Women business owners in Texas get less financing than men do

Women in Texas who own small businesses struggle more than men to access loans, post-COVID data show, and the situation is worse for women of color. Analysis of data from the Federal Reserve System’s Small Business Credit Survey show the special circumstances for women-owned employer firms in Texas. Female small-business owners report more ambitious plans than their male counterparts to boost revenue and add employees. However, on average, women-owned firms report greater occurrence of financial challenges and less access to external financing.

This is particularly true for firms owned by women of color, which have an outsized presence in Texas compared with the nation.[1] These business owners want to grow and they often seek credit, but firms owned by women of color in Texas are more likely to face significant barriers to external financing.

The implications of these different experiences could be broad. Evidence of uneven opportunity could mean friction for Texas economic growth. Potential opportunities to address these gaps include improving access to technical assistance, considering specialized lending programs and prioritizing more research on the topic.

Share of women-owned businesses rises after COVID setback

According to the most recent U.S. Census business data, women-owned employer firms brought in nearly $2 trillion in receipts nationwide in 2021 and more than $432 billion in annual payroll. [2] They now represent more than one in five employer businesses across the nation, with a collective 11 million workers on payroll.

In Texas, the shares of women-owned employers and their average annual revenue are even higher.

As discussed in part one of this series, the share of businesses owned by women had been rising for several decades prior to the pandemic. After a setback during the COVID-19 economic crisis, their numbers are on the rise again, data indicate. As their numbers grow, women-owned businesses will have an increasingly large impact on local, state and national economies.

