

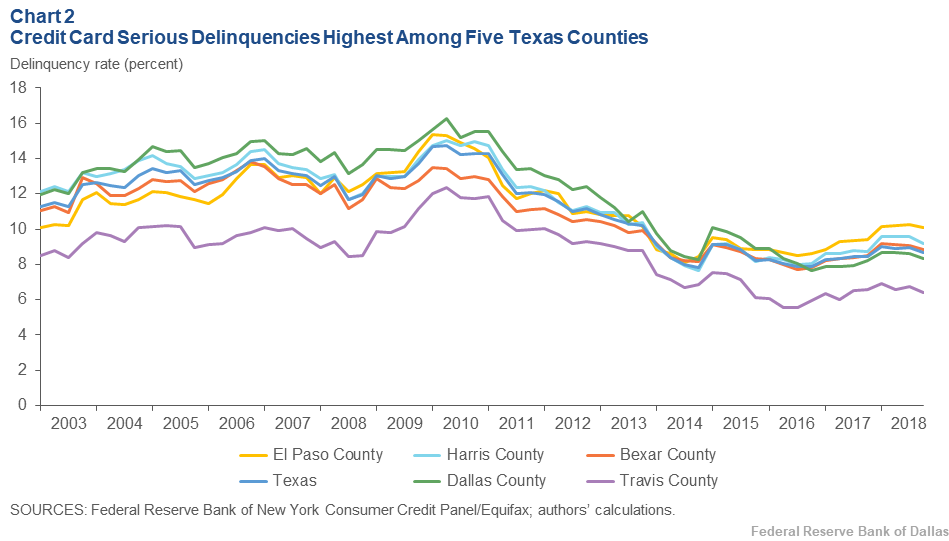

From 2003 to 2007, the rate of seriously late payments on credit cards in El Paso was below the state average for Texas and lower than other large counties with the exception of Travis. During the Great Recession, serious delinquencies rose sharply in El Paso, peaking at nearly 15.5 percent at the start of 2010 (Chart 2). As noted in the statewide report, the passage of the Credit Card Accountability, Responsibility and Disclosure (CARD) Act resulted in a decline of serious delinquencies through 2016. However, in the past two years, late payments have begun to tick up in El Paso, and the delinquency rate is now the highest of the five counties.

Mortgages

In 2006, the percentage of mortgage balances seriously delinquent in El Paso was about 0.52 percentage points below the statewide average of 1.46 percent. However, in recent years, the situation has changed (Table 2). In El Paso County, serious delinquency rates are actually a bit higher than before the recession, whereas for other regions of the state, they have dropped below 2006 rates. This is despite an increasing share of prime borrowers in El Paso’s mortgage market (53 percent in 2006 versus 66 percent in 2018). Although they are now a smaller share of the market, subprime borrowers’ mortgage loans are performing worse than prerecession levels.

El Paso Seriously Delinquent Mortgage Rates Higher than 2006

| Percent of balances seriously delinquent | ||

| 2006 | 2018 | |

| Bexar | 1.46 | 1.04 |

| Dallas | 2.20 | 0.82 |

| El Paso | 1.12 | 1.34 |

| Harris | 1.63 | 0.99 |

| Travis | 0.89 | 0.44 |

| Texas | 1.64 | 0.91 |

| SOURCES: Federal Reserve Bank of New York Consumer Credit Panel/Equifax; authors’ calculations. | ||

Student Loans

Like the rest of Texas, student debt is growing in El Paso County, both in terms of the number of borrowers and the balances held. In 2006, less than 12 percent of adults in El Paso County carried student debt; by 2018, this portion rose to nearly 20 percent. Balances soared as well, with the median increasing 70 percent and the mean 55 percent, adjusting for inflation, as shown in Table 3. While this could be a positive indication of increasing educational attainment, rates of serious delinquency have also risen from 7.8 percent to 14 percent in El Paso—the highest among all counties studied.

Student Loan Balances and Late Payments Surge in El Paso County

| 2006 | 2018 | Percent change 2006 to 2018 |

|

| Balance per borrower ($) | |||

| Median | 8,375 | 14,242 | 70 |

| Average | 17,088 | 26,448 | 55 |

| Serious delinquency rate (%) | 7.8 | 14 | – |

| NOTE: Figures are in 2018 dollars. SOURCES: Federal Reserve Bank of New York Consumer Credit Panel/Equifax; authors’ calculations. | |||

Auto Loans

As of 2017, an estimated 93 percent of households in El Paso County have at least one vehicle, a figure that is similar across Texas. Many of these are likely financed.

