Don’t expect U.S. shale producers to respond quickly to geopolitical disruption

Higher oil prices due to supply disruptions and increased geopolitical risk are unlikely to generate significantly more U.S. oil production in the short term. However, shale oil producers stand to benefit from hedging and revenue opportunities, based on an analysis of market conditions.

Benchmark Brent oil prices surged 19 percent in overseas markets following the attack on the Abqaiq crude oil processing facility and Khurais oilfield in Saudi Arabia on Sept. 14. Oil prices have since retreated, but traders are now watchful of heightened tensions that could send prices higher.

If oil prices climb further in the coming weeks, policymakers, consumers and market participants may wonder if U.S. shale exploration and production (E&P) companies will respond by increasing oil production. The simple answer is “no,” conversations with shale operators and available research suggest.

Investor demands over the past year have forced the E&P sector to focus on returns rather than production growth. Higher oil prices through year-end, should they materialize, present shale firms the opportunity to hedge 2020 production—locking in higher prices—and reach free cash-flow goals earlier than anticipated rather than raise production targets.

Some privately owned producers may drill more in coming months in response to a stronger price outlook, but the overall impact of higher near-term prices on U.S. oil production growth should be minimal.

Improved Hhedging environment

Most oil producers protect themselves from the risk of low oil prices by hedging. Though there are several strategies, hedging in its simplest form occurs when an oil producer identifies prices in the futures markets (also known as the futures curve) that the producer believes exceed what’s likely to occur. The producer hedges by selling a futures contract today in order to “lock in” the potentially higher price at a specified future date.

U.S. oil producer forward hedging was down 25 percent from year-ago levels at the end of the second quarter (the latest available filing data). Only 8 percent of 2020 production is hedged by large-cap E&P companies (those with a market capitalization exceeding $10 billion), as estimated by Tudor, Pickering & Holt, a Houston-based energy investment bank.

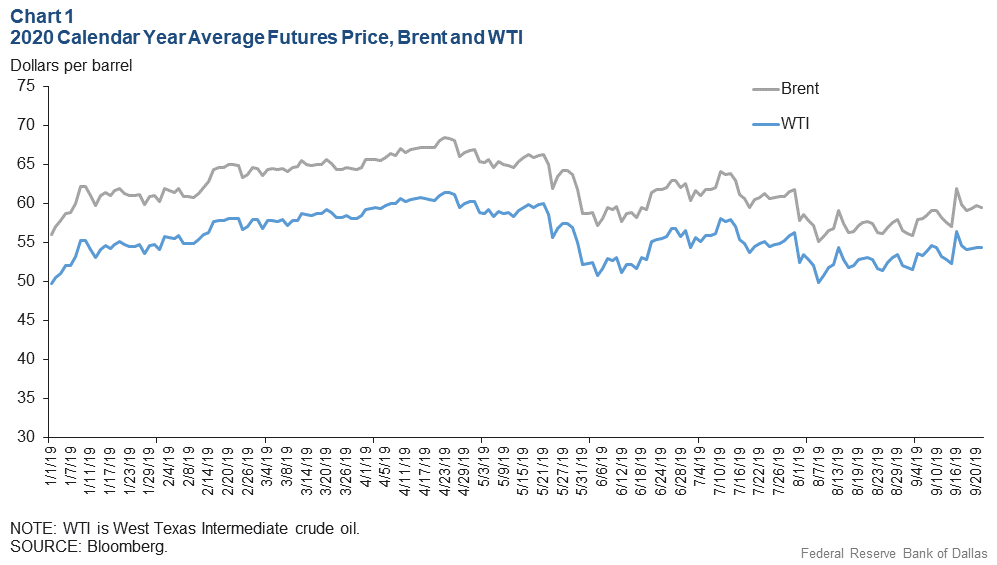

Most shale companies require benchmark West Texas Intermediate (WTI) crude prices of $50 to $55 a barrel to achieve top-line profitability, or positive free cash flow, in 2020, according to the firms’ second-quarter earnings calls and investor presentations. If markets begin pricing a deteriorating economic environment for next year–during which WTI could stay below that range—locking in 2020 hedges above those levels becomes critical.

The problem during most of third quarter 2019 was a futures curve through 2020 that only briefly broke through the $50 to $55 range. With the mid-September price spike, shale firms got another chance to hedge for next year. Based on discussions with shale companies, it appears many E&P firms did just that (Chart 1).

