Assessment of Current Economic Conditions and Implications for Monetary Policy

July 13, 2017

As you know, at its June meeting, the Federal Open Market Committee voted to increase the federal funds rate to a range of 100 to 125 basis points. I believe that this action is consistent with an approach of removing accommodation in a gradual and patient manner, based on our ongoing assessment of economic conditions. At the June meeting, we also published updated principles and plans for gradually reducing the size of the Federal Reserve balance sheet.

The purpose of this essay is to provide a synopsis of my current views regarding economic conditions in the U.S., Mexico, and globally, and my thoughts regarding the appropriate stance of U.S. monetary policy.

The Dallas Fed is one of the 12 regional Federal Reserve Banks in the United States. The Eleventh District is composed of Texas, northern Louisiana and southern New Mexico. Texas accounts for 8.8 percent of U.S. gross domestic product (GDP).[1] It is the largest exporting state in the U.S. and is home to 52 Fortune 500 companies. The characteristics of our district give the Dallas Fed unique insights into energy, trade and immigration issues, as well as great insight into the regional, national and global economies.

With that background, let me begin with a discussion of energy given its importance to the Eleventh District as well as the U.S., Mexico and the world.

Energy

It is the view of our economists at the Dallas Fed that we are in the midst of a fragile equilibrium regarding global oil supply and demand.

In our most recent Dallas Fed Energy Survey, the majority of industry respondents expect global consumption and production of oil to move into rough balance sometime in 2018. This is a delay from our previous expectation that supply and demand would come into balance during 2017. This delay comes despite implementation of the December 2016 agreement between OPEC and certain non-OPEC nations to decrease production levels by as much as 1.8 million barrels per day.

One key issue is that, while OPEC has agreed to reduce production levels, U.S. oil production has been substantially increasing. Since the fall of 2016, U.S. oil production has risen from a low of approximately 8.6 million barrels per day to approximately 9.2 million barrels a day currently. It is our estimate that U.S. production will increase to 9.8 million barrels per day by year-end 2017. There is also a question as to whether OPEC members, and other oil-producing nations, will stick to their commitments to reduce production in the face of steadily rising U.S. production. This fragile balancing process is happening in the context of record levels of excess global oil inventories.

OPEC and non-OPEC countries extended their production agreement on May 25. Assuming they continue to extend their production agreement, our economists anticipate excess inventory levels should begin to consistently decline sometime during 2018. Based on these expectations, while there is certainly a risk that oil prices could break to the downside, my baseline view is that there will be continued price volatility but within a band of the $40s to the low-$50s for the remainder of 2017.

Our recent Dallas Fed Energy Surveys continue to show a notable increase in plans for capital spending in 2017 by exploration and production firms, though at a slower pace in the second quarter. We observe that the bulk of these spending plans are focused on shale oil production and are likely to involve investment in technologies that will create greater production efficiencies. Survey participants report that, in a number of locations, current market prices are sufficiently above breakeven levels to encourage further rig count growth, particularly in the Permian Basin.

Many of our recent discussions with industry contacts continue to be focused on the substantial potential supply upside of the Permian Basin in the years ahead. The Permian Basin has oil-bearing deposits that are layered, allowing multiple horizontal wells to run off a single well pad and much higher resource recovery per acre. The Permian currently produces approximately 2.3 million barrels per day.[2] With technological advances, many of our contacts believe that the Permian can expand production substantially in the years ahead. As a result, we expect that major oil companies, in the near term, may continue to avoid large long-lived capital projects and will, instead, focus their capital spending on more flexible and shorter-life-cycle shale opportunities in the U.S.

The District

Aided in part by improvement in the state’s energy sector, Dallas Fed economists expect Texas job growth of approximately 2.5 percent in 2017, the strongest rate in three years. Our business surveys suggest significantly stronger growth in the state’s manufacturing sector as well as continued strength in services.

Texas continues to benefit from the migration (as well as immigration) of people and firms to the state. Aided by this trend, the state’s economy has become increasingly diversified. The population of Texas is estimated to have grown from approximately 22.8 million in 2005 to almost 28 million in 2016.[3] Based on these trends, and as the energy sector continues to strengthen and recover, Dallas Fed economists are optimistic about the growth prospects for Texas and the Eleventh District in the months and years ahead.

