Excerpts from Richard Fisher's remarks before the Gainesville Area Chamber of Commerce

December 18, 2012 Gainesville, Texas

Where Is America's Middle Class? In Texas

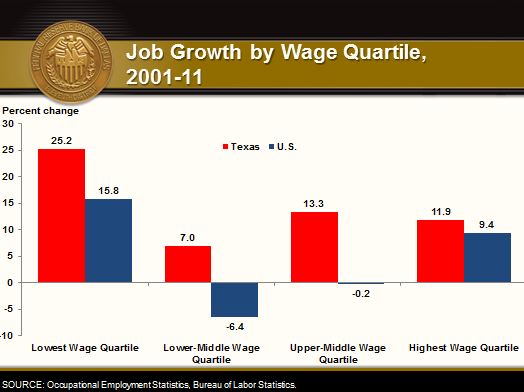

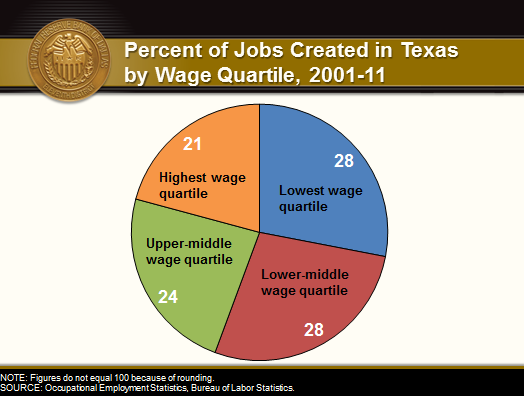

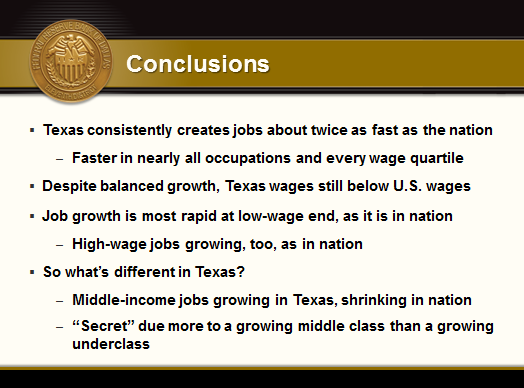

Texas continued its strong pace of economic expansion and job growth in 2012. The Dallas Fed expects the state to post real gross domestic product growth of at least 3.5 percent and job growth of 3.2 percent for the year. An uninformed observer might think the jobs created in Texas are primarily low wage. But the attached job-growth data from Dallas Fed Senior Economist Pia Orrenius show that over the past decade, Texas has led the nation in job creation in all four income quartiles. We do create more low-wage jobs; we also create more high-wage jobs. And, importantly, while the growth rate for middle-income jobs over the past decade has been negative in the U.S., it has been positive in Texas. Middle-income jobs may be declining and "job polarization" may be occurring in the U.S., but the same is not true for Texas, where the middle-income population is expanding.

Using Animal Husbandry to Illustrate Problems Proposed by the Fiscal Cliff

Today's Wall Street Journal notes that, according to the highly regarded analyst Ed Yardini, through September American companies bought $274 billion more shares than they issued. Since September, hardly a trading day goes by without a company announcing a new debt offering to take advantage of today's historically low interest rates to finance further share buybacks and/or special dividend payouts. Too little of this money is being used to invest in job creation and job-creating expansion of plant and equipment in the U.S. Which raises a question about the efficacy of our accommodative monetary policy: Are our massive purchases of Treasury notes and bonds effective in meeting our mandate of conducting monetary policy so as to create maximum employment?

The answer is, quantitative easing is a necessary but insufficient tool to spark job creation. Employers will not deploy the cheap and abundant capital on hand toward job creation while there is so much uncertainty surrounding final demand for the goods and services they sell. Or the uncertainty surrounding the fiscal cliff: Until they know what their taxes will be or how federal spending patterns that affect them and their customers will change (or, one might add, whether the nation will have a more rational regulatory structure), they will sit on their abundant money rather than spend it on unemployment-reducing expansion.

Let me use a little animal husbandry to illustrate this point.

We have a ranch in Franklin County in East Texas. We have a 2,200-pound bull there that breeds our Longhorn cows. His name, incidentally, is "Too Big to Fail."

Now, Too Big has plenty of liquidity at his disposal; he's fully equipped to do what we want him to do. But if we put him on the opposite side of the fence from those pretty cows, he's unable to perform. Think of the uncertainty I've just spoken of, and especially the uncertainty surrounding the resolution of the fiscal cliff, as a fence. Businesses, just like Too Big, have plenty of liquidity; they have the resources they need to do what we want them to do—in this case, invest in job creation. But as long as that fence of uncertainty is in place, they will not be able to perform.

This is one of the key reasons that our political authorities must resolve how they will tax and spend going forward and do so in a way that incentivizes American businesses to breed more American jobs.

See the full presentation for more data.

Notes

The views expressed by the author do not necessarily reflect official positions of the Federal Reserve System.

About the Author

Richard W. Fisher served as president and CEO of the Federal Reserve Bank of Dallas from April 2005 until his retirement in March 2015.