Community banks key to health, resilience of Eleventh District economy

The vibrant economy in the Dallas Fed’s Eleventh Federal Reserve District attracts robust competition for deposits and lending among banks and other financial institutions. Despite the challenges of banking at a smaller size, community banks continue to provide vital financial services and play an outsized role in supporting small businesses in the region. There are fewer community banks in the region than a decade ago, but those that remain are larger due to ongoing consolidation.

Among banks domiciled in the Dallas Fed district, which encompasses Texas, northern Louisiana and southern New Mexico, community banks still represent the largest segment by assets. Community banks have also managed to remain more profitable than their larger regional bank counterparts. This article will discuss some of the main trends that have shaped banking in the region and how community banks have remained important to driving economic growth.

Consolidation shrinks number of community banks but increases average size

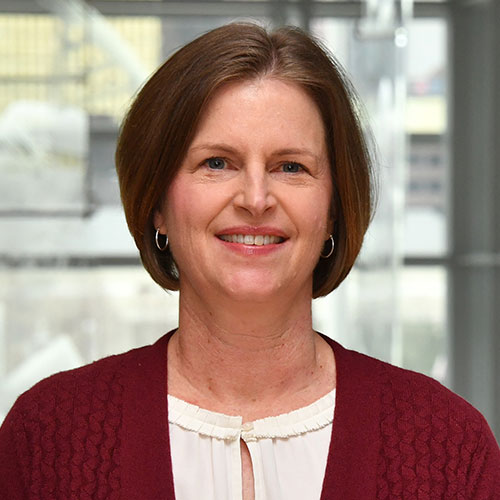

From 2014–2024, the number of Eleventh District community banks—those with less than $10 billion in total assets—declined 25 percent, from 570 to 425 (Chart 1). But as the number of community banks fell, their combined assets increased 45 percent, to $363 billion, and average assets per bank almost doubled, growing to $854 million. The district's number of regional banks—those with asset holdings between $10 billion and $100 billion—grew from six in 2014 to 12 in 2024, and their combined assets increased 48 percent, to $321 billion.

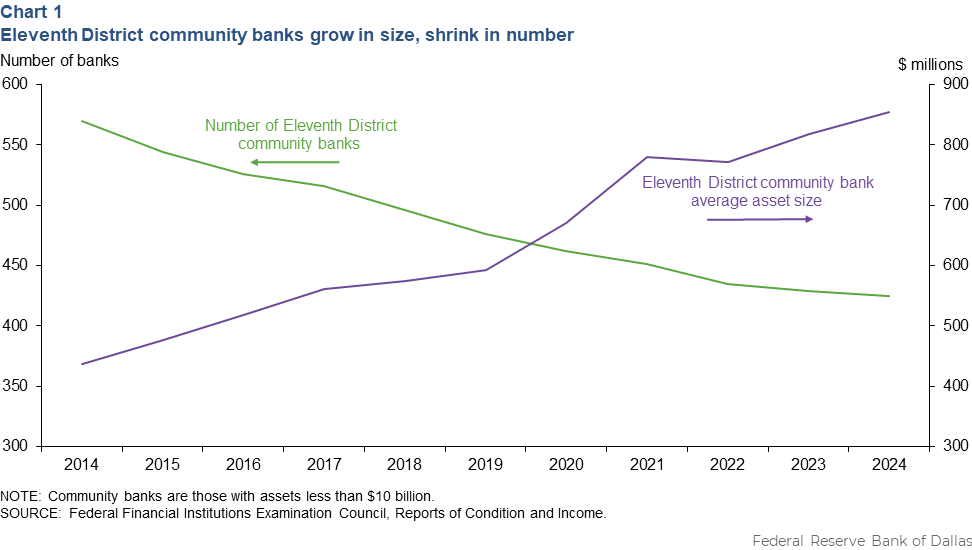

The decline in the number of Eleventh District community banks can be almost entirely attributed to mergers, mostly between community banks. Of the 142 community bank acquisitions in the district from 2014 through 2024, 126 were made by other community banks. (Chart 2).

