Women-veteran entrepreneurs face hardships made worse by pandemic

Helanda Crespin, an Army veteran and owner of WritersKramp Editing Services, is a small business owner struggling to keep her business going, especially during the COVID-19 pandemic. She performs content writing for first-time authors and small businesses. She began WritersKramp in 2015 and is proud to be an independent businesswoman. When she needs help in her business, she always hires female editors and website developers.

We first spoke to Crespin in February 2020 before the pandemic, and we asked how her business was doing.

“Last year was a very lean year for my company,” she said, “And it puts me in the thought process of, ‘Should I continue to go on with this? Is this worth it?’ You know, all of those things that a group of other women-veteran-business owners are all tackling and worrying about.”

Crespin partially attributes her company’s lean year to the notion that editing is not an essential service or is only a temporary one. When we asked for her definition of a “healthy” economy, she replied that the economy is based on the “stability of the country.” She had no idea of the disruption that would hit the country in a matter of weeks.

Small firms grapple with maintaining financial health

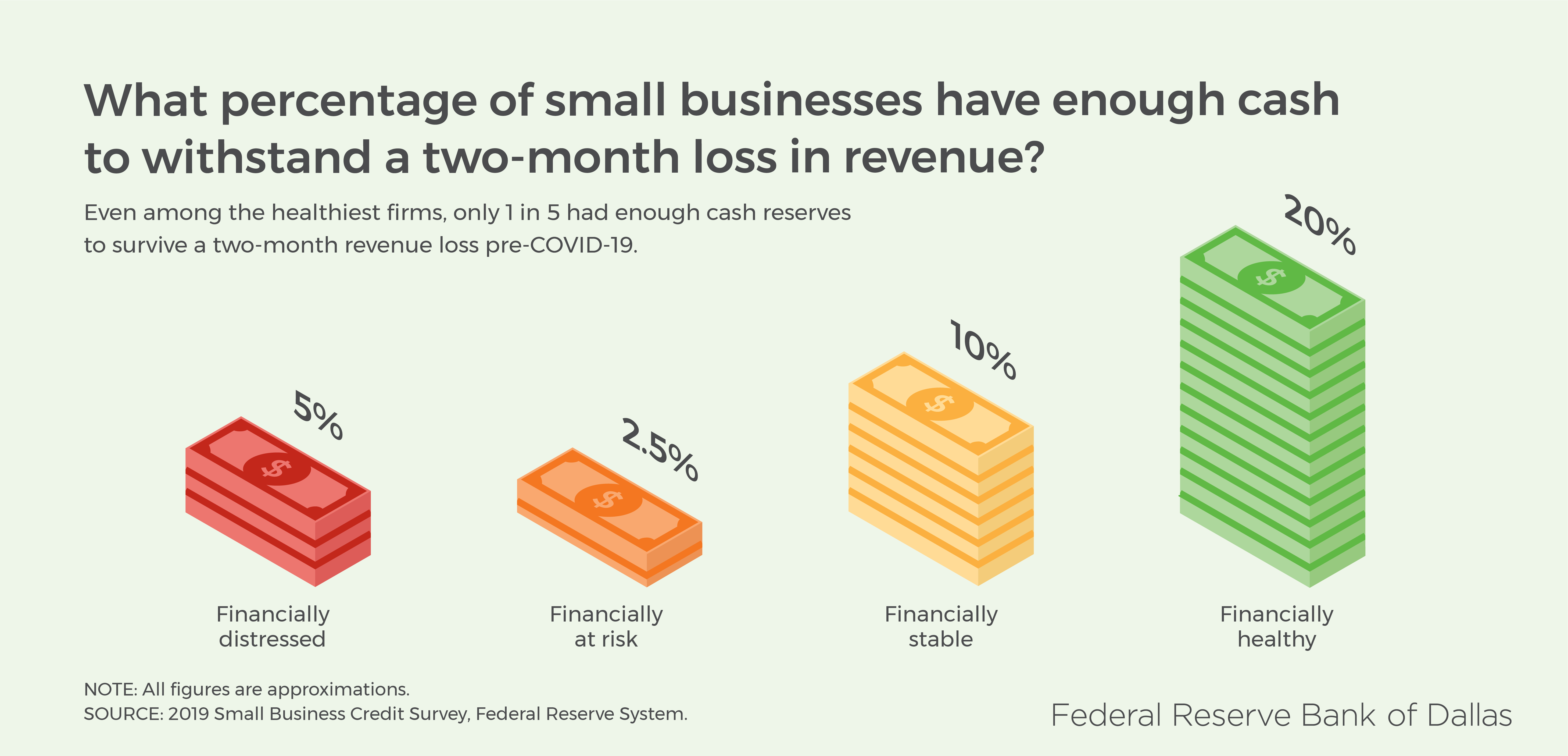

Businesses that were already vulnerable before the COVID-19 pandemic have become even more so during the ensuing recession the last few months. These businesses tend to be smaller and younger and are disproportionately owned by Hispanic and especially Black entrepreneurs. Women-veteran business owners, while not as numerically large, are growing quickly in number and are also disproportionately vulnerable, even before the COVID-19 pandemic. A Federal Reserve Bank of New York study found that in late 2019, when the economy as a whole was thought to be strong, only 35 percent of small firms were financially “healthy.” At that time, only about 20 percent of these healthy small businesses had enough cash reserves to maintain normal operations during a two-month revenue loss. Unsurprisingly, an even smaller share of “stable, at-risk” or “distressed” firms could do so.

At the same time the New York Fed was conducting its study, we were surveying Crespin and other women-veteran-business owners in Dallas-Fort Worth as part of our Moments That Matter Research Project with the Veteran Women’s Enterprise Center. Indeed, our survey participants largely share the same characteristics as some of the New York Fed’s “at-risk” and “distressed” firms. Many were small (with no employees), young (often less than five years old), minority owned (especially Black owned) and not profitable. These findings came before COVID-19 turned the global economy upside down.

Participants share their experiences

Our survey and follow-up phone conversations with these entrepreneurs shed light on the challenges they faced prior to the pandemic and the issues they face now. Before the pandemic, the most common trial faced by our survey participants was lack of access to capital.

“[When I was just starting out] I didn’t know anything about business credit … so [with] the lack of knowledge of that over the years … my credit has taken a beating.”

— Survey respondent