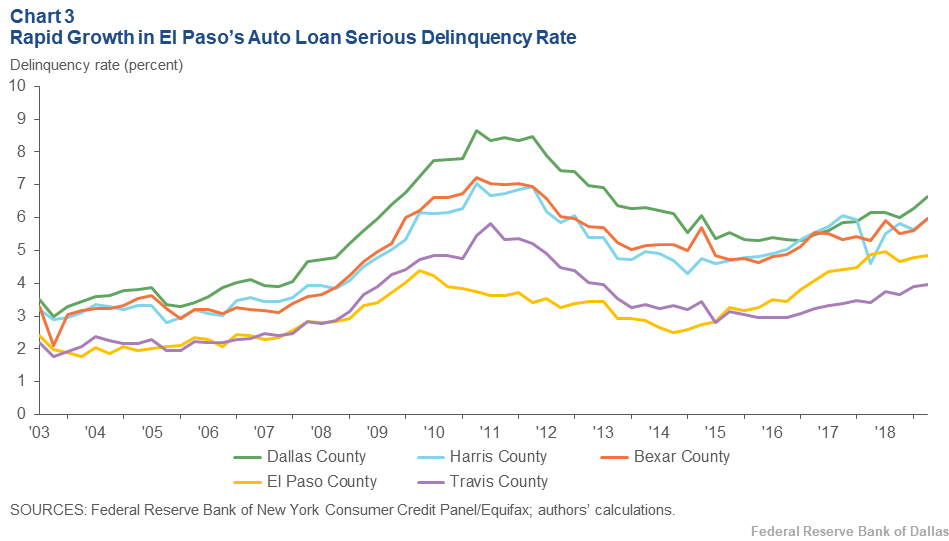

Of those who have car loans, average balances in real terms have remained somewhat steady since 2006 in Dallas, Bexar, Harris and Travis counties—in some cases growing a few hundred dollars, and in other cases actually falling, adjusting for inflation. In El Paso, however, average balances grew 8 percent, from about $21,700 in 2006 to nearly $23,400 in 2018.[4] While an 8 percent increase in 12 years may not seem particularly noteworthy, this balance growth is coupled with a rapidly rising serious delinquency rate. In fact, the share of car debt that is seriously delinquent has more than doubled since 2006. In actual percentages, El Paso’s seriously delinquent auto debt rate was still under 5 percent by the end of 2018—while other counties’ approached 6 percent—but the rate of change since 2014 has been quite large (Chart 3).

There are some possible explanations for this increase:

- Oil bust: From 2015 to 2016, oil prices declined, affecting economic prospects for those who worked in that industry. According to Keighton Allen, senior research analyst at the Dallas Fed’s El Paso Branch, El Paso is home to such workers who commute to the oil-producing Permian Basin, sometimes for weeks at a time:

“While growing auto loan delinquency rates in El Paso reflect a national trend, there could be a regionally specific motive for increased defaults on car payments. El Paso residents, who are often seasonal laborers in the Permian Basin, may have become insolvent following layoffs due to the slowdown in the energy sector. This could be one contributing factor to El Paso’s more dramatic increase than the national average. Some El Paso credit union representatives have corroborated this hypothesis during roundtable discussions.”

Oil-producing counties generally showed higher auto loan delinquencies in the aftermath of the bust.[5] - Lower median Equifax Risk Score: Although the share of subprime borrowers in the auto market has fallen since 2006, loans held by these borrowers are performing worse in 2018 than they were in 2006. El Paso County has a greater share of these borrowers than other counties in Texas, so this shift may be felt more in this market.

- Lender performance: Recent research by the Dallas Fed outlines the role of auto finance companies in increasing delinquencies. Auto finance lending differs from bank or credit union lending in a few key ways, including less-stringent oversight by regulators and a greater share of loans made to subprime borrowers.[6] The share of auto finance companies in the overall car loan market has decreased over time, but in El Paso, loans made by these lenders are performing worse. This is particularly true for borrowers with subprime Equifax Risk Scores: in 2006, less than 4 percent of the balance held by subprime borrowers who had a loan from an auto finance company was 90 or more days past due; by 2018, this had risen to nearly 11 percent.

Overall, despite a relatively strong economy, there are some worrisome signs in El Paso’s credit landscape. Although auto, credit card and mortgage delinquencies are lower than at the height of the recession, there have been upticks in recent years. Compared with other major Texas counties, El Paso now has the highest rate of seriously delinquent balances for credit card, mortgage and student loans. Some of El Paso’s relatively poorer debt performance is likely attributable to its higher share of subprime borrowers. Still, the share of prime borrowers is growing, both in the county and the country as a whole. It remains to be seen if this trend will continue for El Paso, and if so, what impact it will have on debt performance.

More from the Dallas Fed’s Consumer Credit Series

More county briefs featuring Dallas, Bexar and Travis counties are available on the Dallas Fed Consumer Credit Trends webpage.

Lead Author

- Emily Ryder Perlmeter

Community Development Advisor, Federal Reserve Bank of Dallas

Contributing Authors

- Anna Crockett

Community Development Analyst, Federal Reserve Bank of Dallas - Garrett Groves

Vice President of Business & Industry Partnerships, Austin Community College

The information and views expressed in this report are the authors’ and do not necessarily reflect official positions of the Federal Reserve Bank of Dallas or Federal Reserve System; nor do they constitute an endorsement of any organization or program.

Full report is available online: https://www.dallasfed.org/cd/cct/20cctep.

Federal Reserve Bank of Dallas 2200 N. Pearl St., Dallas, Texas 75201 | 214.922.6000 or 800.333.4460