Community banks play outsized role in Eleventh District lending

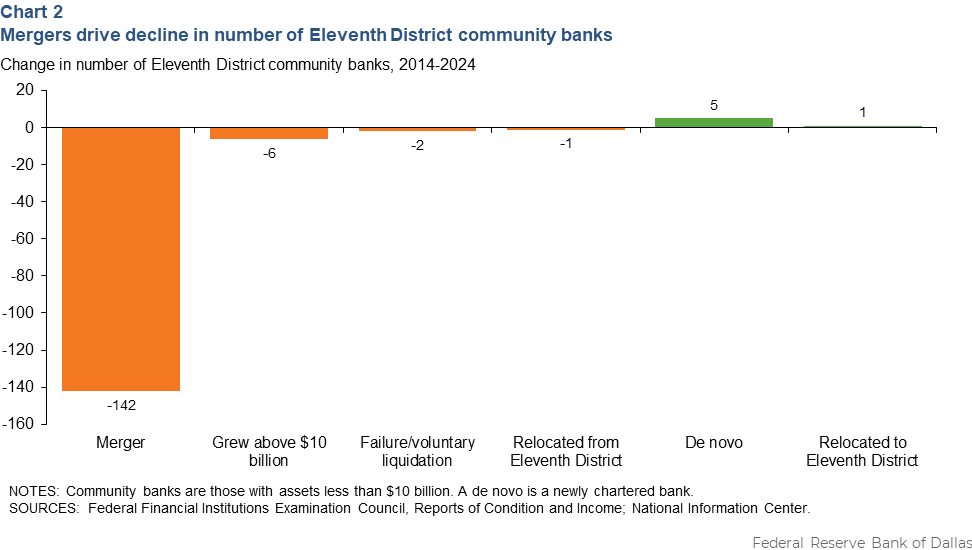

Community banks play an important role in the district. They hold a greater share of assets within the district than their regional counterparts and provide an even larger share of credit, particularly residential and commercial real estate loans (Chart 3).

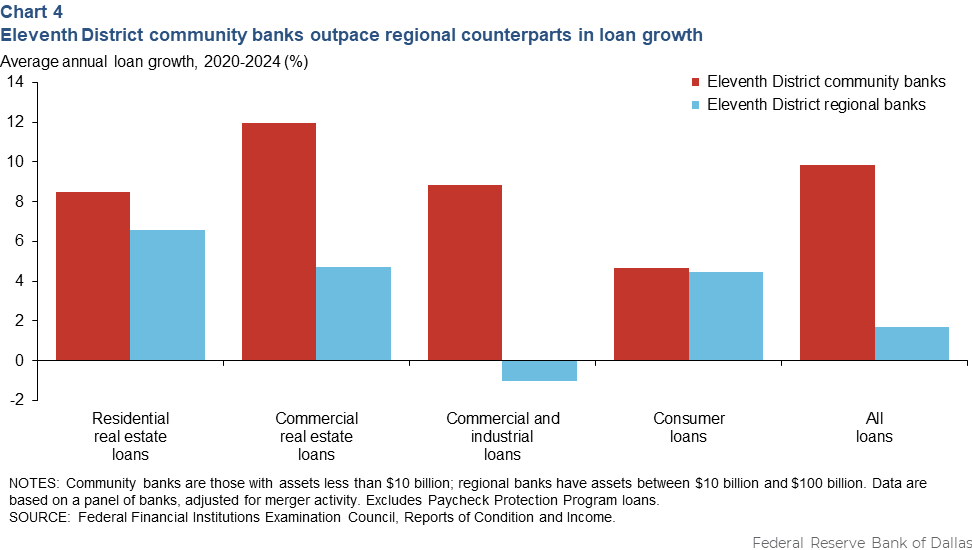

Eleventh District community banks also have recorded stronger growth across all major loan categories than their regional counterparts in recent years (Chart 4). From 2020 through 2024, growth was especially strong in community banks' commercial real estate loan portfolios, which averaged 12 percent growth, and commercial and industrial loan portfolios, which averaged 9 percent.