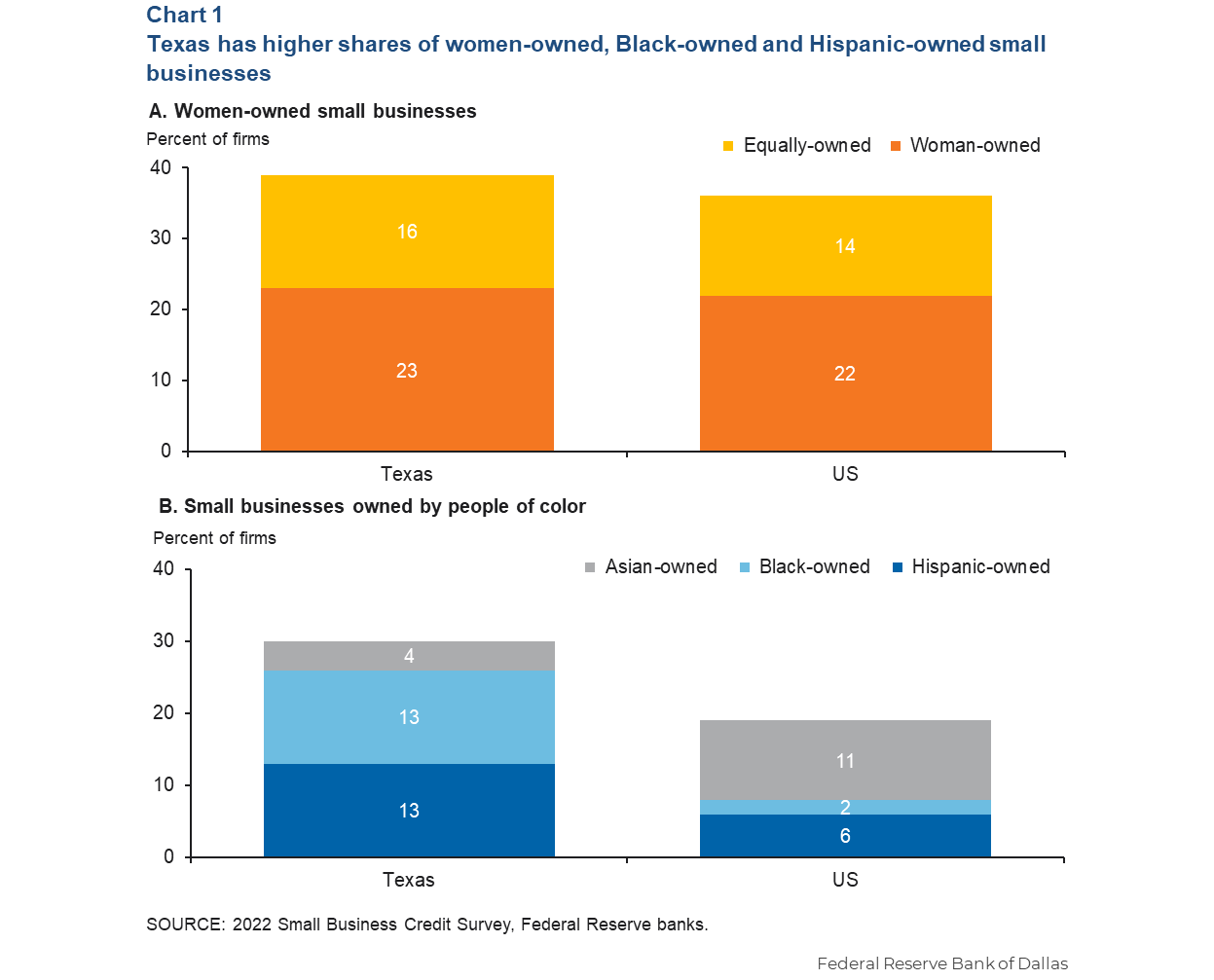

In Texas, close to a quarter of small employers are woman-owned, and an additional 16 percent are owned equally by men and women. These shares are slightly higher than those nationally, in both cases (22 percent and 14 percent, respectively). Texas also has a higher share of both Black-owned and Hispanic-owned firms than the national average. Sample size precludes deeper investigation into firms by specific race and gender, but overall, Texas has higher shares of both women-owned firms and those owned by women of color (Chart 1).

Understanding what differences in characteristics, challenges and goals might exist for women-owned businesses in Texas compared with those owned by men can continue to shed light on potential disparities, investment opportunities and policy interventions to foster more inclusive growth. Much has already been written about the outsized difficulties firms of color and those owned by women faced during the COVID-19 pandemic. For example, 2021 findings from the Federal Reserve System’s Small Business Credit Survey (SBCS) in Texas indicate that although COVID-19 had a negative impact on sales for most firms, those owned by women were significantly more likely to experience a sales decrease compared with those owned by men.

