Current Banking Risks

This summary is drawn from the Dallas Fed’s quarterly assessment of the risk landscape for banking institutions in the Eleventh District. It is not an all-inclusive list of banking risks.

Current risks facing the banking industry are defined as key issues in the present environment that could impact a bank’s ability to operate its business model. These risks are considered the most significant exposures based on a forward-looking evaluation of the inherent risks and effectiveness of risk management activities.

The risks highlighted in this report are identified by their perceived impact, as well as the potential for data gaps that may present a supervisory challenge.

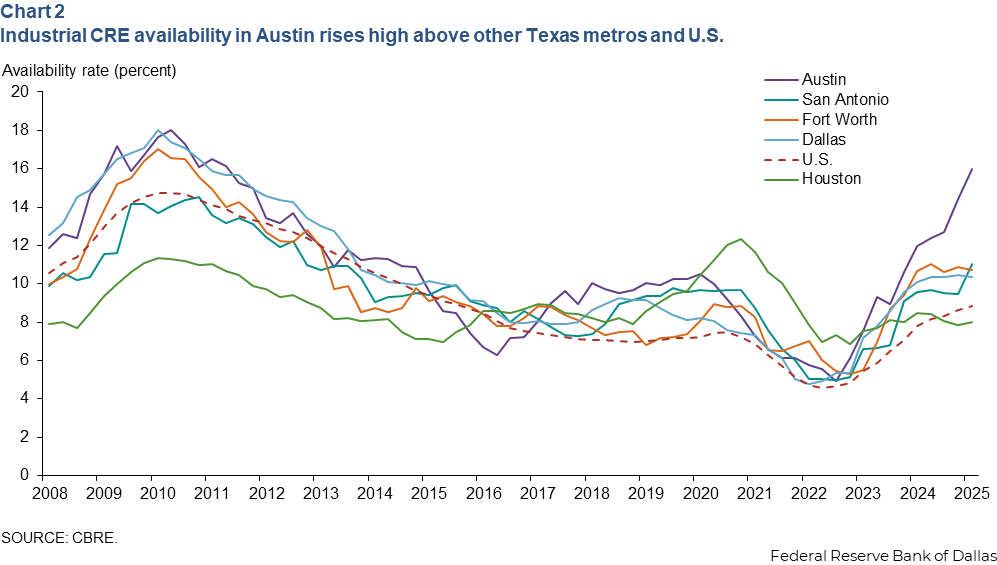

Slower economic growth may reduce expansion and leasing activity in commercial real estate (CRE), and ongoing uncertainty may keep the market in a risk-averse mode. Refinance risk for CRE loans remains a concern: Interest rates remain elevated, and vacancy rates in most major Texas metros have declined modestly but remain elevated.

Increased uncertainty over inflation and concerns over the fiscal outlook have lowered prices for Treasury securities. This could result in increased depreciation of available-for-sale securities and lower levels of tangible equity capital at some Eleventh District banks.

Cybersecurity risk remains elevated in the Eleventh District due to geopolitical factors and the use of new technologies by banks.

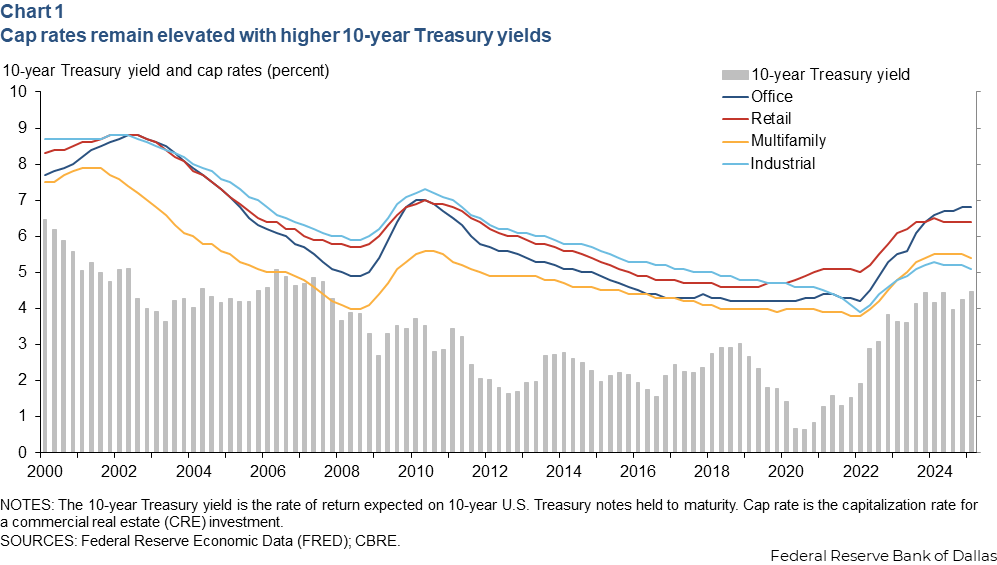

The capitalization rate or “cap rate” for a commercial real estate (CRE) investment reflects the anticipated return implied by its income and market value. Yields on U.S. Treasury 10-year notes are a benchmark for these investments, and the rise in 10-year Treasury rates has put upward pressure on cap rates since 2022 (Chart 1).

Banks with many CRE loans that are expected to refinance soon may want to see strong income growth on the properties. They may also choose to assess appraised values and risk appetite more conservatively to reflect the market’s higher cap rates.

Across the Eleventh District, industrial CRE availability has risen sharply in some metro areas, most notably in Austin, and generally runs higher than the national rate (Chart 2). Meanwhile, industrial CRE rent growth is declining in the district, in line with national trends lower.

Banks with CRE concentration need to ensure they maintain adequate loan loss reserves and capital. In evaluating credit risk across bank CRE loan portfolios, property type, loan maturity and geography are all relevant factors. For smaller institutions, these data are not included in regular public reporting, which complicates the comparison of CRE-concentrated banks.

NOTE: Analysis for this release is based on data as of March 31, 2025.

About Current Banking Risks

For more information about this report, contact Emily Greenwald