Small Business Credit Survey

Financing and Debt

According to survey results, most firms in Texas (64 percent) are funded primarily from their retained business earnings. Although just 14 percent report external financing as the primary funding source, 66 percent of firms do have outstanding debt of some type. Minority-owned and women-owned firms appear more likely to hold smaller levels of debt (Chart 7). In fact, just half of a percent of women-owned firms hold more than $1 million in debt, a far smaller share than either men-owned (12 percent) or equally owned (14 percent) firms.

Among all Texas firms, 42 percent reported applying for financing in the past 12 months.[9] The majority of applicants (67 percent) applied with the goal of expanding their business or pursuing a new opportunity. This is significantly higher than the national average of 56 percent, suggesting that Texas firms are more likely to be looking to expand.

Among those who applied, 42 percent received all financing for which they asked. This is down from the reported 50 percent a year ago. However, the share reporting receiving none of the requested financing remained the same, at 21 percent, indicating that there has been a larger share of owners this survey period whose request was partially fulfilled. Still, this means that an additional 8 percent of applicants may have had unmet financing needs in this survey period.

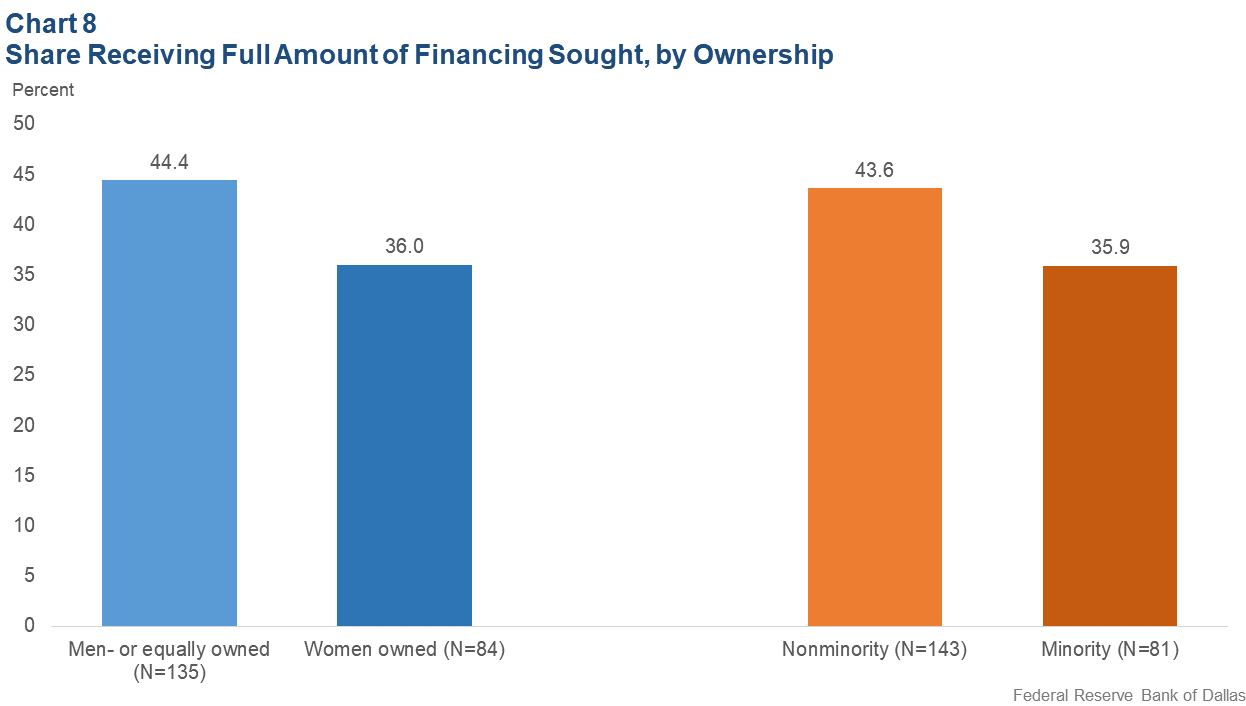

Differences in success of full financing exist by firm ownership demographic. Women-owned firms as well as minority-owned firms are less likely to receive the total amount requested (Chart 8).

Among those who did not receive any of the financing they requested, respondents pointed to insufficient credit history and having too much current debt as top reasons for rejection. However, responses varied once again by ownership demographic. While 35 percent of firms overall indicated issues with too much current debt held, just 8 percent of minority-owned firms pointed to that issue. Both women-owned and minority-owned firms reported more issues with collateral than the average.

Interestingly, although just 28 percent of Texas firms pointed to low credit scores as being behind credit denial, at a national level, 36 percent of firms did. Insufficient credit history, while ranking at the top for Texas firms, came in fourth place nationally.

