Small Business Credit Survey

Performance

More than a third of Texas firms (34 percent) are considered growing, which means they met the following criteria for the past 12 months:

- Increased revenues.[5]

- Increase in number of employees.[6]

- Plan to increase or maintain employees.[7]

This is up from 30 percent in last year’s findings. Interestingly, though, while 59 percent of firms were profitable at the end of 2016, the share dropped to 53 percent at the end of 2017. In fact, 28 percent of Texas firms reported ending 2017 at a loss, a statistically significantly higher share than the national average of 24 percent.

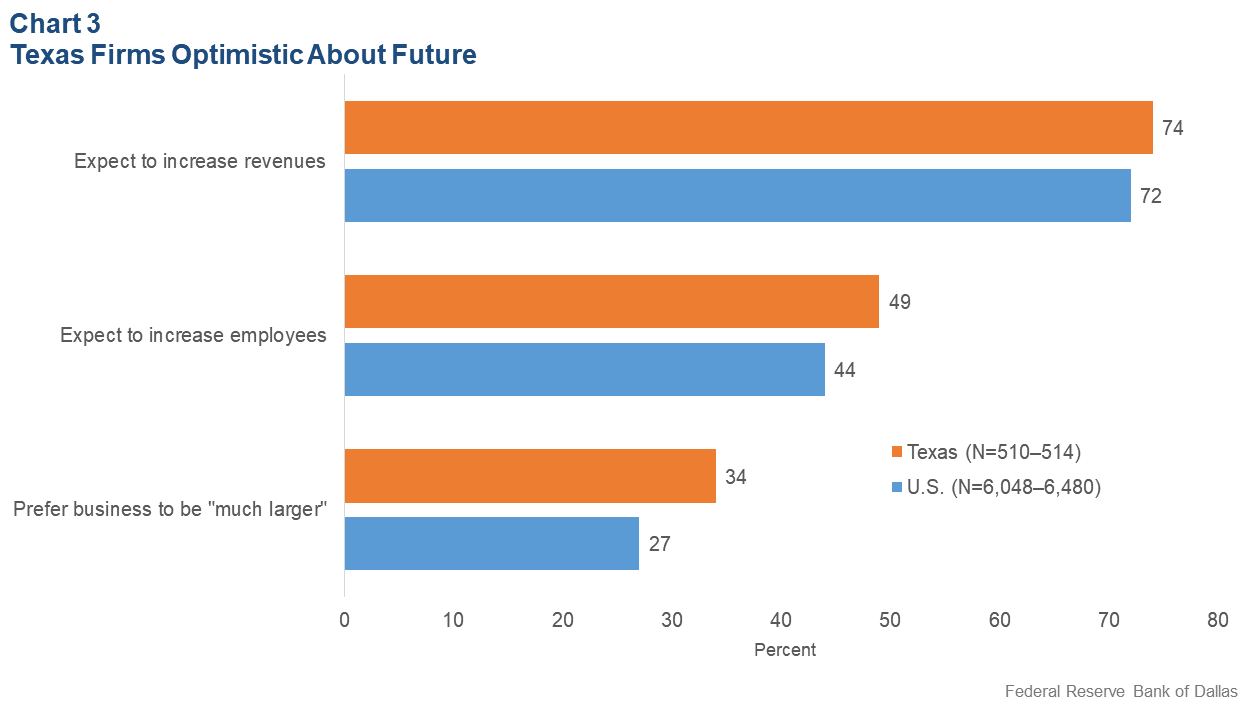

Still, optimism and growth goals are not in short supply in the Lone Star state. A majority of Texas firms were profitable in 2017, and a large share (74 percent) reported expecting to increase revenues in the coming 12 months (Chart 3).[8] Nearly half (49 percent) expected to increase their number of employees in the next 12 months. And when asked about their preference for the future size of their business, 86 percent of Texas business owners wanted to expand. More than a third (34 percent) indicated they would like to be “much larger” than current operations, a significant difference from the nation’s 27 percent, as shown in Chart 3.

Sometimes, rapid growth can come with challenges. Al Salgado, executive director of the Southwest SBDC network, said, “Planning for growth can mitigate risks associated with growing too fast. Businesses owners who grow their firms at a healthy pace understand and plan for the dynamics of their cash flow, they explore the firms’ capacity to deliver an increased level of products, and they communicate in advance with their lender to explore possible funding mechanisms such as a line of credit or loan.” These tactics can help firms expand at a sustainable pace.