El Paso Economic Indicators

June 15, 2021

The El Paso economy continues to recover from the COVID-19-induced recession. The business-cycle index grew in April, and monthly payrolls expanded. Although trade volumes remained below prepandemic levels, monthly trade through the El Paso port of entry grew. U.S. industrial production and manufacturing activity improved, while auto sales stumbled in part due to a semiconductor shortage.

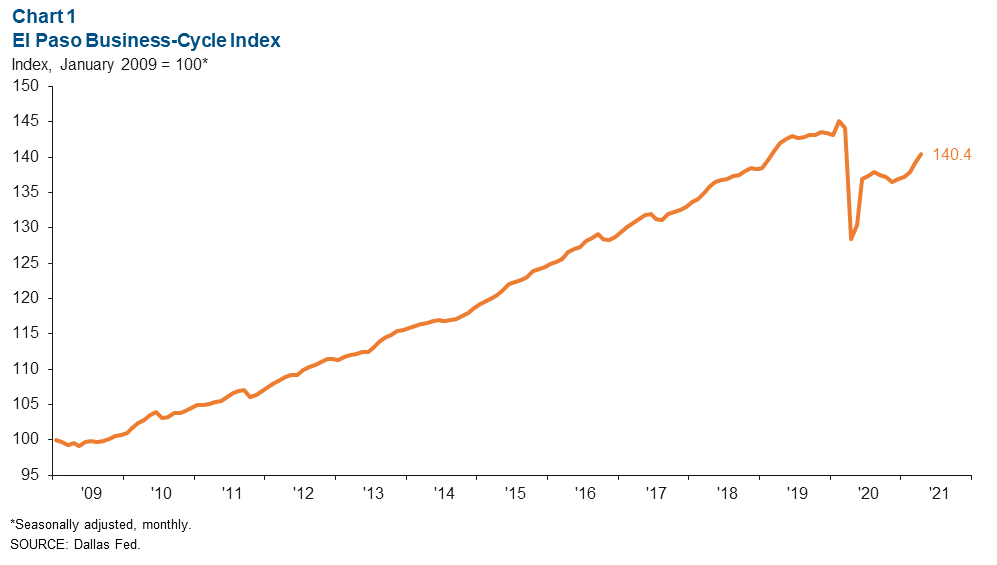

Business-Cycle Index

The El Paso Business-Cycle Index rose an annualized 11.0 percent in April, supported by job gains and a decline in the unemployment rate (Chart 1). Compared with prepandemic levels (February 2020), the index is still down 3.3 percent.

Labor Market

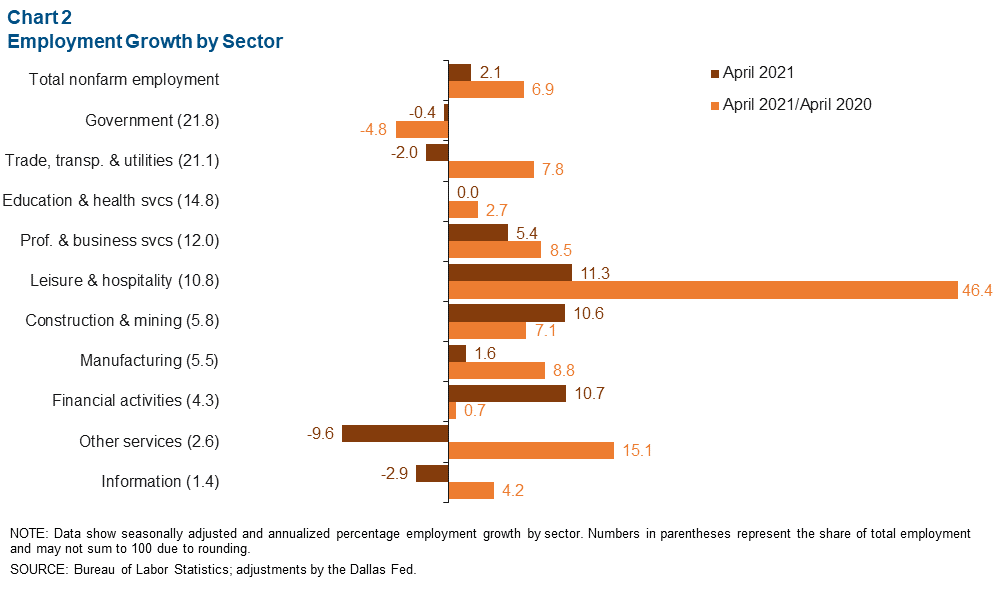

In April, El Paso employment expanded an annualized 2.1 percent, or by 538 jobs (Chart 2). The growth was largely driven by increases in leisure and hospitality (297 jobs), professional and business services (164) and construction and mining (151). Sectors that witnessed monthly employment losses included trade, transportation and utilities (-109 jobs), other services (-69) and government (-20).