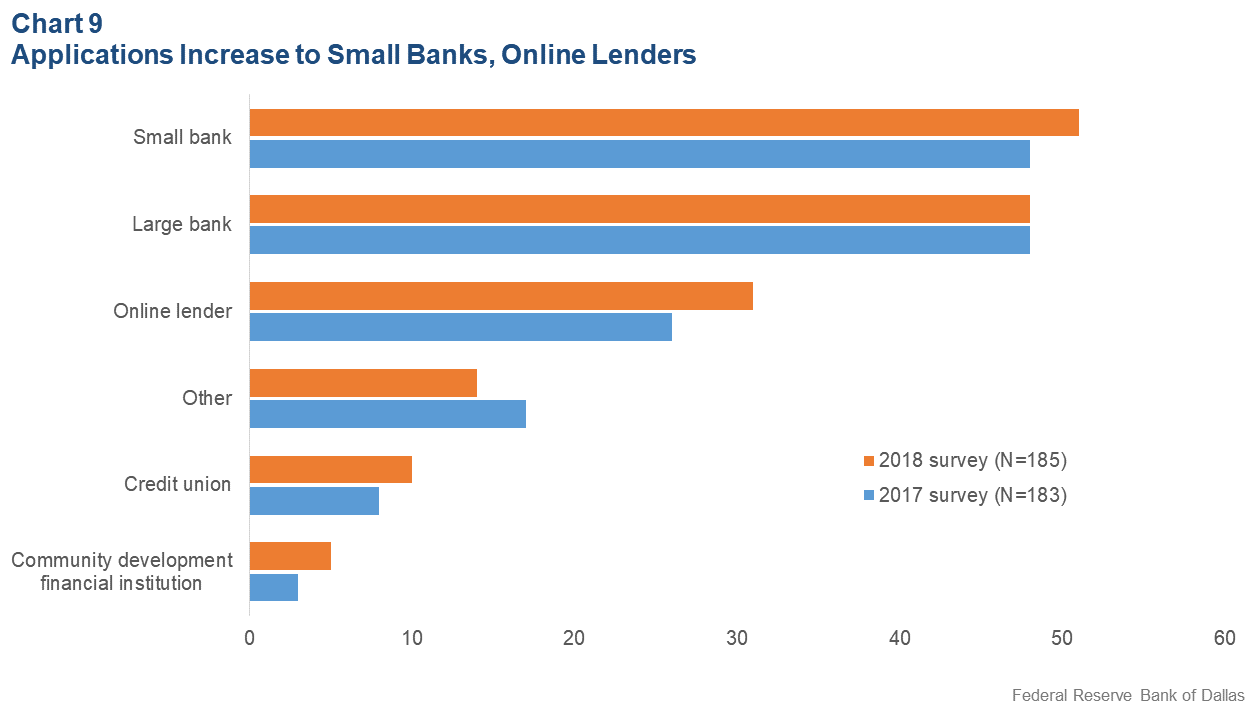

Financing applicants in Texas most frequently sought a loan or line of credit (88 percent). Among those, most reported applying to small banks, up a few percentage points from the 2017 survey period (Chart 9). Online lenders also saw an uptick, from 26 percent in the last report to 31 percent this year. Application rates at credit unions also increased, from 8 percent to 10 percent.

Higher shares of women-owned firms and minority-owned firms reported applying to online lenders: 35 percent, and 38 percent, respectively.

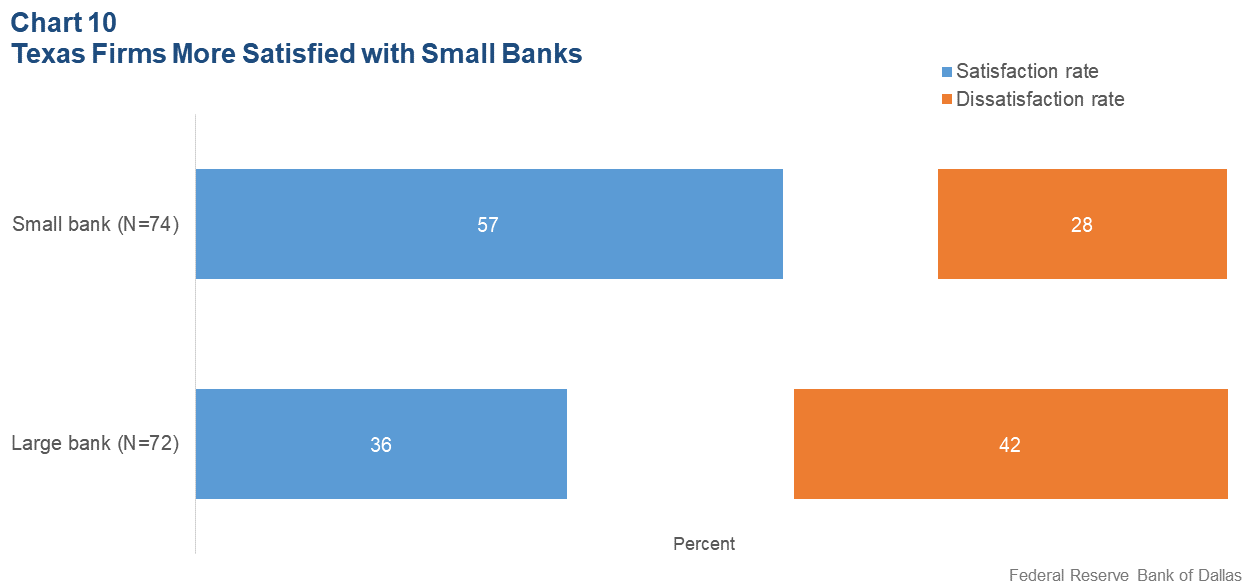

Small and large banks both have high enough sample sizes to take a look at applicant satisfaction rates. Overall, small banks have higher satisfaction and lower dissatisfaction rates than large banks (Chart 10). The top challenges reported with large banks were difficult application processes, high interest rates and long waits for a loan decision.