Consumer Credit Trends for Texas

Credit Card Debt

Credit card delinquency rates throughout the state have fallen considerably since the 2009 passage of the Credit Card Accountability, Responsibility and Disclosure (CARD) Act. This federal legislation put restrictions on the fees credit card companies could charge and limited hikes in interest rates. The CARD Act also required all companies to assess a borrower’s ability to pay before granting credit. As a result, late fees and overlimit fees decreased. The Consumer Financial Protection Bureau conducted studies that also found correlations between the CARD Act and lower overall consumer credit card costs and restricted credit access for young and subprime borrowers.

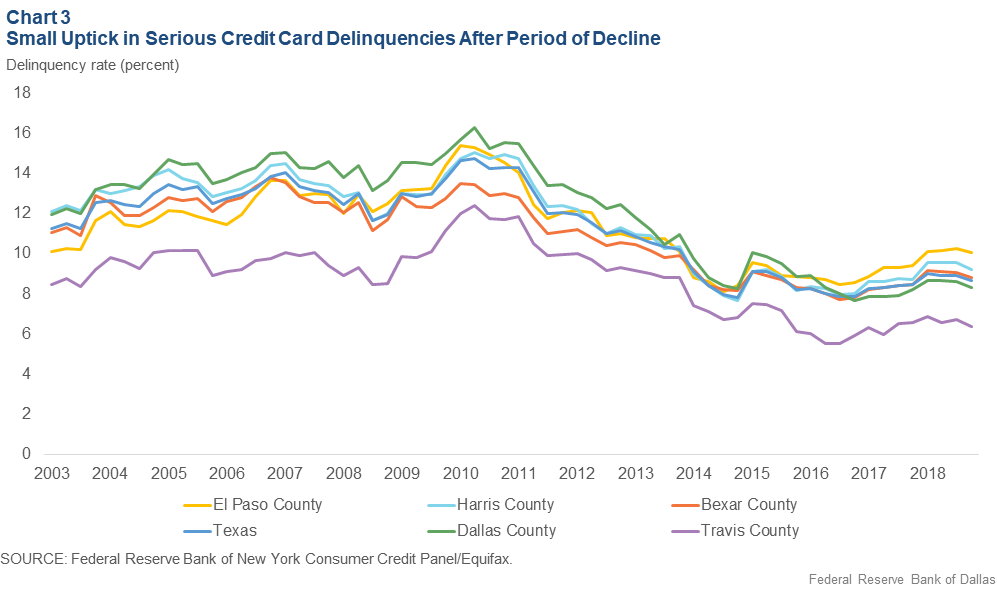

As shown in Chart 3, prior to 2016, Dallas County had historically seen the highest rate of serious delinquency in credit card payments. In the last several years, this rate took a sharper decline than other counties and by 2017, it had become lower than Bexar, El Paso and Harris counties. Dallas County’s share of seriously delinquent credit card loans is now the second lowest—second only to Travis County, which again stands out among the five counties in terms of relatively low delinquencies. Finally, the rise in serious credit card delinquency rates across the board since 2016 is worth investigating.

Considering the CARD Act, it is not surprising that the credit card loan volume in Texas has decreased from $71 billion in 2006 (adjusting for inflation) to $67 billion in 2018. A greater share of that loan volume also belongs to prime borrowers—64 percent in 2018 compared with 53 percent in 2006. Again, the CARD Act likely played a role in these shifts in the market. Overall, it seems that the CARD Act has been successful in reducing fees and improving transparency for borrowers but perhaps with some unintended consequences: research has linked the act with restricted subprime access to credit cards as well as less-competitive interest rates.[14],[15]