Year over year in April, El Paso payrolls were up over 20,000 jobs. Nearly all sectors experienced job growth, including leisure and hospitality (10,607 jobs), trade, transportation and utilities (4,743) and professional and business services (2,919). Only the government sector experienced employment losses during this period, shrinking by 3,383 jobs.

In April, the seasonally adjusted unemployment rate fell from 7.3 to 6.9 percent but remained above that of Texas (6.1 percent). The U.S. unemployment rate fell from 6.1 percent in April to 5.8 percent in May.

Retail Sales

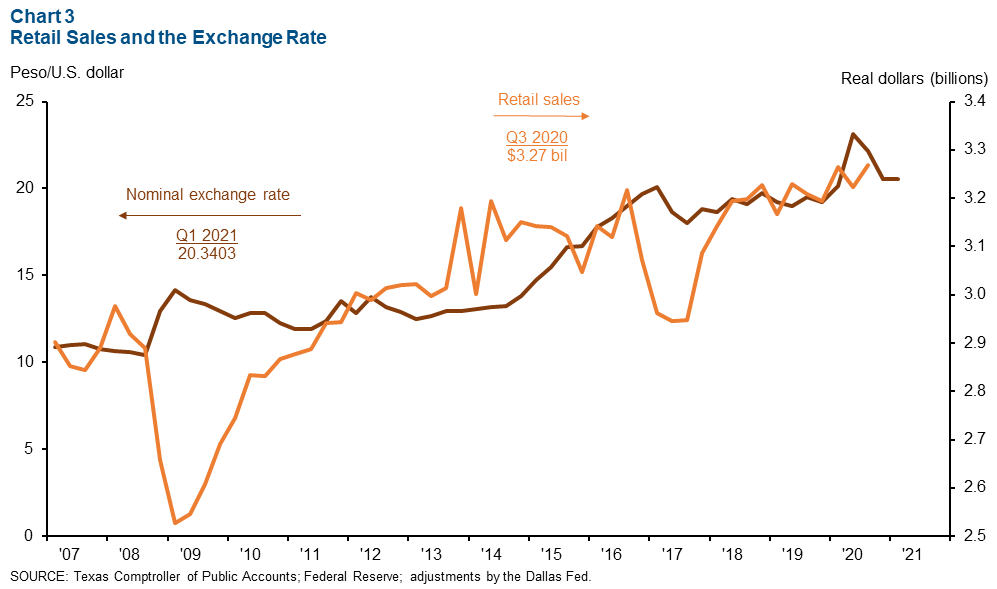

According to the latest estimates available, El Paso retail sales totaled $3.27 billion in third quarter 2020—1.9 percent higher than in the same period in 2019 (Chart 3). Dallas Fed research shows that Mexican shoppers account for about 18 percent of El Paso’s retail sales. Consequently, it may seem counterintuitive that 2020 gross retail sales were stronger than those in 2019 following last year’s closure of the international border for nonessential activities like retail shopping.

However, several factors are at play in the retail sector locally and across the nation. First, consumer spending remained relatively immune to the downturn as households benefited from rounds of fiscal stimulus. Second, many consumers spent less on services and more on goods due to the closure of high-contact businesses and work-from-home policies, propelling e-commerce activity in 2020. Finally, retail sales growth has remained relatively steady since 2017 even though the strong dollar has eroded Mexican purchasing power.