Against this optimistic backdrop, I am cognizant that U.S. trade policy decisions could impact our outlook. In particular, we believe that U.S. trading and cross-border investment relationships with Mexico are important to enhancing job growth and competitiveness in the U.S. as well as economic growth in the Eleventh District.

Mexico is the top destination for Texas exports. Manufactured goods exports supported, directly and indirectly, an estimated 1 million jobs in Texas in 2015, equal to 8.2 percent of the state’s employment.[4] In 2016, Texas exports to Mexico were $92.7 billion. Dallas Fed economists believe that the trading relationship with Mexico has helped various industries in Texas[5] (as well as the U.S.) gain global competitiveness.[6] If this trading relationship were severely weakened, it’s our judgment that the U.S. would lose competiveness and that jobs would be lost to other parts of the world, particularly Asia. In addition, Texas border cities have benefited tremendously from the increasing U.S.–Mexico economic integration—leading to job gains, primarily in service sectors, that have resulted in higher wages and improved standards of living for many Texans.[7]

The U.S.

GDP in the U.S. is estimated to have grown at a 1.4 percent rate in the first quarter of 2017. This disappointing rate of growth was due to weak growth in consumer spending as well as a significant inventory deceleration.

Despite this poor start to the year, our Dallas Fed economists expect GDP growth slightly in excess of 2 percent in 2017. The key underpinning of our forecast is our expectation of a strong U.S. consumer. The U.S. consumer has spent the past nine years deleveraging from record levels of debt to GDP and is today in relatively good financial shape and, as a result, has capacity to spend.

In addition to a strong consumer, we also expect GDP growth in 2017 to be bolstered by some improvement in nonresidential fixed investment. We expect that our estimate of GDP growth, while sluggish by historical standards, will be sufficient to remove remaining slack from the labor market.

Potential changes in fiscal policy and structural reforms could provide upside to this forecast. However, it is also the case that U.S. policy uncertainty in key areas and the rhetoric associated with the public debate regarding these potential policies bear watching and could impact negatively the propensity of certain groups of consumers to spend versus save.

Unemployment

We are making good progress toward reaching our full-employment objective. The June jobs report showed an increase of 222,000 jobs and an unemployment rate of 4.4 percent. The average monthly pace of job gains in 2017 is approximately 180,000 versus 187,000 in 2016. As we move forward, I would not be surprised if the average rate of job growth continued to slow, consistent with a declining level of labor slack in the economy.

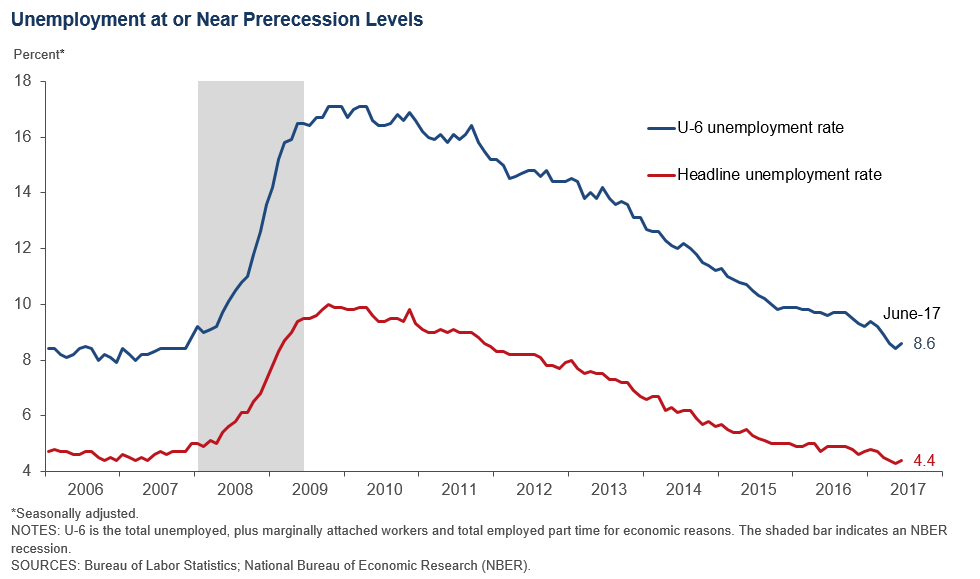

In addition to the headline unemployment rate, my economic team looks at several measures of labor market slack, including estimates of discouraged workers and people working part time for economic reasons (otherwise known as U-6 unemployment), as well as the labor force participation rate.

