Consumer Credit Trends for Texas

Student Loan Debt

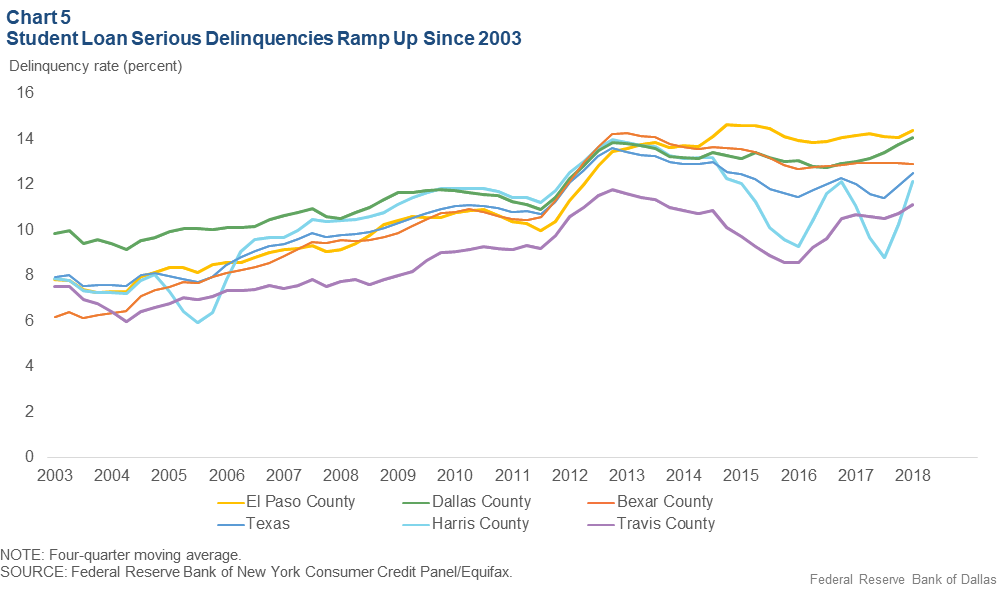

In general, student loan delinquency rates in the Equifax dataset are more volatile, due in large part to how student loans are reported and specifically how delays in the reporting can create uneven patterns.[19] Due to this volatility, data for Chart 5 are presented as a four-quarter moving average. Regardless, it is clear that student loan delinquencies have steadily been on the rise since 2003. Because of a change in reporting from one major loan servicer, there was a spike in the delinquency rate in 2012. For Harris County, trends are particularly erratic. Some of this movement is likely due to temporary disaster relief forbearance following natural disasters such as Hurricanes Rita and Harvey, during which time borrowers affected by storms did not have to make payments. Regardless of the fluctuant patterns, it is clear that serious delinquencies in student loans are generally higher than they have been, as are average borrower balances.

There are a number of trends in student loan data that are unique. First, it is important to note that unlike other loan types, access to federal student loans is not based on credit score. Students from all credit backgrounds are offered the same price and terms of debt. This may partially explain the high rates of serious delinquencies.