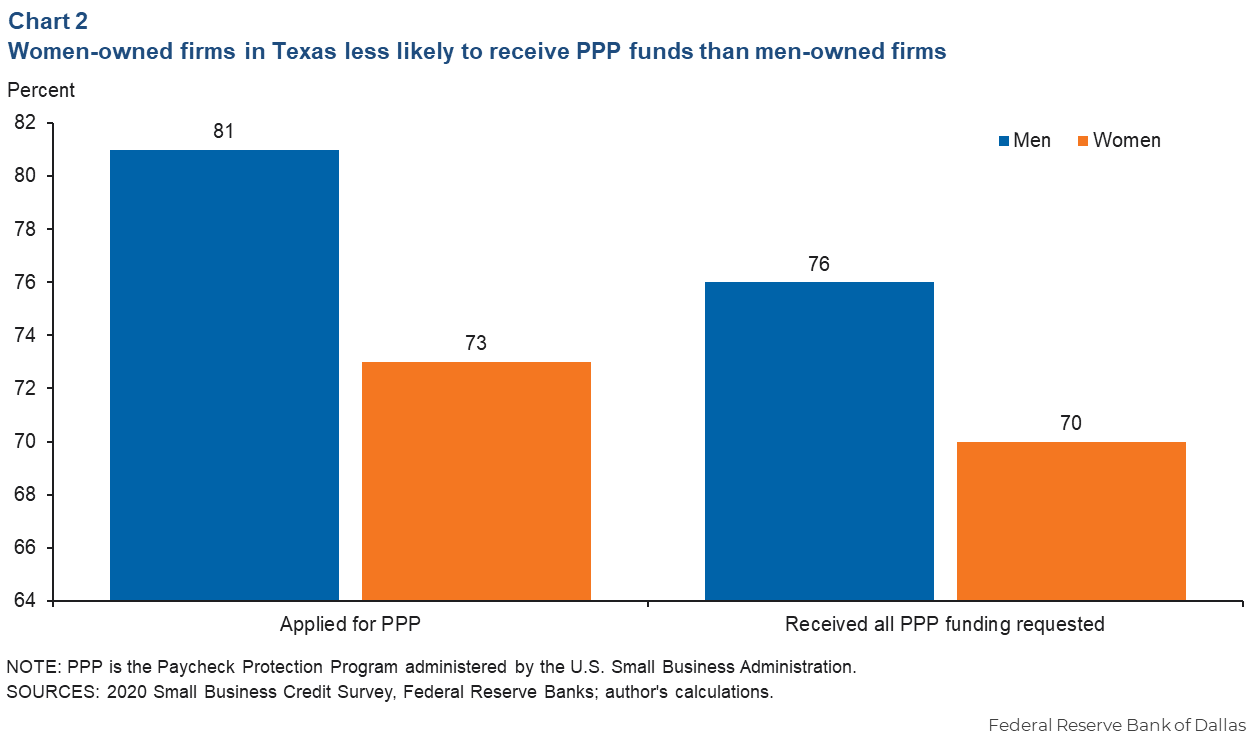

Chart 2 illustrates another gap in COVID-era business experiences. In 2020, 73 percent of women small business owners in Texas applied for the Paycheck Protection Program (PPP) compared with 81 percent of men. Among applicants, 70 percent of women received all requested funding, compared with 76 percent of men. Overall, women-owned firms in Texas were somewhat less able to access the PPP lifeline than firms owned by men.

Women-owned businesses recovered more slowly after pandemic

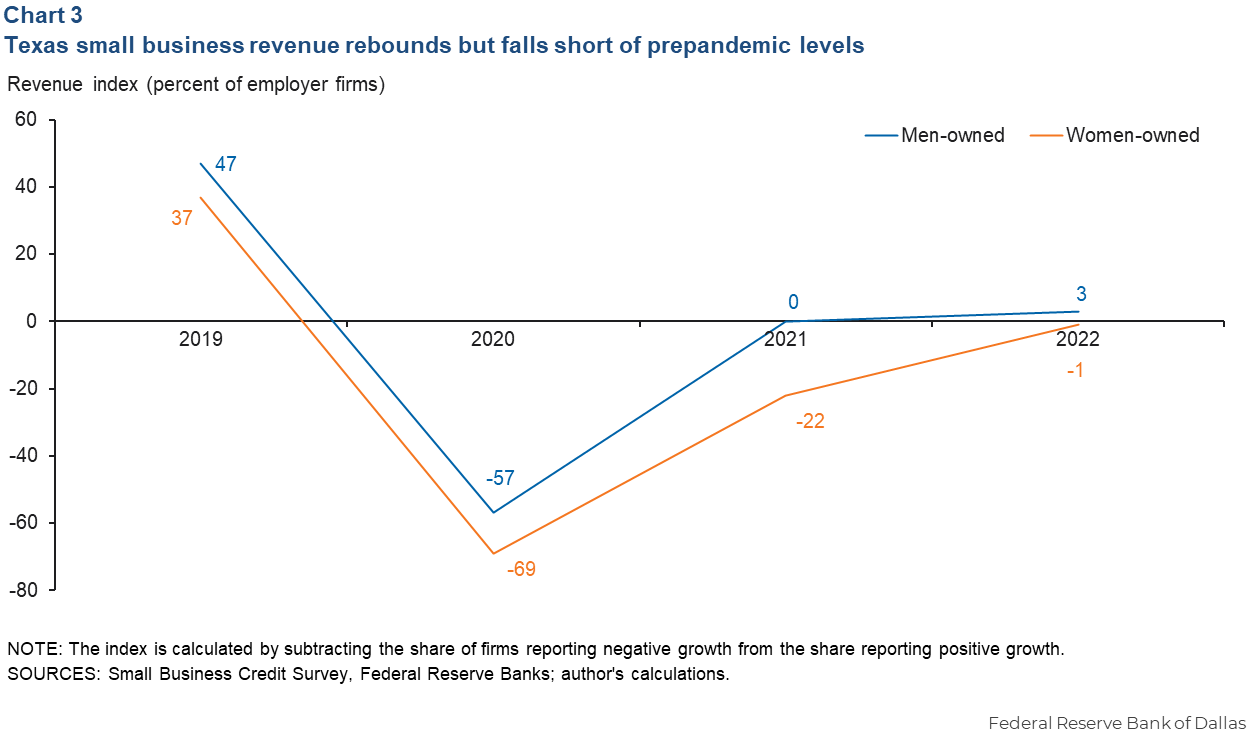

Now that the onset of the pandemic is more than three years in the rearview mirror, how are small firms in Texas recovering? One way to look at this question is shown in Chart 3. Revenue took a significant tumble in 2020, then improved for two consecutive years.

Small businesses owned by men show a revenue index in positive territory for the first time since 2019. For women, despite the improvement, the index remains slightly negative, indicating that more women-owned firms reported decreases in revenue than increases.

