Women veteran business owners: We want to hear from you

The number of businesses owned by female veterans in the U.S. more than tripled in a five-year period, but little is known about these enterprises.

For example, what industries are they in, how do they fund their businesses, and what are their barriers to success? A new Dallas Fed survey of DFW female veteran business owners seeks to answer these questions.

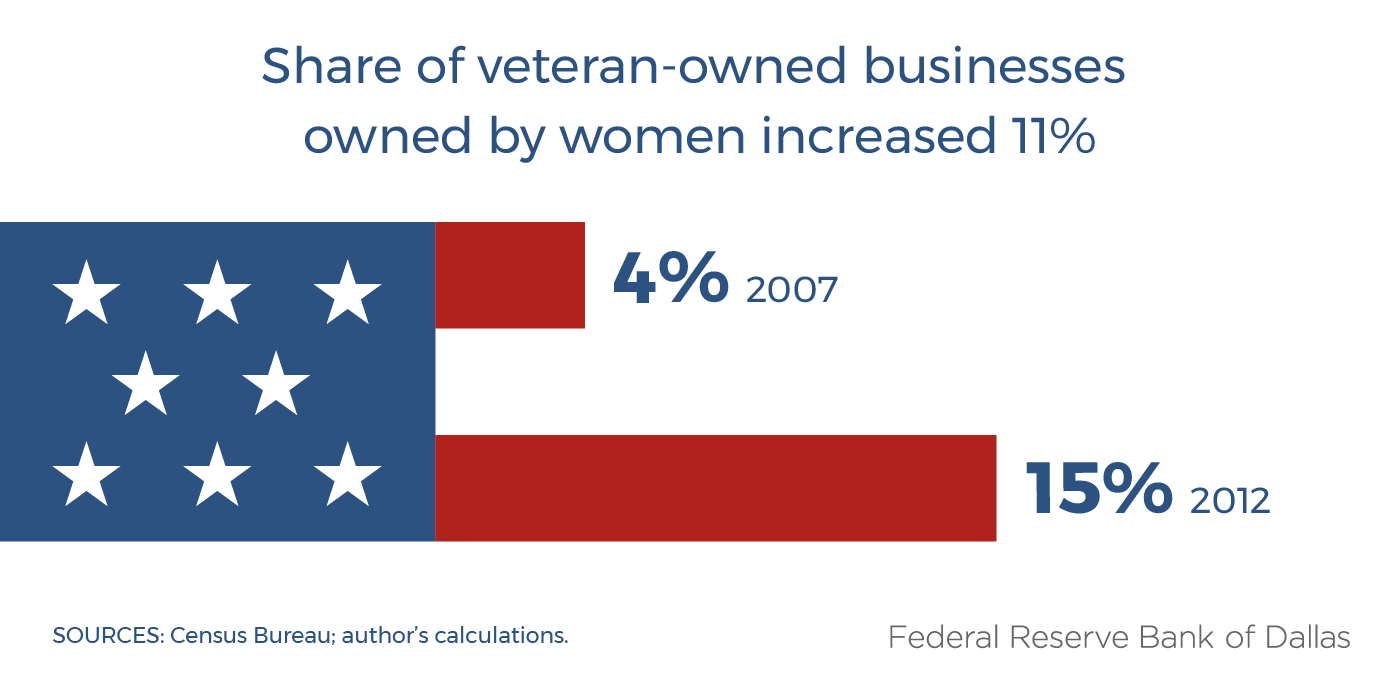

Nationwide, businesses owned by female veterans grew from 4 percent of all veteran-owned businesses to more than 15 percent between 2007 and 2012, according to the Census Bureau’s Survey of Business Owners. That translates to 383,000 women veteran-owned businesses.

About 97 percent of those firms are sole proprietorships that made $7.1 billion in revenue over that period. The remaining 3 percent earned over $10.7 billion in revenue and had a total workforce of more than 100,000. However, little else is known about women veteran-owned businesses and their owners. This is where the “Moments that Matter” research project comes into play.

Moments that Matter

Inspired by the belief that the strength of our region’s small businesses is essential for our regional economy to thrive and by our veterans’ service to the country, the Dallas Fed partnered with the Veteran Women’s Enterprise Center (VWEC), an initiative located in southern Dallas, to launch the “Moments that Matter” research project. This project seeks to identify businesses owned by female veterans in Dallas–Fort Worth and learn about the most important moments in the development of these businesses during their creation, growth and expansion.

The Dallas Fed and the VWEC designed an online survey for these business owners. The data will identify potential gaps in services for women-veteran entrepreneurs and their take on the local business climate. It also will help business leaders and policymakers in DFW create a more supportive environment for women veteran-owned businesses.

With more data on women veteran-owned businesses, we can learn more about what industries they tend to choose, how they fund their businesses at the onset and what barriers to success their businesses face. We can also learn more about what business owners found most helpful when starting their businesses, whether it was an informal network of peers or resources from a nonprofit or business association.

Once the data are collected, the Dallas Fed and VWEC will produce a report illustrating the state of businesses owned by female veterans in DFW. For our region, it’s an opportunity to support an overlooked entrepreneurial community and learn how to effectively engage these businesses.

How can you help?

Women veteran-owned businesses: |

|

Community partners: |

|

Individuals: |

Women veterans are playing a vital part in our economy. They’re workers, they’re consumers—and yes, they’re business owners. As a community, we can help foster a flourishing environment for them over the next decade by shining a light on their experiences today.

Author

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.