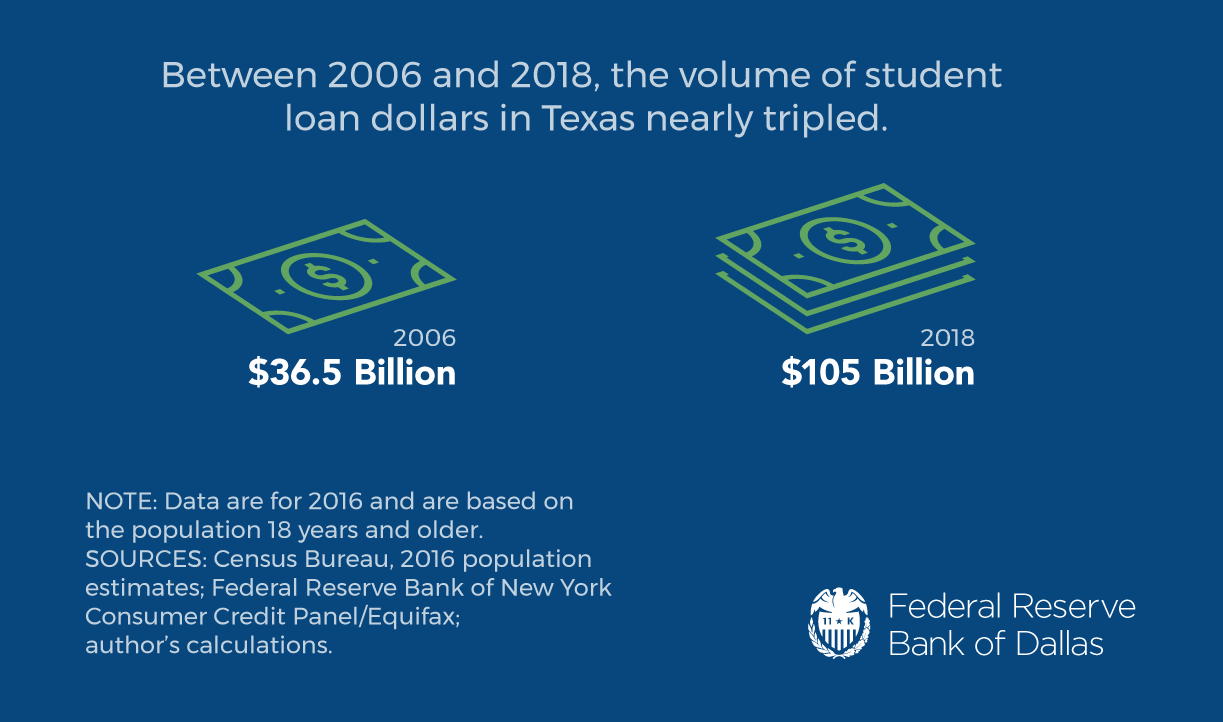

Second, between 2006 and 2018, the volume of student loan dollars in Texas nearly tripled—from $36.5 billion (in 2018 dollars) to $105 billion (Figure 4). None of the other loan types has grown this fast. Third, the share of student loan dollars that belongs to subprime and deep subprime borrowers is high compared with other loan types. A quarter of student loan dollars are tied to deep subprime accounts compared with only 14 percent of auto, 9 percent of credit card and 4 percent of mortgage loan dollars. Given that only 14 percent of overall borrowers have deep subprime credit, an over-representative amount (25 percent) of the student loan volume belongs to those with poor credit.

Figure 4: Student Loan Volume in Texas

Since higher education is seen as a stepping stone along the path of economic mobility, it’s important to consider how student loans may affect the reality of that narrative. For those who take on debt but do not graduate, they may be saddled with a financial burden that holds them back instead of propelling them forward. Even for those who complete their degree, there is some evidence that suggests that student debt contributes to a lag in homeownership among young adults today.[20] Furthermore, some populations struggle more with repayment than others. First-generation college students, black and Hispanic students, and students who attend for-profit institutions are more likely to fall behind on student loan payments.[21]

While higher education is still considered by many to be the route to a well-paying job, the current trends in student debt—should they continue—may deter (or already be deterring) some prospective students from attending college or from taking out appropriate amounts required to graduate. Given the relatively high delinquency rates and the growing amount that each borrower holds, some Texans may conclude that the risk of taking on thousands of dollars in student loans that they may not be able to pay back is not worth it. Indeed, recent research has estimated that between 20 and 40 percent of high school seniors are averse to student debt, which may hinder enrollment in or completion of higher education.[22] With an estimated 60 percent of new jobs in Texas requiring a certificate or college degree by 2030, the state’s workforce likely will rely on more Texans to make that calculation and opt for college.[23]