Despite this gap, women who own businesses want to grow them. Most (53 percent) women-owned firms in Texas expected to add employees throughout 2023, compared with just 40 percent of their men-owned counterparts. These numbers signal a strong desire among Texas women to grow their businesses. But how does the desire match up with financial reality?

The SBCS also offers insight on specific financial challenges. In 2022, just 4 percent of women-owned firms in the U.S. reported no financial challenges. Furthermore, a significantly greater share of women pointed to trouble paying operating expenses compared with men: 67 percent versus 55 percent. Given signs of financial concerns for women-owned firms, how well positioned are they to reach their growth goals?

Women-owned businesses lack access to financing

Access to external financing is critical for many businesses to get off the ground, purchase equipment and inventory, and grow. In fact, lack of financing is considered a primary reason new firms fail. Prior to the pandemic, about two-thirds of small firms in Texas in 2019 carried outstanding debt, and about 42 percent applied for new loans or lines of credit, most often to expand their businesses or pursue new opportunities.

After a drop in applications for traditional financing in 2020 and 2021, demand for new financing ticked back up in 2022 according to Small Business Credit Survey data, with 46 percent of small firms in Texas applying for new loans, lines of credit or merchant cash advances.

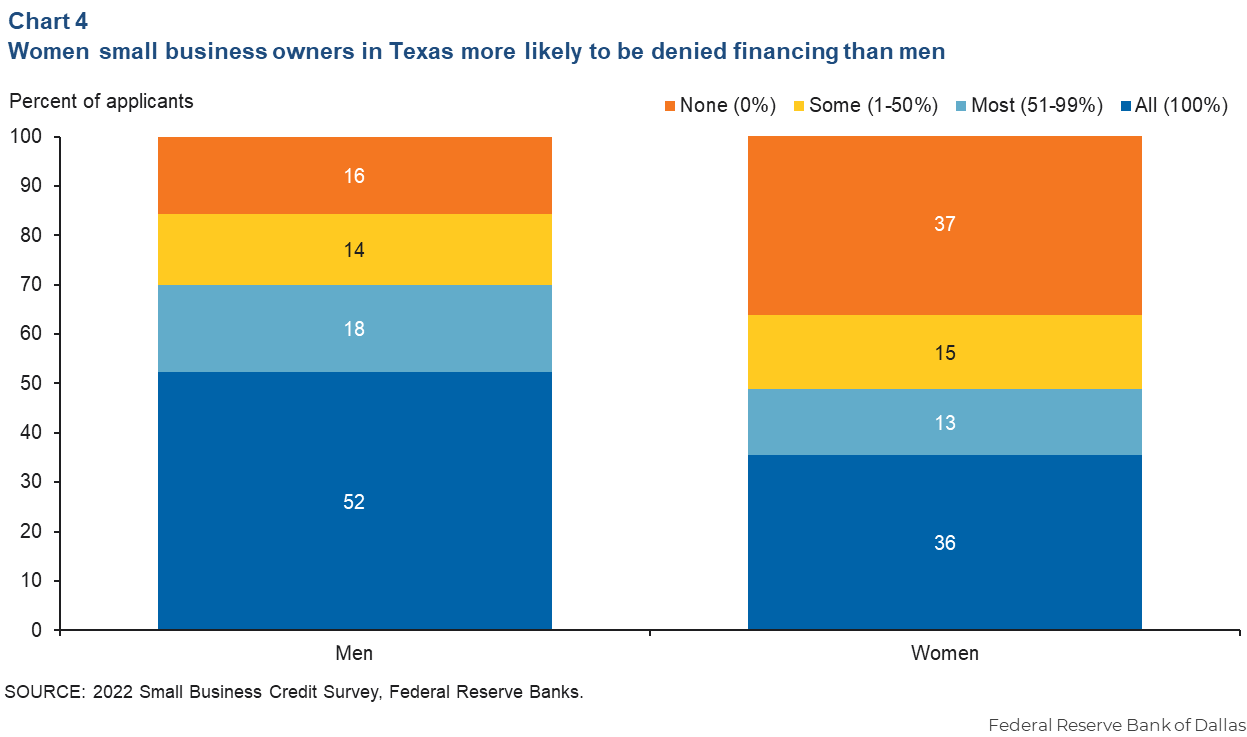

Chart 4 shows the success rates based on gender of the firm owner. While more than half of men-owned small firms in Texas that applied for financing in 2022 received all the financing they requested, just over one-third of women-owned small firms did. In fact, a slightly higher share of women-owned firms received no funding than received all the funding sought.