U-6 unemployment (see chart below) now stands at 8.6 percent, which compares with a prerecession quarterly low of 8.1 percent. Looking at this historical data suggests to me that we are moving very close to full employment in the U.S.

In addition to U-6, we also closely look at the labor force participation rate, which now stands at 62.8 percent. This compares with a participation rate of 66 percent in 2007. Our economists believe that a majority of the decline in participation is due to the aging of the population. This aging trend is expected to continue in the U.S. as well as across almost all advanced economies. Over the next 10 years, we estimate that, due to aging of the workforce, the U.S. participation rate will decline to below 61 percent.[8]

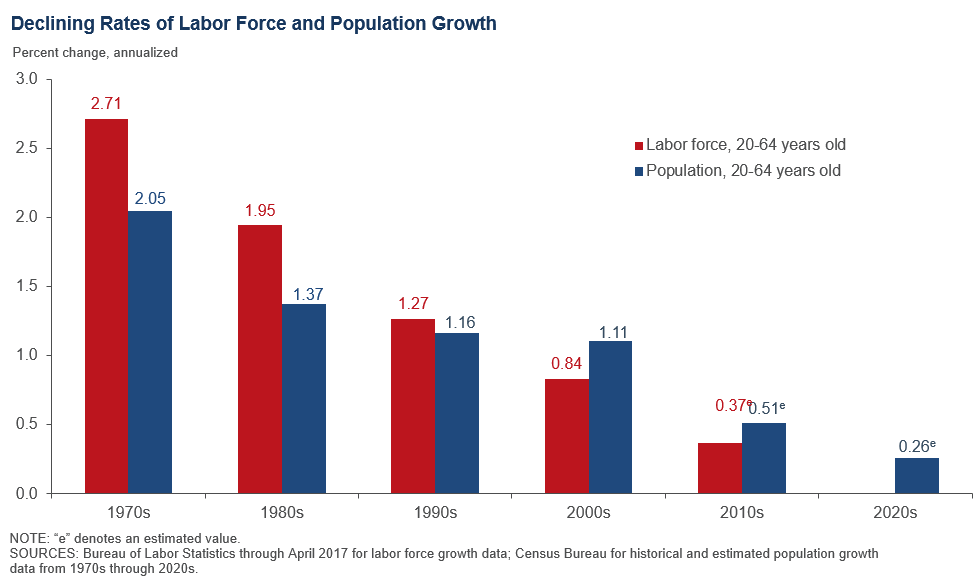

The net impact of this aging trend has been, and is likely to be in the future, a reduction in the rate of labor force growth. You can see from the chart below that, beginning in the 2000s, population growth among those 20 to 64 years old has outpaced overall labor force growth. This trend has been due to a steadily increasing percentage of the 55–64 population within the 20–64 age cohort as well as a plateauing of the rate at which women have been entering the workforce. Dallas Fed economists expect these trends to continue as we head toward the 2020s.

Because GDP growth is comprised of growth in the workforce plus gains in productivity, weaker expected workforce growth trends will likely have significant negative implications for potential GDP growth in the years ahead—unless we take steps to mitigate these effects.

Tackling the Skills Gap in the U.S.

When we look at measures of discouraged workers and those who are working part time for economic reasons, I would note the high correlation between participation rates (as well as unemployment rates) and levels of educational attainment. The labor force participation rate for prime-age workers is approximately 88 percent for college graduates and 81 percent for those who have attended some college. However, prime-age worker participation is only 76 percent for those with a high school diploma and only 66 percent for those who have less than a high school diploma.

Our economists at the Dallas Fed believe that the skills gap in the U.S. is substantial. The National Federation of Independent Business reports that as of June 2017, 46 percent of small businesses indicated that they were unable to find qualified applicants to fill job openings. CEOs report difficulty in hiring workers for middle-class-wage jobs such as nurses, construction workers, truck drivers, oilfield workers, automotive technicians, industrial technicians, heavy equipment operators, computer network support specialists, web developers and insurance specialists. When these types of jobs go unfilled, U.S. businesses expand more slowly and the nation’s growth is impeded.