This is a common issue for both women-owned businesses and veteran-owned businesses. Hardly any of our respondents obtained a business loan from a bank, and many of them relied on personal savings to both start their business and fund them afterward. When asked why they didn’t take out a bank loan, our respondents’ answers varied: a lack of good personal credit, hesitancy to take out a big loan, or simply discouragement from being turned down so many times before.

Follow-up questions after recession

Of course, the recession following the COVID-19 pandemic only exacerbated this problem. Some relief programs, including the Paycheck Protection Program, were and are advantageous for those with existing lending relationships with banks.

When asked in our follow-up survey in April 2020, business owners indicated that the pandemic’s immediate impact on their business was largely the need to use personal funds to keep their business afloat. Some of our respondents felt like none of the relief programs (federal, state or local) provided sufficient support. There’s been “a lot of talk,” one said, but she wasn’t happy with the amount of help she received.

Some business owners had an easier time pivoting during the pandemic—like a financial coach who took her trainings online. Others, like a travel agent, saw their entire industry change practically overnight. Still other businesses, like WritersKramp Editing Services, relied on other small businesses as clients.

“I was struggling before the pandemic,” said Crespin. “Still, I could network and look for clients at small business events. Most of my clients came from these interpersonal social environments. Since the pandemic, I can’t network. Unfortunately, after expenses, there’s no money left for social media advertisement.”

As a result, Crespin says her business is facing hard times ahead—perhaps even closure.

What kind of help do these firms need?

“Since my business is so new, I am not eligible for [many loans and grants] ... This is frustrating, and while it is great that they are offering these funds, it is not relevant to my small business or many other new small businesses, so where do we turn to get help?”

— Survey respondent

When asked about the most critical interventions that would help their businesses, Crespin and other respondents agreed that loans or grants targeted to specific populations (like veterans and women) would be helpful, as would the suspension of existing loan payments.

“Provide financial mentoring for small businesses that struggle with low-to-no revenue streams,” Crespin also suggested, “then connect those mentees with possible financial support.”

In the meantime, Crespin says she is developing other ways to bring in revenue.

The survival of many of these businesses in the postpandemic business climate depends on timely and tailored interventions like those mentioned. Our Moments That Matters report details what business and community leaders can do to support women-veteran-business owners. The report also highlights further findings from our research, such as other roadblocks to success and the role of small business support programs. We hope you’ll take the time to read the stories of these business owners and consider what can be done to support them.

Author

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.