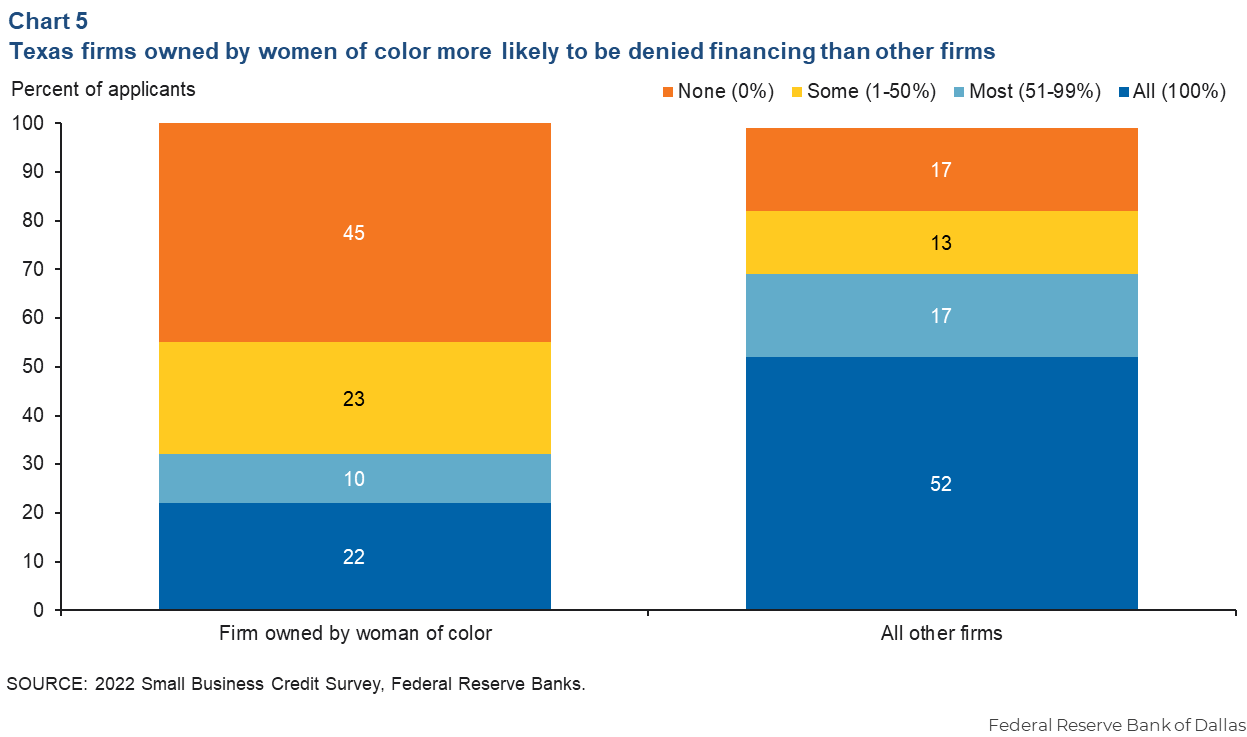

While women certainly appear to face larger barriers in accessing credit, the challenges are starker for women of color. Chart 5 shows the deep disparities faced by small businesses owned by women of color.

Financing disparities in Texas are deep when considering both race and gender. Despite the gap, research suggests women of color are becoming self-employed at faster rates than any other group in the nation. According to the 2022 SBCS, 60 percent of these employer firms in Texas expected to add employees in 2023. This gap in ability to access external financing could be a serious impediment as this group of firms aims to grow.

