Energy Indicators

April 20, 2021

Recent indicators point to an overall improved oil and gas outlook for the U.S. Activity in U.S. oil fields improved, oil prices held comfortably above levels needed to drill new wells for most producers, and industry employment losses slowed in February. Oil consumption outlooks for 2021 were firmed in recent forecasts. OPEC+ announced plans to ratchet up its production over the next several months, but the group retains ample spare production capacity.

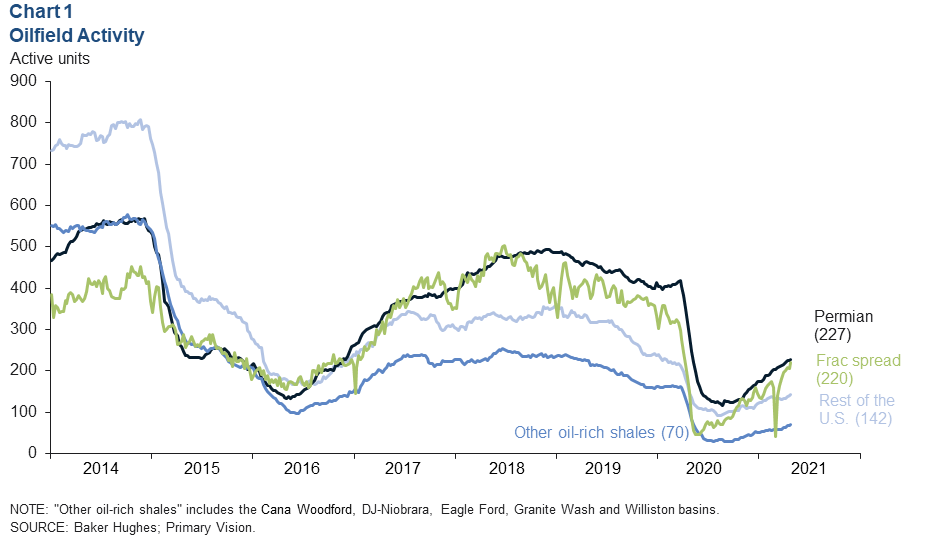

Drilling and completion

Activity continued to improve in U.S. oil fields through the week ending April 16. Over half of the U.S. active drilling rigs (227) were in the Permian Basin, according to Baker Hughes (Chart 1). The number of U.S. active frac spreads rose to 220 that same week, according to data from Primary Vision. These crews do the hydraulic fracturing that brings a drilled well into production.

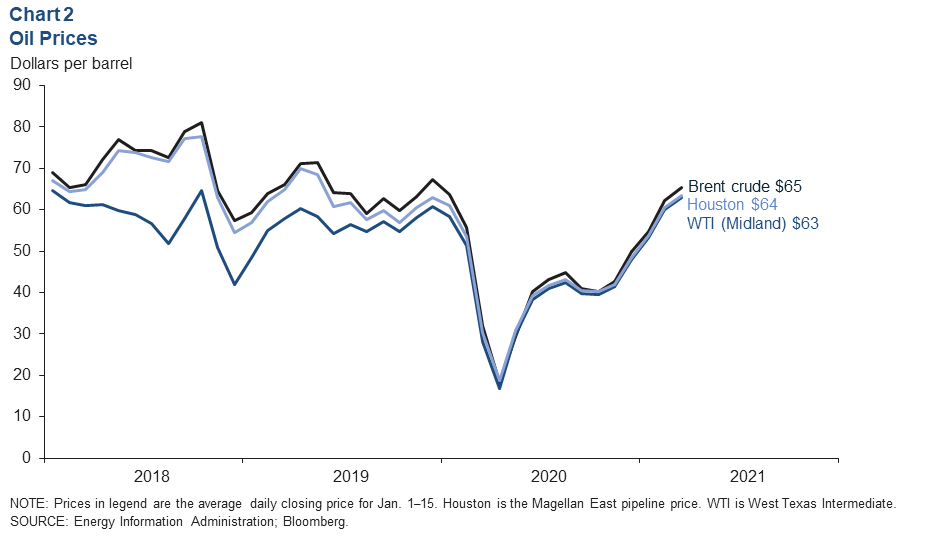

Oil prices

Global benchmark Brent crude averaged $65 per barrel in March—its fifth consecutive month of increases (Chart 2). Houston crude had a slight discount on average at $64, and West Texas Intermediate (WTI) priced in Midland, Texas, managed $63. That put Midland—closer to the wellheads in the Permian Basin—at its highest level since October 2018 and November 2014 before that. However, many oil and gas firms hedged much of their 2021 production at prices between $45 and $50 and are not receiving the full benefits of higher spot market prices.