This substantial skills gap highlights the need for the U.S. to do much more to beef up public/private partnerships that focus on skills training in order to help workers attain the capabilities needed to find employment in the 21st century economy. We also need to invest in programs that improve early-childhood literacy and generally enhance the level of educational attainment among our younger population. Both of these types of initiatives have the added benefit of helping to potentially reduce income inequality by creating broader workforce productivity gains and prosperity.

Inflation

Progress toward reaching our 2 percent inflation objective has been slow over the past several years. I believe this has likely been due to a rising dollar and weaker energy prices, as well as a number of persistent secular forces, such as globalization and technology-enabled disruption (see “Broader Secular Trends” below).

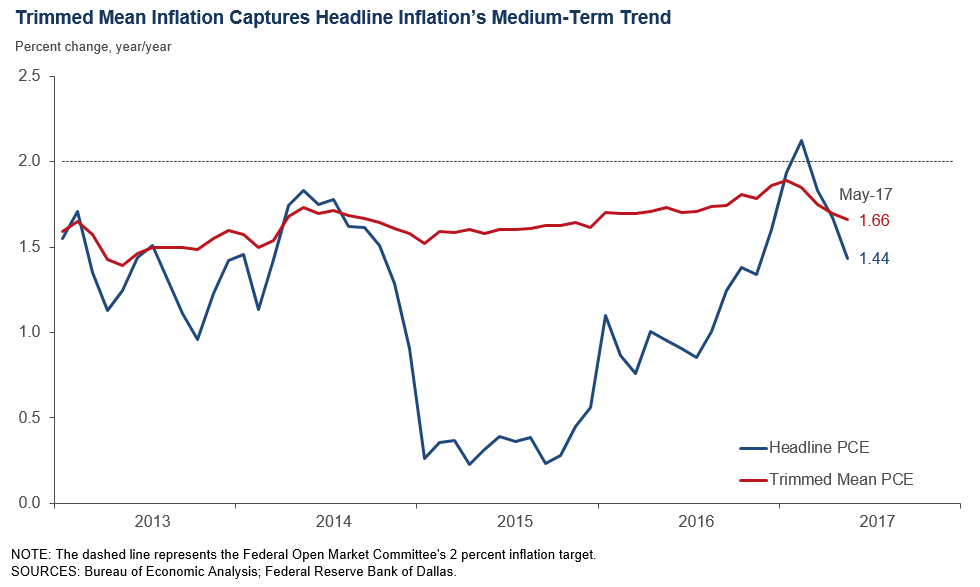

Twelve-month measures of headline and core inflation fell in March, April and May. While I believe that this recent weakening may well be transitory, I intend to be patient and open-minded in assessing upcoming data releases in this regard.

In order to analyze inflation trends, our economists look at headline inflation but also track several measures of core inflation. In particular, Dallas Fed economists closely monitor our Dallas Fed Trimmed Mean PCE inflation rate (see chart below). This measure trims out the most extreme upward and downward monthly price movements and, our economists believe, represents a more reliable indicator of the trend of inflation. The measure gradually increased from 1.7 to 1.8 percent during 2016 after running at approximately 1.6 percent in 2015. Through May 2017, it is running at approximately 1.7 percent on a 12-month basis after having touched 1.9 percent in January. I am of the view that, despite recent weakness, as slack continues to be removed from the labor market, headline inflation should reach, or exceed, the Fed’s 2 percent longer-run objective in the medium term. However, I will be closely watching this measure in the months ahead in order to confirm that recent weakness is indeed transitory and that we are continuing to make progress in reaching our inflation objective.

Non-U.S.

In assessing economic conditions in the U.S., my research team closely monitors economic developments outside the U.S. to evaluate how these developments might impact economic growth domestically. In this regard, we are closely monitoring the evolving situation regarding the United Kingdom’s future relationship with the European Union. At this stage, I believe that the impact of Brexit is likely to be manageable for the U.S., although we are continuing to carefully monitor political developments and other policy decisions that could create a risk of contagion among other European countries.