Trade

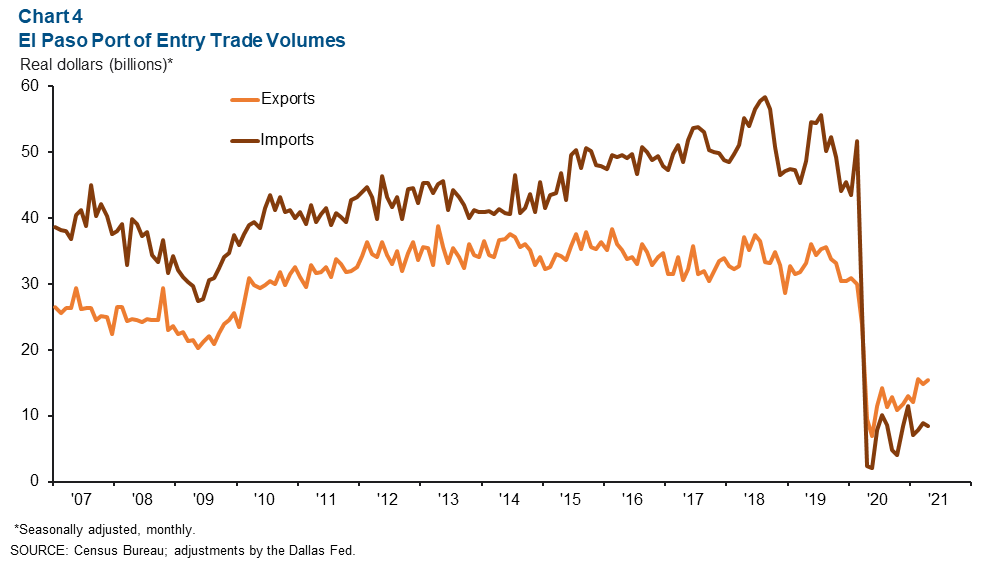

Annualized monthly trade through the El Paso port of entry rose 0.8 percent to $23.9 billion in April (Chart 4). The increase was driven by export growth of 4.1 percent; imports fell 4.7 percent.

Despite the monthly growth, total trade volumes were less than a third of prepandemic levels at the El Paso port. The smaller volumes, particularly in imports, can be explained by two factors. First, during periods of rising COVID cases, deaths and hospitalizations in Ciudad Juárez and northern Mexico, Mexico officials closed all nonessential businesses and placed the border city on lockdown, limiting imports to El Paso. Second, the trade through El Paso is largely related to the manufacture of electric integrated circuits and devices, automatic data processing machines, passenger vehicles, and automotive accessories and parts, which were impacted by the ongoing semiconductor shortage.

Industrial Production and Maquiladora-Related Activities

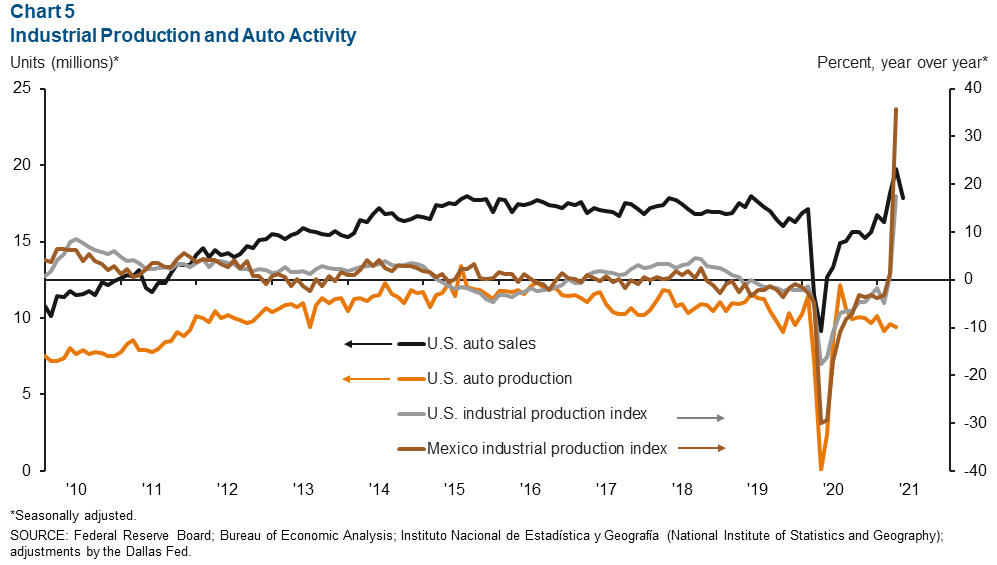

The monthly U.S. industrial production index rose from 98.5 in March to 99.0 in April and was up 17.6 percent from a year ago (Chart 5). Mexico’s industrial production index fell slightly from 98.9 in March to 98.7 in April but was 35.7 percent higher than a year ago. The Institute for Supply Management manufacturing index inched up from April’s 60.7 to 61.2 in May. Survey responses indicated that manufacturers continue to struggle to meet elevated demand due to labor constraints and supply-chain challenges.

U.S. auto and light-truck production rose from 9.5 million units in April to 10.2 million units in May. Meanwhile, monthly auto sales fell from 19.8 million in April to 17.8 million in May but were up 40.8 percent from a year prior. Auto sales are closely linked to the local economy because roughly half of maquiladoras in Juárez are auto related.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions can be addressed to Keighton Hines at keighton.hines@dal.frb.org. El Paso Economic Indicators is published every month after state and metro employment data are released.