Small Business Credit Survey

Financial Challenges

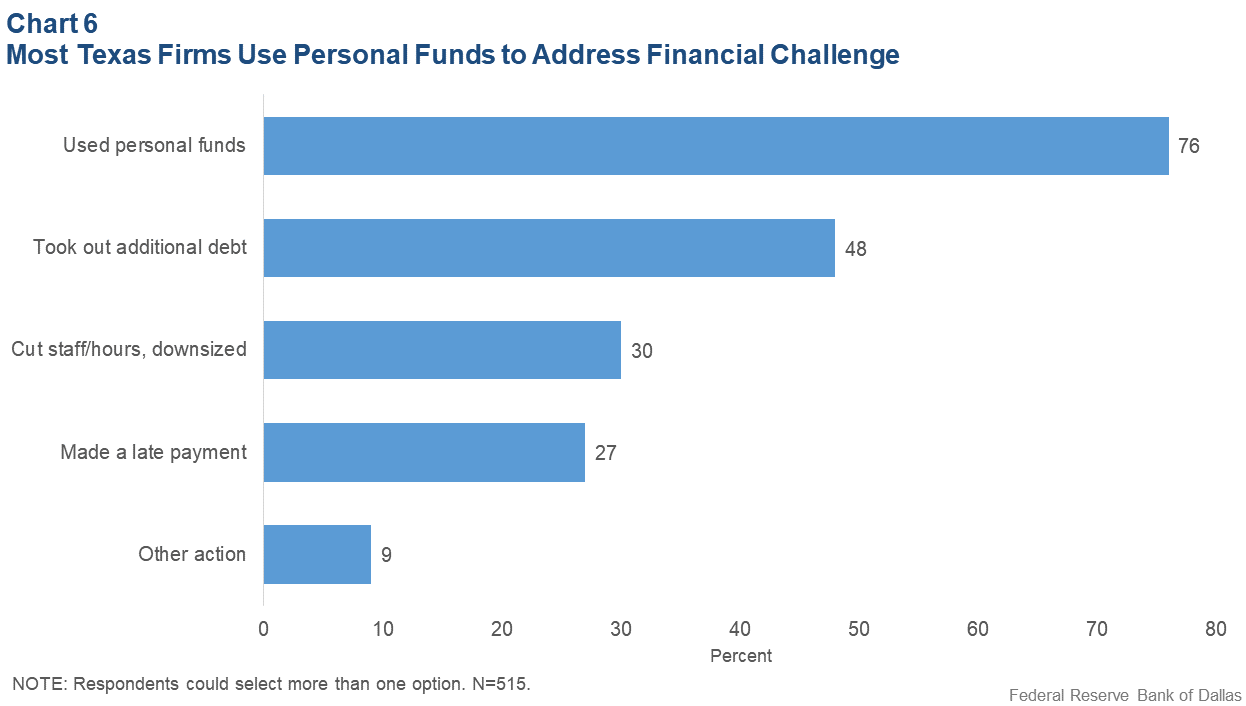

Sixty-two percent of Texas firms experienced at least one financial challenge, a decrease of 2 percentage points from last year’s report. For those who did have a challenge, the rankings are similar to the previous report (Chart 4). However, at nearly one-third (32 percent), a larger share of respondents reported issues with credit availability than prior findings (29 percent).

