Consumer Credit Trends for Texas

Mortgage Debt

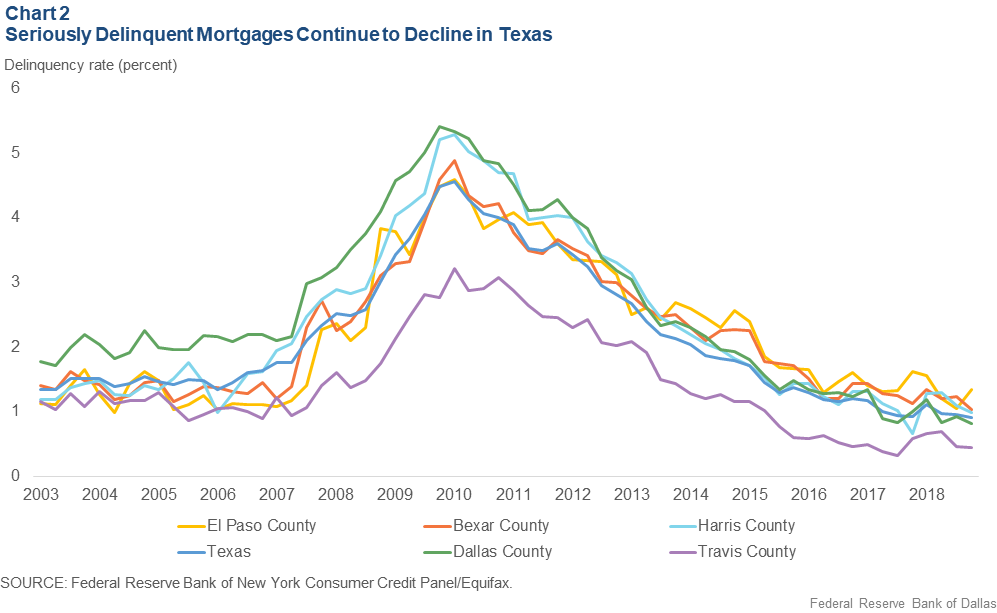

Mortgage delinquency rates in all counties in this study and the state of Texas were low in the early 2000s and then spiked during the Great Recession. Dallas County had the highest serious delinquency rate during the recession, reaching 5.41 percent in 2010. With the exception of El Paso County, other counties and the state as a whole have seen their serious delinquency rates fall even lower than their prerecession rates. Notably, Travis County saw a relatively small spike in delinquencies during the housing crisis and today has an especially small delinquency rate of under 0.5 percent. One potential explanation for this trend is that there is a greater share of prime borrowers in Travis County than there are in other parts of the state. Travis County also boasts higher educational attainment rates and higher median incomes, both of which tend to be correlated with better credit scores. A Travis County report on these issues will be forthcoming in 2019. Chart 2 shows the 16-year trend of mortgage delinquency rate in five of the most populous Texas counties and Texas as a whole.

Statewide, the share of the mortgage loan volume that belongs to prime borrowers has gotten larger over time. In 2006, before the housing crisis, 67 percent of the aggregate volume belonged to prime borrowers. That figure grew to 81 percent by 2018. The median loan amount also increased from nearly $121,000 in 2006 (in 2018 dollars) to over $134,000 in 2018.