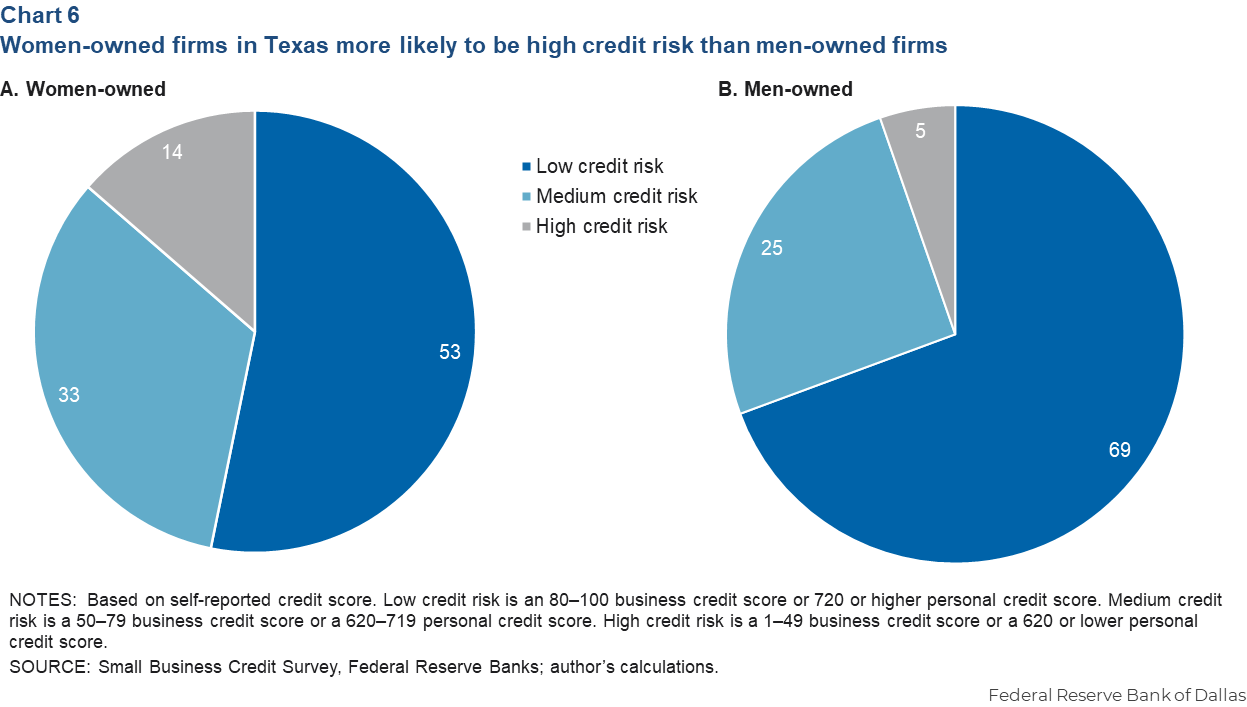

Credit scores play an important role in a lender’s assessment of a loan application. Self-reported credit scores for women-owned firms in Texas show slightly higher credit risk on average compared with men-owned firms. While close to 70 percent of male business owners in Texas reported credit scores considered to be low risk, just 53 percent of female business owners did the same. Additionally, about 14 percent of women reported credit scores in the highest risk category, compared with just 5 percent of men. (Chart 6)

This difference in average credit score undoubtedly explains some portion of the gap in accessing financing, but there are several other factors lenders use to assess the creditworthiness of an applicant, such as annual revenue, collateral and documentation (financial statements or business plans). The smaller average revenue generated by women-owned firms could also play a role, as may differences in collateral. On average, in the U.S., women hold less wealth than men, a disparity that is larger in size than the gender pay gap. This could, in turn, result in less access to collateral for business loans.

Another gender related difference among Texas small business owners: of those who applied for financing, three-quarters of women noted that “meeting operating expenses” was a primary reason to seek credit compared with two-thirds of men. This difference echoes the gap in financial challenges for female small business owners, who were 12 percentage points more likely to struggle paying their expenses than men. Still, meeting operating expenses was the top reason for all loan applicants in Texas and the U.S., regardless of gender. This contrasts with SBCS findings from before the pandemic, when most firms applied for financing to expand or pursue new opportunities. This overall shift to seek help to meet operating expenses is indicative of the bumpy road to postpandemic recovery for small businesses across the country.

Women-owned firms struggle to attract and retain employees

Most women-owned firms in Texas planned to add employees in 2023. But most women-owned firms that attempted to hire also reported difficulties with hiring or retaining qualified staff in 2022. This is not surprising, considering the ongoing tightness in the labor market. In fact, Dallas Fed President Lorie Logan in early October called out the labor market’s continued strength across the country, despite some evidence of slowing. With expectations for wage growth hovering around 5 percent, continued difficulties for financially constrained small business owners are likely.