We also monitor the major emerging-market countries, particularly China. China is challenged by a high degree of overcapacity (particularly in state-owned enterprises) and high and growing levels of debt. The nation is also in the midst of a multiyear transition from being a manufacturing- and export-driven economy to one that is based on consumer spending and services. This transition is likely to take many years, and the world is going to have to become accustomed to lower rates of Chinese growth. In the meantime, China has worked to manage capital outflows and currency volatility. As we saw in the first quarter of 2016, this situation has the potential to create periods of financial market volatility and lead to bouts of tightening in global financial conditions, which could, in turn, slow economic growth in the U.S.

The Mexico Economy

As I discussed earlier in this essay, Mexico is a very important relationship for the United States as well as the Eleventh District of the Federal Reserve. The Mexico economy grew an estimated 2.7 percent in the first quarter of 2017 and is expected to grow at approximately 2 percent for the full year. This compares with 2.3 percent growth in 2016.

For a number of reasons, including weakness in the energy sector as well as concerns regarding trade relations with the U.S., the peso has been highly volatile over the past 18 months. From November 2016 through January 2017, it declined as much as 15 percent against the dollar, and has since appreciated roughly 20 percent—and now stands at a higher level than immediately prior to the U.S. election. Due at least in part to previous weakness in the currency, Mexico inflation has risen substantially and is now estimated at well above the central bank’s 3 percent inflation target. In response, Banco de México has raised its policy rate 10 times over the past 19 months to 7 percent in order to stem price pressures. The central bank’s actions have created headwinds for short-term economic growth but should help anchor inflation expectations in the medium and long term.

In addition, between 2012 and 2014, the Mexican government initiated a broad set of structural reforms aimed at improving labor practices and fiscal policy as well as liberalizing the financial, telecommunications, energy and education sectors. These sweeping reforms are aimed at boosting national productivity and competitiveness.

Broader Secular Trends

In addition to monitoring cyclical trends, my economic research team carefully considers and works to understand several key secular drivers. As I have emphasized over the past year, these drivers are likely having a powerful influence on unfolding economic conditions.

I have particularly focused on four key secular drivers:

- Aging-workforce demographics in the U.S. and across major economies. As discussed earlier, aging-population trends, on balance, reduce labor force participation rates and ultimately create headwinds for potential GDP growth. These demographic trends are also likely to impact the “dependency ratio”[9]—that is, they are likely to lead to a situation in which an increasing share of the population is depending on those of working age to pay for future medical and retirement benefits. These trends are likely to exacerbate the issues regarding the sustainability of U.S. government fiscal obligations (discussed further below).