If shale firms can protect 2020 production and cash flow targets with $55 to $65 hedges, a floor could be established for supply forecasts that currently anticipate U.S. shale production growth of about 600,000 barrels per day for the year ending December 2020. The hedges would prevent spending reductions and lowered production targets for some companies should prices decline significantly.

Increased cash flow

The E&P sector has shifted into a returns-focused business model, emphasizing capital discipline instead of accelerating production growth since the end of 2017. Before that, investors rewarded shale companies for increasing production even if they spent more than their cash flow. Investors now demand E&P companies show more spending restraint and generate positive free cash flow; production growth is not a high priority like before.

Facing questions on what their response would be if prices surged, most E&P management teams over the past year have said they would not ramp up spending or raise production targets, instead preferring to receive higher revenue.

That is the likely response among most large public shale firms; investors would punish most companies announcing a spending increase. Higher revenue will probably be committed to servicing debt and returning money to investors by paying (or increasing) dividends and pursuing stock buybacks.

Assuming shale companies hold larger hedging portfolios and oil prices climb through the end of the year, most of the firms should be in a better position on a free cash-flow basis going into 2020 than previously expected. Moreover, as shale companies increase their dividends, a steadier stream of cash that is less vulnerable to oil price swings is required to meet those commitments. Aggressive hedging helps achieve that goal.

More drilling among smaller operators

While large-cap E&P firms face investor pressures, some small-cap and privately owned companies are more likely to respond to higher prices by raising production targets. They don’t face the discipline of public equity markets and use oil reserves as collateral for access to credit; this forces many of these companies to “grow through the bit,” as shale operators have traditionally behaved.

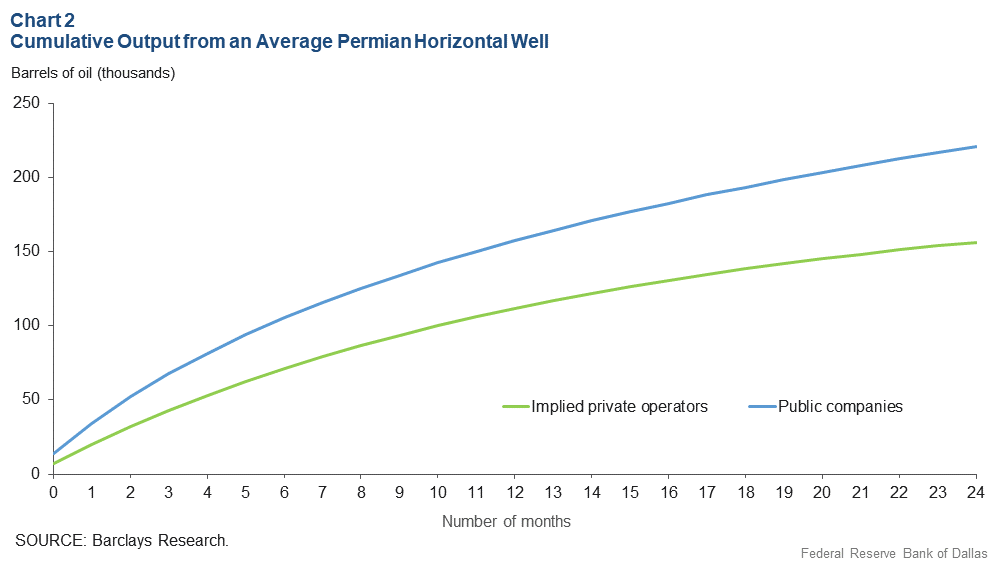

Some of these companies may view a price surge—if sustained— as an opportunity to increase production. However, their contribution to U.S. supply is set to decline in coming years as they generally hold less-prodigious acreage and are more capital constrained than typical large-cap operators (Chart 2).

Even if some companies decide to spend more on drilling, it will take months for any impact on supply to materialize. Based on conversations with shale operators, the average horizontal well pad in the Permian Basin takes four to six months from the commencement of drilling to production coming online. A drilled-but-uncompleted well—one that has not yet been hydraulically fractured—may take one to three months to go into production.

And no company will accelerate spending and production activity without a belief that prices will remain higher for the foreseeable future. Given that only a small number of producers will commit to a higher activity level with higher prices, and the inherent lag that occurs between drilling and production, the U.S. supply response to additional supply outages and higher prices would not appear for another two quarters, if at all.

About the Author

Garrett Golding

Golding is a business economist in the Research Department at the Federal Reserve Bank of Dallas

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.