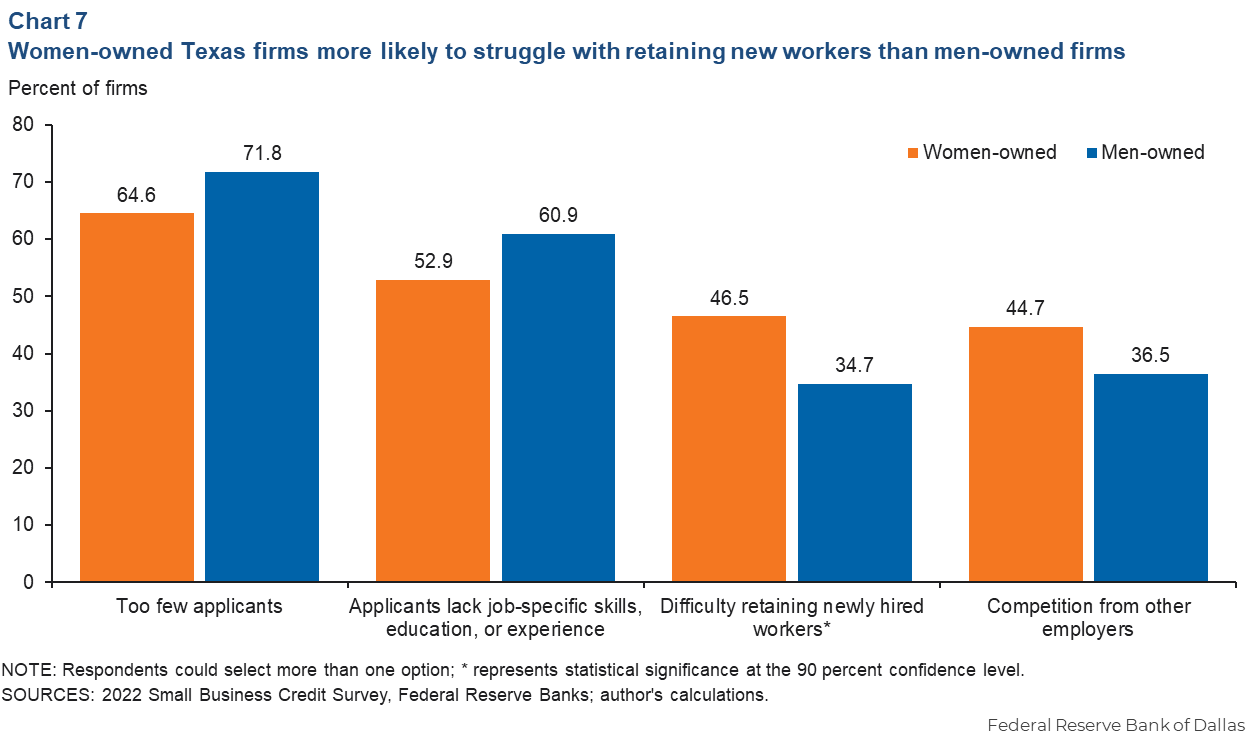

Most small firms in Texas that faced hiring challenges in 2022, regardless of owner demographic, reported there were simply too few job applicants. Sixty-five percent of women-owned firms reported this challenge compared with 72 percent of men-owned firms. Most firms also indicated a job-skills mismatch, because applicant skills or education didn’t meet the position requirements (Chart 7).

The only statistical difference in hiring challenges between men-owned and women-owned firms in Texas, however, is in difficulty retaining workers. While nearly 47 percent of women-owned firms reported struggling recently with employee retention, the same was true for just over one-third of men-owned firms. This difference could be related to the more prominent financial challenges for women-owned firms, which may have less ability to raise wages or increase benefits to retain new employees.

