Consumer Credit Trends for Texas

Auto Debt

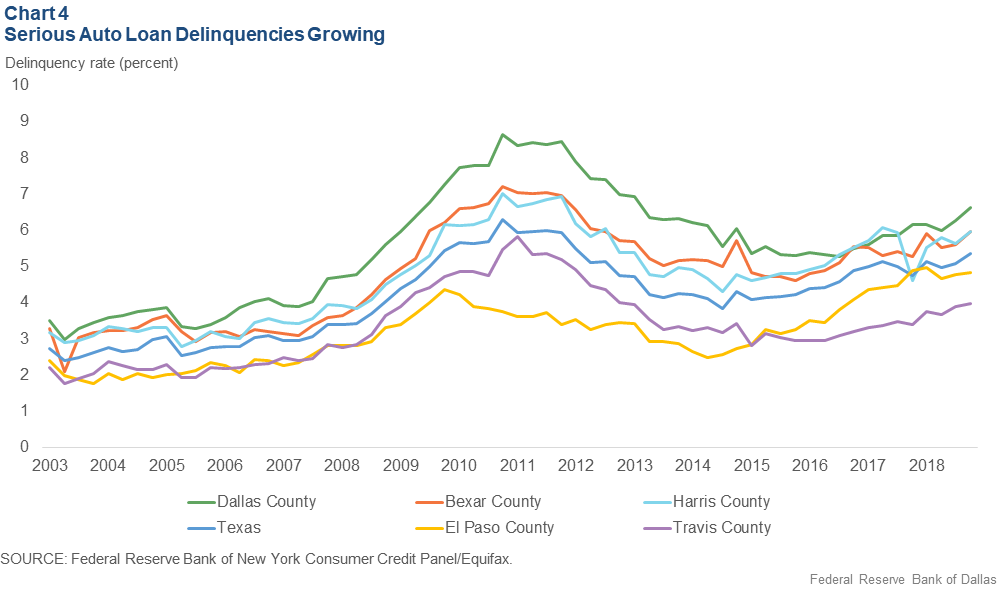

While serious auto loan delinquency rates were relatively low in the early and mid-2000s, delinquencies have recently climbed again after a brief postrecession recovery (Chart 4). This trend has been seen across the country. The Federal Reserve Bank of New York observed that more consumers—from all credit backgrounds—are taking out car loans than ever before.[16] While the overall credit quality is high, the increased number of subprime borrowers in absolute terms may help explain why auto delinquencies have increased in recent years. Indeed, auto debt performance in the subprime market has deteriorated since 2015. In Texas, the subprime serious delinquency rate was at 16.7 percent at the end of 2018, swiftly approaching its 2010 recessionary peak of 18.2 percent. And yet, the economy is healthier than it was during the recession. New York Fed researchers note that in the midst of a healthier economy, this auto trend suggests “not all Americans have benefited from the strong labor market.”[17]

Of the Texas counties in this report, El Paso County experienced a particularly steep rise in serious auto debt delinquencies, with its rate nearly doubling from 2014 to 2018. Unlike other counties and the state at large, El Paso’s serious delinquency rate is currently past its peak during the Great Recession. A few possible factors are at play. First, the average car loan carried in El Paso County is higher than the other four counties, despite El Paso’s relatively low median household income. Secondly, since mid-2017, the performance of auto debt for prime borrowers in El Paso has worsened, while prime performance in other counties has remained relatively stable. However, at a rate of about 0.2 percent, serious delinquencies in the prime market are still quite rare.

Lastly, the dip in serious delinquencies in Harris County in late 2017 and early 2018 could be due to loan forgiveness efforts after Hurricane Harvey and a boost in the local economy due to the oil business recovery. Once again, some experts view car loan delinquencies as a weather vane for the economy as a whole, so further research into the recent rise in delinquency rates may be warranted.[18]