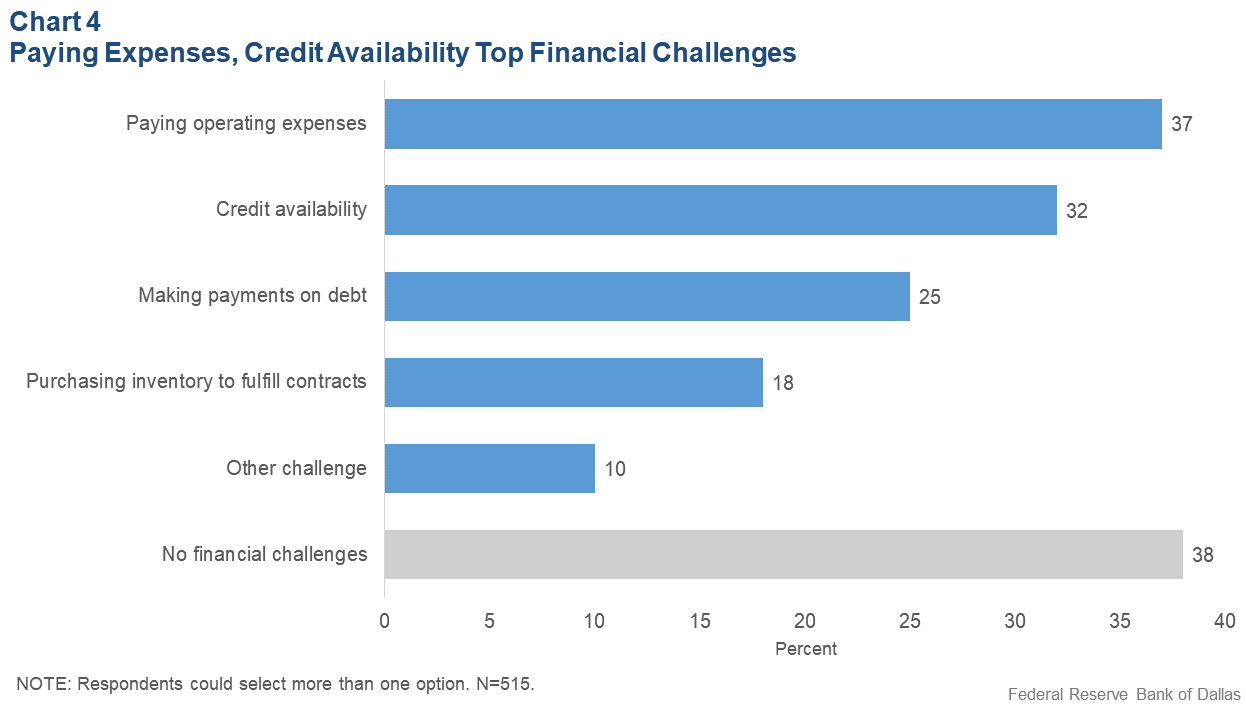

As in previous years of research on this topic, this year’s findings indicate that minority-owned firms struggle more with credit access. As Chart 5 shows, 37 percent of minority-owned firms reported struggling with credit availability compared with 29 percent of their nonminority counterparts. This 8-percentage-point gap is significant but is half of last year’s gap of 16 percentage points. This year, minority firms also appear more likely to struggle with paying operating expenses than their nonminority peers, although the differences on this measure are not statistically significant.

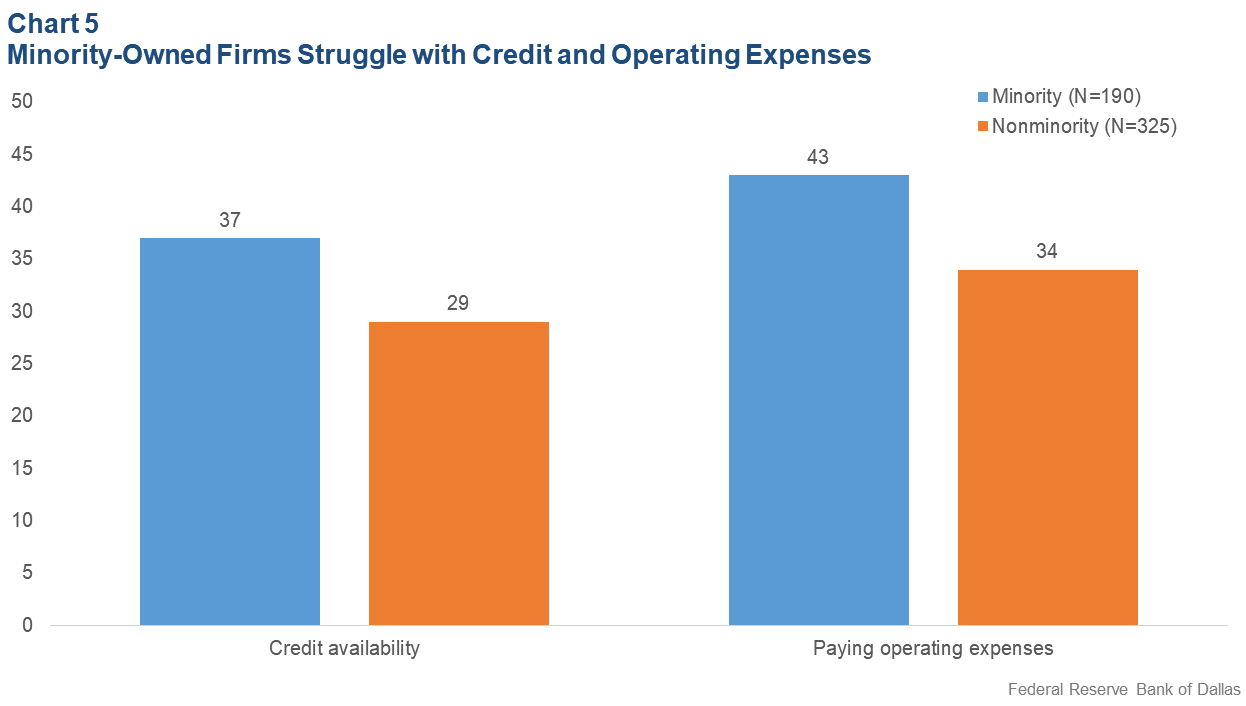

The majority of firms that experienced a financial challenge used personal funds to address the situation, regardless of demographic (Chart 6). Nearly half took on additional debt while 30 percent cut staff or downsized operations. More than a quarter (27 percent), though, made a late payment on money owed, up from 24 percent from the previous findings. Late payments can have an adverse effect on a firm’s ability to obtain future financing, so this should be monitored. As Mark Langford, executive director of the North Texas SBDC network said, “Managing cash flow is critical to the survival of any business … . This can be done with a simple spreadsheet or a robust accounting system and must take seasonality, collection time and changing costs into account.” He noted that service providers like the SBDCs can help with this aspect, with education and guidance. “It can be a daunting task to many business owners,” said Langford, “but the consequences of not knowing this information can mean the difference between success and failure.”