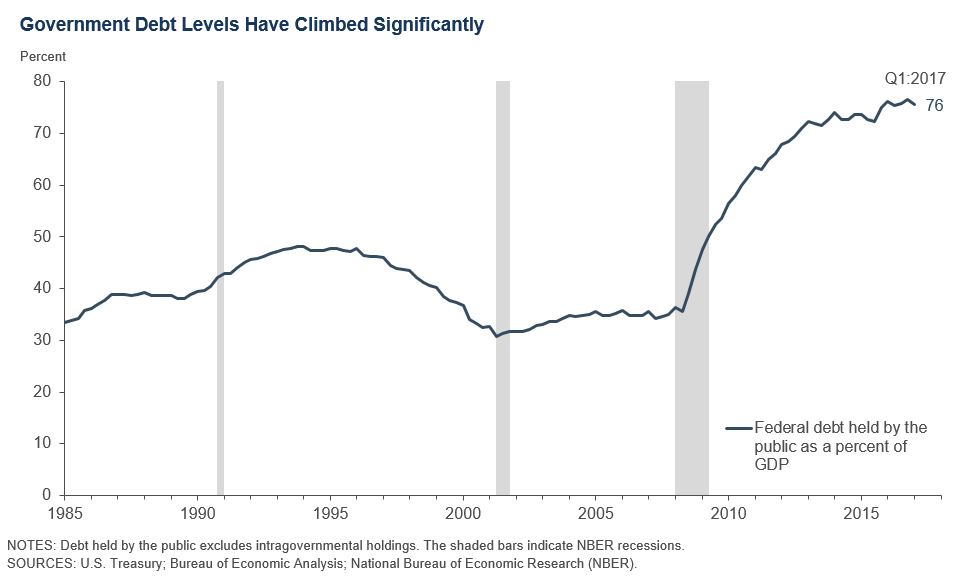

- Limits to the sustainability of the so-called global debt super cycle. Historically, the U.S. and other countries have used increasing debt—often through tax cuts and increased government spending—to boost economic growth. At this point, there are likely limits to the ability of countries, including the U.S., to further increase debt to GDP in order to generate higher levels of economic growth. As I discussed earlier in this essay, we have seen a deleveraging of the U.S. household sector since 2008. As a result, the household sector is in much better shape today. However, while household balance sheets have improved since the Great Recession, government debt held by the public stands at approximately 76 percent of GDP (see chart below), and the present value of future unfunded entitlements is now estimated at $46 trillion.[10] These obligations will increasingly work their way into U.S. budget deficits over the next five to 10 years—raising questions regarding fiscal sustainability which, if not addressed, could negatively impact longer-run economic growth.

Globalization. Economies, financial markets and companies are more closely intertwined than ever before. For example, regarding trade, estimates indicate that in excess of 40 percent of the content of U.S. imports from Mexico is of U.S. origin.[11] This is because much of this trade is related to integrated production chains and logistical arrangements between U.S. and Mexican companies. As mentioned earlier, it is our view at the Dallas Fed that these arrangements have helped improve U.S. competitiveness and created jobs in the U.S. Without these arrangements, these jobs might have otherwise been lost to other areas of the world, particularly Asia.

While trade and globalization have yielded net economic benefits for the U.S. economy, they have also created severe local hardships that the U.S. and other advanced economies have struggled to address. The challenge is how to reap the benefits of globalization while addressing the disruptions it creates—failing to do so is likely to have negative implications for trade and the pace of economic growth in the U.S. and globally.

Technology-enabled disruption. In order to improve their competiveness, many companies are actively investing in technology, which is leading to a significant reduction in the number of workers needed to produce goods and services. The result is that U.S. workers across a range of industries are finding their jobs being eliminated. While this trend has increased productivity in most industries, I believe one key reason that overall labor productivity growth has been sluggish is that displaced workers are often going to less-productive jobs. This issue is a key reason I have been emphasizing the need for beefed-up skills training to help displaced workers get retrained so they can find more-productive employment.

In addition, many industries are facing a disruptive competitor that is threatening their business model by offering lower cost and greater convenience in the sale of goods or services. Think the digital camera versus the old film industry, Amazon versus retail stores, Kahn Academy versus brick-and-mortar schools, 3-D printing versus traditional manufacturing, Uber and Lyft versus taxis and so on. This technology-enabled disruption has allowed consumers to achieve better value and more easily shop for merchandise and services in a way that lets them easily choose the lowest price. It has also reduced the pricing power of many companies and caused them to intensify their focus on creating greater operational efficiencies.

I believe that the dislocations resulting from technology-enabled disruption are sometimes confused with the impacts of globalization. This is a powerful trend, apart from globalization, which may help explain why the rate of employment among prime-age workers in the U.S. has not recovered to prerecession levels. It may also help explain why companies have been more hesitant to make capacity expansion decisions as well as invest in major capital projects.

In light of these secular trends and the sluggish economic growth over the past several years, I have been speaking the last several months about the need for structural reforms and fiscal policy to join the menu of economic policy. Monetary policy is not designed, by itself, to address the key structural challenges we face today stemming from changing demographic trends and lower rates of productivity growth, as well as dislocations created by globalization and increasing rates of technology-enabled disruption. While monetary policy has a key role to play, it is not a substitute for structural reforms and other actions that could address deeper fundamental challenges.

The primary prism I use to judge new structural reforms and potential fiscal policies is whether they help grow the labor force and/or improve productivity growth in the U.S. GDP growth is comprised of these two components, and I believe potential new policies should be judged in the context of whether they create sustainable improvement in these measures.

The Current Stance of Monetary Policy

As I mentioned earlier in this essay, I believe that we are making good progress in accomplishing our dual-mandate objectives of full employment and price stability. However, I am cognizant that progress toward our 2 percent inflation goal has been slow and, at times, uneven. I intend to be patient in critically assessing upcoming data to evaluate whether we are continuing to make progress in reaching our inflation objective.