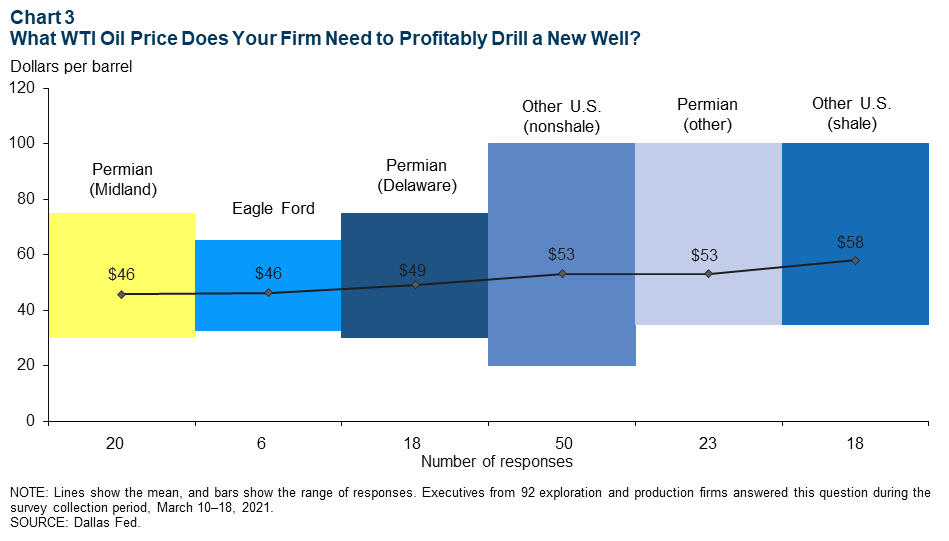

Breakeven prices

The average breakeven price for drilling a new well increased slightly to $52 per barrel across all respondents to the March Dallas Fed Energy Survey (Chart 3). Operators in the Permian and Eagle Ford on average needed a lower price of $46.