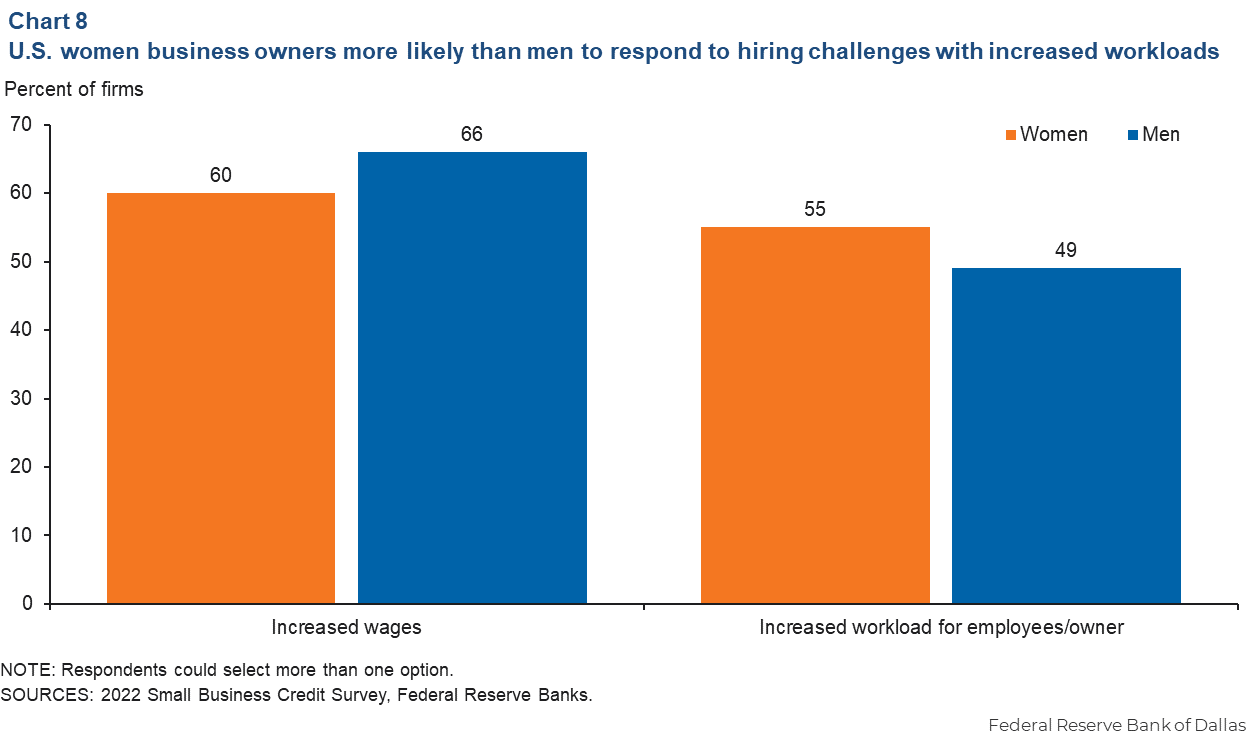

Although the Texas sample precludes a deeper analysis of actions taken in response to hiring difficulties, we can glean insights from the national SBCS data. Indeed, despite an overall shift in the U.S. toward increasing wages to attract employees, women-owned firms across the country were more likely to increase current employee workload compared with men, and less likely to raise wages (Chart 8).

Existing resources can help bridge the gap

This analysis suggests a disconnect between women business owners and the processes and resources for accessing capital. Existing resources can help fill the gap in some cases. Some women-owned small businesses could benefit from technical assistance preparing business plans, account statements and other appropriate documents required by lenders. Local city economic development offices, chambers of commerce, small businesses development centers, nonprofits and microlenders across the state offer such help. Additionally, some alternative lending products may help broaden access to credit for underserved firms. For example, the Texas Small Business Credit Initiative operates a $354 million loan guarantee program (LGP). Texas’ LGP, funded through the Treasury Department’s State Small Business Credit Initiative, will offer a financial institution a government guarantee for a portion of a loan, making the loan less risky. For women-owned and minority-owned firms and firms employing fewer than 10 people, the guaranteed portion may be higher, further incentivizing lenders to extend credit to these groups.

Despite the challenges faced by women business owners in Texas, they have been optimistic about revenue performance through 2023. While 58 percent of men-owned firms expected revenue growth in 2023, almost 70 percent of women-owned firms did, a statistically significant difference. This finding, coupled with women’s outsized employee growth expectations, paints a picture of hope and enthusiasm among Texas women business owners. This is true particularly for firms owned by women of color, of which 74 percent predicted revenue growth in 2023 and 59 percent expected to add employees.

How these expectations match up with reality for women-owned firms across Texas remains to be seen. Further research is needed—particularly qualitative research—to more deeply understand the decisions, experiences and underlying factors behind the gaps in access to capital. With the launch of the 2023 Small Business Credit Survey, such analysis should be possible next year.

Notes

- Firms of color are defined as a small business that is more than 50 percent owned by a person who identifies as Asian, Black, Hispanic and/or American Indian. White-owned firms are considered those firms more than 50 percent owned by a person who identifies as non-Hispanic white.

- Employer-firms are those that employ at least one other person, either part-time or full-time, other than the business owner.

About the author