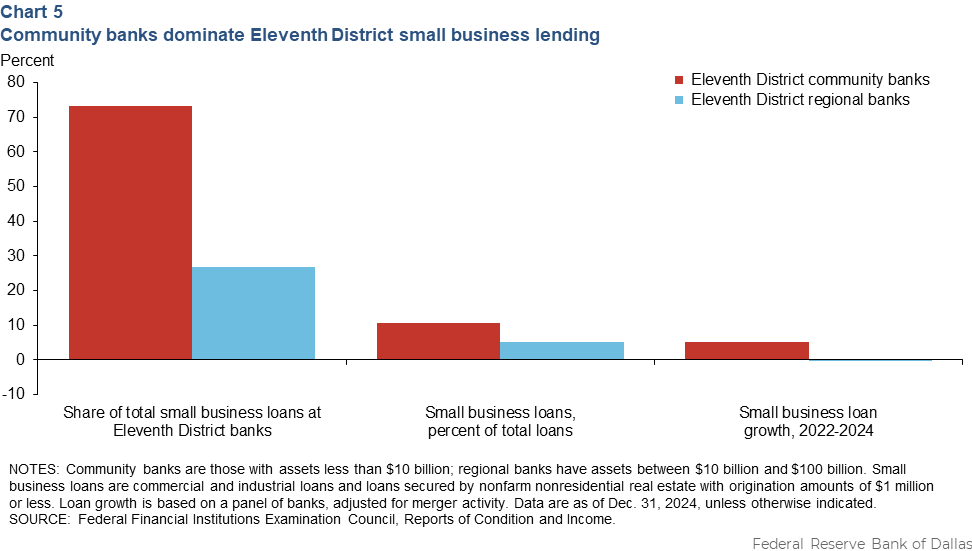

Moreover, community banks are important providers of credit to the district’s small businesses. Of the $290 million in small business loans held by Eleventh District banks at year-end 2024, $231 million, or 73 percent, was held by community banks (Chart 5). Postpandemic, community banks continued to be vital small business lenders and grew their small business loan portfolios. On the other hand, the district’s regional banks recorded no postpandemic growth in small business loans.

Community banks are particularly important for small businesses during difficult times such as the pandemic. Eleventh District community banks were active in distributing Paycheck Protection Program loans, which were available from March 2020 through May 2021. As of year-end 2021, community banks accounted for 83 percent of the total number and 70 percent of the total dollar volume of PPP loans held by Eleventh District banks.

Net interest income drives community banks’ higher profitability

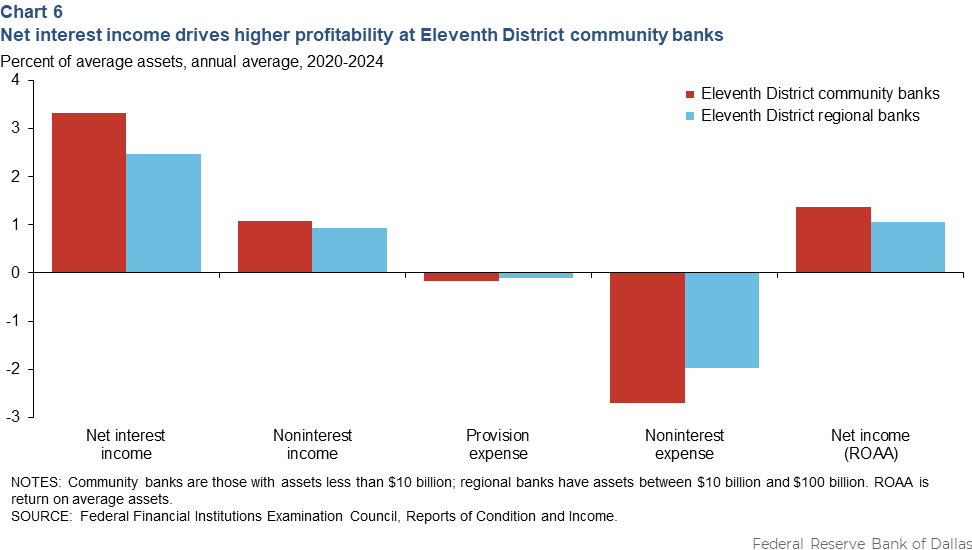

Larger banks enjoy economies of scale over smaller rivals because their fixed operational costs are spread over a higher volume of assets. Despite that disadvantage, Eleventh District community banks have been more profitable than their regional counterparts in recent years, earning an average return on average assets of 1.4 percent from 2020 through 2024, compared with 1.1 percent for the district’s regional banks in the same period (Chart 6).

Net interest income drove community banks’ higher profitability over that five-year period, averaging 3.3 percent of average assets. That topped the district’s regional banks by 85 basis points, more than enough to offset regional banks’ 71-basis-point advantage in noninterest expense-to-average-assets over the same period.

Salary expense accounts for more than half of community banks’ 71-basis-point disadvantage in noninterest expense. Community banks need the same expertise as their regional counterparts, but due to regional banks’ economies of scale (greater asset holdings), they derive more value from the cost of employing that expertise.

Our community bank contacts have noted that staffing and succession planning can be challenging, especially in rural and sub-rural areas. Higher noninterest expense for community banks could also be due to their larger share of small business loans, which can be more costly and labor-intensive to underwrite than loans to larger companies.

While their numbers have declined and they often face operational challenges, community banks remain vital to the district’s financial health and resilience. And even as their asset holdings have grown, they remain true to their roots and behave as community banks. They continue to fund most small business lending in the district and are particularly valuable for their support of small businesses and local economic development.

About the authors