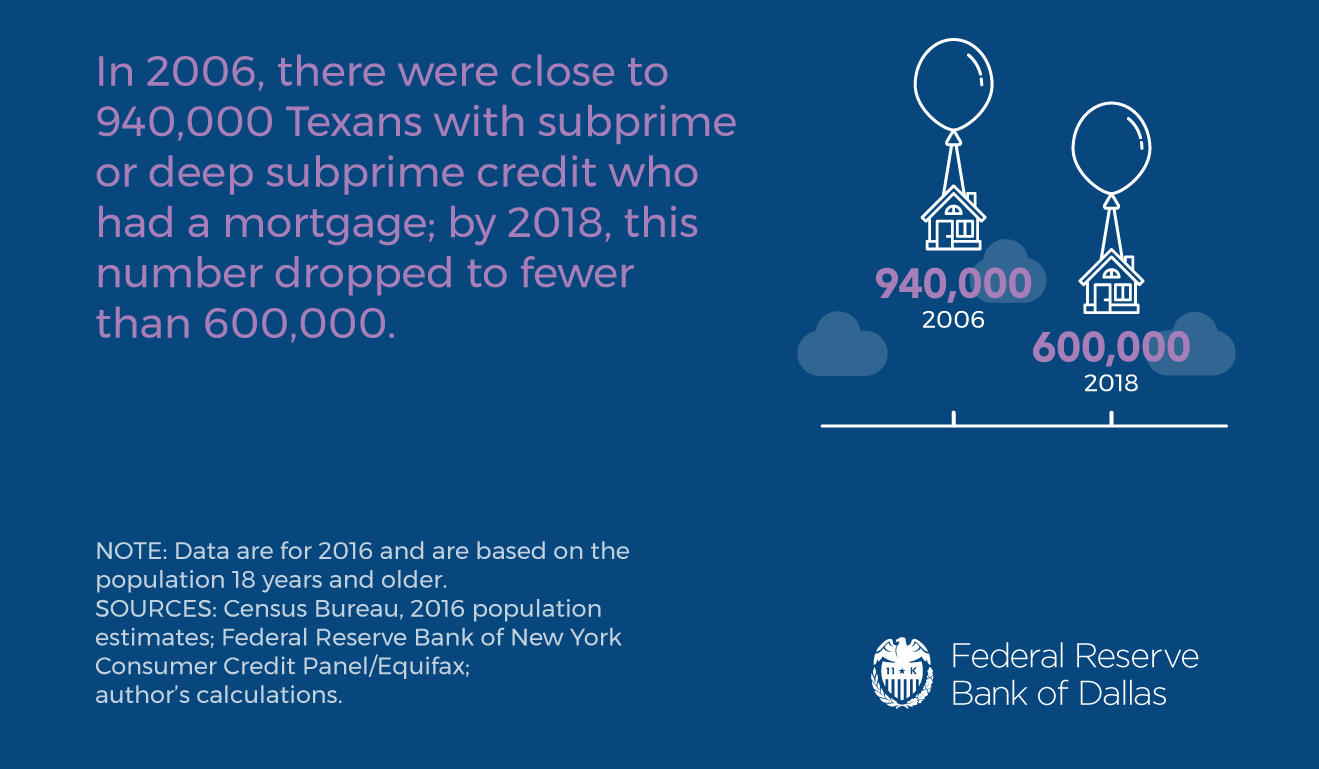

Digging deeper into the data, it appears that two phenomena are at play. First, from 2006 to 2018, the average mortgage amount increased for prime borrowers, but not for subprime borrowers. Those with prime credit appear to be accessing more expensive houses than they were 12 years ago, while their peers with lower credit scores have experienced no change. Second, in those 12 years, there has been a significant decline in the number of subprime borrowers who even have a mortgage. In 2006, there were close to 940,000 Texans with subprime or deep subprime credit who had a mortgage; by 2018, this number dropped to fewer than 600,000 (Figure 3). Even the number of mortgage holders with “near prime” credit—not typically considered to be very risky borrowers—decreased by 98,000 borrowers or 15 percent between 2006 and 2018. Meanwhile, the number of prime mortgage holders grew by 36 percent over the same time frame, increasing from 2.6 million borrowers to almost 3.6 million.

Figure 3: Texans with Subprime Mortgages

Although the overall credit economy had been trending more toward prime credit in that time period, the impact has been a bit larger in the mortgage market, where lending standards have fluctuated post-recession, especially for subprime borrowers.[13] In 2006, prime borrowers held a 16 percent larger share of the mortgage market than they did the overall credit market. In 2018, that gap widened to 21 percent, with prime borrowers holding 55 percent of the overall market and 76 percent of the mortgage market. Is this decline in non-prime borrowers in the mortgage market a result of improving credit scores, or is it because those with non-prime credit have less access to credit than they once did? The answer is beyond the scope of this paper, but these data, taken together with the increase in the credit-invisible population, suggest that a combination of both factors is likely at play. The Dallas Fed will explore this question further in future publications on credit scores and housing.