I have consistently stated that I believe there is a cost to excessive accommodation in terms of limiting returns to savers, as well as creating distortions and imbalances in investing, hiring and other business decisions. Monetary policy accommodation is not costless. It has been my experience that significant imbalances are often easier to recognize in hindsight and can be very painful to address.

However, I also believe that the key secular drivers discussed earlier in this essay will continue to pose challenges for economic growth. As a result, my view is that the neutral rate, the rate at which we are neither accommodative nor restrictive, is likely to be much lower than we are historically accustomed.

Based on these considerations, I have argued that future removals of accommodation should be done in a gradual and patient manner. “Gradual and patient” means to me that I will be open to updating my views on the economic outlook and the appropriate stance of monetary policy based on incoming economic information. I will avoid being rigid or unduly predetermined in my views.

At present, with a federal funds rate at a range of 100 to 125 basis points, I would like to see some greater evidence that we are making progress toward meeting our 2 percent inflation objective in the medium term. I am cognizant that several secular forces (described earlier in this essay), particularly an intensifying rate of technology-enabled disruption, are likely impacting the pricing power of businesses and creating downward pressure on inflation. I plan to continue to work to try to better understand the impact of these secular forces in the weeks and months ahead.

Separately, with the Federal Open Market Committee having now published updated principles and plans for reducing the size of the Fed’s balance sheet, I believe it will likely be appropriate to begin the process of balance-sheet reduction sometime later this year.

Notes

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.

| 1. | Bureau of Economic Analysis, Fourth Quarter 2016. |

| 2. | Based on the Energy Information Administration, Drilling Productivity Report, June 12, 2017 |

| 3. | Census Bureau. |

| 4. | “Texas Border Cities Illustrate Benefits and Challenges of Trade,” by Jesus Cañas, Federal Reserve Bank of Dallas Southwest Economy, Fourth Quarter, 2016. Also see “Jobs Supported by State Exports 2015,” by Jeffrey Hall and Chris Rasmussen, Office of Trade and Economic Analysis, International Trade Administration, U.S. Department of Commerce, May 31, 2016. |

| 5. | “Texas Comparative Advantage and Manufacturing Exports,” by Jesus Cañas, Luis Bernardo Torres and Christina English, in Ten-Gallon Economy: Sizing Up Texas’ Economic Growth, Pia M. Orrenius, Jesus Cañas and Michael Weiss, eds., New York: Palgrave MacMillan, 2015. |

| 6. | “Intra-industry Trade with Mexico May Aid U.S. Global Competitiveness,” by Jesus Cañas, Aldo Heffner and Jorge Herrera-Hernández, Southwest Economy, Second Quarter, 2017. |

| 7. | “So Close to Mexico: Economic Spillovers Along the Texas–Mexico Border,” by Roberto Coronado, Marycruz De León and Eduardo Saucedo, in Ten-Gallon Economy: Sizing Up Texas’ Economic Growth, Pia M. Orrenius, Jesus Cañas and Michael Weiss, eds., New York: Palgrave MacMillan, 2015. Also see “El Paso and Texas Border Cities Close the Gap in Per Capita Income,” by Roberto Coronado and Robert W Gilmer, Crossroads, Issue 2, 2012. |

| 8. | “Labor Force Projections to 2024: The Labor Force Is Growing, but Slowly,” Monthly Labor Review, Bureau of Labor Statistics, December 2015, www.bls.gov/opub/mlr/2015/article/labor-force-projections-to-2024.htm. |

| 9. | “Global Demographic Trends Shape Policy Environment,” by Mark Wynne, Federal Reserve Bank of Dallas Economic Letter, vol. 11, no. 7, 2016. |

| 10. | 2016 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, June 22, 2016. |

| 11. | Give Credit Where Credit is Due: Tracing Value Added in Global Production Chains,” by Robert Koopman, William Powers, Zhi Wang and Shang-Jin Wei, National Bureau of Economic Research, NBER Working Paper no. 16426, December 2011. |

About the Author

Robert S. Kaplan was president and CEO of the Federal Reserve Bank of Dallas, 2015–21.