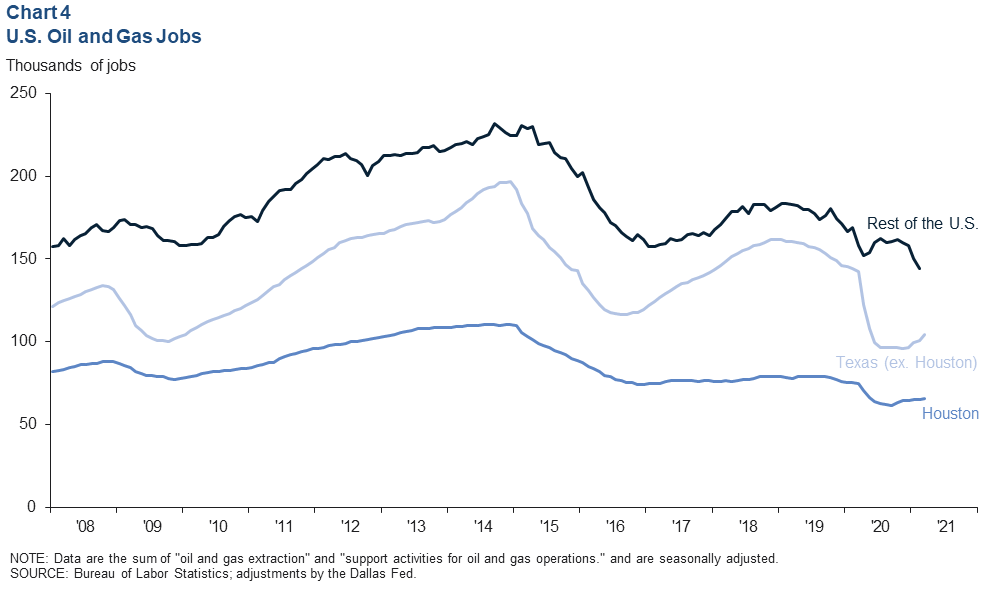

Employment

The number of U.S. upstream oil and gas jobs (extraction and support activities for oil and gas) declined slightly in February to 310,300, the latest data available (Chart 4). This marked the lowest total since July 2006. Roughly 65,000 (or 21 percent) of those jobs were based in Houston, and another 100,100 (32 percent) were based in the rest of Texas. Texas jobs data for March 2021 showed an increase of 4,300 oil and gas jobs. The increase was almost entirely composed of support activities (oil field services) outside of Houston.

Despite oil field activity levels recovering and oil prices overtaking first-quarter reported breakeven levels for most producers, companies on balance expect only slight increases in staffing in 2021. Ninety-two percent of respondents to the Dallas Fed Energy Survey indicated they intend to leave staffing either unchanged or increase staffing by the end of the year.

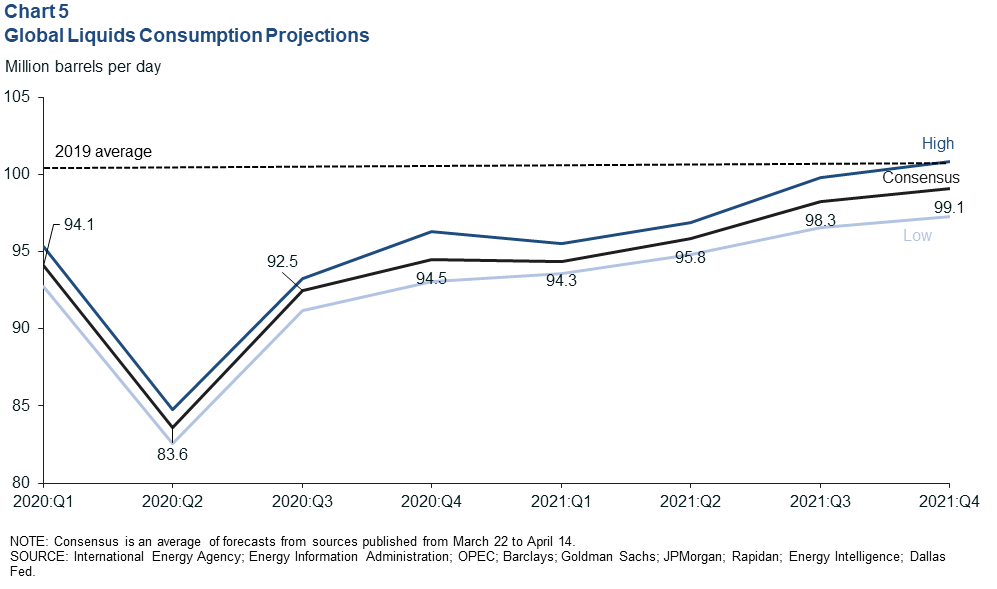

Consumption

A consensus average of demand projections published from mid-March to mid-April—including the major agencies, several banks and consultancies, and the Dallas Fed—was 4.8 million barrels per day (mb/d) of global liquids consumption growth from first quarter to fourth quarter 2021 (Chart 5). That is an increase from the 4.3 mb/d of growth projected in January. The more bullish growth total is due in part to the rollout of COVID-19 vaccines in early 2021.

There is more than enough spare production capacity to meet projected global demand growth in 2021. Saudi Arabia, Russia and several other countries known collectively as OPEC+ were withholding nearly 8.1 mb/d of production capacity from the market in first quarter 2021. The group announced in early April that it would begin steadily increasing production in the months ahead, noting that the pandemic was still a concern for global demand forecasts.

Additionally, as much as 1.5 mb/d of Iranian production could be brought back to market relatively quickly should progress be made on sanctions relief in a new nuclear deal.

About Energy Indicators

Questions can be addressed to Jesse Thompson at jesse.thompson@dal.frb.org. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.